Check March 2024, shareholding !!!

Posts in category Value Pickr

Rajratan Global – Focused Tyre Beadwire Company (03-05-2024)

Latest Concal:

Management:

Yes. So, our main competitor is Tata Steel. They have increased the capacity last year. Okay.

And they will also try to push bigger quantity.

No, first year, I will not, would not like to give any number on EBITDA from Chennai.

Because it’s a new plant, it will take some time to stabilize.

Very difficult to predict what China will do. We will have to look at government support to

whom fight with China because they supply without margin, they supply at a loss also. So, that is not a competition we can talk about. Otherwise, we are competitive with any other country,any other plant in the world other than China.

Tata Steel has capacity of 60 KT.

Simple Investing (03-05-2024)

Earlier I had the erstwhile Max India (before demerger) which included Max Healthcare, Max Ventures and Max finance. Yes, I had sold all three and at bang on wrong time after getting frustrated. All three businesses were excellent but promoter intention to exit had been hurting returns. Finally all three got good homes and went to do excellent.

Regarding re-entry, its in the Max India catering to senior living, care homes etc. part. Again the business is good and very long term in nature. Having seen Max India erstwhile ups and down, I have conviction that sooner or later this promoter does well with its companies either with it or exiting it with right deal with right people.

Last time I did not have patience and there was no precedent to learn from. This time, having learnt from past on same promoter, I have trust (for now) that over long term, value will be created.

Also, last time 10% or more of my then portfolio was invested in Max. That was big enough number to be losing patience if we lose even little bit of conviction. This time its just 0.5% now. I wanted to scale up to maybe 2-3% to begin with but stock ran up too fast after my first entry.

Disc: Same as above.

Basilic Fly Studio Ltd (03-05-2024)

People exiting or entering a stock based on one exchange filling error should revisit their thesis (if they have one) before making such decisions. Especially in case of SME stocks, one needs to have strong understanding of the business before buying the stock.

But looking at the reactions here, looks like people just jumped in the wagon reading the word VFX in company’s profile and are now jumping out because company didnt show 50% profits YoY (I dont think they even promised that).

In stock market, decisions without thinking are the most expensive ones. Please be patient and wait for clarification to emerge after concall scheduled next week.

Ugro Capital – Opportunity To Invest in a Fintech-like Company Below Book Value (03-05-2024)

Dear Value pickr family,

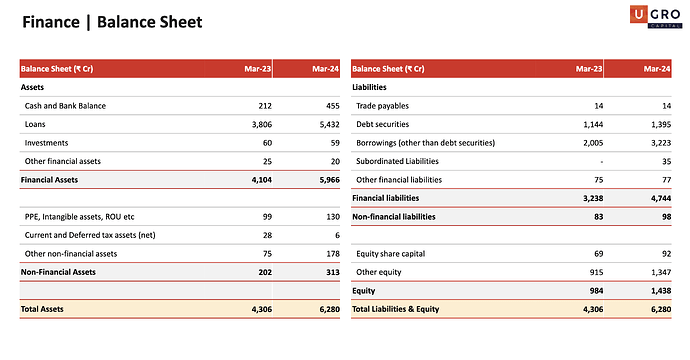

Could anyone of you help me to understand how the ROA of Ugro is being calculated for F24.

ROA: 2.3%

AUM: 9047Cr

On book and off-book mix for loan is 55:45

Management said that they calculate the ROA on balance sheet and not on AUM. Please explain me the calculation. Thanks!

Varun beverages fast growth duopoly business (03-05-2024)

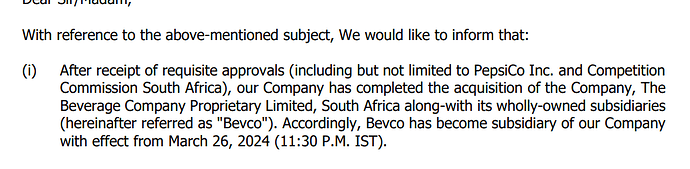

@Jitendrapd94 As Bevco became subsidy on 26th March , 2024 , will its earning will be part of March quarter consolidated earning ?

Basilic Fly Studio Ltd (03-05-2024)

Having three entries muddled up is not typo

Employee Expenses reduced, current assets go up, direct expenses changed

In their favour tax paid was based on higher value.

Could be intentional, oversight, who knows. Definitely not done themselves any favour

P.S.: disclosure : invested. Exited partially today

Ranvir’s Portfolio (03-05-2024)

RPG Lifesciences –

Q4 concall and results highlights –

Q4 outcomes –

Revenues – 127 vs 118 cr ( up 7 pc )

EBITDA – 22.4 vs 17.8 pc ( up 26 pc, margins @ 17.6 vs 15 pc )

PAT – 13.2 vs 10.4 cr ( up 28 pc )

FY 24 outcomes –

Revenues – 582 vs 512 cr ( up 14 pc )

EBITDA – 135 vs 107 cr ( up 26 pc, margins @ 23.3 vs 21 pc )

PAT – 87 vs 67 cr ( up 30 pc )

Segment wise performance for FY 24 –

Domestic branded formulations – 390 vs 340 cr ( up 15 pc ). New products ( launched after FY 19 ) contributed to 25 pc of sales. Sales force productivity crossed 5 lakh

International formulations – 106 vs 92 cr ( up 15 pc ). New products ( launched after FY 19 ) contributed to 30 pc of sales

APIs – 85 vs 79 cr ( up 7 pc ). Company hopes to ramp up API segment growth into double digits – going fwd

Company’s leading brands in India formulations market include –

Azoran ( immunosupressant )

Aldactone ( Diuretic – used to treat high BP/ heart failure )

Lomotil ( used to treat diarrhoea )

Naprosyn ( potent painkiller )

Serenace ( anti-psychotic )

Norpace ( used to treat abnormal heart rhythm )

Manufacturing facilities –

02 – formulations facilities @ Ankleshwar. Unit -1 caters to domestic and emerging mkts. Unit -2 caters to developed mkts

01 – API facility @ Navi Mumbai. Company makes the APIs of immunosuppressants in-house

In Q4, company’s secondary sales grew by 19 pc vs Industry growth of 6 pc !!!

Naprosyn and its line extensions – touched 75 cr sales in FY 24

Immunosuppressants portfolio – touched 70 cr sales in FY 24

Company aspires to take both these portfolios beyond 100 cr sales each

Cash on books @ 127 cr – actively looking at M&A opportunities ( cash build up has happened despite spending 140 cr for modernisation of one of their formulations and API facilities over last 2 yrs )

Company has traditionally been a laggard wrt chronic therapy sales. Have identified Derma, GI, Cardio, metabolic disorders – as key focus areas to ramp up their presence in chronic therapies. The ramp up shall however take time as the incumbents are well entrenched

The Jan-Aushadhi Kendra led Generic-Generic medicines do pose a long term threat to the company. However, if the manufacturers supplying to Jan-Aushadhi Kendras were to comply with the WHO GMP / Other quality standards, their product costs shall rise materially and be comparable to branded generics

When the company launches a new product in the Mkt, its manufacturing is generally outsourced. Only when its volumes build up beyond a certain scale, the company brings its production inhouse

Some countries to which company is exporting to are facing forex shortages. Hence the Govt’s there are resorting to import restrictions which is reducing company’s export growth rates. Still, Pharma Industry is one – which is the last one to face such restrictions

Company has identified new APIs for in-house manufacturing. Aim to launch these by FY 26 – should lead to better growth rates in the API vertical

Disc: holding, biased, not SEBI registered

RPG LIFESCIENCES – Change in Governance and Performance (03-05-2024)

RPG Lifesciences –

Q4 concall and results highlights –

Q4 outcomes –

Revenues – 127 vs 118 cr ( up 7 pc )

EBITDA – 22.4 vs 17.8 pc ( up 26 pc, margins @ 17.6 vs 15 pc )

PAT – 13.2 vs 10.4 cr ( up 28 pc )

FY 24 outcomes –

Revenues – 582 vs 512 cr ( up 14 pc )

EBITDA – 135 vs 107 cr ( up 26 pc, margins @ 23.3 vs 21 pc )

PAT – 87 vs 67 cr ( up 30 pc )

Segment wise performance for FY 24 –

Domestic branded formulations – 390 vs 340 cr ( up 15 pc ). New products ( launched after FY 19 ) contributed to 25 pc of sales. Sales force productivity crossed 5 lakh

International formulations – 106 vs 92 cr ( up 15 pc ). New products ( launched after FY 19 ) contributed to 30 pc of sales

APIs – 85 vs 79 cr ( up 7 pc ). Company hopes to ramp up API segment growth into double digits – going fwd

Company’s leading brands in India formulations market include –

Azoran ( immunosupressant )

Aldactone ( Diuretic – used to treat high BP/ heart failure )

Lomotil ( used to treat diarrhoea )

Naprosyn ( potent painkiller )

Serenace ( anti-psychotic )

Norpace ( used to treat abnormal heart rhythm )

Manufacturing facilities –

02 – formulations facilities @ Ankleshwar. Unit -1 caters to domestic and emerging mkts. Unit -2 caters to developed mkts

01 – API facility @ Navi Mumbai. Company makes the APIs of immunosuppressants in-house

In Q4, company’s secondary sales grew by 19 pc vs Industry growth of 6 pc !!!

Naprosyn and its line extensions – touched 75 cr sales in FY 24

Immunosuppressants portfolio – touched 70 cr sales in FY 24

Company aspires to take both these portfolios beyond 100 cr sales each

Cash on books @ 127 cr – actively looking at M&A opportunities ( cash build up has happened despite spending 140 cr for modernisation of one of their formulations and API facilities over last 2 yrs )

Company has traditionally been a laggard wrt chronic therapy sales. Have identified Derma, GI, Cardio, metabolic disorders – as key focus areas to ramp up their presence in chronic therapies. The ramp up shall however take time as the incumbents are well entrenched

The Jan-Aushadhi Kendra led Generic-Generic medicines do pose a long term threat to the company. However, if the manufacturers supplying to Jan-Aushadhi Kendras were to comply with the WHO GMP / Other quality standards, their product costs shall rise materially and be comparable to branded generics

When the company launches a new product in the Mkt, its manufacturing is generally outsourced. Only when its volumes build up beyond a certain scale, the company brings its production inhouse

Some countries to which company is exporting to are facing forex shortages. Hence the Govt’s there are resorting to import restrictions which is reducing company’s export growth rates. Still, Pharma Industry is one – which is the last one to face such restrictions

Company has identified new APIs for in-house manufacturing. Aim to launch these by FY 26 – should lead to better growth rates in the API vertical

Disc: holding, biased, not SEBI registered