today came across this stock Nila Spaces, anyone has any information as screener data for the last Q seems to be eye-catching

Posts in category Value Pickr

JTL Industries – Fast Grower at an inflexion point (01-04-2024)

JTL Achieves Highest Ever Annual Sales Volume

FY 24 Volume – 341,846 MT (43% Growth YoY)

Q4FY 24 Volume Growth – 20% YoY; Flat QoQ15605:49 PM

Yogesh Portfolio (01-04-2024)

JTL Industries FY24 Business Update:

The company is clearly winning the battle in the steel tube and pipes category.

JTL Industries grew sales volumes by 42.5% YOY in FY24.

This is a far better show than the likes of APL Apollo that grew sales volumes by 15% YOY and Hi-Tech Pipes that grew sales volumes by 10% YOY.

The CAPEX plans at JTL Industries are well on track as the company is set to improve on its product mix and capture market share.

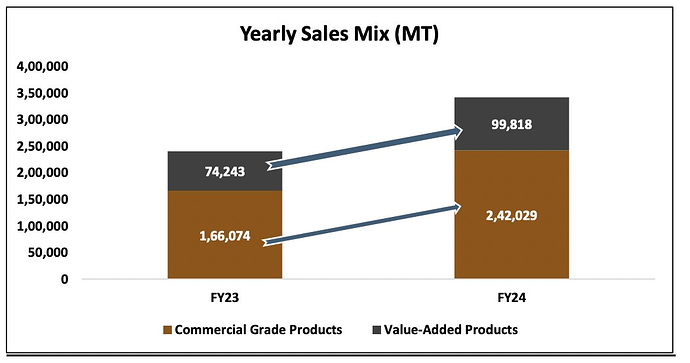

The only concern with JTL Industries is that the value-added segment grew at a slower pace (up 34% YOY) than overall volume growth (up 42.5% YOY).

The company never had any issues on the fundamental side and has kept performing much better than its peers.

JTL Management had guided to grow volumes by 35-40% CAGR for the next few years so this volume growth number of 42.5% is at par with what the management had guided in the past.

JTL Industries – Fast Grower at an inflexion point (01-04-2024)

JTL has just reported annual performance.

Solex Energy – Undervalued Solar PV Manufacturer or Microcap Value Trap? (01-04-2024)

Does anyone know about the current capacity of the company for solar modules?

Raymond – The Complete Man (01-04-2024)

Should happen by Q1 end or most certainly by Q2

Smallcap momentum portfolio (01-04-2024)

How are you looking at this whole momentum thing? The aspect of returns and the activity of doing, both.

Regarding returns, how do you think they will be in the future, not that we can predict, but given that this is a weekly strategy and more than 52 weeks have passed, I guess we can get some idea if something is done that many times. Do you think returns will become half, or they will be lower but will not be halved, or do you even think there could be a losing streak too?

Regarding the activity, you have laid out all of your work, including the list that will be bought, how do you look at the strategy itself, from the looks of it (I haven’t gone through it in detail, neither have I used it) it does not look too complicated, sure there is some work to be done to get the end list, but the very structure does not look too complicated (again, I did not look into it deeply). So assuming everyone who has replied is finding it fairly doable, then how do you associate such high returns with a strategy like this? Or it is that, the strategy is not that simple, it is your clear presentation that made it look like simple, so the high returns are in proportion to the work done, so they are justified.

I know that many simple things work with investing, some analysis is done, there is valuation comfort, even margin of safety, strong business, and if one has patience, the end result could be good. But, I am not too sure if trading is simple, because the emphasis is also on time, losses, along with return, and chasing momentum is definitely hard.

So if you can tell what your initial thoughts were before starting, and how the strategy has evolved over the many weeks, how your outlook has evolved, any new learning etc.

I would like to know about your perspective, which you have now, because the returns are already known, and they are very good.

Anyone looked at Somany Ceramics (01-04-2024)

The corporate structure has become more and more complicated over the years. In 2012, there were only 2 subsidiaries – SR Continental and Somany Global both of which were 100 % WOS. But in FY23, there are 11 subsidiaries and 3 associates / JVs. And many of these subsidiaries are NOT 100 % WOS.

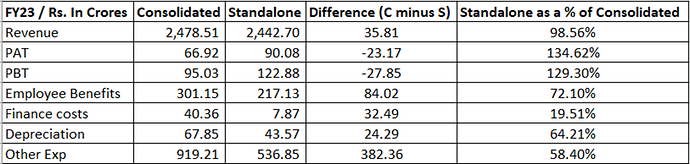

Almost Rs.131 crore have been invested in these Subsidiaries / JVs so far, but the returns from them are nil. While Standalone revenues are almost same as Consolidated, Standalone profits are significantly higher. Look at the table given below:

While almost entire revenues are coming from Standalone, a large part of the costs (Rs.382 crore of Other Expenses!) are stuffed away in subsidiaries. What is happening here? This pattern would have been okay if these were 100 % WOS, but now I think someone is saving on taxes at the cost of listed company’s shareholders.

Another issue is every year there are exceptional items, that too for reasons as bizarre as losing money in employee fraud or broker defaults and so on:

- Loss on disinvestment of a subsidiary Rs.2.18 crores has been shown under the head Exceptional Item in FY23

- Rs.18 crores invested in bonds of SREI which went bust was shown as an exceptional loss in FY21

- Rs.26 crore lost due to a broker default was shown as an exceptional loss in FY20

- Rs.16 crore fraud was committed by an employee shown as an exceptional item in FY19

- Rs.4.4 crore loss on discard of certain plant and wage settlement of previous years shown as exceptional item in FY18

- Rs.4.06 crores impairment of certain plant and machinery shown as an exceptional item in FY17

- Rs.4.43 crores being payment of Rs.3.83 crores to GAIL India Limited towards one time settlement of ‘Pay For If Not Taken Obligation’ for calendar year 2014 and loss of inventory of Rs.60 lacs due to fire in FY16 shown as exceptional item

- Rs.77 lacs for diminution in the value of subsidiaries shown as exceptional item in FY12

If you have an exception every year, it is no longer an exception, it is a rule.

Raymond – The Complete Man (01-04-2024)

any update on the demerger?

Investing Basics – Feel free to ask the most basic questions (01-04-2024)

Example of platform companies