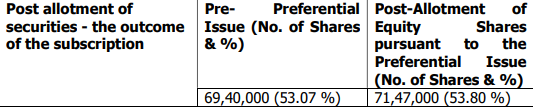

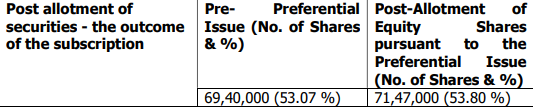

1.5% on total basis, only promoter stake increased by .61%, check below table of promoter stake pre and post issue.

1.5% on total basis, only promoter stake increased by .61%, check below table of promoter stake pre and post issue.

A detailed business analysis prepare by me is hereby uploaded:

Business Analysis.docx (3.2 MB)

Can you please share snapshot of that

(post deleted by author)

Loan growth has surpassed deposit growth and Loan/Deposit ratio seems on higher side as compared to last few years. CAR is also reduced. Ability to raise deposits is going down even after increasing branches in Rural areas.

Probably it will take some time to reflect in deposits.

These could be the concerns. Also NIM will take some time to go to reasonable levels. GNPA has started moving up but should not be a major concern.

They have managed to report very good Net Profit growth in spite of all these concerns which is a Positive. I believe Management may able to overcome some of these concerns but will take few quarters.

Disclosure : invested since 2011 but have been prudent in booking profits from time to time.

Minority shareholding need not be institutions. Retail investors are minority shareholders. Retail investors have voting rights.

If i can understand one thing about china, that is We are always in for a suprise.( may be too much of a statement !). I have often noticed analysts chasing flip floping policies.

Following is a summary of an article > China’s impressive commodity imports mask deeper complexities (msn.com)

and ultra long bonds > China weighs more stimulus with $139 billion of special bonds (msn.com)

Hope this adds value to discussion at this thread ?

In the Q3 FY 24 results announcement they have reiterated that the merger is going ahead. As the bank owns 75% of the equity and there are is no significant minority holding with institutions (who can oppose delisting), it is clear that the merger and de-listing will be implemented as soon as regulator approvals are recieved.

Though the company is not required to declare quarterly results, the company has decided to declare quarterly results. Board is meeting on 24th January to declare quarterly results.

Macfos.pdf (664.0 KB)

It is great that a company of small size, listed on SME exchange is declaring quarterly results, coming out with investor presentation etc.

Sir, Kindly tag Rohan Verma Ji on twitter (@_rohanverma)

EvoLve theme by Theme4Press • Powered by WordPress & Rakesh Jhunjhunwala Latest Stock Market News

The Most Valuable Commodity Is Information!