Thanks Aadhar. This helps

Posts in category Value Pickr

The Anti-Portfolio (24-02-2024)

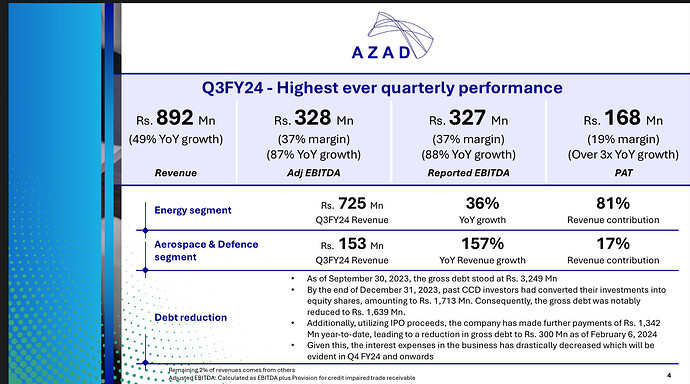

@vikas_sinha as seen in the investor presentation there has been a debt to equity conversion of 171Cr which led to the debt reducing from 325 Cr to 164 Cr. They used IPO proceeds to pay off 134 Cr and hence 30 Cr of gross debt remains. You may want to update your post.

Temp post for data point, will be deleted.

Investing Basics – Feel free to ask the most basic questions (24-02-2024)

This is related to tax. If I gift the money to my wife and invest in buy back. Will the gain be tax free? similar to PPF, and SGB

Dreamfolks services limited( DFS) (24-02-2024)

Thanks for your video

but being shareholders we are well aware of the reasons behind the fall after Q1.

Ranvir’s Portfolio (24-02-2024)

Piramal Pharma –

Q3 FY 24 results and concall highlights –

Revenues – 1959 vs 1716 cr, up 14 pc

EBITDA – 576 vs 514 cr, up 94 pc ( margins @ 17 vs 10 pc – huge improvement )

PAT ( before exceptional item ) – 35 vs (-) 90 cr

EBITDA margin expansion led by better operating leverage, lower RM prices, cost optimisation initiatives

Segment wise revenues –

CDMO – 1134 vs 1010 cr

Complex Hospital Generics (CHG) – 567 vs 514 cr

India Consuer Health (ICH ) – 252 vs 226 cr

Company seeing good traction in CHG business even in Mkts outside US

All of company’s recently inspected CDMO facilities received EIRs from USFDA

Company seeing good demand traction for innovation related and on-patent work in its CDMO division ( specially for the molecules in the commercial stages )

Company launched 03 new generic injectable products in US and EU in Q3. Have a product pipeline of 25 more generic injectables in various stages of development

Maintained media and advertisement spends at 13 pc for their ICH business ( these r unusually high levels – should reduce going fwd )

Power brands ( in ICH ) – I-Range, Littles, Tetmosol, LactoCalamine, Polycrol grew by 12 pc and contributed to 41 of ICH sales

E-Commerce contribute 17 pc of ICH sales

Company received first oder for Anti-Body drug conjugates involving monoclonal antibodies

Company is maintaining its Mkt leadership in Intrathecal Baclofen ( 78 pc mkt share ) and Sevoflurane ( 44 pc mkt share ) in US mkt

Q4 is generally the strongest Qtr. Same is likely to continue for this FY as well

At present, 35 molecules are in Phase -III in the company’s CDMO pipeline

Steady state gross margins for the company are in the range of about 65 pc

As the scale of operations increase, company expects further improvement in EBITDA margins

Expect capex intensity to reduce going fwd vs last 2 yrs

The OnPatent: Generic split in the company’s CDMO business is at 45:55 with a tendency towards increase in the OnPatent work with every passing year

CHG business in US is witnessing moderate pricing declines. Company is launching new products, improving backward integration and selling greater volumes to counter the same

Current Debt/EBITDA at around 3.5. Aim to bring it down to below 3 in short term

Current asset turns achieved by the company are around 1-1.2. Aim to take it to above 2 in next 2-3 yrs

Company aims to close FY 24 with a high teens kind of topline growth ( that means – Q4 should be bumper )

Disc: holding, biased, inclined to add more, not SEBI registered

My portfolio updates and investment journey (24-02-2024)

Sir whats your average price in Nuvama

Angel One: Metamorphosis into a Fintech? (Previously Angel Broking) (24-02-2024)

Possibly for ipl sponsorship. Angel One secured ipl sponosorship and surpassed Groww with a bid of ₹410 crore in online stock trading category. My11Circle, RuPay, Angel One, and CEAT secure sponsorship deals worth ₹1,485 crore for IPL – MediaBrief. Looks like Angel wants to be aggressive.

Chennai petroleum (24-02-2024)

while analysing the ten years profile in Annual report two things we need to consider other than the gross refining margins.

- Based on crude oil price, raw material cost as a % of turnover varies from 66 to 88%.

- Excise duty as a % of turnover varies from 8.5% to 46%.