why company is not focusing on domestic market share it will further boost company’s revenue .can anyone have a reason why company is not focusing on domestic market & one more thing i would like to mentioned about subsidy by the government it will impacted if there is rulling party change

Posts in category Value Pickr

Shivalik Bimetal Controls Ltd (SBCL) (06-11-2024)

So longevity of the designs are more than 15 years as a typical vehicle platform exists for 10-15 years. What changes are shapes and sizes of the shunt resistor based on battery pack design / power requirements / environmental factors etc.

ISA have 500-600 SKUs of shunt design. They used to patent this design at a discussion stage which became extremely inconvinient for the OEMs whenever they need to do slight modification or change the source. That is where new players like SBCL become extremely important from IP perspective.

Another thing to note is whenever a new shunt order or a design modification order comes, SBCL charges a tooling cost on that prototyping. Sometimes same OEM gives the order to multiple tier 1 and the tier 1 sends the same order to a few player. I came across an interesting instance where SBCL got the same prototyping order from 3 different Tier 1s.

The design, to approval to large volume delivery takes around 2-3 years as there are rigorous lifetime tests done on the components.

@Donald da, The module part is still unclear to me on whether they would become a full fleged module supplier. But it seems that the company is taking early steps towards becoming atleast a contract manufacturer for module components. Studying Tier 1s design freeze are a bit complicated at these stage as the SKUs would be even larger and there are no public information of it. These are custom tuned to the product’s requirment.

On the results with the US election and hopefully a significant policy push towards electrification, I feel that we will see good demand coming through in next 2-3 years.

Disc : I belong to this industry and significantly biased.

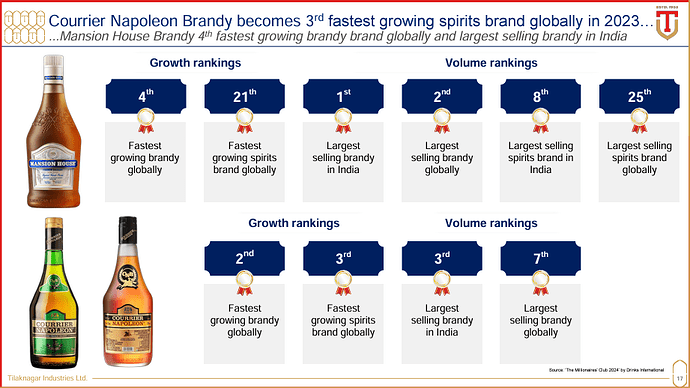

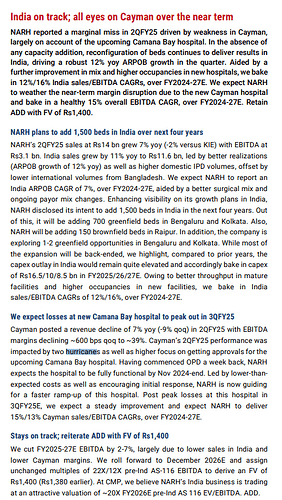

Tilaknagar Industries- Potential Turnaround Candidate (06-11-2024)

Q2 FY2025 Concall Highlights

Financial performance:

![]() Achieved highest ever quarterly EBITDA in Q2 at Rs. 66 crs, YoY growth of 39.1%

Achieved highest ever quarterly EBITDA in Q2 at Rs. 66 crs, YoY growth of 39.1%

![]() EBITDA margin at 17.6%, 422 bps expansion YoY. Industrial Promotion Incentive by Maharashtra, Q1 was 5.56 cr, Q2 was 10.36 cr. Margin Expansion mainly due to cost optimization, premiumization not impacted improvement.

EBITDA margin at 17.6%, 422 bps expansion YoY. Industrial Promotion Incentive by Maharashtra, Q1 was 5.56 cr, Q2 was 10.36 cr. Margin Expansion mainly due to cost optimization, premiumization not impacted improvement.

![]() Profit after tax at Rs. 58 crs, YoY growth of 82%; driven by reduction in finance costs

Profit after tax at Rs. 58 crs, YoY growth of 82%; driven by reduction in finance costs

![]() Net debt free as of September 2024, with net cash Rs. 25 crs.

Net debt free as of September 2024, with net cash Rs. 25 crs.

Guidance:

12 to 15% volume guidance on steady state basis.

Andhra Pradesh

AP has significant brandy drinking population.

Degrowth due to policy change.

Expect volume to grow significantly, as TI is leading player in state. 30 lakh cases industry, can be in 2 to 3 years, it can be 40 lakh cases.

AP is currently 30% of sales.

Retail going private makes market consumer driven. It benefits TI as company have good franchise. Industry will increase and company will take bigger pie. 10% shops will increase. Private players will make sure they are stocked, customers are satisfied etc. Expect overall improvement that will help to grow.

Telangana:

Overdue position is now 10 weeks. Normal is 8 to 9 weeks. Highest was 18 to 19 weeks.

IMFL Pricing committee will soon decide pricing.

Total receivable is 130 cr. Overdue is 80 cr.

Karnataka

Reduce duty, increase in volume. MRP goes down have impact positive impact.

Assam & North East:

Assam is very receptive to new product that is why Mansion House Whisky is launched in Assam. It is semi premium segment, comparable brands Royal Stage, Royal Challenge. It is priced at 560 rs. For 750ml bottle. Assam is having large market for this segment.

Upfront investment, working capital is lower compared to others.

Others:

Luxury foray is few week away. It will have incremental margin expansion, which we are not guiding as of now. One more launch after 6 months.

Easing of raw material and packaging cost.

Expect further expansion of margin.

Green Apple Flandy have very good response. It will not be millionaire brand this year. Flavoured spirts is fastest growing category in IMFL.

Tax can be back from Q1 FY2026.

Brandy is more than 90% of sales. Visio is to have 20% from Non Brandy by 2030.

CAPEX:

Maintenance CAPEX of 15 to 20 cr/year.

Distillery CAPEX not yet decided, recommission 100KLPD plant, which will cost 45 cr. If new distillery build it may cost 100 to 120 cr.

Strategic Investments:

Spaceman Spirits Lab Pvt. Ltd., the makers of ‘Samsara Gin’ and ‘Sitara Rum’.

Will start selling their brand in select state and internationally.

FY 2024 Revenue only 20 cr. It can be 100% for next two years.

TI will manufacture and sell in agreed state, where revenue and cost will come to TI books and will pay royalty to Spaceman spirits.

Samsara Gin and Sitara Gin goes along with TI’s luxury brand gives opportunity as alcoholic beverages is distribution driven market.

Round the Cocktails Pvt. Ltd., the makers of ‘Bartisans’, a ‘Ready to Pour’ cocktail mixers brand.

High brand recall, strong unit economics. Company is in non-alcoholic beverages.

80% sale online, they are digital fist company.

Expect significant growth.

It has no restriction on marketing due to non-alcoholic beverages.

There will be collaboration between Bartisans and Tilaknagar Industries.

Incredible spirits: It was small investment at 1cr. Sell this stake at cost in October.

Investor Presentation:

https://www.bseindia.com/xml-data/corpfiling/AttachLive/0f22af78-57a7-40d1-8c67-f926584c0c9c.pdf

Disclosure: Invested

Subex Ltd. – Possible Turnaround? (06-11-2024)

Hey, anyone still tracking or is invested in this stock? One of my close friend recommended this stock to me but i am still hesitant.

Voltamp Transformers (06-11-2024)

does anyone have the analysis on the capacity usage of these players vs how much capex, source of funding etc? Pls post even if these are scattered info (not in organised format).

Voltamp Transformers (06-11-2024)

I think the transformer story is in tact.

Voltamp won the new order, though not very big.

Shivalik Bimetal Controls Ltd (SBCL) (06-11-2024)

Disappointing result…waiting for management commentary

Mahesh’s Portfolio (06-11-2024)

Hello everyone

Its a long time since I updated. Have been continuing with my old strategy of monthly SIP.

And its 12 years since I started equity investing this way. Some of the learnings I would like to share.

One thing that I always was intrigued was to know how compounding works in case of equity investing. The rise in the market thrilled me and the fall made me nervous. I had bookish knowledge to small degree but the doubts were always there. If I keep investing in stocks the way I did, (Method which I explained in the previous posts) will it really help to achieve a decent return? This question always was there at the back of the mind. More important question was really does compounding work the way its been glorified in stock market investing?

Afterall with a FD it is a more straight forward affair. At the end of every year the interest keeps on adding to the principal. Its only of late that I have begun to understand the beauty of compounding in equity investing.

In the early years of investing, say after 4 to 5 years the rise in returns is fast and fall is faster. Infact after 8 years of investing, during covid, my return almost became zero. Since then the bull run has helped to get a return of around 19%.

The last one month has been heavy on the portfolio. and the returns which was 19.5% last month has come down to 18.5%. No doubt in absolute terms I did have a big notional loss, But the percentage point reduction is less.

This I think is the power of being in the market for a long term.

Five years ago a similar fall would have bought down the returns by 5 to 6 percentage points.

I am writing this only with one purpose, may be some young investors out there who may be experiencing the volatility and concerned about the returns, we need to understand with time in the market the returns become more consistent and less volatile.

This journey is not without challenges. So many obstacles will come. But the important thing is don’t stop the monthly investment.

As the celebrated investor and the founder of Vanguard group John Bogle says, “Stay The Course” and we should do well!