Management team, if you go through the investor presentation, as of Aug 23, it looked like the family members mostly run the business, while yes, an owner-operator model is good, the management looks like it lacks the drive and probably the capacity of delivering on their lofty expectations.

Posts in category Value Pickr

Inox India, a story worth looking? (03-04-2024)

Impact of this patent could be understood via this article, though not a detailed one;

Chaman Lal Setia Exports Ltd (CLSE) (03-04-2024)

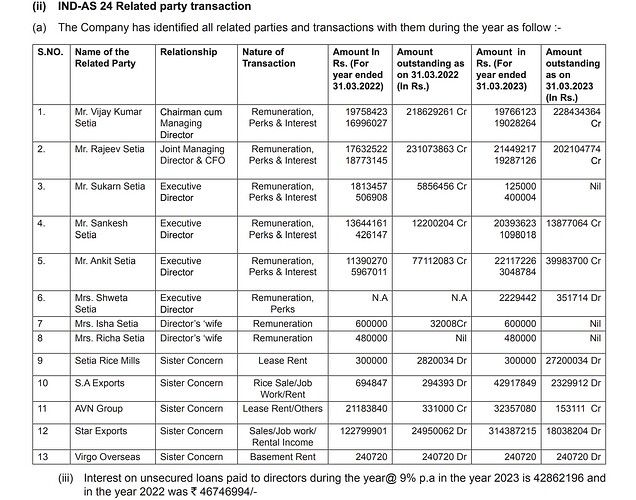

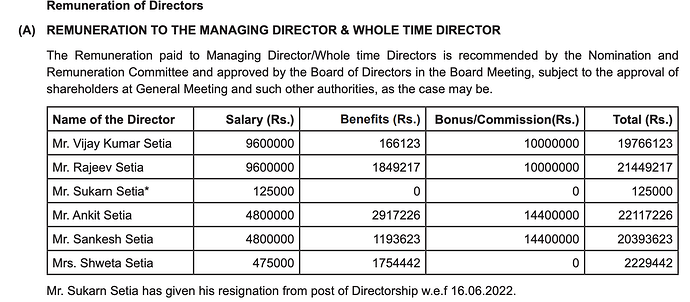

I was going through FY23 Annual report and came across a related party and saw two entries for amount FY23

- First one matches exactly with Compenstation. What does the second entry refer to?

- Why are they taking loan from Promoters at 9% ? Isn’t that too high rate of interest given that they are a sizeable business now and getting short term from HDFC ?

Both snapshots are taken from Annual Report FY23

Investing Basics – Feel free to ask the most basic questions (03-04-2024)

Good idea, research report by fund houses typically cover that aspect, idea will be useful for undiscovered companies.

BEW Engineering- A proxy play on pharma and chemical sector (03-04-2024)

Post Conference Note Bharat Connect Conference Rising Stars 2024

BEW Engineering Ltd

CMP: INR 1,503 | Market Cap: INR 4,627 Mn| View: Not Rated

Key highlights

● The company targets to have only 15 days receivables and thus only onboards orders which can be

completed in a short span. Order book timeline was 10-12 months before which has now come down

to 4 months due to this strategy.

● The capital coming in from fund raising will provide expansion opportunities leading to significant

growth.

● New infrastructure set up recently has started production in February with full-fledged production to

start in June.

● Capacity has doubled compared to September last year.

● Received big order from Aditya Birla (Thailand) and Bangladesh in FY24. First tranche of the Bangladesh order has been executed.

● Witnessing continuous in flow of repeat orders.

● Spherical dryer did not see the anticipated demand, but the company is optimistic of the product once

the industry uses it and realises its usage and potential.

Fund Raising

● The company raise INR 270mn through equity in September. Post September, INR 150mn warrants were issued; 25% of it has been received as FD. This week, INR 550mn worth of shares have been issued at INR 1540/share.

● The net worth will increase to INR 1300mn from INR 270mn.

Guidance

● Current order book at INR 700mn for next year.

● 20% revenue growth is expected in FY24 with much further improvements expected in revenue and margins going forward.

● Target to achieve INR 1500mn revenue in FY25. The company’s foray into larger customer base and new geographies will help in achieving these targets.

● Targeting much higher profitability with 25% EBITDA margins.

● Capacity expansion are in plans with Capex of INR 700mn with 10x revenue potential.

● The funds raised will help in becoming creditor debt free.

● Target to reach 100% capacity utilisation in the next 3 years.

● With planned capacity expansion and huge vendor base, the company is optimistic of achieving INR 2500mn revenue.

DDev Plastiks Industries – A Smallcap Gem (03-04-2024)

Got it, thanks a lot.

DDev Plastiks Industries – A Smallcap Gem (03-04-2024)

Got it, thanks a lot.

DDev Plastiks Industries – A Smallcap Gem (03-04-2024)

Quotes nexan and Prysmanian as clients…amongst the largest wire producers in Euro Zone.

Read an article (08 month old) recently highlighting the short supply of HVDC cables for under sea cables being faced in UK and frnace, who plan to lay these for transfer/ trade of power within european countries acrosss the seas.

DDev Plastiks Industries – A Smallcap Gem (03-04-2024)

Quotes nexan and Prysmanian as clients…amongst the largest wire producers in Euro Zone.

Read an article (08 month old) recently highlighting the short supply of HVDC cables for under sea cables being faced in UK and frnace, who plan to lay these for transfer/ trade of power within european countries acrosss the seas.

Eris Lifesciences – 100% of sales from India Pharma Market (03-04-2024)

Hello

wanted to start a new thread on this … Both the Biocon divestiture to Eris and their acquisition of Swiss Parenterals.

Market seems to be overly concerned about rising debt levels in the company.

Market is also worried that all cash flows are being invested in acquisitions and feel some will go wrong.

In a way only time can say . But management seems to be quite convincing.

Malolan