Q1 FY25 results came out 5 minutes ago. Will take a deeper look later.

The only trust, they kept our trust is what I want to say – DPU is 3.75 vs 3.55 previous qtr and they walked the talk on higher DPU

Posts in category Value Pickr

Indigrid InvIT: High yield on stable and predictable revenues (24-07-2024)

Great articles to read on the web (24-07-2024)

Thank you for sharing ![]()

Jyoti Resins & Adhesives Limited (with bloated reserves) (24-07-2024)

Why jyoti resins have very less CFO(cash flow from operation) as compared to PAT(net profit) ?

=Till 2021, Pat and Cfo are almost similar. However ,from 2022 onwards, cfo is very much less compared to Pat

Let’s see

2022

Pat@20 cr

Cfo@ 3cr

=This disparity was due to high receivables(12cr)

2023

Pat@46 cr

Cfo@ 1cr

=This disparity was due to

A…High receivables(27cr) and

B…Increase/ Decrease in noncurrent financial asssets(-27cr)

2024

Pat@67 cr

Cfo@ 27 cr

=This disparity was due to Increase/decrease in other bank balance(55cr)

====================

Can anyone throw light on following two items and why these 2 are under working capital changes?

A…Increase/ Decrease in noncurrent financial asssets

B…Incerase/decrease in other bank balance

=In screener, above two items are kept under “other wc items”

Pulz Electronics – proxy to the Indian entertainment sector (24-07-2024)

Just a guess. They probably want to issue bonus shares in the ratio 1:1 just as they did a few quarters back. This would deplete the reserves by approx Rs 11cr and increase the equity capital by the same amount.

Disclosure: Invested from lower levels. Reduced my holdings in the recent correction.

Microcap momentum portfolio (24-07-2024)

Followed videos and made setup.

Tried below code with attached CSV file , but blocking at Line 10. Can you please help me

Its showing like this & never coming out

C:\Users\Veera\Downloads\ind_niftysmallcap250list_veera.csv

1 import yfinance as yf

2 import pandas as pd

3 import csv

4

5 df= pd.read_csv (‘http://10.10.10.28/ind_niftysmallcap250list_veera.csv’)

6 dataset = {}

7

8 for index, row in df.iterrows():

9 grse = yf.Ticker(row[“Company Name”])

10 hist = grse.history(period=“1y”)

11 hist[‘ticker’]=row[“Company Name”]

12 dataset[row[“Company Name”]] = hist

13 stock_data = pd.concat(dataset)

14 print(stock_data)

if i execute only from line 1 to 9 , its working till that level

Screener.in: The destination for Intelligent Screening & Reporting in India (24-07-2024)

Hi @satvik-bansal The Expected Numbers are Proprietary ratios created at our end. We source the raw financial data from CMOTS India. The ratios and other calculations are made by our team.

Avantel (24-07-2024)

Some work I’ve done on Avantel:

Business Overview

Avantel designs, develops and manufactures satellite communication, radar systems and electronics for defense & aerospace. Clients include Boeing, Lockheed Martin, ISRO, Indian Navy, Bharat Electronics, Indian Railways, Garden Reach Shipbuilders etc.

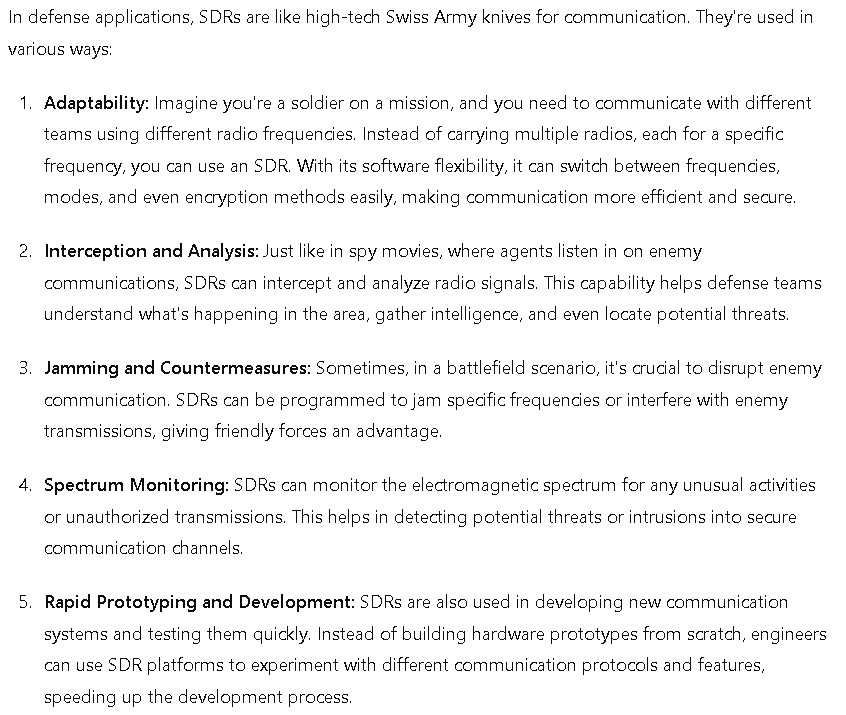

One of their defense electronics products is software defined radios (SDRs) — they have a collaboration with Hagenuk Marinekommunication (HMK) — “compliance to the software communication architecture (SCA), which enables interoperability between different systems, is a major development where very few companies, maybe, I would say three companies right now are in that space. And the major player obviously is Bharat Electronics and we would be number two, if I’m not wrong, in that space of SDRs with SCA compliance and that covers various spectrums like HF, VHF, UHF, L band.”

Management

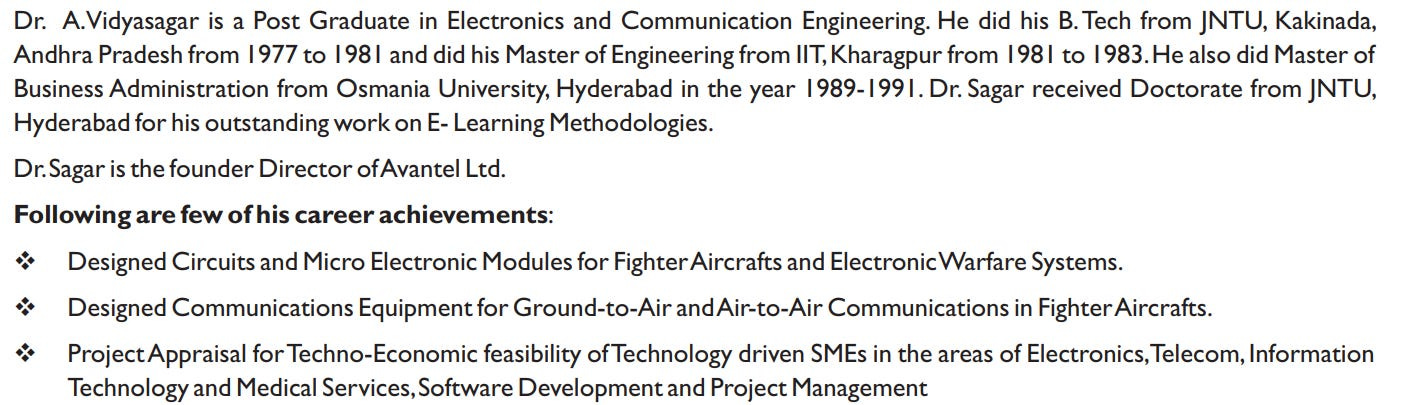

Avantel was founded in 1990 by Dr. Abburi Vidyasagar (present chairman & managing director), who, along with his family members, holds ~40% stake in the company.

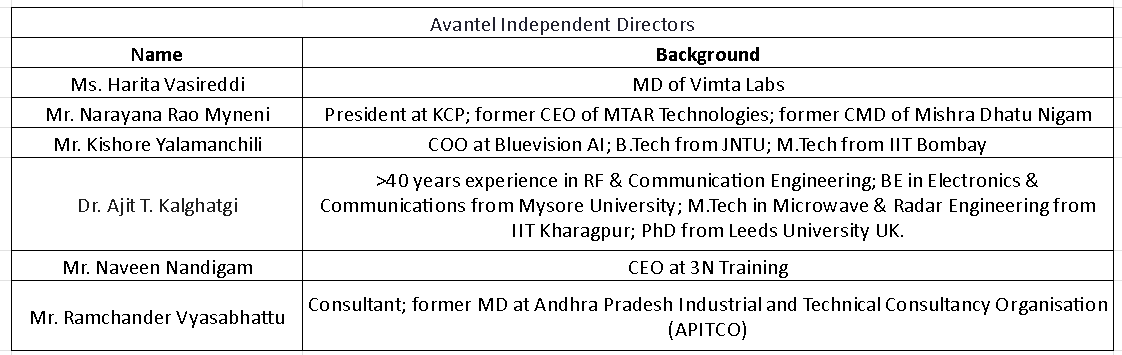

Avantel’s independent directors include

As a side note, Mr Siddhartha Sagar Abburi — the CMD’s son, having an engineering degree and a masters in computer science — has a passion project called Simply Science. It is an edtech portal, making science fun for students in high school. I have a subscription to the portal, and I can vouch for its excellent content quality and design. It operates under Wiki Kids Pvt Ltd.

The promoters also have a charity called Lakshmee Foundation, and they recently donated twenty lakh shares of Avantel (worth ~35 Cr INR at CMP) to the trust.

Innovative Monopoly

Conventional economic theory says that perfect competition is the most efficient market structure: with no product differentiation or entry barriers, the threat of competition forces a company to operate efficiently. But Peter Thiel disagrees.

Thiel realises that an innovative monopolist can use its sustained profit pools (RoCE > cost of capital) to think long-term and invest in R&D and technology to strengthen entry barriers.

In my assessment, Avantel is an innovative monopoly. In a speech, the CMD explained that ~90% of revenue comes from unique, differentiated products where they are the sole supplier.

To corroborate this claim, one can look at various tender documents. For instance, this RFI document lists Avantel as the sole vendor for three products (serial numbers 1, 20 and 21).

Another tender by Garden Reach Shipbuilders is a single tender for “1KW HF TX RX System for 04 SHIPS OF NGOPV (Yard 3037-3040)”. It says, in unambigious terms,

Offer of any firm, other than M/s.Avantel Limited, Hyderabad participated in the Tender No. GEM/2023/B/3787564 dtd: 04.08.2023, will not be considered and will be rejected

This is reflected in the numbers, which show that Avantel’s average RoCE from FY13 to FY24 is ~35%. Incremental RoCE (Δ EBIT / Δ capital employed ) between FY23 and FY24 is ~93%.

As for how this monopoly is achieved and sustained, a discussion of Avantel is incomplete without a discussion of their R&D. As the CMD has explained in past annual meetings,

It takes about three to four years of advanced planning and development…so we invest in R&D, and then come up with a product. And that will be an entry barrier, because we are three to four years ahead of [competitors]. By the time they want to get into that you have already captured it. So that’s how we survived all these years…whatever we invested three, four years back…have given results today…we should understand that you invested earlier and the returns are coming this year.

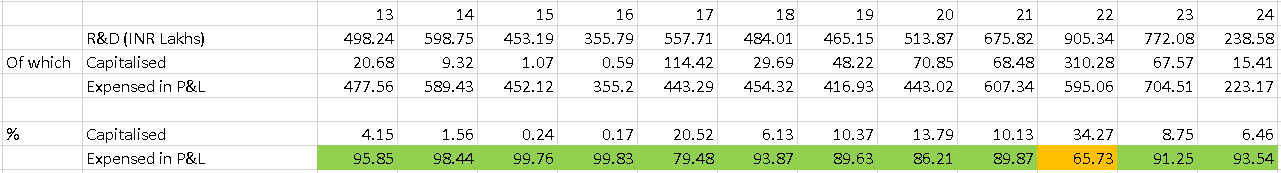

Importantly, for most years in the last decade, consistently over 90% of the total R&D spend has been debited to the P&L instead of being capitalised, an indication of conservative accounting.

In the past, during the period from FY14 to FY17, R&D expense as a % of revenue jumped substantially from their standard high-single-digit range to an average of 16% from FY15 to FY17 (excluding the abnormal 45% in FY14).

This was primarily directed towards:

- real time train tracking systems (in collaboration with Highness Microelectronics), and

- 1 KW HF power amplifier and antenna tuning unit.

As a result, operating margins contracted by 700-800 basis points and return on capital employed plummeted.

Sure enough, Avantel received an order worth INR 1.25 billion for train tracking and wrote in its FY21 annual report – “this year, the company has also signed a highest value contract till date with Indian Navy for supply of 125 No’s 1 KW HF Transceivers.”

Avantel received a CII Innovation Award in 2019, and the document sheds interesting insights on three of their innovations:

Innovation 1 — MSS Mark II System using DBF Technology

The MSS Mark II system Supports Voice and Data communications through Indian Satellite and facilitates continuous connectivity for Indian Navy assets in high Seas across its area of interest. The MSS MK II system is an improvement to the existing data only MSS MK I system supplied by Avantel itself and is currently operating on Indian Navy Ships, Submarines, Aircraft, Strategic Vehicles and Manpack terminals. The usage of DBF technology has enhanced the data rates and facilitates optimum utilization of Satellite Bandwidth.

*Innovation 2 —*1 KW HF Transceiver

To meet the indigenous requirements of an Indian Navy Project for procurement of 1 KW HF systems, there was requirement to develop and manufacture various technologies of 1 KW HF systems in India itself. In this endeavor, Avantel has indigenously designed and developed various major sub systems viz. 1 KW power amplifier, remote control unit, HF interface unit, power supply unit and antenna tuning unit. Only two sub systems namely, Exciter and Modem have been sourced from their collaborator Hagneuk Marine Kommunikations, Germany.

The field evaluation trials (FETs) have been successfully completed by Indian Navy for the project. Out of the indigenous developed systems, the ATU technology is critical and is being offered by very few Global OEM’s. Avantel could develop the 1 KW ATU technology in a record time.

Avantel has implemented proprietary, automatic tuning algorithms for fast tuning with impedance and VSWR detection in its ATU solution.

Innovation 3 — Critical Subsystems for Electronic Warfare in LIC (Low Intensity Conflict) areas

Avantel has indigenously designed and developed solid state wideband power amplifiers required for ECM jammer in the frequency band of 1.5 to 1000MHz with power outputs of 1KW for the project LIC. These power amplifiers are supplied to the system integrator M/s Bharat Electronics Ltd, Hyderabad. These power amplifiers are import substitution products to the units imported from EMPOWER, USA resulting in 30 to 40% cost savings for the customer.

As seen in the above description of their innovations, Avantel has been able to indigenously develop import substitute products, often in record time periods.

In a speech, the CMD suggested that over the years, through cost savings from import substitution, Avantel’s products have saved >1000 Cr INR for the country.

More recently, Avantel won two awards in the Defense India Start-up Challenge.

Defence India Start-up Challenge (DISC 8) under Mission DefSpace is launched with 23 Problem Statements (PS) aimed at developing technologies addressing every stage of a space mission – from mission planning to satellite data analytics

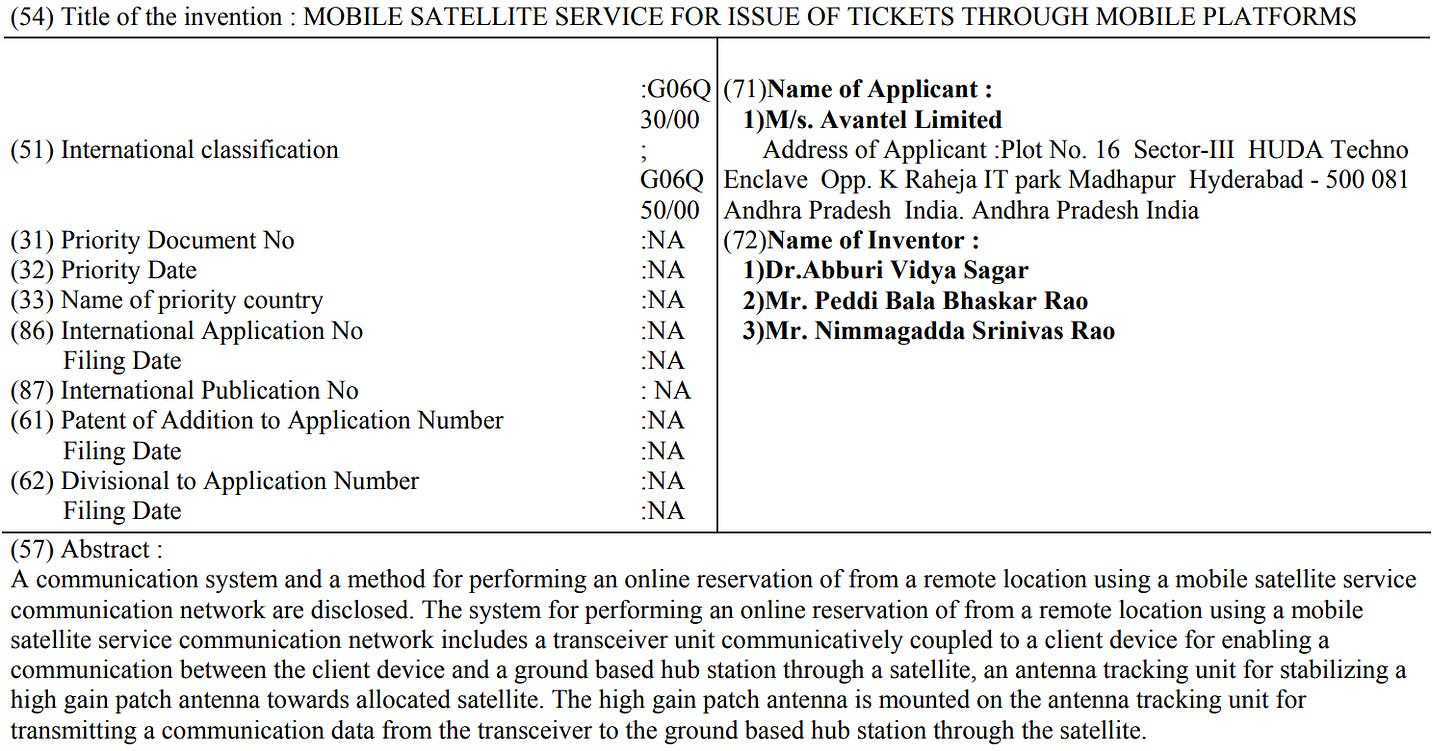

Additionally, they have various patents, as seen below.

Their R&D capabilities are also validated by the numerous awards they have won. Avantel was named among the top 25 most innovative companies; won 1st prize for excellence in R&D in the MSME category etc. (the list goes on). Regarding attracting talent right out of college, Avantel has tied up with an engineering college (VNRVJIET) and is also one of the bigger recruiters at ANITS.

Order Book and Growth Prospects

I have mapped out their reported orders and execution time frames, for better growth visibility. Here is a live Google Sheets for ongoing monitoring of their disclosed orders.

The existing business continues to grow, and I am expecting ~18% revenue CAGR from FY24 to FY27, before some of the new optionalities and levers start contributing meaningfully from FY27 onwards (see below).

Members of Parliament elected in the Lok Sabha have a right to raise questions to cabinet ministers. These are categorised as either ‘starred’ questions (answered verbally in the Parliament) or ‘unstarred’ (answered in writing). Interestingly, here is a document that details an unstarred question answered by the Minister of State for Electronics and Information Technology. It corroborates Avantel’s 45 Cr investment “to establish an additional facility for electronics design manufacturing and engineering service” on 3.42 acres of land that is expected to generate employment of 185 workers.

Additionally, Avantel has been setting up their medical devices vertical, which can begin adding to the financials in these coming years. As for assessing the soundness of this capital allocation, their foray into medical devices appears to be a case of unwarranted diversification; management has elaborated that they want to participate in affordable healthcare.

On the positive side, the capital deployed in this segment is only INR 2 Cr, well under 5% of total capital employed. Furthermore, their facility is being set up at the Andhra Pradesh Medtech Zone (AMTZ), a medical technology park with common manufacturing and scientific facilities. Management has commented “they [AMTZ] invested more than INR 100 crores on test facilities which are made available to the companies there…it is an ideal place to do something in medical electronics.”

As for revenue targets for the medical devices segment, the CMD mentioned INR 2.5 Cr for FY25, 10-15 Cr around FY26 or FY27, and “we are confident that we will reach 100 crores by 2030”.

Management has explained that, with regards to non-core diversifications, they will “leverage the existing strengths and…find new markets and new applications for the existing products and technologies” — for instance, in medical devices,

We are very well positioned in that because our expertise in electronics and engineering and mechanical, everything is very helpful in making world class equipment. We are not compromising on quality or anything. We are trying to build artificial intelligence into that. We want to make this equipment IoT enabled and benchmarked against the best in the world.

— CMD in the FY24 AGM, 30 May 2024

Optionalities and Terminal Value

When Peter Thiel ran some projections in 2001, he realised that 75% of PayPal’s value would come from cash flows generated after 2011, i.e., terminal value.

Similarly, when Elon Musk says that he expects Optimus to drive the majority of Tesla’s long term value, it is terminal value to which he is referring.

In that context, there are a number of levers that I believe can structurally improve Avantel’s terminal value.

While we have consolidated our existing business in satellite communication for defence applications, we are also diversifying into two different areas and we expect to see the results in two years from now in a big way. We are very confident that both these initiatives will put the company in a different orbit. From 2026-27 onwards, we expect to see the results. From 2027 onwards, three years from now, there will be a quantum jump, and then we expect the company to be doing very well and establish itself among the top five companies in the country in defence communication.

— CMD in the FY24 AGM, 30 May 2024

These initiatives are:

- SDR exports — “[SDRs] will also have possibility to expand in the global market. While satellite communication sometimes is specific to a particular country, particularly when it comes to geostationary orbit satellites, these SDRs which we are working on have mostly terrestrial communication, so they have market across the globe. So, we’ll be open to supplying this abroad as our functionality and specification of our products will be as per global standards.”

- Space offerings

- Ground station as a service (GSaaS) — think of it like the space equivalent of a data centre; a private space company wants to communicate with its satellite and needs on-ground terminals and mission control centre, so instead of building and owning it themselves, they can outsource it to a GSaaS player.

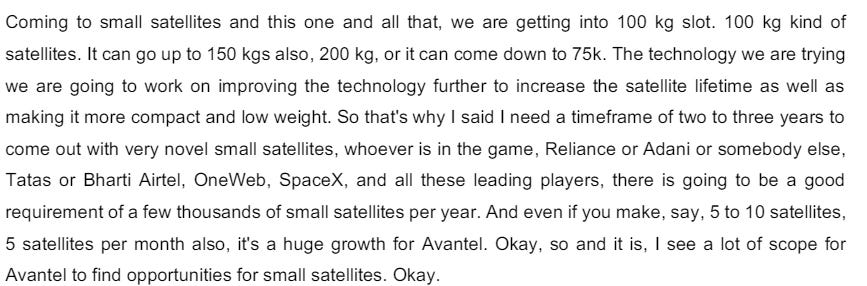

- Assembly, integration and testing of satellites — they are establishing a 70,000 square feet facility (4 acres land area available) in E City, Hyderabad, scheduled to be operational by October 2024, where they will be able to do up to 1000 kg satellites in-house. Additionally, management commentary on small satellites below.

Here is an excerpt from Ashlee Vance’s biography of Elon Musk, to connect the dots on small satellites.

Some members of the military had already been promoting the idea of giving the armed forces more aggressive space capabilities, or what they called “responsive space.” If a conflict broke out, the military wanted the ability to respond with purpose-built satellites for that mission. This would mean moving away from a model where it takes ten years to build and deploy a satellite for a specific job. Instead, the military desired cheaper, smaller satellites that could be reconfigured through software and sent up on short notice, almost like disposable satellites. “If we could pull that off, it would be really game-changing,” said Pete Worden, a retired air force general … “It could make our response in space similar to what we do on land, sea and in the air.” [emphasis added]

Investment Prospects

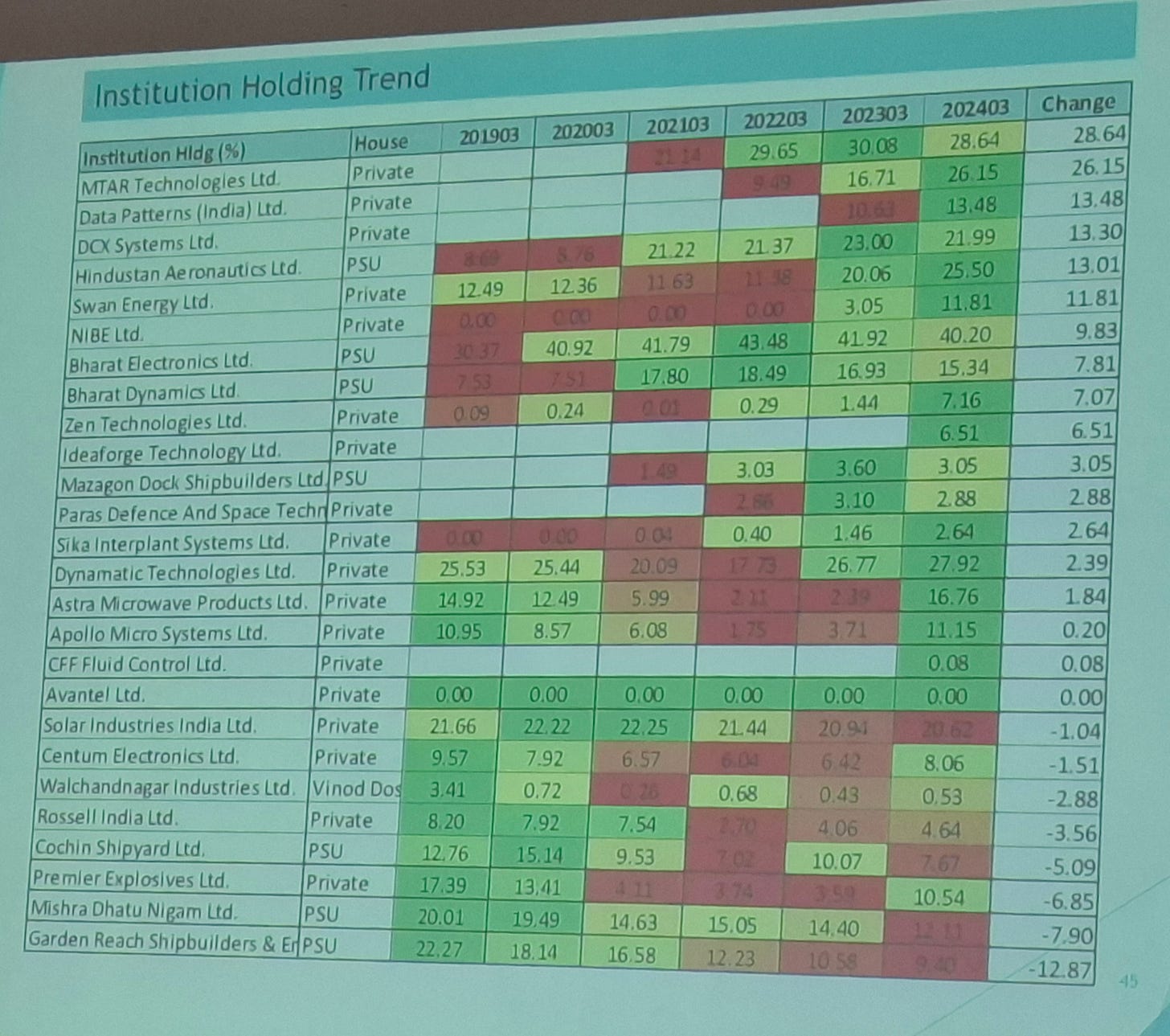

Interestingly, Avantel is the only listed company in the defense sector that has zero DII/FII holdings! In my humble assessment, this is unsustainable, and I envisage institutions participating in Avantel’s growth trajectory sooner or later. While their participation, or lack thereof, is unlikely to affect terminal value itself (except through reflexivity, perhaps), it will likely influence the pace with which the value gets recognised.

Ganesh Housing- A Potential Play for Housing for All theme? (24-07-2024)

Business Updates

- The trend of bookings in premium housing usually picks up after the first floor is completed and the sample flat is on show

- Q1FY24 was exceptional in one sense so its not completely comparable to the current quarter’s numbers

- Sequentially there will be a growth in all the quarters going forward

Participants

Nuvama Wealth

Profitmart Securities

Countercyclical Investments

Manya Finance

Arjav Partners

Oneup Financial

Antique Stock Broking

QnA

- Total sales value is Rs 450 crores and the cost is Rs 350 crores for the Malabar Retreat project

- The company has enough cash balance on hand for construction of first phase of the projects and pre sales from projects will be used to construct

- Most of the costs have already been done on land which is historical and now the only cost that remains is construction cost which is done from pre sales and customer advances

- In FY27 The Malabar Retreat project will get completed and that has a revenue potential of Rs 450 crores

- In the next 7-10 years the company will use all the land bank that it has on its books and value of land on books on a baseline can be estimated at Rs 20000 crore on a conservative basis

- Currently in no hurry for JV deals and can do this in future if an opportunity comes across but not for now

- The selling price in Malabar Retreat is around Rs 5500/sqfoot and the idea is to do at a lower amount initially and with new bookings done every quarter the price will keep inching up

- Post implementation of RERA and GST the real estate industry is now fully converted to organized. Even the smaller unorganized developers have converted themselves to the organized space

- There are multiple good developers in Gujarat which are doing very good in respective areas and around 15 odd developers in Ahmedabad have a good market share in the city

- Each good developer has their own niche which they have developed over the years and they have their own area of excellence in terms of land bank in respective areas

- No large developer in Ahmedabad will have more than 10% market share

- As of now no concrete plans to go out of Ahmedabad but there is a continuous evaluation of opportunities outside of Ahmedabad as well

- The cash balance was Rs 230 crores as on FY24 of which Rs 60 crores is still remaining. Looking at the way projects are planned the construction cost is already in the books and also being funded by advances and collections from customers

- There will be no additional equity or debt raised from the market to fund any of the projects