ACIC Will Achieve Margin Parity With Own Business By End Of FY25: Samhi Hotels | CNBC TV18

Posts in category Value Pickr

Rajeesh’s Portfolio (11-11-2024)

Same Case Today too. Bought,

2 Shares of Tata motors

1 Share Dr Reddy’s

I kind of know that Tata motors is going to go down further but no one knows how much and I pretty much see value in it at this rate. So With conviction I’m placing my bet on Tata motors. This makes my tally to 75!!!

I am also very very bullish on rupee devaluation and Dr Reddy’s being Export driven company gets more Earnings on Dollar. And Indian Inflation is as per Govt. is 5.81% but overall actual inflation is more than 12% and Medical Inflation is so elastic which makes Dr Reddy’s very highly valuable in India as well. And I dont know how people are neglecting it. For a 1 lakh crore Mcap company, Its growing at a breaking neck speed.

This is the Basic EPS of Dr.Reddy’s (Latest in first). I feel it being Very Very attractive, Its oversold, historically PE is near lowest!!!

Closely watching Musk’s actions on Starlink introduction in India based on which I will take a call on Indus Towers and Bharti Airtel. But bit confused as Birla is thinking of infusing fresh capital into Vodafone Idea, which is like an indicator on Telecom market is here to stay and I dont want to jump the gun.

And I’m excited to get 100 more shares of NMDC from my Naked Trader Satellite portfolio!! Taken by Bit of a surprise

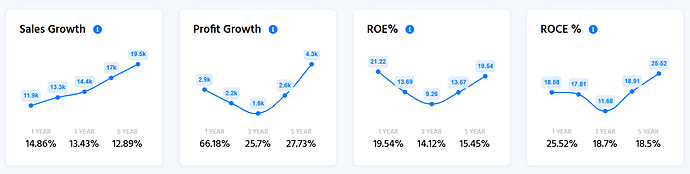

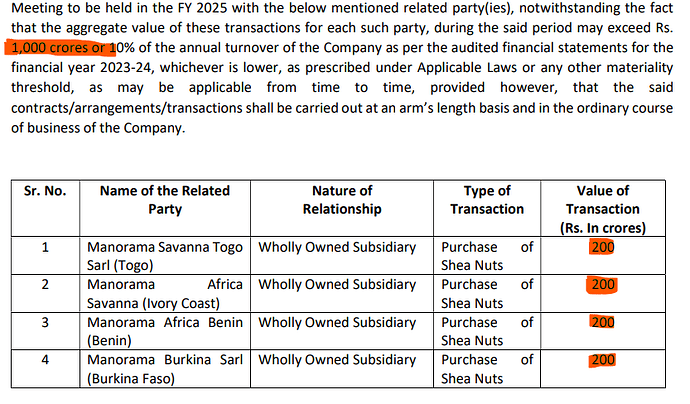

Manorama Industries: Creating Wealth from Waste (11-11-2024)

Seems Procurement going to be 1000+ Cr in Near Future

200*5 Subsidiary(Ghana is not mentioned in Notice) + Domestic Procurement

How much of it will be saleable could be the question.

Does anyone has readymade(extracted) data for 500 cr of annual sales how much procurement they did ?

it will give us idea.

Cigniti Technologies – Global Leader in Software Testing (11-11-2024)

Last day for Cigniti open offer tendering tomorrow.

We will know if it’s a success or failures soon.

Then real price discovery starts after that.

Macfos Limited- A niche E-commerce Company (11-11-2024)

The receivables have now become almost 68% of the total consolidated revenue (62 crs out of 90 Crs consolidated). This is a big red flag to me. Can someone elucidate why receivables might not be a terrible thing in such a business?

Discl: Tracking for now. Was invested in a short position a while ago.

Solex Energy – Undervalued Solar PV Manufacturer or Microcap Value Trap? (11-11-2024)

Solex has released it’s unaudited financial results today for H1 FY25.

Revenue : 274 cr. (YoY 3x) (HoH flat)

Net Profit : 13 cr. (YoY 13x) (HoH up 50%)

EPS: 15.5 (YoY 15x) (HoH up 50%)

Extrapolating these figures according to management’s 800 cr revenue guidance for full FY25, Netprofit can come out to be 40cr if margins remain same.

At today’s mcap of around 1800 cr. the FY25 PE comes out at 45

But since the incremental revenue of H2-FY25 will be coming from new ~800MW TOPCon module line (operational Q4-FY25), better margins are definately possible.

This coupled with the possibility of another 100% revenue growth next year should mean good upside for the scrip.

Despite this, it must be taken into account the effect of Trump slowing down renewable energy projects in the US. If Solex’s (or any other Indian PV manufacturer) upcoming module capacities are to be fully utilized (that too at good margins), the export market to US is very important to monitor.

Burger King ~ Whopper of an Opportunity (11-11-2024)

Restaurant Brands Asia (RBA), which operates the Burger King brand in India, faces some challenges in maintaining a strong, competitive position within the Indian fast-food market. Based on my experiences as a regular customer of both Burger King and McDonald’s in Mumbai, there are evident discrepancies in the ambiance and customer service provided by Burger King. Over several visits, I observed that Burger King outlets often keep their air conditioning off, even during peak summer, citing “repair work” as the reason. Additionally, the staffing is noticeably limited, which affects service quality and speed, further detracting from the customer experience. In contrast, McDonald’s consistently offers a pleasant atmosphere and attentive service, suggesting that they prioritize customer comfort and a welcoming environment. Burger King’s approach to cost-cutting by reducing essential aspects of customer service, such as air conditioning and staffing, may harm its brand image, risking a downgrade in consumer perception. This approach could lead Burger King to be seen as less of a premium fast-food option and more comparable to local, lower-cost eateries. Additionally, Burger King’s strategy of opening outlets near McDonald’s locations in hopes of sharing foot traffic does not seem sufficient to build a strong brand identity. Without significant product differentiation, customers might regard Burger King as merely a follower rather than a distinct option. While RBA may benefit in the short term from cost reductions, the long-term risks include eroded brand value, dwindling customer loyalty, and stagnated growth. If Burger King continues without improvements in service quality and distinct brand positioning, it risks losing its edge and, potentially, its market share in India’s highly competitive fast-food industry.

Hitesh portfolio (11-11-2024)

@hitesh2710 hitesh sir what is your view on solar module or cells comp which have 40 to 50 % revenue come from usa OR more exporter in module and cells ? if it will impact negative then what happen of india 300 gw target of RE by solar till 2030 ? can this company will grow like previous growth in domestic as well as out side ? plz explain sir ,

KPI Green- Turning Sunshine Into Cashflows (11-11-2024)

bonus will not lead to long term appreciation – in short term it could jump…

company’s ROE will surely come down due to large IPP projects. this requires huge debt – for 1.2GW at least Rs 3,500 cr debt will be needed !!

this will reduce CPP/ EPC – which is high margin and low capital.

am sure such high valuation is not justified from IPP business.

One important point discussed by CFO on investor call – execution of projects… if there is delay in project execution it could impact profits.

also will there be penalties on delay in project?

Trent — A value unlocking story from the house of TATA (11-11-2024)

Thanks for your comments. I would like to mention here, I can be wrong – H&M is H&M while Trent is creator of brands/business models. Comparing companies withing India & even abroad is a good exercise. It gives us a perspective but there may sometimes be more to it. Few days back, I read I think in this same thread that Trent would be next Titan. This was again amusing because at that point of time the mcap of Trent was almost equal to Titan. So, it had already become a Titan.

Both Titan & Trent are creators & custodian of multiple brands so its good to compare the mcap & valuations with a pureplay fashion retailer but with a pinch of salt.

Trent is indeed very highly valued but comparison with H&M may not be the ideal way to look at it after seeing what they can do with brands they create from scratch, the main market where they operate and the immense business leadership, acumen & strategy they get being part of the Tata group in their main market.

Disc: Same as above. Not a buy/sell recommendation. Not eligible for any advice.