I am interested to Join Mumbai Group

Posts in category Value Pickr

Sona Comstar BLW – Direct EV Play (14-07-2024)

The EV transition is contingent upon 2 factors:

(1) Upfront cost —-which is further dependent on battery tech / decrease in battery cost as batteries are 40% of cost

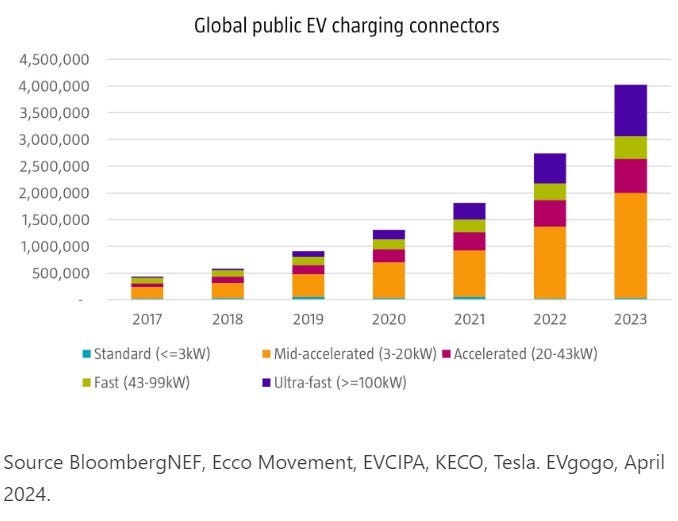

(2) Charging Infra

I started positioning myself in the stock only after seeing the green shoots in the PV action after FY24 results.

Full stack:

(Sona BLW Precision Forgings Ltd – by Pankaj Garg)

This company falls in fundamental VCP framework. Some stocks remain expensive for a long period of time…this imo is one of them.

Time technoplast (14-07-2024)

It’s currently fairly valued, not highly valued. 15x EV/EBIT for a company that earns 15-16% ROCE. The perfect definition of fair valuations!

I think you’re anchoring yourself in past valuations of 6-8x EV/EBIT, when business had mediocre returns on capital. But now the fundamental situation of the company has changed.

If we take 15% CAGR growth rate for the next 5 years (Highly likely), along with 1-2% increase in EBITDA margins (Very likely as well as value added products share increases), and an exit multiple of 20x EV/EBIT (fair enough for company that’ll earn 20% ROCE), The price target comes out at 600rs

Now this is without considering any new LPG order or any new growth driver that might come in the next 5 years

Plus if market likes the consistent growth performance, it may give even higher exit multiple (supreme industries currently trades at 52x EV/EBIT at 28% ROCE)

Disclosure: Invested from 38 levels. Have added 6-7 more times since then, last price added at 166. Biggest position in my portfolio. I have personally seen the metamorphosis of this company from Cigarbutt type investment to possibly a consistent compounder type. So my opinion might be biased

Carysil (earlier Acrysil) – Kitchen sinks (14-07-2024)

debt to equity is .85.How is it resonable.any thought on this ?

Ambika Cotton Mills (13-07-2024)

If he is so keen to talk to the investors then why not doing concall?

Time technoplast (13-07-2024)

Not sure what valuations parameters you are using but in this bull market I find it reasonably valued.

Screener.in: The destination for Intelligent Screening & Reporting in India (13-07-2024)

In screener can i get forward p/e?

The HS Portfolio (13-07-2024)

- Religare is more of a special situation play where Burman’s have a real probability now of taking over. It has ample corporate gov failures in past and present is not so good. But it has a good insurance franchise and some other decent assets. As a negative, however this story is playing out for last 18 months and probably will continue for some more time.

2 On Manali Petro: @LarryWink Kindly help out the gentleman.

3 Swan: Pure punt I have taken. If they are able to execute of Floating Storage and shipbuilding oppurtunities they can do well. However its an extremely risky play as company has multiple moving parts, managment execution and quality is suspect and ofcourse CG concerns exist.

I will not add more to all the three positions taken here and fully expect to lose money on atleast one of them.

Screener.in: The destination for Intelligent Screening & Reporting in India (13-07-2024)

Let me know this by an example to illustrate how Screener might calculate the “Expected Quarterly EPS” using hypothetical data.

Company XYZ Example:

-

Historical Sales Data:

- Q1 2023: ₹500 million

- Q2 2023: ₹550 million

- Q3 2023: ₹600 million

- Q4 2023: ₹660 million

Observed Sales Growth Rate:

- Q1 to Q2: 10%

- Q2 to Q3: 9.1%

- Q3 to Q4: 10%

Average Sales Growth Rate: (10% + 9.1% + 10%) / 3 ≈ 9.7%

-

Expected Sales Growth Rate for Q1 2024:

Using the average growth rate of 9.7%, we project the Q1 2024 sales:- Q1 2024 expected sales: ₹660 million * (1 + 9.7%) ≈ ₹724.02 million

-

Historical Profit Margins:

- Gross Profit Margin: 30%

- Operating Profit Margin: 20%

- Net Profit Margin: 15%

-

Projected Gross Profit for Q1 2024:

- Gross Profit: 30% of ₹724.02 million ≈ ₹217.21 million

-

Projected Operating Profit for Q1 2024:

- Operating Profit: 20% of ₹724.02 million ≈ ₹144.80 million

-

Projected Net Profit for Q1 2024:

- Net Profit: 15% of ₹724.02 million ≈ ₹108.60 million

-

Outstanding Shares:

- Let’s assume Company XYZ has 10 million outstanding shares.

-

Projected EPS for Q1 2024:

- Projected EPS = Projected Net Profit / Outstanding Shares

- Projected EPS = ₹108.60 million / 10 million shares

- Projected EPS ≈ ₹10.86

Summary:

Based on this example, Screener’s expected quarterly EPS for Company XYZ for Q1 2024 would be ₹10.86.

Key Points:

- Sales Growth Rate: Derived from historical sales data.

- Profit Margins: Historical profit margins are applied to projected sales.

- Adjustments: Expenses, taxes, and other factors are considered based on historical trends.

- Outstanding Shares: The number of shares is used to calculate the EPS.

Screener uses historical financial data and observed growth patterns to estimate future performance, ensuring the projections are based on realistic and data-driven assumptions.