This is interesting…if its true then they are probably the 1st of its kind in india…so far there is an israeli company which has been able to produce ~2$…Reliance’s 1$ target is for year 2030.

@1957 whats your take on hydrogen from waste water ? i must’ve missed this in case its already discussed on this thread. this, i think is, different from electrolysis.as Wastewater has a high organic content.This is a biogas, biohydrogen through photo-fermentation or dark fermentation. i am not sure what type fermentation this company deploys. most of biohydrogen in india i know of are produced around 7-8$ …if they can produce at 1$, thats really nice !

Posts in category Value Pickr

Green Hydrogen as a Fuel – Indian Companies leading the Green Revolution (26-02-2024)

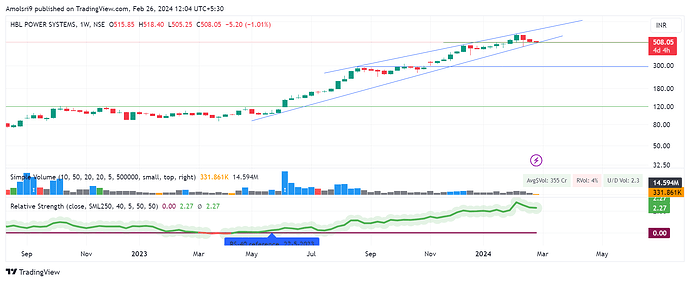

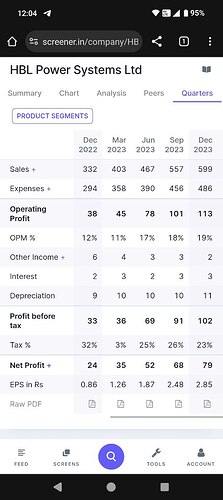

Hitesh portfolio (26-02-2024)

Hi Hitesh sir,

I would like to request you to please share your views on HBL Powers valuations. The scrip is trading at 50 + PE and has done very well for us investors. I feel the company can continue to do well with its various revenue streams in defence and railway sectors. But due to no concalls and no quarterly commentary from the management for investors, i wonder what’s the estimated FY25 or FY26 forward PE for HBL should be? It would be of great help if you could please share any insights here please.

AGI Greenpac- on the cusp of growth? (26-02-2024)

Piramal has historically had better margins and has a specialty business that is more prominent than AGI. Hence, I would assume that there will be some sort of discount. However, your point on valuation catch-up could be valid to some extent.

Green Hydrogen as a Fuel – Indian Companies leading the Green Revolution (26-02-2024)

There is a company called Ossus Bio that is using waste water to produce green hydrogen and they are claiming to make it at less than $1. Nikhil Kamath has invested in this company and recently had the founder on his podcast

https://inc42.com/buzz/ossus-renewable-bags-funding-from-nikhil-kamaths-gruhas-to-produce-green-hydrogen/#:~:text=We%20are%20currently%20the%20only,less%20than%20%241%20per%20kg.

SmallCap Hunter : Trying to find the dark horses with triggers (26-02-2024)

Apar Industries manufactures busbars, as mentioned in their Q2FY23 conference call.

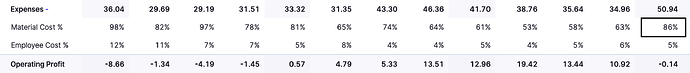

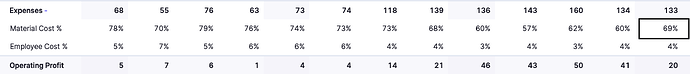

SKM Egg Products – thinking out of the shell (26-02-2024)

Maize prices

The poultry industry anticipates that 10-20 percent of maize could be used for ethanol production, which would increase the demand-supply gap further, causing a spike in maize prices.

Since the government has fixed a cap of 1.7 million tonnes of sugar for ethanol production anticipating a lower sugarcane output, it is hoping to largely fill the gap by allowing more quantities of maize to be used for producing ethanol, in order to achieve its target of 15 percent ethanol blending with petrol this year.

Neeraj Kumar Srivastava, former Chairman of the Compound Livestock Feed Manufacturers Association (CLFMA):

Already it is a hand-to-mouth situation in the case of maize. Further fall in supply could take maize prices from the current level of Rs 25 per kg to Rs 30 per kg, unless more is imported

What does this mean for SKM?

Maize is the primary feed ingredient for SKM. Quoting their website:

The birds are fed a highly nutritious, balanced diet composed primarily of maize, grains with vitamins and minerals added.

But unlike several smaller poultry players, SKM is also backward integrated and they have their own feed mill established for manufacturing poultry feed. Hence, while poultry feed price has increased from Rs 35 to 42 per kg, SKM probably has not felt as big of a pinch as of yet due to a rise in exports and the fact that they make their feed in house. Companies like Ovobel are probably facing a lot more pressure on their margins due to the increase in maize prices, with their OPM% dropping to below 0% and reporting a loss making quarter:

Compare that to SKM’s costs, the increase is not as drastic, and that is the advantage of backward integration:

There may be a little more pressure on margins in the coming quarters if the maize prices do end up rising further, but in my opinion the company is better placed to survive over its competitors. Thoughts?

Buy Unlisted Shares (26-02-2024)

Seems like his last lines might be true…Because semi-con manufacturing is a very automated process and needs close to no monitoring.

Tamil Nadu’s Semicon Story: State Looks To Boost Chip Production | CNBC TV18

How easy would it be to reach a summit like this without a business?

He says Hidenobu Hitotsumatsu is a ghost.

Hidenobu Hitotsumatsu, is registered with the Ministry of Corporate Affairs (MCA), bearing DIN 08320813.

I might be wrong too but just trying to find answers to the questions he raised in deleted tweet…

Smallcap momentum portfolio (26-02-2024)

thanks for both the replies – helpful ![]()

Smallcap momentum portfolio (26-02-2024)

@vkediaonline As I mentioned, I will try and have a new thread based on Microcap 250 index this evening. I did not change anything. This is working well for me.