(post deleted by author)

Posts in category Value Pickr

Rohit’s Portfolio : Requesting Feedback (18-02-2024)

- Prakash Industries – key triggers are

- Coal block getting commissioned going into summer

- Promoter releasing pledges

- Metal upcycle starting – results have seen steady upwards tick

Will play this with a strict SL.

- Globus Spirits – its more about opportunity cost here. Management seems to have become pessimistic on Ethanol business given flip flop on goverment policy impacting RM costs. Their liquor businesses will still take a lot of time to scale. In a market where more promising opportunities are there, happy to come back when things look-up.

Sudarshan Chemicals (18-02-2024)

Please read forum guidelines properly before initiating a thread.

https://forum.valuepickr.com/faq

To nurture a vibrant community ValuePickr does not restrict anyone from starting a thread on a stock of his/her choice. Only Caveat is if you are going to introduce a discussion on a stock, we expect you to do your homework and start the thread with some basic info-set on the business, product segments, and 1st level analysis such as growth drivers, a few positives & negatives, immediate triggers if any, and enumerate some RISKS.

Nothing very heavy is required, but enough to set the tone for 2nd level of discussions. Starting a New Thread: Please follow these guidelines – #2 by Administrator

Thread initiators are usually alerted to edit their post, and make necessary changes before thread is opened up again. So you/ can look to edit the post in order to meet prescribed guidelines. We have the responsibility – especially the thread initiator (assumption is he/she is a savvy investor) – to cater to bringing everyone on same page – quickly – if you know what we mean.

There are cases where someone isn’t interested to take things deeper herself/himself, but wants to get some answers to specific queries, then one is better off posting the same in Company Q&A category threads.

Company Q&A

Use this section

Venky’s India – Leader in Chicken and Eggs (18-02-2024)

So you know if the company is the company hedging the risks of corn and soya price increases

Building a feed processing plant is counter intuitive if the price rise comes from soya price increase. It could hv probably applied that capital towards hedging instead of diversifying into parallel industries

I assume if company is supplying to the likes of McDonald’s they have a guaranteed volume at a certain price per kg.

This could be a huge risk in the short term due to inflation and investors don’t like choppy margins

Windlas Biotech – Pure play CDMO currently at ~1.1x sales (18-02-2024)

Its not 600-750 cr per quarter it is 700-750 per year as against current TTM revenue of 600 cr.

Your statement indicates a 4-5 fold increase in revenue which is not the case.

Please see the concall extract below.

Komal Gupta: Yes, so, Nitin, as I mentioned, the current capacities we had increased and we have been

consistently working on. So we are comfortable delivering INR700 crores to INR750 crores with

some incremental expansion internally that we have been working on. We have been adding it

as needed. So we are able to do that. So we should be able to deliver INR700 crores to INR750

with that. And there is other work going on for further runway…

disc.: not invested. tracking

Rohit’s Portfolio : Requesting Feedback (18-02-2024)

Trying to follow this thumb rule of investing when taking up initial positions (inspired by SOIC):

1% – Tracking

2% – Low conviction/exploring thesis

4% – Medium conviction and results show thesis has started playing out (e.g., Aarti industries)

6%/8% – High conviction with thesis getting validated

No position >8% due to concentration risk (Learned this the hard way after Polycab fiasco)

Obviously these are very different from what you see above because the total portfolio value keeps changing but on a high-level

Tracxn Technologies (18-02-2024)

Can anyone help me understand what could be the reason for slower growth in customer addition than the competitors? Ideally for a company with such a base should show higher growth? Are they lacking in the value provided to the customer?

NTPC – Thermal Power (18-02-2024)

To meet the growing demand, the government has announced to continue relying on coal with nearly 80 GW of new coal-fired capacity planned by 2030

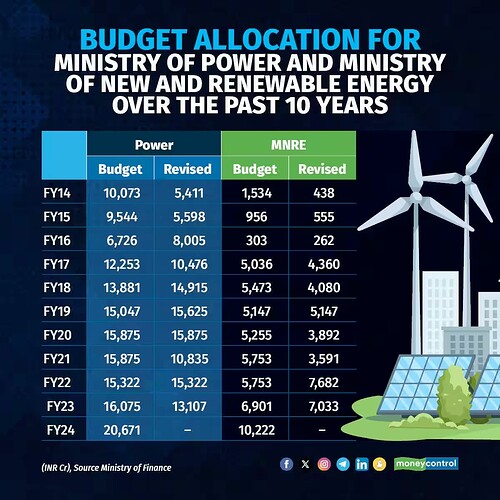

Scaling up renewable energy: The allocation to the new and renewable energy sector increased 99 percent to Rs 10,222 crore in 2023 from Rs 956 crore in 2014-15. Between 2013-14 and now, India’s installed pure renewable energy capacity (excluding hydropower) has almost quadrupled to reach 132 GW from 28 GW in 2013-14.

National Green Hydrogen Mission (NGHM): Since renewable energy alone would not be enough to meet India’s energy needs, the central government has attempted to get into new energy sources such as green hydrogen. The Union Cabinet approved the NGHM on January 4, 2023, with an initial outlay of Rs 19,744 crore, including Rs 17,490 crore for incentives. The government’s aim to produce at least 5 MMT of green hydrogen annually by 2030 under the NGHM would require 60-100 GW electrolyser capacity and 125 GW renewable energy.

India’s power sector is regulated by the CERC with an availability-based earnings model (fixed RoE on power generation assets) and, thus, the regulated tariff model provides strong earnings visibility for power-generation companies.

Additionally, with improved coal stocks at thermal power plants, plant availability factor (PAF) has improved and, thus, we expect fixed cost under-recoveries to decline for power companies.

NTPC

- Healthy expansion plans with significant capacities under construction

- NTPC has also entered into a JV for nuclear power generation.

- The PLF of NTPC’s coal stations was 76.40% as against the national average of 68.51%.

- MoU with the Maharashtra government for green hydrogen projects

- NGEL plans for green hydrogen and derivatives (green ammonia, green methanol)

- With renewed focus on RE (130 GW by FY32), we believe re-rating drivers like improving ESG scores

Quick notes on some terms:

PLF – Plant load factors (PLFs)

A cost-plus basis is a way of charging for a product or service where the price includes the cost of production or service plus a profit

Indiabulls Housing – A compounder from here? (18-02-2024)

Overtly optimistic. The truth is that most of their loans are stuck. They are not able to raise money easily!! They issued ncds many times. At the interest rate of 10.75 percent and yet they barely get subscribed to the minimum. They try to raise for 1k cr and it barely gets subscribed 110-120 cr!! The issue cost takes the effective interest rate for money raise to 12.5-13 percent!!

PayTM (One 97 Communications Ltd) (18-02-2024)

Please look at the below screenshot

OCL is reaching out to all their merchants and asking them to change their settlement bank account from PPBL to something else. Please note that KYC for these merchants in order to accept payments was done by OCL and not the Paytm Payments Bank. So all these merchants still continue to be eligible to accept digital payments through a QR code or soundbox.

Once merchants change their settlement bank account (this can be done easily without a physical visit), merchant’s life will carry on as is.