report HUDCO enclosed

Nirmal_Bang_HUDCO_Q1_FY25_Result_Update.pdf (726.6 KB)

Posts in category Value Pickr

HUDCO Urban Development – Will it develop the investor too? (15-08-2024)

Krystal Integrated Services Ltd – Share Analysis – Facilities Management Services Industry (15-08-2024)

Sorry for the split up. As the Forum post are limited to 40000 character unfortunately i have more than that which not allowed me to post.

Some Q & A, Concall

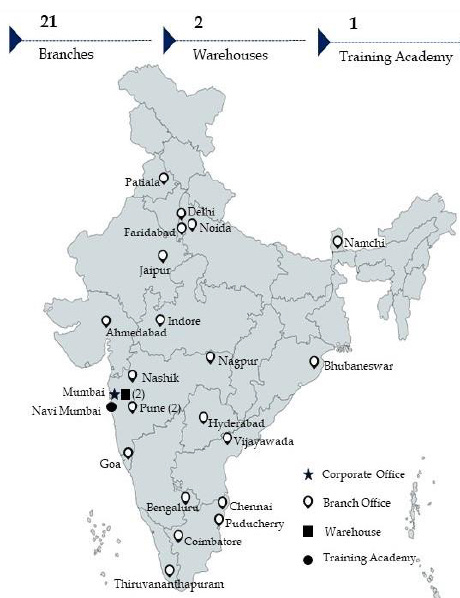

Training Academy

We have a Krystal Integrated Training Academy which is there one at Vashi. We are going to replicate that in the geographies where we are aspiring to have business.

we signed up an agreement with ITI at Tukkuguda MIDC Industrial Technical Institute and it is a brilliant partnership that we have done there wherein we will train the ITI students in batches at our Tukkuguda office in improving soft skills, interview skills and so on and so forth, CPR, firefighting and all that.

Tax Benefits

The tax rate what you are referring is due to our 80JJAA benefits. So that is the reason why you see our tax components are fluctuating year-on-year.

Receivable Days

Again, receivable days, generally also if you have both government and corporate they are about 70 to 75 days.

Contract Years

This is typically 3+1-year contract, 3-year plus 1 year renewable and after the renewal period then there is a rebidding for that.Some Guidance

- we are going to continue our growth by 25% to 30% year after year . So in that context, if you see the 70% contribution , so that government side will keep on having that contribution. In terms of which are exactly because this is a cyclical process which exactly are contracts which are getting over because they will not get over exactly at the financial year end .

Types of Customers

One is retail, one is key accounts and one is mega accounts .

- Anything which is 10 lakh and less billing for months is retail.

- 10 lakh to 50 lakh three account per month billing

- 50 lakhs and above is major accounts per month billing.

Conclusion

Why would i like to buy this ?

- My Opinion

- Industry is in growth stage – Man power is required everywhere as India is growth stage – Airports, IT Companies and so on.

- Company is in growth stage – Geographic’s expansion, catering growth.

- Very strong presence in One area – Mumbai – Need to track whether they are able to do in Other area too.

Why wouldn’t i like to buy this ?

- My Opinion

- Competitive Industry

- Very low to No Pricing power

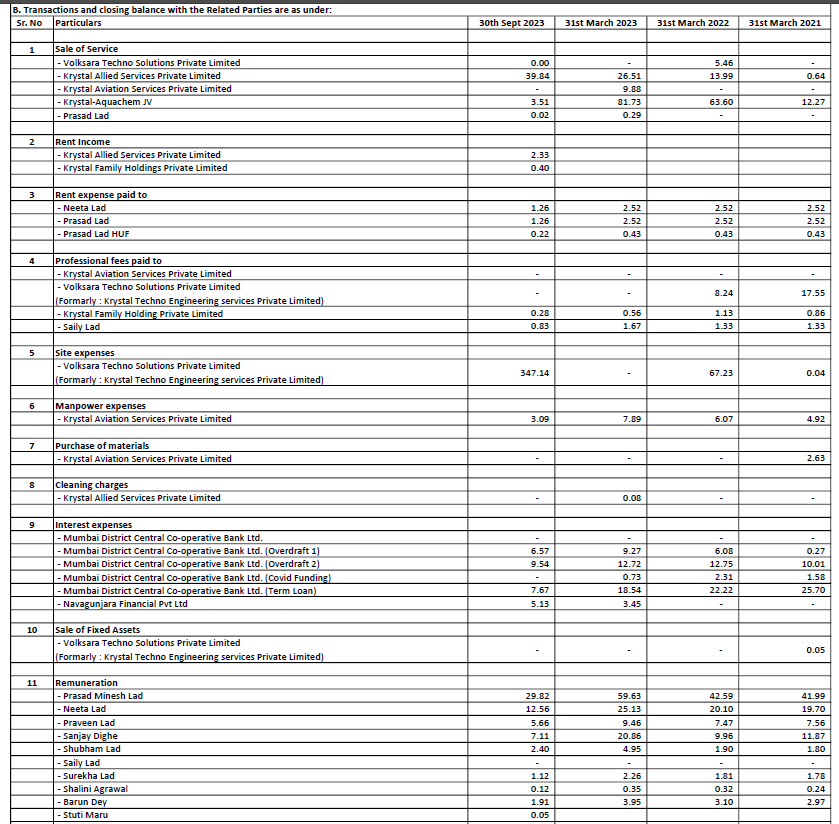

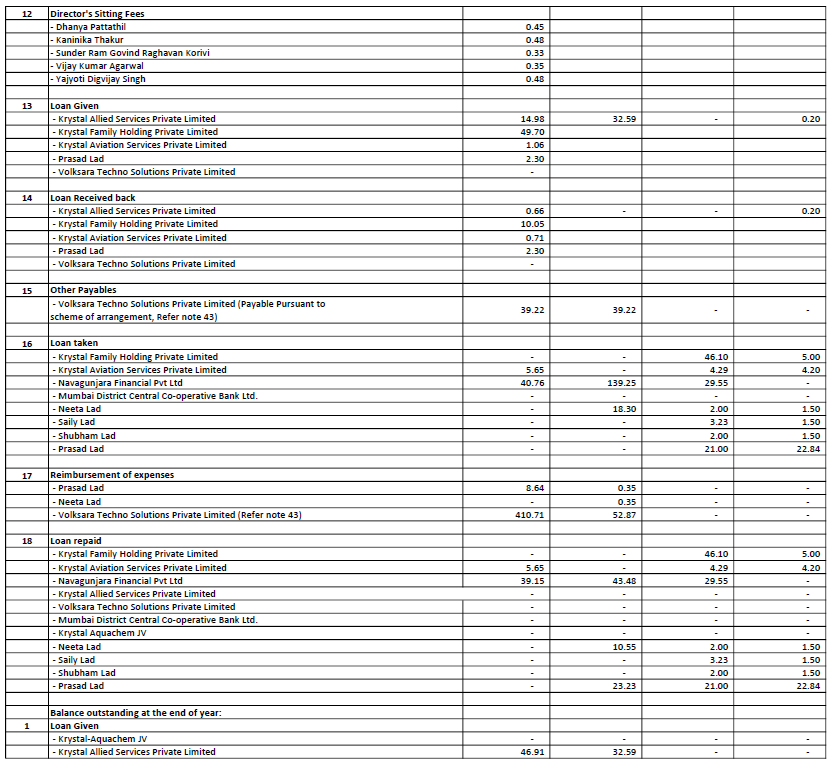

- RPT – Related party transactions

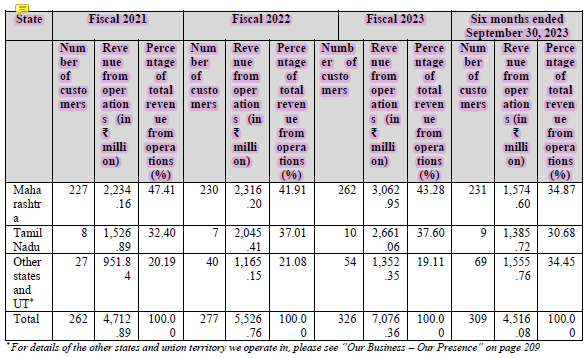

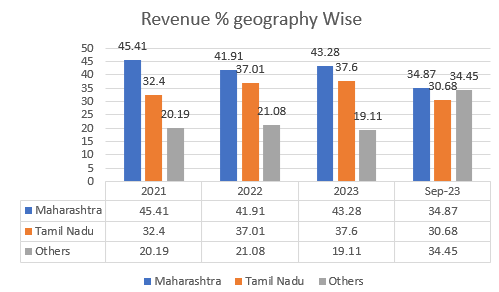

- Revenue concentration – Business wise and Geography wise

- Working capital intensity.

My point is not to fill up the page but to provide something which will be useful for us. Please like it and comment for further improvement.

Krystal Integrated Services Ltd – Share Analysis – Facilities Management Services Industry (15-08-2024)

AGENDA

- Introduction

- Business Segment

- Geographic’s and Customers

- Management Structures

- Industry Analysis

- Competitive Analysis

- Financial Analysis

- Technical Analysis

- Risk Analysis

- Some Q & A and Concall

- Summary

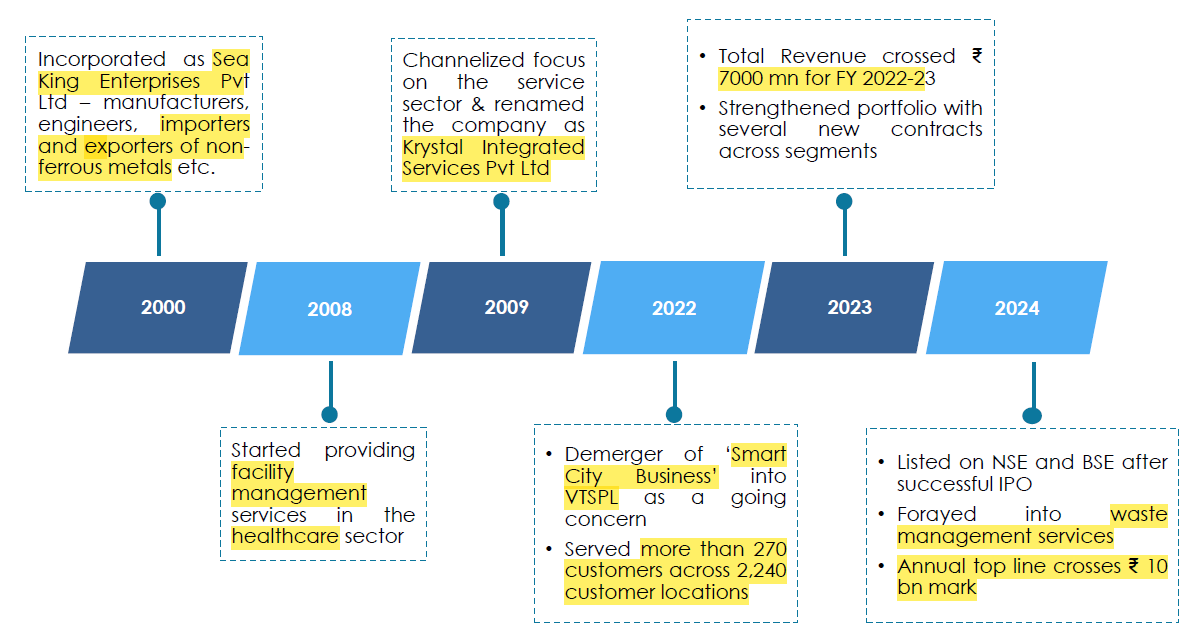

Introduction

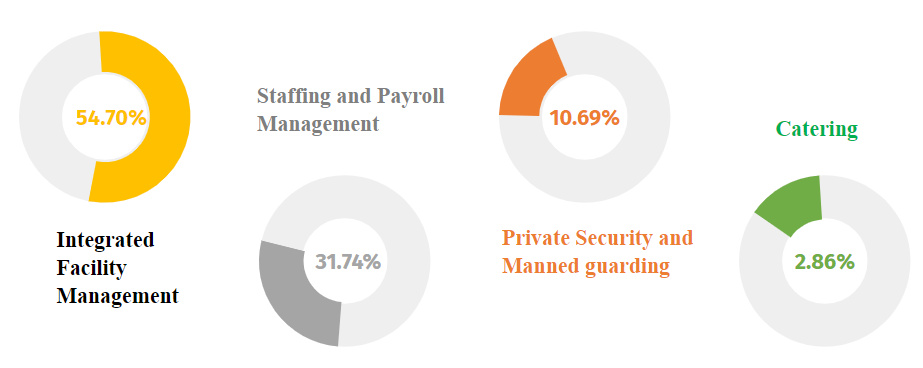

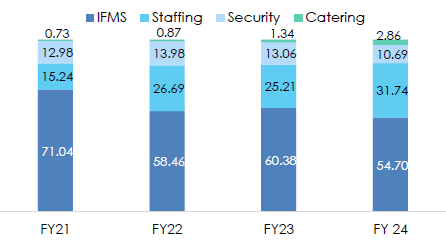

Business Segments

Integrated Facility Management

Soft Services

- Housekeeping / Cleaning / Janitorial

- Disinfection & Sanitation

- Landscaping & Gardening

Hard Services

- Pest Control Services

- Mechanical Maintenance Services

- Electrical Maintenance Services

- Plumbing Maintenance Services

- Heating, Ventilation & Air-conditioning (HVAC) Services

- Façade Cleaning

- City Maintenance Services

- Municipal Sewage Treatment

- Solid Waste Management

Other Services

- Catering

- Production Support Services

- Warehouse Management

- Airport Management

- Multi-level Parking

- Airport Traffic

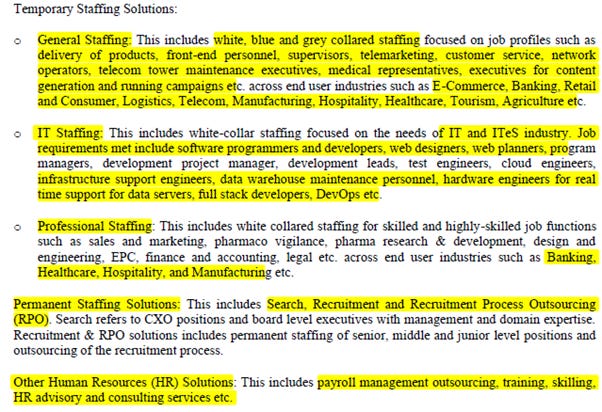

Staffing and Payroll Management

Private Security and Manned guarding

Access control: We ensure that only authorized personnel are allowed to enter the facility and control the movement of people within the facility.

Surveillance: We monitor the facility using CCTV and other surveillance systems and respond to any security breaches or incidents.

Patrols: We regularly patrol the facility to detect and deter any suspicious activity or potential security threats.

Emergency response: We provide services in case Of emergencies including fire, medical emergencies, or criminal activity.

License: To engage in the business of a private security agency under PSARA in 12 states and one union territory .

Catering

-

Foods Customised by the customer, including breakfast, lunch and dinners for employees. We also provide traditional snack items.

-

Our central kitchen located in Kalina.

-

In Fiscal 2021, 2022 and 2023 and six months ended September 30.2023 , we offered catering services to 13, 47, 67 and 52 customers, across 17, 60, 72 and 63 customer locations in India .

-

Our major customers for these services (provided through Krystal Gourmet ) include Tema Speciality Hospital & Research Centre .

Geographic’s & Customers

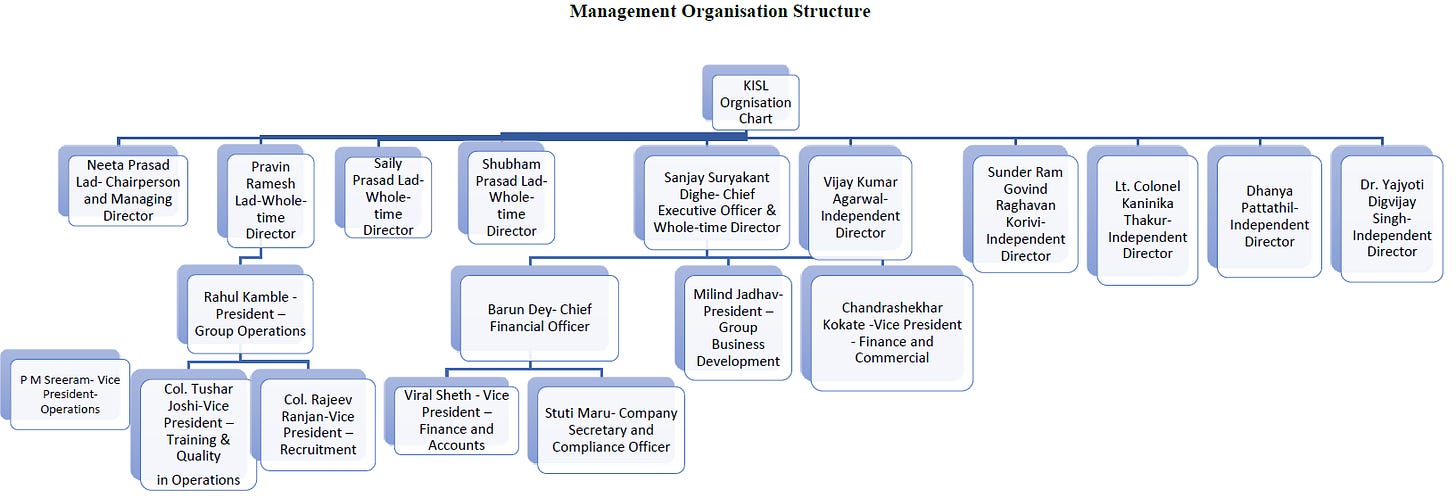

Management Structure

Management

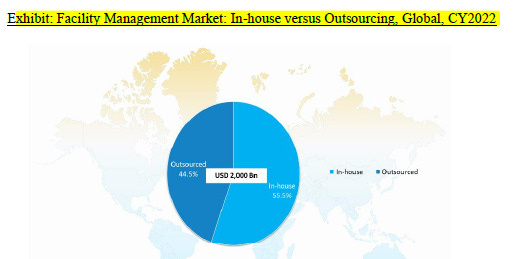

Industry Analysis – IFMS

GLOBAL INTEGRATED FACILITY MANAGEMENT MARKET

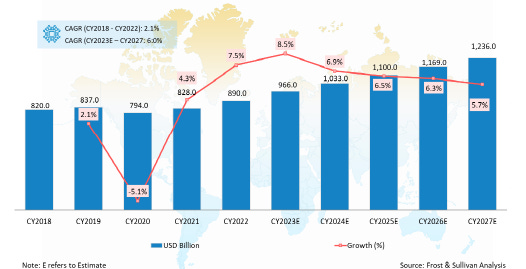

Outsourced Facility Management Market: Historic Revenue Trend and Forecast. Global. CY2018 — CY2027

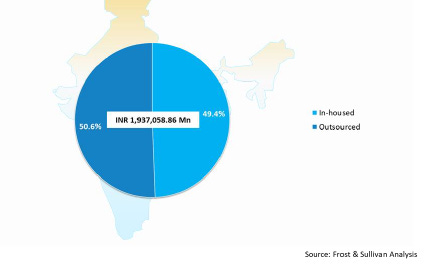

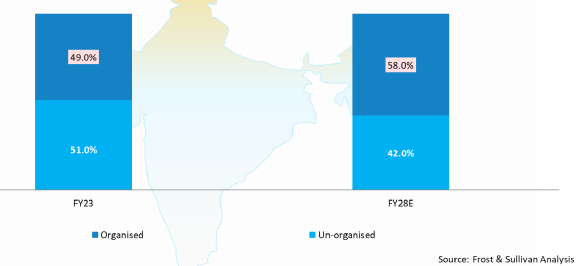

Total integrated Facility Management Market: In-house versus Outsource, India FY2023

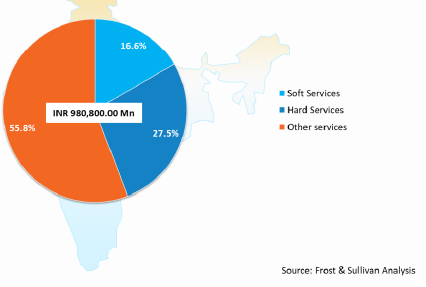

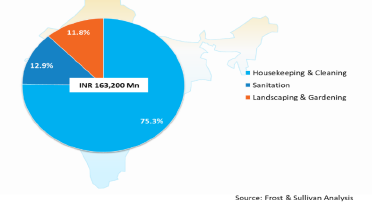

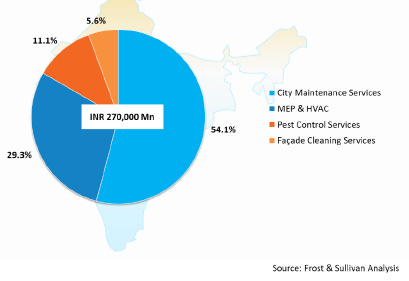

Integrated Facility Management Market by Services

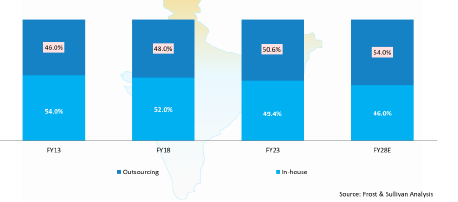

Total Integrated Facility Management Market: Outsourcing Trends- India- FY2013- FY2018- FY2023 and FY2028

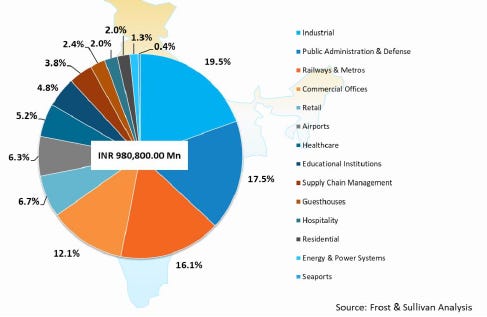

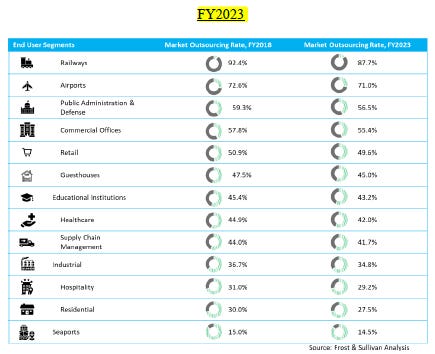

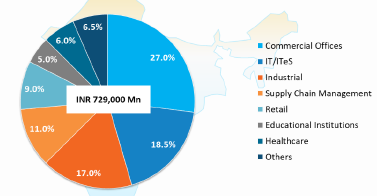

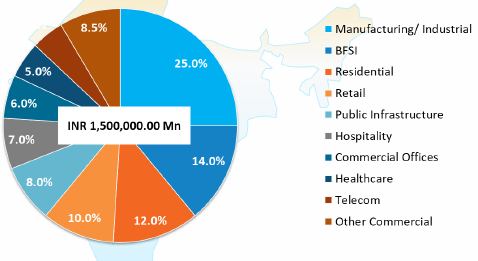

Outsourced IFMS: Breakdown End-user Sent India FY2023

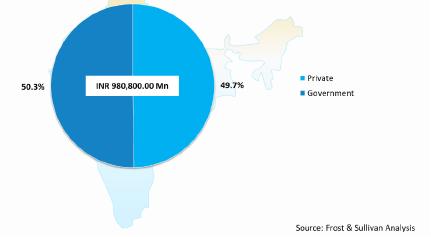

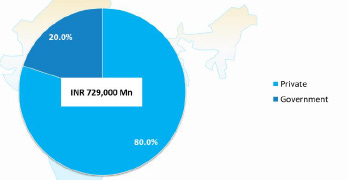

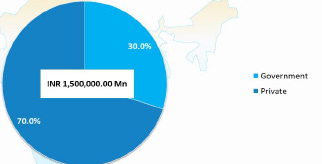

Outsourced IFMS Breakdown Gov vs Private FY2023

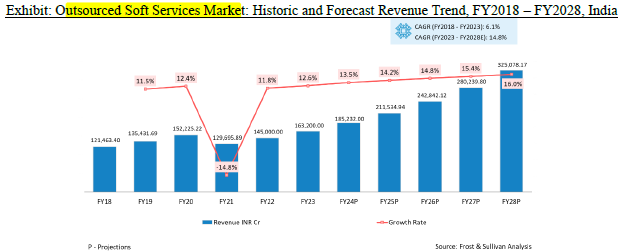

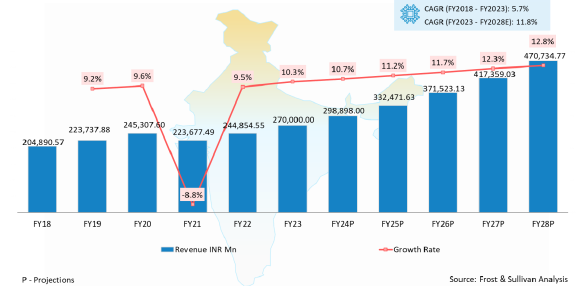

Soft Services

Hard Services

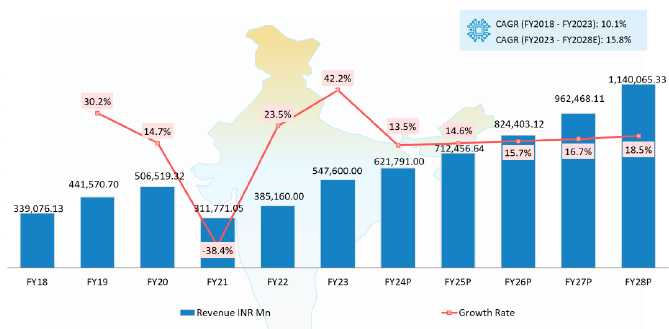

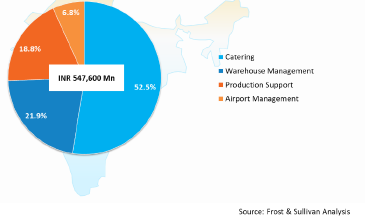

Other Services

CATERING SERVICES MARKET

The Catering Services market is highly fragmented with close to 60-70% of the total market dominated by unorganized companies and the remaining 30-40% of the market with organized companies .

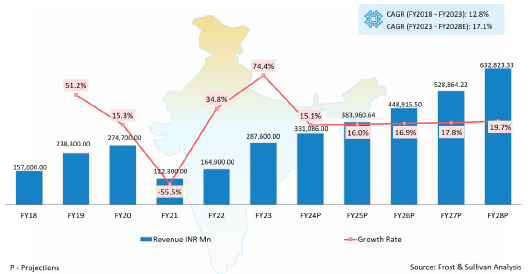

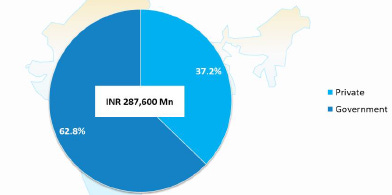

STAFFING AND PAYROLL

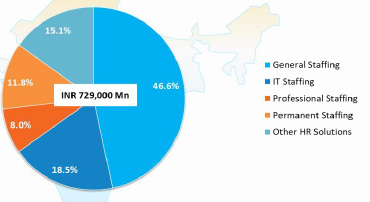

Segmentation by Services, FY2023, India

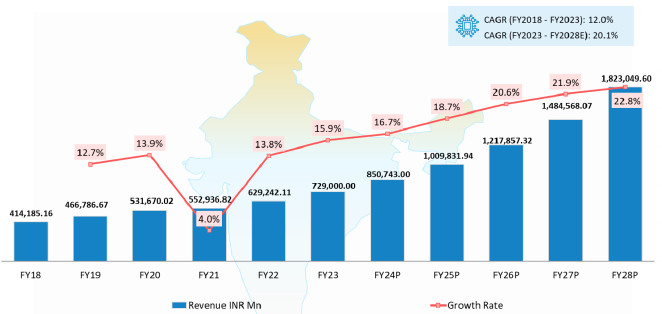

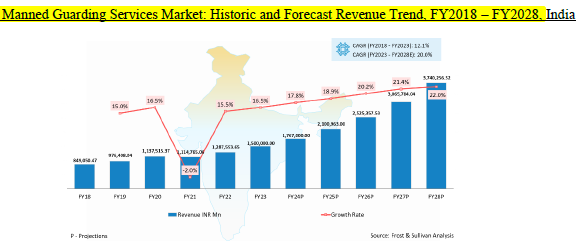

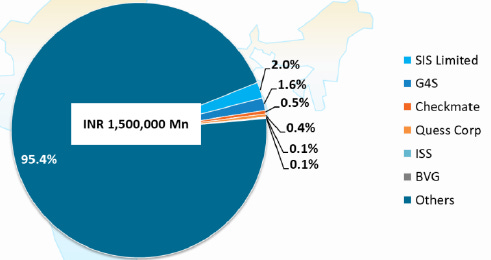

PRIVATE SECURITY/ MANNED GUARDING SERVICES MARKET

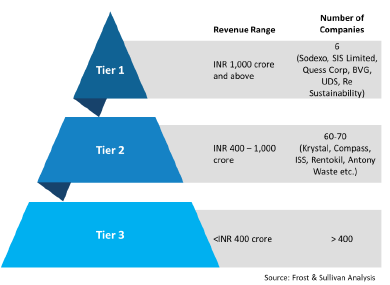

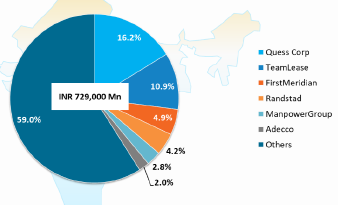

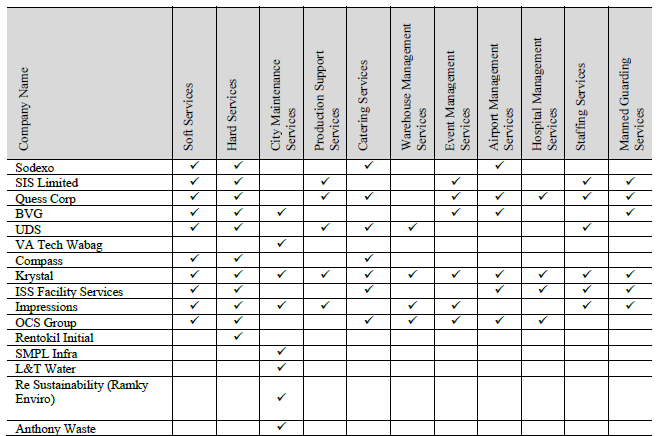

Competitive Analysis – IFMS

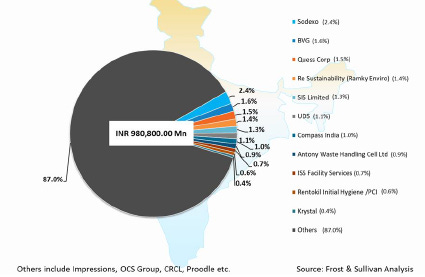

- The top four companies IFMS Market are Sodexo, BVG, Quess Corp, and SIS Limited.

- They have a combined market share of 6-8% of the total market in FY2023.

Competitive Analysis – IFMS

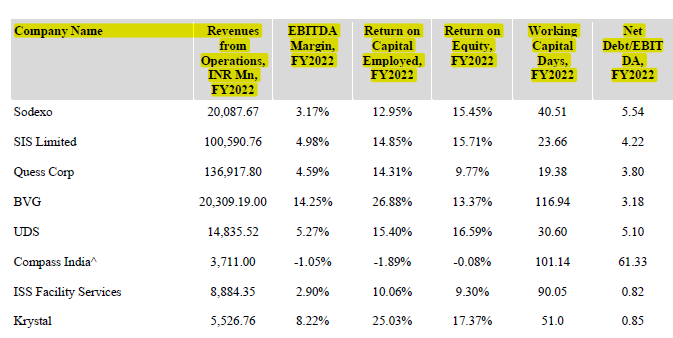

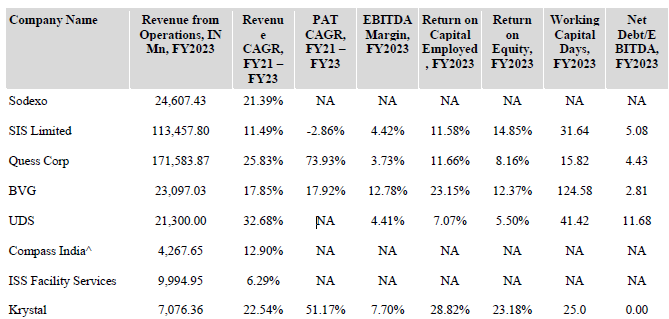

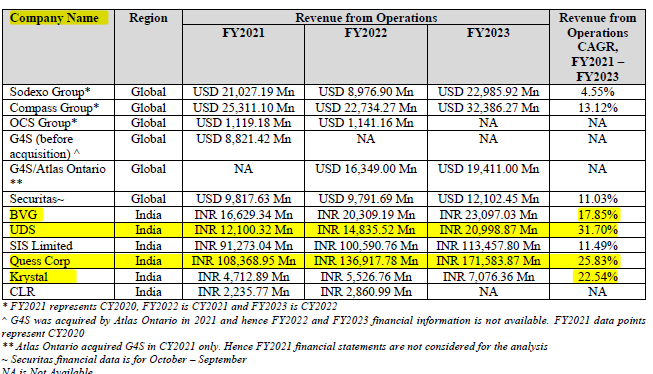

Financial Information of Major Companies. India FY2022

Financial Information of Major Companies. India, FY2023

Segmentation by Services

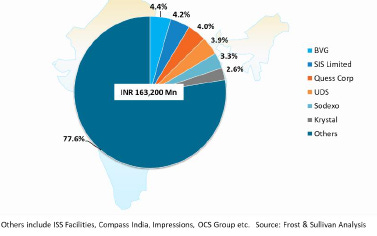

Soft Services

- Soft Services is extremely fragmented in India with the market leader BVG having a share of 4.4% of the total market in FY 2023.

- The top five companies in this segment are BVG, SIS Limited, Quess Corp, UDS, and Sodexo.

- These five companies account for a combined share of 19.8% of the total market in FY2023.

- Krystal is the sixth largest Soft Services company with a market share of 2.6% in FY2023.

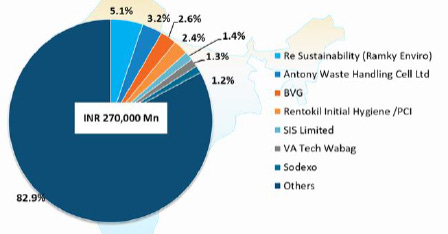

Hard Services

The competitive structure is very similar to the Soft Services segment.

- For example, The top two companies in this segment

Re Sustainability (Ramky Enviro) and Anthony Waste are predominantly into waste management services and water and wastewater treatment solutions and services business .

- Major Integrated Facility Management Services companies present in Hard Services are BVG, SIS Limited, Sodexo, Quess Corp, ISS, UDS, Compass, Krystal among others .

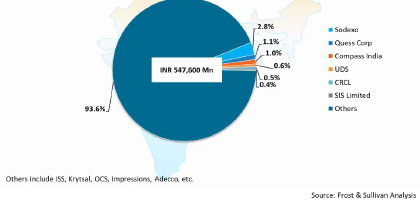

Other Services

-

Sodexo is the market leader with a share of 2.8% of the total market in FY2023.

-

Other major companies in this segment are Quess Corp, SIS Limited, Compass, UDS, BVG, CRCL, ISS, Krystal among others.

CATERING SERVICES

- The Catering Services market is highly fragmented with close to 60-70% of the total market dominated by unorganized companies and the remaining 30-40% of the market with organized companies .

- Within the organized segment, Sodexo, ISS, CRCL, Krystal, Proodle Hospitality, Comprehensive Support Services (CSS), ISG Hospitality Service, Compass, and Quess Corp are some of the major players. Catering companies are promoting.

WAREHOUSE MANAGEMENT SERVICES MARKET

-

Based on the above analysis, the Warehouse Management Services Market is forecast to grow at a CAGR of 12.0% from FY2023 – FY2028 to reach INR 211,761.25 million.

-

The market is highly fragmented in India and the organized sector accounts for around 40% of the market while the remaining 60% is accounted for by the un-organized sector companies.

-

Both Multi-National Companies (MNC) and local companies . MNC companies mostly operate in Tier 1 and Tier 2 cities while Tier 3 cities are mostly catered to by the local companies. The major companies present in the organised sector are D V Shankar, Mahindra Logistics, Blue Dart, Toll logistics, DHL, Kuehne Nagel and Ceva Logistics.

-

A few of the Facility Management companies providing Warehouse Management Services in India are UDS, Krystal, Impressions, and OCS Group.

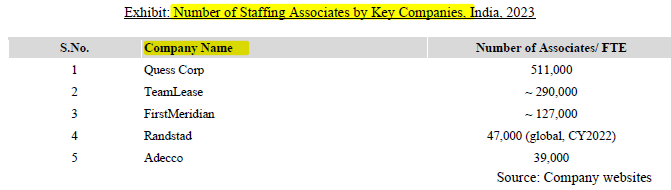

Competitive Analysis – Staffing and Payroll

-

The competitive landscape is highly fragmented in India . Is it estimated that more than 1,000 companies are operating in this space in India. The organised market consists of 20-30 companies and is dominated by international and national companies.

-

Major players in this segment include Quess Corp, Teamlease, First Meridian, Randstad, Manpower Group, Adecco, Datamatics Staffing Services Limited, Collabera, Artech Infosystems Pvt. Ltd., Kelly Services etc .

-

General Staffing and IT Staffing are the major segments in Staffing and Payroll Management Services Market in India with a combined market share of 65.2% of the total market in FY2023 .

-

General Staffing Segment in India is a nascent industry when compared to developed markets like the USA, Japan,and Italy.

-

General Staffing segment witnessed a strong growth of 15.3% in new jobs added in FY2023 at around 1.47 lakh jobs across the segment, as per the Indian Staffing Federation.

-

This is expected to increase the industry share from the present 5.0% to 20.0% in the next five years.

-

The market is extremely fragmented in India , with more than 20,000 companies operating in this market.

-

The organised segment comprised of about 40-45% of the total market in FY2023.

-

SIS Limited is the market leader in this highly fragmented market with a share of 2.0% in FY2023 .

-

SIS Limited, G4S, Checkmate, Peregrine, ISS, Sentinels, Securitas, Global Security Services, Krystal etc . are some of the major companies operating in this market in India.

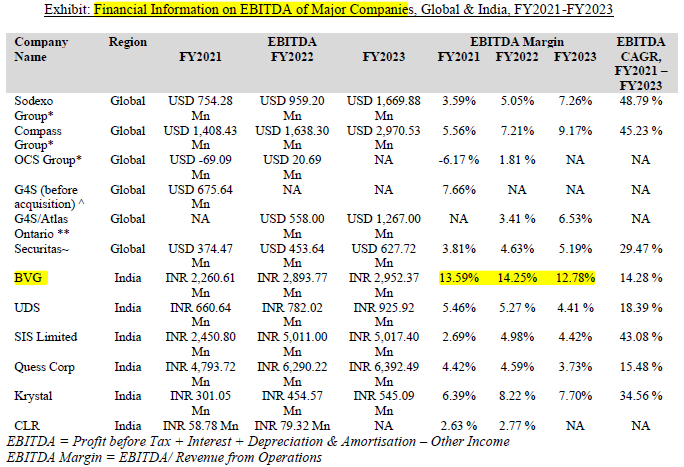

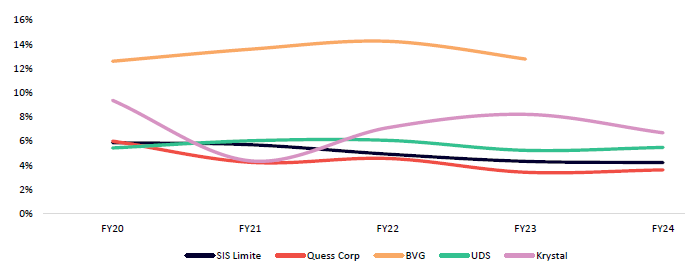

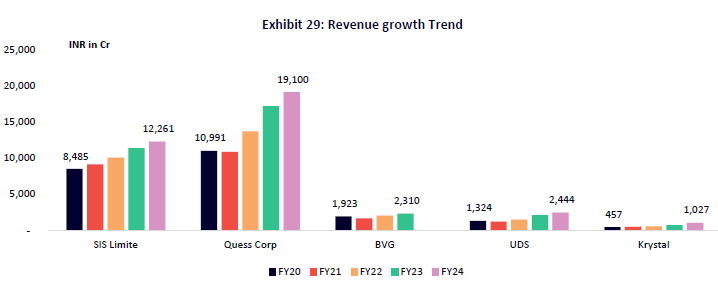

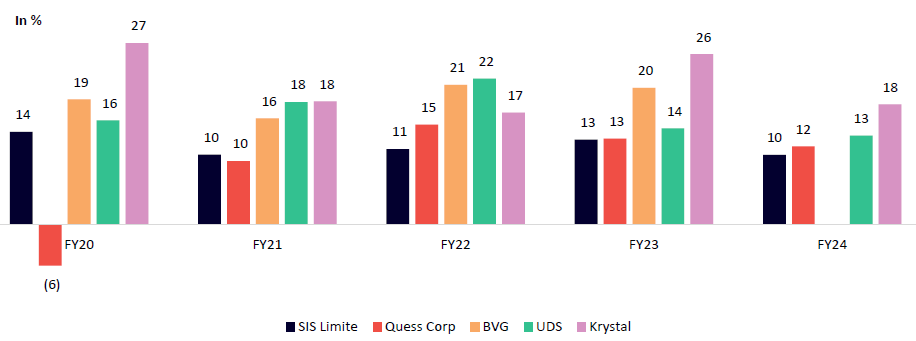

Competitive Analysis – Financial Benchmarking

EBITDA margin Trend (Source: Nuvama)

Revenue growth Trend (Source: Nuvama)

ROE profile of key players growth Trend

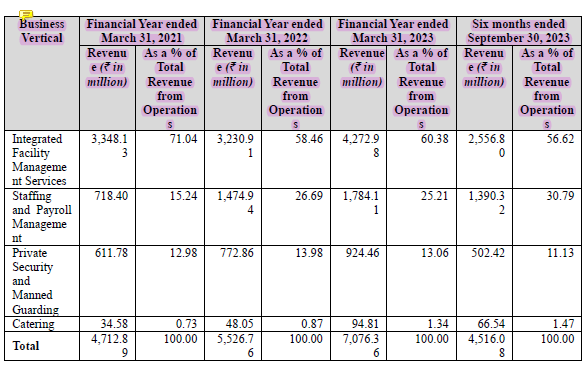

Financial Analysis

Revenue Segments wise

Revenue Geography wise

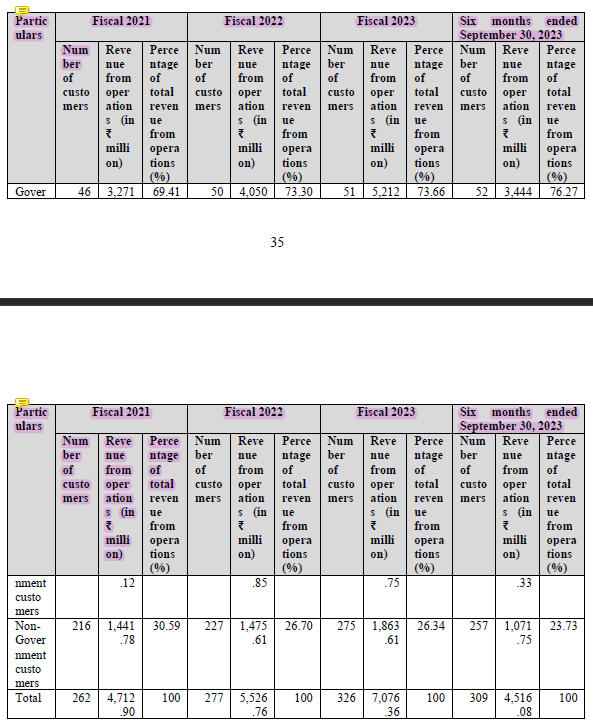

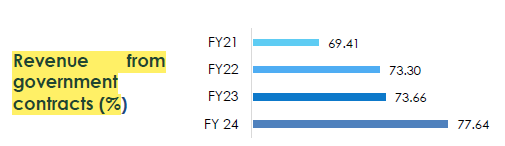

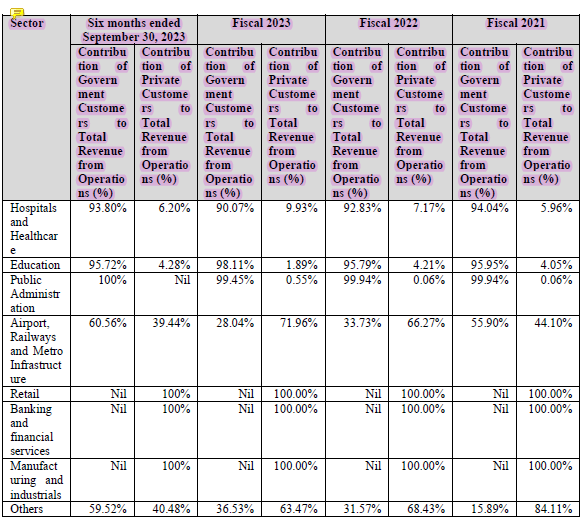

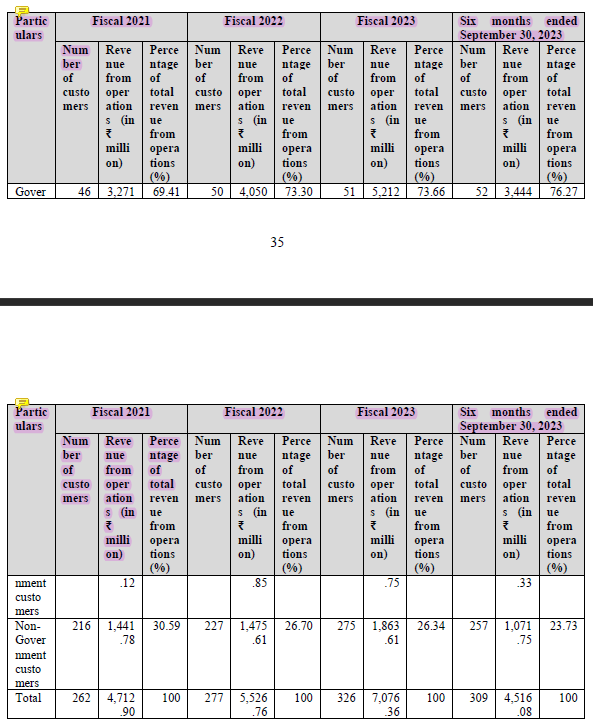

Revenue Model

- Government – B2G

- Private – B2B

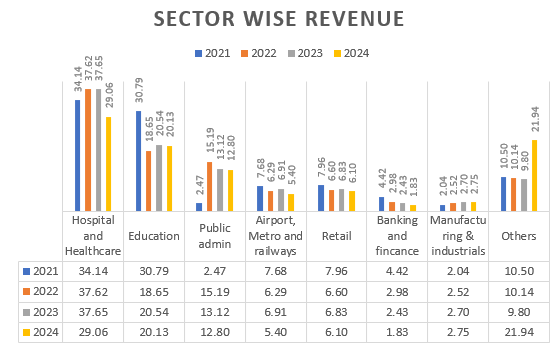

Revenue Sector Wise

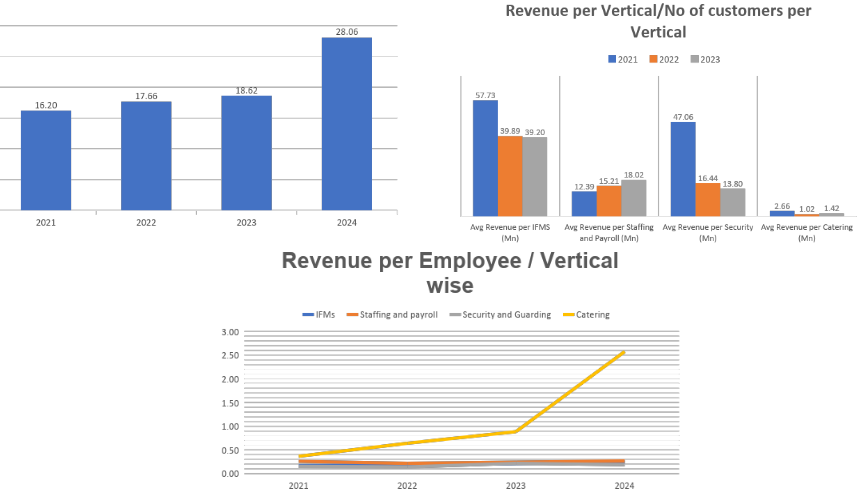

KPI Analysis

Risk Analysis & Key Trackers

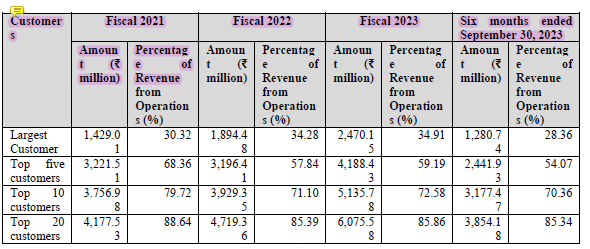

- Revenue Concentration top 5, 10, 15.

- Government Contracts plays a major role – Contracts for 3 years.

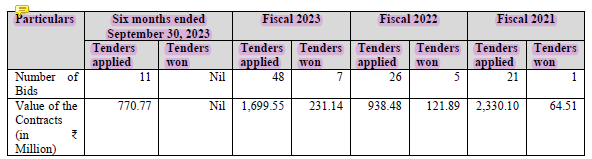

- Bids and Wins

- Geographics Concentration

- Major revenue is derived from only one segment.

- For the six months ended September 30, 2023 and Fiscals 2023, 2022 and 2021, our revenue fromintegrated facility management services has contributed to 56.62%, 60.38%, 58.46% and 71.04%

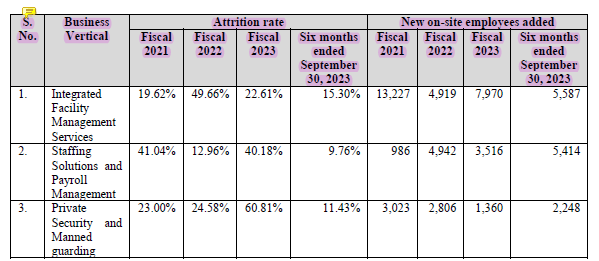

- Manpower intensive business – High Attrition Rate

- Attrition rate for Fiscals 2021, 2022 and 2023 and the six months ended September 30, 2023 was 22.00%, 35.88%, 31.38% and 12.98%

-

Contract Renewal and Extension

- In 2021, 2022 and 2023 & six months ended 30, 2023, we were able to successfully extend or renew Nil, 40.00% and 42.86% and Nil of our government contracts that were expiring in the respective years.

- Government Contracts plays a major role – Contracts for 3 years.

-

Expense – Biggest is from Employee Benefits

- Employee benefit constituted the largest component of total expense representing 84.12%, 88%, 89.31% and 86.01% of our total expenses for six months.

-

No Background Verification for employee

-

Trade receivables

- Trade receivables constitute a significant portion of total assets, and were representing 48.35%, 43.56%, 59.64% and 59.16% of our total assets as on September 30, 2023, March 31, 2023, 2022 and 2021 , respectively.

- Our trade receivables outstanding for over six months were representing 11.67%, 19.76%, 13.02% and 15.51% our total trade receivables as on September 30, 2023, March 31, 2023, 2022 and 2021.

- Our balance write offs from trade receivables were Nil, 0.04 mn, 0.03 mn and 0.76 mn as on September 30, 2023, March 31, 2023, 2022 and 2021.

-

Complaints Against the Company

- September 30, 2023 and Fiscals 2023, 2022 and 2021 , the number of physical and written complaints received by our Company from our customers were 41, SO, 5S and 77, respectively.

-

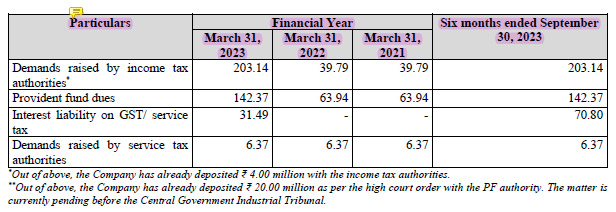

Contingent Liabilities

- RPT

Subsidiaries & JV

- Flame Facilities Private Limited (“FFPL”)

FFPL is authorized to carry on the business of providing facilities such as House keeping, security management, financial consultant, consultancy in commercial, financial, taxation, arrangement of management personnel, training and placement of security guards, developing human resource etc. as authorized under the objects clause of its memorandum of association.

- Krystal Gourmet Private Limited (“KGPL”)

KGPL is authorized to came on in India Of abroad the business of Importers, exporters, manufacturers, buyers, sellers, suppliers, traders, producer, merchants, hire purchase dealers, brokers, stockiest, distributors Of otherwise dealing in natural food extracts, food products, fast foods including instant food mixes, processed foods, dehydrated foods, health foods, farm products, fruits, vegetables, pulses, juices, jellies, ice creams, jams, tea, coffee, cocoa, chocolate, spices and condiments, cookeries, bakery, confectionery, groceries, poultry, eggs, vegetable oils, vegetable ghee, sausages, prawns, potted meat, table delicacies and masalas, vinegar acetic acid, glucose, wines, spirits, beers, porters, yeast, pickles, ciders preserved food and of such other related ingredients.

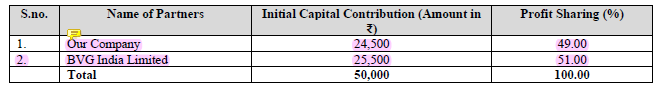

BVG & Krystal Joint Venture (“BKJV”’)

BKJV was set up for providing all types of security solutions, including supply of security personnel, protection of property, house-keeping and all other relevant and incidental work.

Krystal Nangia JV

In case the bid for the proposed project is not awarded to the Nangia JV, the JV Agreement will stand terminated.

Panasonic Energy India Company Ltd (15-08-2024)

Good detailed post. Thanks for sharing.

Have added it to the watchlist now. Like the MNC heritage and that they reward shareholders thru dividends

While it’s understandable that you feel the stock should command a higher premium, a few things that may be worthwhile to note

-

Stock has already run up a lot in the last 1 year. 31 pe for a microcap (albeit Panasonics heritage) is not a bad valuation given the market segment it operates in

-

Return metrics for Eveready are superior on a few parameters: operating margin, roe (although Eveready is debt heavy)

The question to ask is whether the stock is undervalued and my limited sense is it’s not. Will not be too confident to buy at the current price

However I haven’t read on the company so it could be a flawed assessment.

Thank you

Aptus Value Housing : Is valuation justified or just another HFC? (15-08-2024)

I think it’s the case with all the AHFCs like Aavas also.

Though it’s not a good practice to compare on a PE basis, they have been derated from PE around 40 to 25 currently.

None of the AHFCs have shown any price appreciation during this bull run.

Sooner or later they have to show the price appreciation reflecting the AUM growth.

Apeejay Surendra Park Hotels – Potential Value Unlocking (15-08-2024)

Hi, is there a way to validate the occupancy rate? 90%+ is unbelievable. Any idea about what occupancy rate they reported in q1?

Also the number of keys will increase by 10% for FY25. Are the revenue and PAT also expected to increase by 10%?

Piccadily Agro Industries Ltd (15-08-2024)

Just to give an idea on growth rates… Radico has done 60% and 110% volume growth in FY24 & FY23 respectively in its lux segment (Rampur whiskey + Jaisalmer Gin). Rampur whiskey is a direct competitor of Indri.

You can draw your own conclusions on revenue & margin from Indri assuming 150k / 250k cases in FY25 and FY26 respectively. Add to that Camikara rum that’s going to show volumes in FY26 once the next production run is ready to be bottled.

Don’t forget the 50 lac cases worth of Malta they sold in FY23 and prolly similar in FY24. Whiskey wouldn’t be substantial portion.

Focus Lighting & Fixtures Limited (SME) (15-08-2024)

Sharing my experience why I had exited this company. It could be just my way of observing things. I could be 100 % wrong also.

- Hardly any presence this company on any social network. We all know Today’s era of Digital marketing

-Very cheap WordPress website, hardly works.

-In last concall someone asked, there is a business named focus lighting register in USA. Mr Sheth was completely unware of the that company which seem to be very famous Hows that possible.

.

Piccadily Agro Industries Ltd (15-08-2024)

(post deleted by author)