‘So, now we talk about the run rate of the manufacturing facility after the manufacturing

agreement coming live into action with the first full batches coming into place in November

from December, January, the facility has started producing in full swing and in March we

recorded a manufacturing volume quantity of about 7.5 lakh liters, which takes us to an annual count of about 8,400 tons and along with this, we expect that the kind of growth we are expecting this year, we should be able to reach to almost 90% of the capacity utilization, which is about 16,000 crore in next 1-1.5 year at max’. from page no 5 of concall… Can someone pls explain this?

Posts in category Value Pickr

Sirca Paints India Limited (01-07-2024)

DCX Systems Ltd (01-07-2024)

Although order has to is to be executed across 3 years, it is still a very welcome order.

L&T single order of 1250cr. Great achievement.

Lockheed Martins trial order from last year. Great achievement.

Future is bright. Company has to execute and uphold the quality.

JHS Svendgaard – An Oral Care FMCG Major In Making (01-07-2024)

May be avoided as RoE and RoCE are falling for past 7 years

Rural Elect Corp (01-07-2024)

Seperate from what we were expecting but good news keeps coming

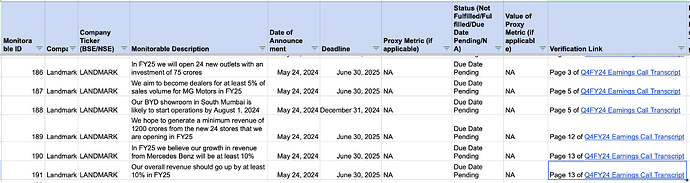

Landmark Cars – Listed premium Car dealership in India (01-07-2024)

Hello,

In the below tracker, I have started tracking important company goals for Landmark Cars.These goals are referred to as ‘monitorables’ in the tracker.I will update this document regularly to reflect the current status of these goals.

Here’s a snapshot of what the tracker includes:

- Company Ticker: For identifying the company

- Monitorable Description: Description of the goal or metric being tracked

- Date of Announcement: When the monitorable was announced

- Deadline: Target date for achieving the monitorable

- Status: Current progress (e.g., Not Fulfilled, Pending)

- Verification Link: A link to see where we got the information about the goal.

I hope this information makes it easier to observe how well companies are progressing towards their stated goals.

Screenshot of the tracker below:

Full tracker attached below:

Tracking Company Monitorables-10.xlsx (127.5 KB)

CFF Fluid Control Limited – SME (01-07-2024)

As a value investor, it is difficult to buy defence stocks at present level. However, as the sector is leading, one wishes to be invested here. I therefore applied in recently Motilal Oswal Defence Index Fund… May be just a way to invest without looking at valuations.

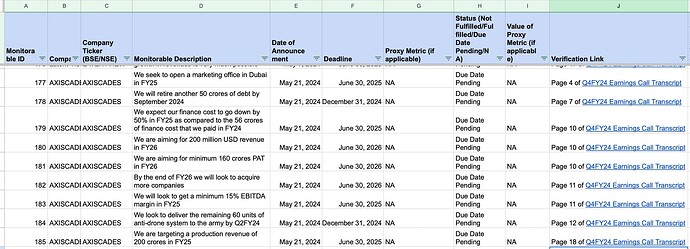

Axiscades Engineering – Untested and a high Potential Opportunity (01-07-2024)

Hello,

In the below tracker, I have started tracking important company goals for AXISCADES.These goals are referred to as ‘monitorables’ in the tracker.I will update this document regularly to reflect the current status of these goals.

Here’s a snapshot of what the tracker includes:

- Company Ticker: For identifying the company

- Monitorable Description: Description of the goal or metric being tracked

- Date of Announcement: When the monitorable was announced

- Deadline: Target date for achieving the monitorable

- Status: Current progress (e.g., Not Fulfilled, Pending)

- Verification Link: A link to see where we got the information about the goal.

I hope this information makes it easier to observe how well companies are progressing towards their stated goals.

Screenshot of the tracker below:

Full tracker attached below:

Tracking Company Monitorables-9.xlsx (127.1 KB)

Ranvir’s Portfolio (01-07-2024)

RACL Geartech –

Q4 and FY 24 results and concall highlights –

Company’s product profile includes transmission gears and shafts, sub assemblies, precision machined parts, chassis parts and Industrial gears

Company has 02 manufacturing facilities in India ( Gajraula and Noida ) and 03 warehouses in Europe

Q4 outcomes –

Sales – 115 vs 96 cr

EBITDA – 24 vs 23 cr

PAT – 8.5 vs 9.5 cr

FY 24 outcomes –

Sales – 433 vs 367 cr

Gross Margins @ 71 vs 70 cr

EBITDA – 101 vs 90 cr

PAT – 40 vs 37 cr

Company has 22 active customers for its products ( globally )

Company has been awarded Tier – 1 supplier status by a premium German car manufacturer for manufacture and supply of parking lock mechanisms. Mass production for this is expected to start in Feb 26

Company lost some business in FY24 due mismatch in Gear Grinding capacity. The same has now been rectified. Gear grinding is one of the most important part of their manufacturing process

Company is targeting a revenue of 550 cr for FY 25. That’s almost 30 pc growth from 433 cr topline it clocked in FY 24

Company has strong relationship with ZF group. In coming years, revenues from supplies to ZF group should contribute Double digit revenues for the company

Disc: hold a small tracking position, looking out for improvements in Quarterly results before adding, not SEBI registered, biased

DCG WIRE and CABLE (01-07-2024)

DCG wire is proxy power energy sector theme avilable is good price