Thank you for sharing industry level perspective. I should have looked at other players as well. One question that is coming to my mind is that Infra and realty sector is growing. That should result in increase of demand for proxy play as well like adhesive in this case. I can understand about Piditilie that is is such a big play and can’t grow much. But companies like Jyoti Resin has enough runway to grow for next 5-10 years considering they are only present in 14 states.

Posts in category Value Pickr

Jyoti Resins & Adhesives Limited (with bloated reserves) (18-02-2024)

Thank you for sharing industry level perspective. I should have looked at other players as well. One question that is coming to my mind is that Infra and realty sector is growing. That should result in increase of demand for proxy play as well like adhesive in this case. I can understand about Piditilie that is is such a big play and can’t grow much. But companies like Jyoti Resin has enough runway to grow for next 5-10 years considering they are only present in 14 states.

Phantom Digital Effects Limited (18-02-2024)

The number shown in q3 result is misleading.

7.8 cr of profit divided by 1.36 cr equity shares is about 5.73 rs/share.

Phantom Digital Effects Limited (18-02-2024)

The number shown in q3 result is misleading.

7.8 cr of profit divided by 1.36 cr equity shares is about 5.73 rs/share.

Jyoti Resins & Adhesives Limited (with bloated reserves) (18-02-2024)

The problem is not with just Jyoti Resin, but at an industry level. The companies are having a hard time increasing their top line due to sluggish demand. The only saving grace for all the companies is the drastic fall in the price of raw material which is propelling them forward in terms of their EBIDTA and PAT margins and more or less keeping EPS flat since more than a year now.

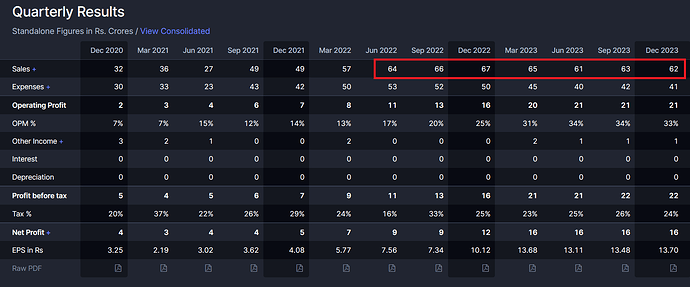

Quarterly results of Jyoti Resins

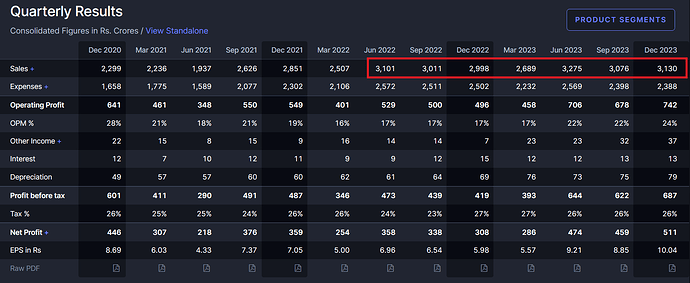

Quarterly Results of Pidilite

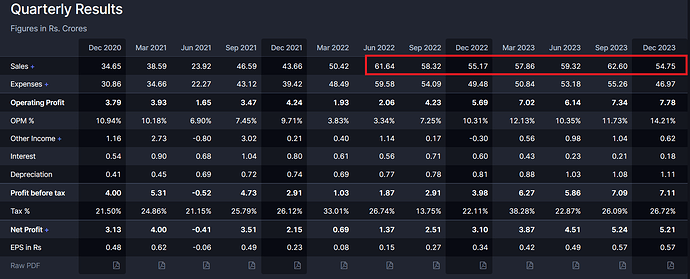

Quarterly results of HP Adhesives

Jyoti Resins & Adhesives Limited (with bloated reserves) (18-02-2024)

The problem is not with just Jyoti Resin, but at an industry level. The companies are having a hard time increasing their top line due to sluggish demand. The only saving grace for all the companies is the drastic fall in the price of raw material which is propelling them forward in terms of their EBIDTA and PAT margins and more or less keeping EPS flat since more than a year now.

Quarterly results of Jyoti Resins

Quarterly Results of Pidilite

Quarterly results of HP Adhesives

Jyoti Resins & Adhesives Limited (with bloated reserves) (18-02-2024)

(post deleted by author)

Jyoti Resins & Adhesives Limited (with bloated reserves) (18-02-2024)

Company guided 25% CAGR growth for next 3 years as per their investor presentation https://euro7000.com/wp-content/uploads/Investor-Presentation-Q1FY24.pdf . Over the last 5 years, Company have grown at CAGR of 38%, 103%, 113% on Revenue, EBIDTA, PAT. They are number 2 in white glue(product Euro 7000). Not sure if any of you have used their product. Management is conservative and going into 1-2 new state every year. All ratios are excellent. ROCE 70%, ROE -50%, 0 debt, last 5 years sales growth > 50%, OPM 23%. Company is now in 14 states and have opportunity to go into other states and open more branches. Also company has recently increased capacity to 2000 TPM which will increase revenue.

I am not sure why this stock keep going downward irrespective of good numbers and available at 25 PE for such high growth company. Is there anything I am missing/not seeing which market is seeing. Currently I have 2% allocation, but I want to make it to 6% as soon as stock moves to upward trajectory. It seems I am more bullish on this company than management ![]() But I dont want to be wrong to lose big money as I am already in 10% loss in this company.

But I dont want to be wrong to lose big money as I am already in 10% loss in this company.

Any thoughts from anyone who is tracking this company closely. Any risk/negative news on the company? I heard company hired professional CEO also. But I am not confirmed on it.

Jyoti Resins & Adhesives Limited (with bloated reserves) (18-02-2024)

Company guided 25% CAGR growth for next 3 years as per their investor presentation https://euro7000.com/wp-content/uploads/Investor-Presentation-Q1FY24.pdf . Over the last 5 years, Company have grown at CAGR of 38%, 103%, 113% on Revenue, EBIDTA, PAT. They are number 2 in white glue(product Euro 7000). Not sure if any of you have used their product. Management is conservative and going into 1-2 new state every year. All ratios are excellent. ROCE 70%, ROE -50%, 0 debt, last 5 years sales growth > 50%, OPM 23%. Company is now in 14 states and have opportunity to go into other states and open more branches. Also company has recently increased capacity to 2000 TPM which will increase revenue.

I am not sure why this stock keep going downward irrespective of good numbers and available at 25 PE for such high growth company. Is there anything I am missing/not seeing which market is seeing. Currently I have 2% allocation, but I want to make it to 6% as soon as stock moves to upward trajectory. It seems I am more bullish on this company than management ![]() But I dont want to be wrong to lose big money as I am already in 10% loss in this company.

But I dont want to be wrong to lose big money as I am already in 10% loss in this company.

Any thoughts from anyone who is tracking this company closely. Any risk/negative news on the company? I heard company hired professional CEO also. But I am not confirmed on it.

GMM Pfaudler: A safe way to play the Pharma/Chemical cycle (18-02-2024)

My initial impression was that the company is doing too many acquisitions in a short span of time. But looks like there is a very clear strategy of seismic shift of focus towards mixing solutions, coz it opens up more avenues for the firm. I had a question on valuations – seems like there is a downwards trend in the stock since the last six months or so. Part reason is clearly the slowdown in mother industry for their largest revenue segment – chemical and pharma. Is there something else the market is factoring in?

Also – besides expanding avenues, is the focus on mixing solutions a part of managements plan to be less dependent on cyclicality in pharma and chemicals?

Expert views awaited – cheers!