Dear Sir,

PRICOL stock PE around 43x , is consider as a high valuation , is it hold the stock at current valuation. your kind reply on this request

Posts in category Value Pickr

Pricol limited – OEM automotive (22-06-2024)

Manappuram Finance (22-06-2024)

What about holding company discount for manappuram? My understanding is that asirvad ipo is not going to be full value unlocking for manappuram as holding company discount will always be there. Correct me if am wrong

.

Sansera Engineering (22-06-2024)

Thank you for giving us this opportunity, I would like to know if Sansera plans on acquiring the entire 51% stake in MMRFIC after the semiconductor development, if so what topline contribution can we expect to see post-acquisition?

Sansera Engineering (22-06-2024)

There is a plant visit scheduled by the company, in which I am participating; if the people tracking the stocks have any specific question, please either DM me or post it on the thread. Will try to get answers where possible.

Disc: Not invested in the company.

Smallcap momentum portfolio (22-06-2024)

@Siddharth515 As I have said in some of my previous posts, I have not done any backtests. I do not have the resources for that.

When the market goes down, this pf is also expected to go down. However, as we are rebalancing every week, there is a good chance that we will have the strongest stocks from the index in our pf.

Microcap momentum portfolio (22-06-2024)

As requested, I am giving below link to the Google Spreadsheet.

I have removed the formulae as the url will vary for everyone when they integrate the bhavcopy.

@hariharancj I am concerned that you are seeing big differences between the two. Please have a look at the sheet and let me know where the error is coming from. Look back dates or 1y / 6m price change or STDEV. Let us see where the error is.

Microcap momentum portfolio (22-06-2024)

Update for entry on 24th June 2024

50 EMA (21027) > 200 EMA (18739); hence, we can continue without any change.

Based on ranking:

- KIRLOSENG

- KIRLOSBROS

- JYOTICNC

- AZAD

- PURVA

- IFCI

- TECHNOE

- RTNPOWER

- CHOICEIN

- KPIGREEN

- NETWEB

- TVSHLTD

- GANESHHOUC

- HERITGFOOD

- TIMETECHNO

- THOMASCOOK

- ITDCEM

- IIFLSEC

- BASF

- VOLTAMP

- ASHOKA

- WABAG

- HGINFRA

- JKIL

- KESORAMIND

Based on A → Z for easy tracking:

- ASHOKA*

- AZAD*

- BASF*

- CHOICEIN

- GANESHHOUC

- HERITGFOOD

- HGINFRA

- IFCI

- IIFLSEC*

- ITDCEM

- JKIL*

- JYOTICNC

- KESORAMIND

- KIRLOSBROS

- KIRLOSENG

- KPIGREEN

- NETWEB

- PURVA

- RTNPOWER

- TECHNOE

- THOMASCOOK*

- TIMETECHNO

- TVSHLTD

- VOLTAMP

- WABAG*

Exits:

ARVIND, ASTRAMICRO, STAR and TARC make an exit.

ANANTRAJ, ELECTCAST and MOIL stay within the top 30 and hence remain.

Entries:

ASHOKA, BASF, IIFLSEC and THOMASCOOK make an entry.

JKIL and WABAG cannot enter as there is no vacancy.

AZAD is still under 6 months in the stock exchange and hence not considered. As JYOTICNC already in the pf, it is not being removed.

Prestige Estate – Will it increase the Prestige of Retail Investors (22-06-2024)

Raising of funds by way of issuance of equity shares or other eligible securities for an aggregate amount not exceeding Rs. 5,000 Crores (Rupees Five Thousand Crores only) by way of qualified institutional placement (“QIP”) or other permissible mode in accordance with the applicable laws, subject to the receipt of the necessary approvals as may be required

monetize assets of the Hospitality segment through Prestige Hospitality Ventures Limited,

wholly owned subsidiary of the Company by way of issue of shares (through primary or secondary or both) subject to approval of shareholders, market conditions and receipt of applicable approvals. In this regard, the board has formed sub-committee to oversee and structure the process. The committee is tasked with the responsibility of ensuring compliance with all regulatory requirements, coordinating with advisors and underwriters, and making

all necessary arrangements

As per bord meeting on 21.06.2024

Techno electric engg ltd (22-06-2024)

A lot on emphasis is being given on data center story, for me that will evolve but the Transmission side itself is a great thesis for the medium term to be in the stock. Sure technicals are supporting

(my views are biased so take with a pinch of salt)

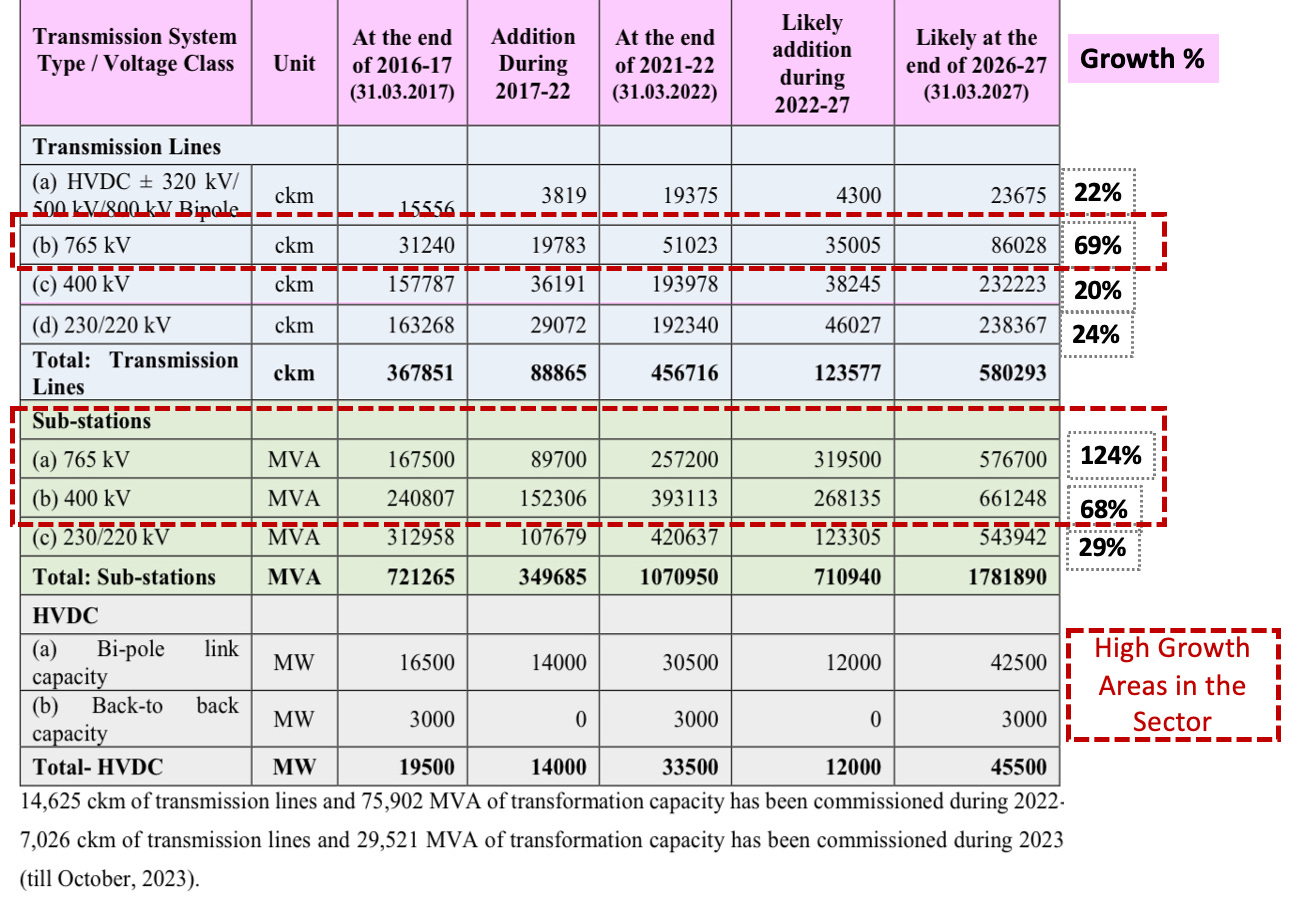

This is the data from National Electricity Plan. Clearly we are moving towards higher kV transmission grid. This plan is for 500GW of renewables.

I personally believe that 500GW is not end of the story…rather there will continued ramp up in renewables…as they get lion share of incremental power installation. There are many moving parts especially around Round the Clock generation and transmission with possible solutions in the future like green hydrogen and BESS (contingent upon becoming cost effective). I’m positive that this cycle in power capex will need more proactive grid development as the time required for grid development is way more than that of RE deployment. If there is lack of visibility of storage development, the transmission network will require even more capacity.

Technoe has very good credentials in STATCOM and 765kV substation deployment, the management has weathered the power downcycle remarkably and now is gearing to take advantage of the upcycle.

This is my thesis in short.

(Techno Electric & Engineering Company Ltd. – by Pankaj Garg)

Rest I am a techno funda follower so have risk management in place.

Regards

Pankaj Garg

(pankajg.substack.com)