It’s there in their annual report FY 24.

Posts in category Value Pickr

Tata Motors – DVR (27-10-2024)

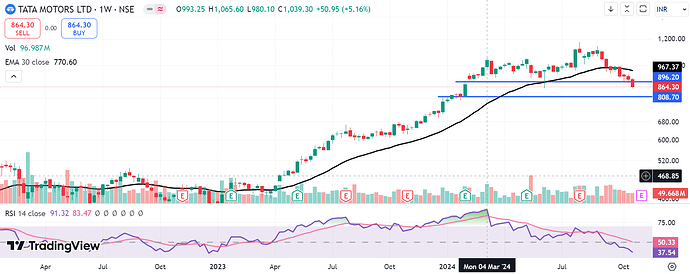

Technicals on Weekly Chart :

Huge Negative Divergence b/w the stock price and RSI on weekly chart –

On hitting an ATH of 1063 in March the stock was at 92 RSI, but even hitting a new ATH of 1185 the stock was at a much much lower RSI of 64.

Fundamentals –

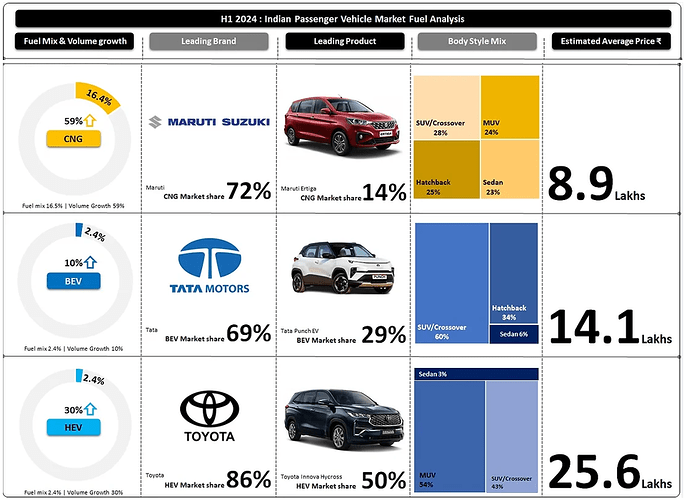

BEVs on the Backfoot? Surge of CNG and Hybrid Alternatives.

Volume growth in H1 2024:

- CNGs – 59%

- BEVs – 10%

- HEVs – 30%

- Growth in CNGs was largely driven by new products like Tata Punch with dual-CNG tank, and Maruti Fronx, both launched in H2-2023. The rest of the growth came from higher sales of Maruti products: Ertiga (+19%), Dzire (+12%) and Brezza (+10%).

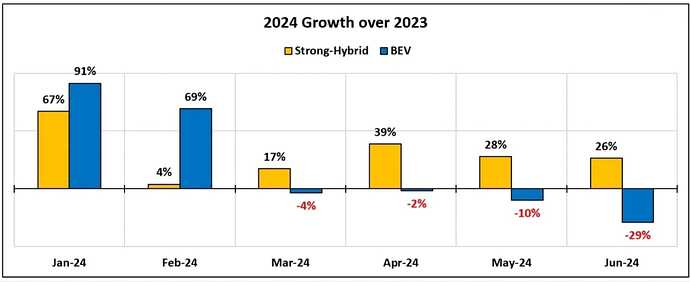

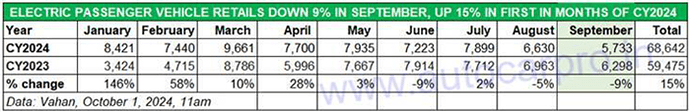

- Demand for EVs in India fell to a 19-month low of 5,733 units in September 2024.

- The average car sales price for BEVs is ₹ 14.1 lakhs, and for HEVs it is ₹ 25.6 lakhs, with present sales gap of a mere 1%.

- 52,415 BEVs and 51,832 HEVs were sold in H1 2024.

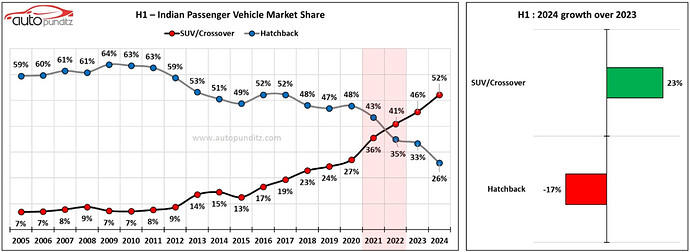

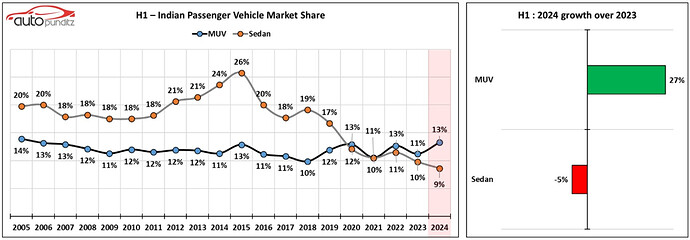

Post-pandemic shift from Hatchbacks to SUVs/MUVs.

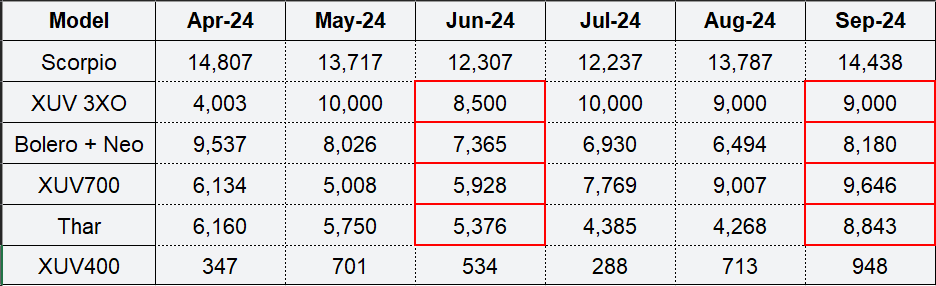

- Hatchbacks losing market share to SUVs/MUVs dominated by Mahindra and Toyota.

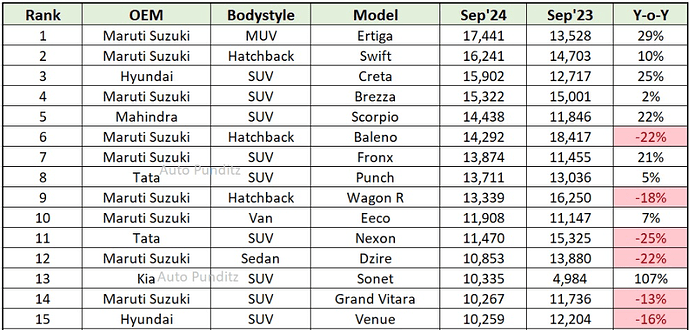

- Only three Hatchbacks out of top 15 selling cars in September sales fig. This trend can be observed for the past few months.

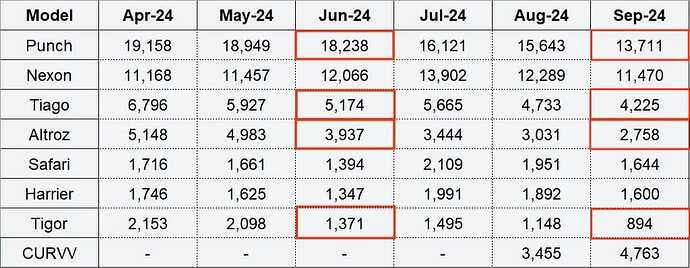

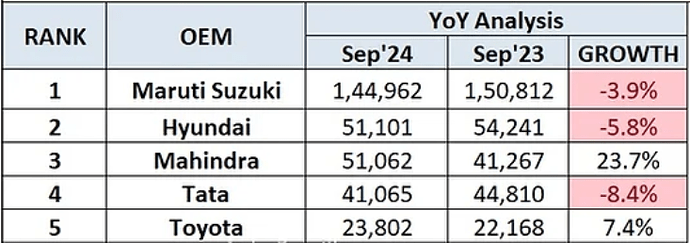

- Post H1 2024, sales fig. for Tata Motors have taken a further hit.

- Facing the most YOY and the most MOM degrowth among all the Hatchback manufacturers.

- Mahindra with its SUV-heavy portfolio has taken over Tata Motors September sales fig. and is behind Hyundai with a mere 40 units gap.

We're all aware that there is a shift towards SUVs/MUVs by the aspiring Middle class, for the better looks and superior feeling of ownership. But what about the shift from EVs?

India mirroring the trend in global EV sales.

- Europe which saw BEVs record their largest YoY decline since January 2017 – of 36 percent in August – demand for EVs in India fell to a 19-month low of 5,733 units in September 2024.

- Demand rose consistently and hit a high of 9,661 units in the month of March 2024. However, since then, as per retail sales data from the Vahan website, monthly numbers have gone down, dropping to 6,630 units (down 5 percent YoY) in August and now 5,733 units in September.

All in all, Tata Motors is losing from all ends.

Disc- No rec. of buy or sell. Sold off holding from family portfolio @ 980-1000.

The Anup Engineering Ltd – Can it scale up? (27-10-2024)

Did anyone attend concall?

Elecon Engineering Limited (27-10-2024)

Amazing, Thanks for clarifying!

Walchandnagar Industries | Return of a Golden Era (27-10-2024)

First Corporate Presentation After preferenctial issue

Walchand-.pdf (4.5 MB)

…

IDFC First Bank Limited (27-10-2024)

No, Deepak. Let me clarify a couple of points. It’s important to note that this is a very gray area, so there is definitely room for a lot of interpretation on both sides. While I am convinced of my position, I am simply presenting my argument. I completely agree that there can’t be a clear yes or no in this situation. I understand if you present other points, such as the cost of a banking license, and I cannot quantitatively address those.

Let me play devil’s advocate and share my perspective.

First, it was a merger; he was not hired on that specific date. When merger talks are initiated (which can be from a year to six months before the announcement), each party shares their financials. After reviewing both sets of books, they agree on a merger price.

Once the merger is announced, and the price is fixed, there are predefined rules in the agreement that allow or disallow certain actions. This is established to protect the agreed-upon value, ensuring that neither party undermines it. In this case, Mr. Vaidyanathan and his team took over the management, and the previous IDFC Bank management stepped away. It was their responsibility to thoroughly review the books and ensure nothing adverse happened from the merger announcement onward.

Second, and most importantly, Mr. Vaidyanathan was managing part of the combined entity during this period (namely, Capital First). He was not just hired on the first day of the merger.

I want to reiterate that this is a gray area. My point is that Mr. Vaidyanathan cannot completely distance himself from responsibility. This attitude would be particularly concerning for a Capital First shareholder, as they could feel impacted from both sides.

Elecon Engineering Limited (27-10-2024)

Yes it means capex is done to the tune of Elecon release of POs. Incoming is always based on either the vendors timeline to deliver, or deliver schedule given by the business (Elecon). They may have given a schedule basis how they wish to utilise/account for. They may also be waiting on some front end developments.

Yes, there was some confusion on the definition. Although, I don’t think this was intentional. For EBIDTA.

I have a hunch that, come year end, Elecon may deliver higher than expectations. I feel they are waiting on order releases.

Even If management delivery meets annual guidance, it’ll be a great year. Anything more will be spectacular.

ITC: “Will”(s) “Gold Flake” assist “Ashirwad” to win “Bingo!”? (27-10-2024)

why this tunnel vision on ITC hotels? In the premium segment of Hotels, how many brands are there like ITC? Given the 5T$ economy target and the resultant side effects, shouldn’t premium hotels, well, command a premium and therefore their margins? Not now, maybe a few years later?