As a customer, i am not happy with Blinkit. I ordered 7 items and items was delivered in sealed bag. However, one item was missing despite paying delivery fees of Rs 9. There is no customer care executive to call, they are asking us to email the issue. However, since item was of low value (Rs 20), i feel writing email to Blinkit is Hassle/hurdle or not a good customer service. So i am not inclined to use Blinkit again.

Posts in category Value Pickr

How to register with SEBI as a Research Analyst? (23-04-2024)

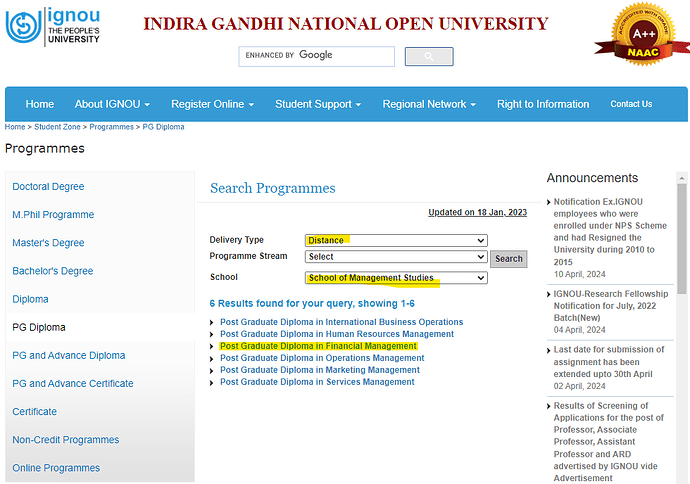

I saw that a lot of folks were curious to know courses that can be done from remote and in the shortest duration. Below, I think, shall help all such folks:

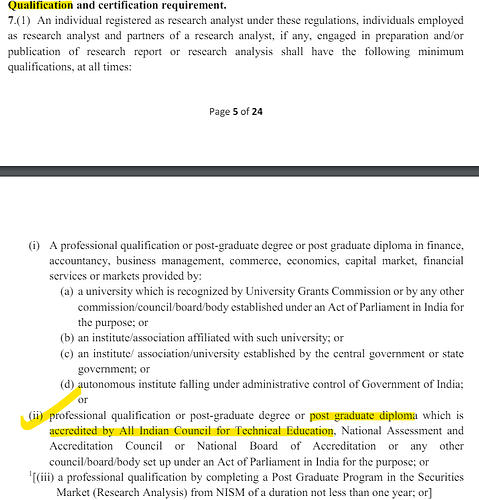

Excerpt from the SEBI Regulations [SEBI | Securities and Exchange Board of India (Research Analysts) Regulations, 2014 [Last amended on August 03, 2021]] on RA qualification:

Highlighted the most relevant 1 Yr. course in IGNOU [Link: Programmes at IGNOU – PG Diploma]:

Note: Shared as per personal understanding of the SEBI regulations. This is not validated by the external agency.

Microcap momentum portfolio (23-04-2024)

Sir, gone through it, and videos, but not getting understood on certain points, though you were very good, request one more session if you are comfortable please. Thank you sir.

LUX INDUSTRIES – Can it Scale? (23-04-2024)

Any news behind the movement today. None that I could find. Thanks

Disc.: invested

Ranvir’s Portfolio (23-04-2024)

Dr Reddy –

Q3 concall and results highlights –

Revenues -7237 vs 6790 cr

Gross Margins @ 58.5 vs 59.2 pc

EBITDA -2023 vs 1939 cr ( margins @ 28 vs 29 pc )

PAT -1381 vs 1244 cr

R&D spends @ 556 cr ( @ 7 pc of sales, up 15 pc YoY )

Cash on books @ 5900 cr

Region wise sales performance –

North America – 3349 vs 3056 cr, up 7 pc

Europe – 497 vs 430 cr, up 15 pc

India – 1180 vs 1127 cr, up 5 pc

Emerging Mkts – 1283 vs 1309 cr, down 2 pc

APIs + Pharma Services – 783 vs 775 cr, up 1 pc

Acquired the branded portfolio of MenoLabs in US. Its focussed on women health ( basically – health supplements ). The portfolio consists of 07 brands mainly targeting the symptoms of menopause and pre-menopause

Entered into exclusive collaboration with Coya Therapeutics for development and commercialisation of COYA 302 ( a biologic ) – for treatment of Lateral Sclerosis

Hoping for a double digit growth in India business in Q4. Focussing on in-licensing and collaborations to bring innovative products to Indian Mkts. Company is investing significantly behind this initiative

Also launched the innovative – Wearable Medical Device – Nerivio in India in Q3. It’s used for treatment of Migraine. The device is worn on the arm and works on Remote Neuromodulation principles to alleviate migraine symptoms. The device transmits electrical pulses to achieve Neuromodulation. Its a USFDA approved treatment

Generics pricing declines in US are mild to moderate

Company has received 09 product approvals in the China Mkt. 03 of them were received in Q3

Company had earlier acquired Premama Wellness ( in 2022 ) in the US mkts – also focussed on Women’s health. The recent acquisition of MenoLabs adds to company’s presence in Women’s health in the OTC space. That’s where the company intends to expand even more

OTC sales in US already contribute to 10 pc of company’s US sales

Company has a product launch pipeline of 26-27 products to be launched in US over next 2 yrs. This pipeline consists of a healthy mix of ‘tough to make’ and ‘tough to develop’ products

Company intends to launch 06 biosimilars in US by FY 30. First biosimilar launch is planned in FY 27. Company also has a pipeline of additional biosimilars to be launched till FY 35

Dr Reddy’s acquired the US generics business of Australia based Mayne Pharma in Q4 FY 23 for $ 105 million. Company is happy with the acquired portfolio’s performance in US mkts

Company is investing behind building capacities in its CDMO business – which is small right now. But they are seeing good demand trends in the CDMO space

Company has invested a lot in the API and Formulation capacities for GLP-1 products ( these are peptide based medicines ). Intend to launch them across the world mkts ( depending on patent situations – country to country )

Disc: holding, biased, not SEBI registered

Pharma || Hospitals || Diagnostics : Industry perspective (23-04-2024)

Dr Reddy –

Q3 concall and results highlights –

Revenues -7237 vs 6790 cr

Gross Margins @ 58.5 vs 59.2 pc

EBITDA -2023 vs 1939 cr ( margins @ 28 vs 29 pc )

PAT -1381 vs 1244 cr

R&D spends @ 556 cr ( @ 7 pc of sales, up 15 pc YoY )

Cash on books @ 5900 cr

Region wise sales performance –

North America – 3349 vs 3056 cr, up 7 pc

Europe – 497 vs 430 cr, up 15 pc

India – 1180 vs 1127 cr, up 5 pc

Emerging Mkts – 1283 vs 1309 cr, down 2 pc

APIs + Pharma Services – 783 vs 775 cr, up 1 pc

Acquired the branded portfolio of MenoLabs in US. Its focussed on women health ( basically – health supplements ). The portfolio consists of 07 brands mainly targeting the symptoms of menopause and pre-menopause

Entered into exclusive collaboration with Coya Therapeutics for development and commercialisation of COYA 302 ( a biologic ) – for treatment of Lateral Sclerosis

Hoping for a double digit growth in India business in Q4. Focussing on in-licensing and collaborations to bring innovative products to Indian Mkts. Company is investing significantly behind this initiative

Also launched the innovative – Wearable Medical Device – Nerivio in India in Q3. It’s used for treatment of Migraine. The device is worn on the arm and works on Remote Neuromodulation principles to alleviate migraine symptoms. The device transmits electrical pulses to achieve Neuromodulation. Its a USFDA approved treatment

Generics pricing declines in US are mild to moderate

Company has received 09 product approvals in the China Mkt. 03 of them were received in Q3

Company had earlier acquired Premama Wellness ( in 2022 ) in the US mkts – also focussed on Women’s health. The recent acquisition of MenoLabs adds to company’s presence in Women’s health in the OTC space. That’s where the company intends to expand even more

OTC sales in US already contribute to 10 pc of company’s US sales

Company has a product launch pipeline of 26-27 products to be launched in US over next 2 yrs. This pipeline consists of a healthy mix of ‘tough to make’ and ‘tough to develop’ products

Company intends to launch 06 biosimilars in US by FY 30. First biosimilar launch is planned in FY 27. Company also has a pipeline of additional biosimilars to be launched till FY 35

Dr Reddy’s acquired the US generics business of Australia based Mayne Pharma in Q4 FY 23 for $ 105 million. Company is happy with the acquired portfolio’s performance in US mkts

Company is investing behind building capacities in its CDMO business – which is small right now. But they are seeing good demand trends in the CDMO space

Company has invested a lot in the API and Formulation capacities for GLP-1 products ( these are peptide based medicines ). Intend to launch them across the world mkts ( depending on patent situations – country to country )

Disc: holding, biased, not SEBI registered

Likhitha Infrastructure: CNG Infrastructure Play in India (23-04-2024)

@rajyashrajsingh Has anyone done some analysis of management of this company. Not much material available in public domain. Also which sectors will be beneficiaries of “ National Gas Grid”. Any thoughts on this.

Meghmani Finechem – Underrated multibagger? (23-04-2024)

all the derivates are commodity products… its just that they have slightly better realisations than caustic soda, so it ultimately reflects in higher margins. The sticky margins and business should imo start once they are deep into the chlorotoluene value chain.