Look at price to sales metric, hero is valued at around 87000cr whereas tvs at 99000 + 12000 cr in dents so around 1,11,000cr, although both have similar margins, I think it is because of better product portfolio of TVS and also Hero had some CG issues related to promoters in the past.

Posts in category Value Pickr

52 week highs and all time highs strategy (14-01-2024)

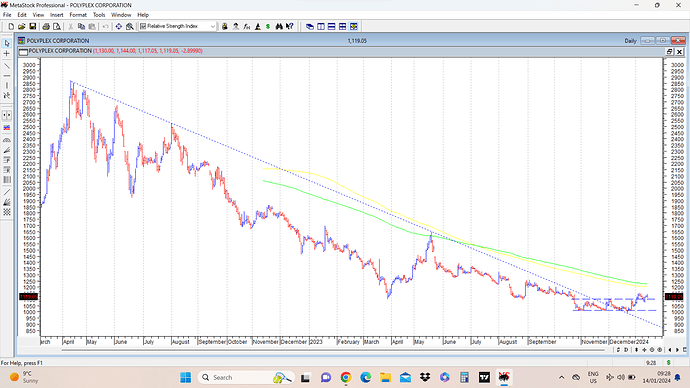

Polyplex cmp 1119 had a prolonged fall from a high of 2870 in April 2022 to a low of 991 in Dec 2023. Nearly 20 months of one way fall. Now first signs of a probable bottom formation.

Firstly price broke out above a falling medium term trendline.

Secondly we have a Wycoff type of “spring” formation and price broke out above tight small range between 1000-1100 which lasted more than 2 months.

disc: no positions, under watchlist.

Is China investible? (14-01-2024)

Due to SEBI regulations on the quanta of money Indian mutual funds can invest abroad, Mirae is no longer accepting fresh subscriptions. See Mirae Asset Mutual Fund stops accepting money in overseas funds – The Economic Times

However, what’s already been trading on exchanges can chang hands so one should still be able to buy it through an investment platform.

Borosil Renewables – Bright as sunlight (14-01-2024)

I do not think current price action is due to hope of anti dumping duty but increase in container rates by @30% (as confirmed by my exporter friend) due to red sea issues as well as container scarcity as ships are taking longer detour (cape of good hope route) thereby putting container supply chains in tizzy. This will allow company to raise prices thereby improving profitability for this quarter at the minimum. Looking at US/UK action against Houthis and their defiance (as of now), it seems this issue will linger on for few more months.

Mahanagar Gas Ltd – a natural monopoly (14-01-2024)

The Article dies not mention about Li ion battery replacement cost, which could be one of the major cost factor even if recycling is adopted in a big way as replacing with a recycled battery will also cost money which would be of recurrent nature.

But the way in which EV adoption is taking place would over , hopefully some solution to high repair maintenance cost would be brought down in the long run and the Govt subsidy will continue for quite some time.

EV will coexist for quite some some along with other renewable & non renewable form of energy.

Great articles to read on the web (14-01-2024)

great article to read

Ronak’s Portfolio – building it slowly (13-01-2024)

Thank you so much @harsh.beria93 for your input, I love your portfolio’s thread and keep looking for ideas from there.

Got interested in Rice companies as there are mainly 3-4 major brands out there and most of those trading at reasonable valuations. Yes, I am looking at Chamanlal and KRBL (aware about CG issues)

Just going slow and reading more companies in detail. I can stay invested only if I have enough confidence in my holdings and feel confident about it.

TCPL Packaging Ltd. — Statistical Facts & Figures — Views Invited (13-01-2024)

Third rotogravure press will be in commercial production by Jan-2024. With the new capacity kicking in from the fourth quarter of 2023-24, TCPL flexible packaging division expects to record solid topline growth in 2024-25.

Investing Basics – Feel free to ask the most basic questions (13-01-2024)

Does anyone invest in US equity or mutual funds? I am in US and struggling to invest in US stocks due to below reasons.

-

It is hard to find companies apart from FAANG stocks and some other stocks like Costco etc? How do we find good mid and small cap companies in US? Since most of us are born in India and know most of the companies since we have consumed their product. Atleast I am facing this challenge.

-

Any mutual funds which can give 15% type of return in US

-

Is there any small case concept in US? I couldn’t find similar concept here

-

Are there any good forum like our favorite value pickr for US stocks as well?

-

Any good investors to follow for US equities?

Any pointers for US equities will be appreciated