Thanks Mohit…I think we will get more information soon as they have appointed IR Kaptify. I am planning to take a small position and build on as I get more conviction

Posts in category Value Pickr

Ratnaveer precision a newly headed steel company (30-03-2024)

(post deleted by author)

Shriram AMC – Waking up after a hibernation. Mcap 300cr (30-03-2024)

Shriram AMC earlier was privately owned by promoters of Shriram Finance. Now post merger within the group, Shriram AMC is step down subsidiary of Shriram Finance. (Shriram AMC is held by Shriram Credit company limited which was owned by Shriram Capital. Shriram Capital was merged with the listed Shriram Finance in 2022-23. Shriram Capital was earlier held privately by the promoters of Shriram Finance)

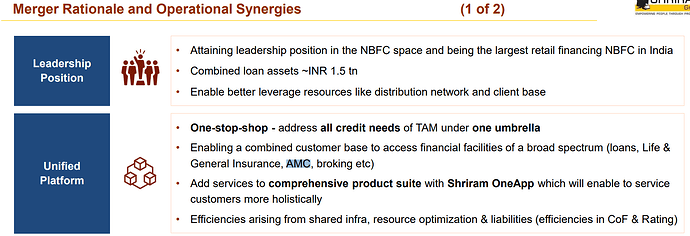

The main intent of merger of Shriram Transport with SCUF and Shriram Capital was to expand its offerings, become full fledged retail NBFC and to cross sell. Check below image from the presentation dated 13.12.2021 pg 6. Shriram Finance presentation

Now lets go through the organizational changes post 2022:

- Feb 2022 – Mission1 PE acquired 23% stake in Shriram AMC via warrants. Converted full warrants in Nov 2023.

- Aug 2022 – Appointment of new CIO Mr. Deepak Ramaraju. Was FM at Sanlam group (promoter grp) managed India fund earlier.

- Feb 2023 – Appointment of new MD Mr. Kartik Jain.

- Sep 2023 – Launch of new NFO – Shriram Multi Asset fund. Collected 90crs of AUM.

- Sep 2023 – Appointment of new Chief Business Officer – Mr. Chetan Doshi

- Nov 2023 – Shriram Finance MD in a interview on Nov 7th informed Bloomberg that they are restarting the AMC venture and willing to grow for the low income grp population. He also informed that they are willing to launch more schemes once they have research and operational capabilities.

- April 2023 – till date – Multiple hirings. They had just 8 employees till Sep 22. Employee base has increased from 8 in Sep 2022 to 17 in March 2023 to 28 in Sep 2023 to 51 in Feb 2024 (Source – EPFO website data). Employee additions in a service led business is a good trigger.

- Oct 2023 – till date – Equity AUM till Sep 2023 was less than 200crs. Post Multi Asset NFO E-AUM increased to 290crs in Nov 2023. Equity AUM as of Feb 2024 stands at 340crs (Source – Fund factsheets). Liquid AUM rose from 74crs in Oct 2023 to 103crs in Feb 2024.

- March 2024 – Shareholder approval to get into different business as per SEBI act. Special resolution Shriram AMC

Remember promoters tried to revive the AMC biz in 2013-14 also but didn’t suceed. This is their 2nd attempt. However, now Shriram Finance is serious since its their subsidiary now. Imp links on what Shriram Finance’ MD Mr. Umesh Revankar says about AMC biz:

- Mr. Umesh Revankar on AMC biz – https://www.youtube.com/watch?v=ZyvpNL8UpsU (watch from 1.35)

- Mr. Umesh Revankar on new ventures – https://www.youtube.com/watch?feature=shared&v=U5fj-ppj7T4 (watch from 3.50)

- Mr. Umesh Revankar on Shriram AMC – MC Interview | Shriram AMC to focus on hybrid funds: Umesh Revankar

Linkedin posts on various hiring –

- Shriram Asset Management Company Limited on LinkedIn: #shriramamc #jobopportunities #financecareers #hiringnow | 14 comments

- Shriram Asset Management Company Limited on LinkedIn: #financecareers #joinourteam #nowhiring #jobsearching #sharetohelp

On new distributor additions –

- Chetan Doshi on LinkedIn: #shriramamc #shrirammutualfund #quantmentalapproach #investmentinsights…

- Shriram Asset Management Company Limited on LinkedIn: #shriramamc #newbeginnings #mutualfunddistributors #partnership…

- Swapnil Deo on LinkedIn: #shrirammutualfund #mutualfundsahihai #mifaa

- Shriram Asset Management Company Limited on LinkedIn: #shriram #shriramamc #shrirammutualfund #mutualfundssahihai #partnership…

Now since you have gone through various organizational changes, let me summarize and share my thoughts:

Summary:

- Focus from Shriram Finance since its now their step down subsidiary.

- Management level changes (New MD, CIO, CBO).

- New Employee hirings (from 8 employees in Sep 2022 to 51 employees now) (Source – EPFO website data).

- New Distributors getting added (earlier they were not focusing on this part) (Source – Linkedin postings)

- Fresh capital funding (They got capital from Mission1 stake purchase and preference share issuance (now converted to Equity shares))

- New fund offering

Thesis and crystal ball gazing:

- AMC biz at small 300crs mcap.

- They have just re-started. Will take 1-3 years to scale-up AUM (need to show fund performance (hardly any alpha generated by funds yet)). Profitability is 3-4 years away since in AMC biz expenses are upfront. They have the new website also now. They are sharing office space with Shriram Finance now (AR FY23 – In FY23 they signed 5 year arrangement with Shriram Finance for “Infrastructure sharing including lease agreement for branch offices”).

- Service led biz hiring a lot of employees is itself a good trigger. All of them will start contributing now.

- They had few distributors – Shriram MF is focusing on onboarding and meeting them now.

- Parent Shriram has huge cross sell opportunity. Shriram Finance has 3000 branches (think of some branches contributing MF AUMs going forward which till now was hardly anything). Shriram’s has Fixed deposit AUM base of 20k crs! which they can cross sell.

- Shriram One app – Shriram has an all-in-one app. They still haven’t incorporated MF biz in the app since currently they are in initital stages of developement and the app is just 6 months old. Shriram MF didn’t even have their own app (still doesn’t).

- AMC based out of Mumbai – AMC is a networking biz and Mumbai is the hub of AMC biz. Shriram AMC is based out of Mumbai which will help them get relevant employees, connections, etc.

- Alteration in MOA – To carry out various different business as per SEBI act. Board approval is still pending Special resolution Shriram AMC

Issues:

- Lossess since 2013. Will take 1-3 years to scale-up AUM. Profitability is 3-4 years away since in AMC biz expenses are upfront.

- Currently only 61lacs of AMC service income is derived for full year.

- What if Shriram Finance stops focusing on Shriram AMC. Same happened in 2013-14 also when they tried to revamp the biz (But earlier was owned privately by the promoters of Shriram Finance and now is a step down subsidiary of Shriram Finance).

- Currently its at 300cr mcap. AMC biz trades at 10-15% Equity AUM (meaning 2000-3000cr AUM is already factored in this mcap). However, buying a AMC biz at 300cr mcap will look cheap too with parent having good cross selling opportunity.

- AMC industry is highly competetive industry.

- Illiquid stock. Hardly 2k volumes.

- Hope trade/investment works? Never worked for me.

Your different views accepted.

Disclosure: Invested. Not a registered RIA. Not a buy recommendation. Consult your Investment Advisor.

Kama Holdings Limited (30-03-2024)

i understand, but many Promoters prefer to do a buyback to avoid taxation, rather than Dividends which will put them at hishest tax level. Also they tender at last minute, just enough shares to keep at the 75% limit, based on shares that are tendered by other shareholders.

Kilburn Engineering – Huge undervaluation (30-03-2024)

Management Guided for total consolidated revenues of Rs. 450-500Cr by FY-25 with 18-20% Margins easily achievable.

Also, the company will close this year with consolidated orderbook of Rs.310-320Cr and expects orders worth 150-200Cr to flow in first four months of FY 25.

Also, the management was bullish on ME Energy which can give better revenues as post consolidation Balancesheet Strength would increase which could help ME Energy bid for high value orders going forward.

Alufluoride Limited-conversion of waste into wealth (30-03-2024)

Sir, that looks like a rising wedge to me. I think a breakdown’s more probable.

Satia Industries – Journey towards Cyclical to Shallow Cyclical? (30-03-2024)

In the recent concall,management is talking about the delay in the implementation of new education policy and hence the lack of proper demand in the market currently as the publishers are acting cautious.

Any update by when is this going to happen?I tried searching for the same on google but couldn’t find anything specific related to the education policy implementation.

Also,my another concern is(as already mentioned by one of the folk in this thread)that management is not planning any specific capex for raising the topline,i wonder if the management will be able to taste the fruits of the expected flood in demand in future.

Any comments on this please.

Hindustan Unilever (HUL) (30-03-2024)

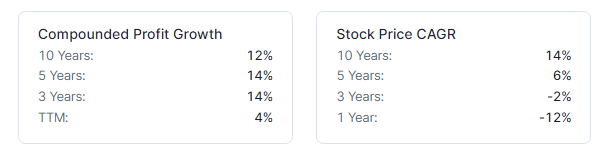

In the past 3 years, profit has grown by 14% while stock price has compounded at -2%. Given that it’s HUL and points i mentioned earlier

HUL seems a good defensive, reasonably priced stock to me.

Counter views invited.

Thanks

Yogesh Portfolio (30-03-2024)

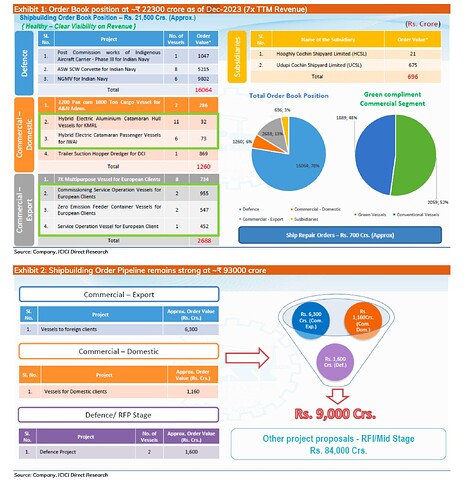

Cochin Shipyard

Anticipated Breakout and Financial Growth Trajectory

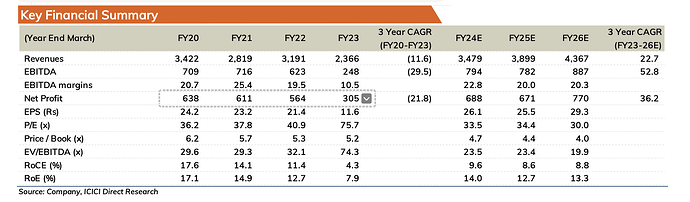

Breakout is expected in near future as stock is currently in a consolidation phase, with its price oscillating between ₹800 and ₹900 with volumes drying up. It exhibits a robust growth trajectory, reflected in the ascending trends of its revenue, operating profit margin (OPM), and net profit. The order book stands impressively at seven times the trailing twelve months (TTM) revenue, signaling strong future earnings potential. Over the next three years, the company is projected to achieve a compound annual growth rate (CAGR) of 22.7% in revenue and an even more impressive 36.2% in net profit, underscoring its promising financial outlook.

Disclaimer: Not buy or sell recommendations, only for educational purpose

Invested ~ 8.5% of total capital @ 890

Johnson Controls-Hitachi Air Conditioning (30-03-2024)

Seems Johnson Controls Hitachi is on block

Milwaukee-based Johnson Controls has been working with its advisers to sell its residential and light commercial businesses, including a U.S. business and a 60% stake in an air-conditioning venture with Japan’s Hitachi (6501.T), opens new tab called Johnson Controls–Hitachi Air Conditioning, the sources said, requesting anonymity as the discussions are confidential.