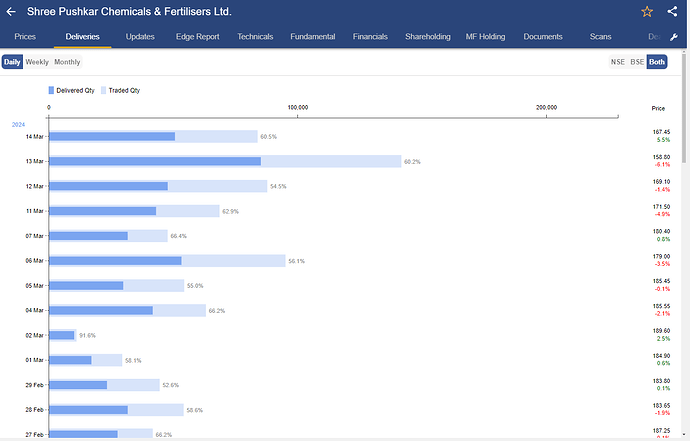

High volumes and deliveries

Posts in category Value Pickr

NR Agarwal- A value buy with possibility of being a multi bagger (15-03-2024)

Hi, does anyone have idea about the rough margin potential of the new plnt ? The facility was commissioned yesterday so atleast capex has gone live on time as indicated by the management earlier.

Shaily Engineering Plastic (15-03-2024)

Sure, here are the sources

Chart 1 – Care Rating Report – Sep 2023 – On Screener

Chart 2 – https://static.shaily.com/bTIx2i3RRCQuOLTFoeU2-shaily-corporate-presentation-august-2015-pdf

Chart 3 – Divided volume of polymer processed in kg by Sales , Gross Profit, Operating Profit

Chart 4- Ypsomed – Trading View – Financials (listed comp) – YPSOMED HLDG Revenue Breakdown – SIX:YPSN – TradingView — India

ICICI Securities Ltd (15-03-2024)

Now the fate of ICICI Sec is sealed. Looks like it will be merged with the bank as per their plan. Unfortunate.

Hariom Pipes Ltd: A Capex Play! (15-03-2024)

- Fy24 is expected to be between 1160-1190 Cr as per the last quarter press release (80-85% growth over FY 23)

- The above translates to nearly 340-370 Cr sales in Q4-> this will be the highest ever quarterly sales, and if the EBITDA margins sustain, 40-45 Cr ebitda

- FY26 target of 2500 Cr will be nearly 2x of FY24 ( in the arihant capital interaction – available on youtube, they have mentioned the internal target of 2500 Cr in calendar year 25 itself, so FY 26 might be slightly higher if they sustain.)

- In case they achieve these numbers , stock price should reflect this trajectory over next 8-10 quarters

Disc- Invested and biased , holding from 590 odd levels.

Sugar Cycles: 7-8 years of losses followed by 2-3 years of super gains! (15-03-2024)

Sugarcane production in UP is higher, but a lot of cane in UP is going towards molasses (gur) and khandsari thats why sugar output is lower. But the impact on sugar mills is not much as sugar prices have bounced back after a drop in Feb.

On more fundamental level, since there are many more uses of sugar coming up like bio-chemicals, sugar stocks will give good returns over long term. With every evantuality the industry is coming up with new products. When there was sugar glut few years back, industry (with Govt support) came up with ethanol. Now with ethanol ban, they are going in for bio-chemicals – which is market driven. Thankfully companies did not put up too much ethanol capacity (max revenue for any sugar company should be 25% from ethanol) and conserved capital which will be invested in these new products or for buy back – both are good for investors.

There is no downside for the industry from here… it can go only upwards so long term investors will benefit.

Shaily Engineering Plastic (15-03-2024)

Hi. I am going to study this in detail and get back. Please confirm what is the data source or sources for the figures and charts you shared in your post. Just to make sure that we both are looking at the same thing.

Shilchar Technologies – Power & Distribution Transformers – Sunrise Sector? (15-03-2024)

I am not buying at the current price. I am waiting for the price to fall.