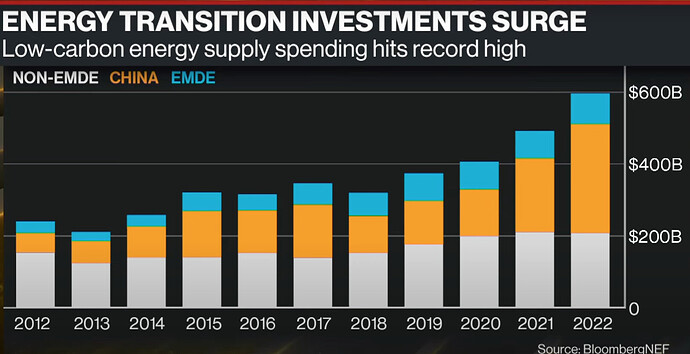

Energy transition direct relation to storage too.

Posts in category Value Pickr

Ambika Cotton Mills (03-01-2024)

Disclosure: Not invested

https://www.screener.in/company/AMBIKCO/#chart

@Jose ,

Thank you for clarifying the data and analyzing the Inventory/Finished goods ratio.

The company demonstrates a comprehensive understanding of the cotton/finished goods cycle and the temporal parameters governing its operations. This comprehension facilitates heightened profitability during periods of elevated cotton prices, leading to an augmented operating profit margin (OPM) and an appreciable surge in the market share price. Conversely, a decline in OPM during the low cotton price phase of the cycle results in a market derating.

It is evident that the informed retail shareholder should align their investment strategy with the same cyclical pattern, adopting a time horizon spanning 3 to 4 years. Drawing parallels to financial instruments, the company, based on historical performance, can be likened to a 2-year fixed deposit.

Capturing that exact low and selling at that exact high may be possible for the raw cotton price enthusiast :).

Before finalizing our algorithms, it is noteworthy, as per @Jose ‘s discerning observation, that the inventory/finished goods ratio is notably high. Additionally, @praveen_potnuru highlighted that a significant portion of exports is directed towards Bangladesh. The recent upheavals, such as violent protests, have adversely impacted the garment industry, attracting attention and likely affecting Ambika.

One could suppose that this problem is deeply embedded and had an impact on Ambika prior to the bursting of the boil. Pure speculation on my part.

Even so, these problems will eventually be solved, and Ambika should be back to its regularly scheduled cycle.

A more substantial concern that the Cotton/Finished Good ratio raises, albeit with a lower probability, is the prospect of Ambika facing heightened competition and a consequent erosion of customer loyalty. Such a scenario could exert considerable influence on the OPM, thereby diminishing returns for the retail shareholder.

thank you @Jose and @praveen_potnuru for the insight.

RACL Geartech Limited (03-01-2024)

I also found another news more interesting and provide more insight into management thinking. They have hired Mr. Arora as HR head who has experience of 20 years in this field. He should help in talent hunt and building leadership pipeline in the company to take it to the next level.

SmallCap Hunter : Trying to find the dark horses with triggers (03-01-2024)

Single property was only for comparison purposes. Advani Hotels did have the upper hand as the property is based out of the most favoured holiday destination.

Aster DM healthcare (03-01-2024)

* From an industry perspective, you could look at other similar companies (my review was EV/EBITDA is of the magnitude of 18-40). So on a relative basis looks fairly valued to undervalued (depending on what multiple you use). Once detailed historical financials for India business are available, should be possible to understand DCF basis

Narayana Hrudayalaya Ltd

EVEBITDA 21.5

Operational Beds – 6096

Founded – 2000 – 24 year ago.

Compared to Aster India

EVEBITDA – Valued more than NH post demerger

Operational Beds – 4080 (India – other than Kerala it is Asset light)

India operation started around 2014.

Key aspect is Aster yet to establish out side Kerala which enjoy its GCC brand recall.

My one cent is India business is unfavorable.

Pragnesh’s portfolio (03-01-2024)

Please go through this thread

Green Hydrogen as a Fuel – Indian Companies leading the Green Revolution (03-01-2024)

A couple of points:

(1) On.Energy storage, batteries may be preferred for storage of small amount of energy… However for grid scale where large amount of energy to be stored, the emerging trend is to go for hydro pumping storage due to low cost , 50-100 years life cycle and no import content in construction where as lithium ion batteries are expensive with import content would be bulky for mega energy storage, batteries would require frequent maintenance and low life cycle of batteries.

(2) On electrolyser,/ fuel cell, a lot of developments taking place very fast and RO water may not be required.

SmallCap Hunter : Trying to find the dark horses with triggers (02-01-2024)

What’s the thesis behind the single property selection? Did you dive deep into Advani hotels?

Ambika Cotton Mills (02-01-2024)

Ambika Cotton Mills

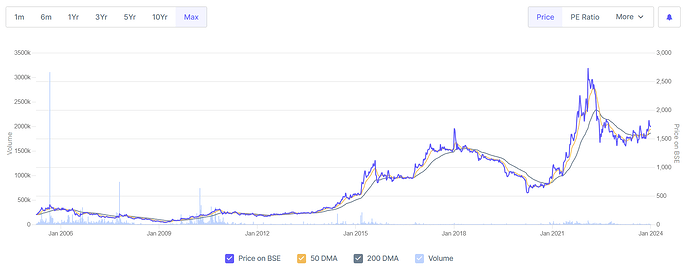

I have been looking at the charts of Ambika Cotton Mills and Cotton prices. Prices seem to be moving in perfect correlation with cotton prices except for a deviation in 2014. The company has been existence for a very long time and has gone through many difficult cycles. The company is known to have maintained inventory levels quite well in the previous cycles.

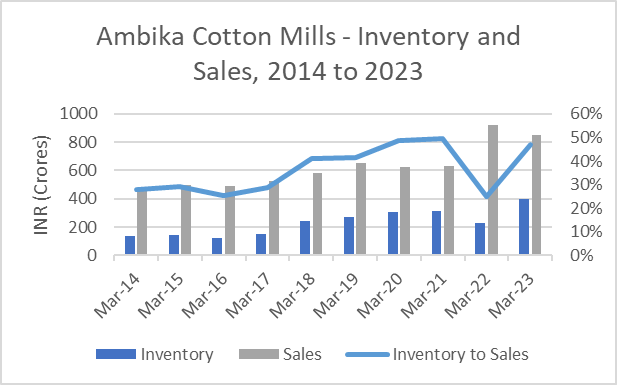

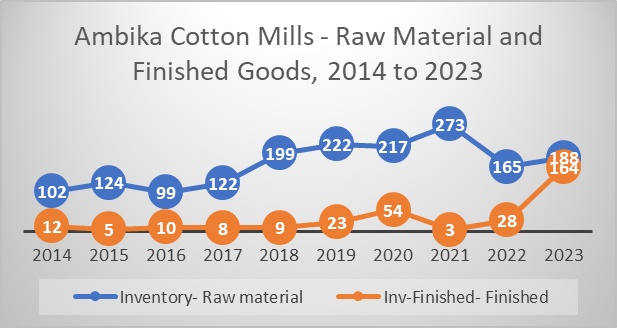

I tried to plot how inventory has changed with cotton prices. Just wanted to know how well the company has managed the inventory over the cycles. Inventory has increased over the years as sales has. So I plotted Inventory to sales over the years. Inventory to sales has remained the lowest in 2022 when cotton prices were at the peak point. Also to be noted the inventory especially raw materials were at the highest point in 2021 when cotton prices began to increase. However, one significant difference that I have noticed this time was the increase in finished goods inventory. Every year until now finished goods inventory was only a small share of overall inventory. However, the finished goods inventory has significantly increased this time around.

The company may be finding it difficult to sell its finished inventory. Noticed the chairman saying in the AGM that they are not selling at lower margins to increase the sales. Inventory has further increased in half year from 397 crores to 498 crores.

Inventory may go increase further going forward until the cycle reverses. Most of these inventory would be yarns and other related items which has a high shelf life. Similarly, the company doesn’t have to worry about the style or anything of that sort which should affect the selling price once cycle reverses. I think the strong cash position is one of the company’s competitive advantages. The company can still run business as usual, even if cotton prices fell further. The company is run like a traditional business with focus being solely on the core business. That could be one of the reason why company was not very positive on buybacks. The company never had a lot of cash on their balance sheet until 2022, and they are already in a poor cycle. So the next time cycle reverses the company may have to look for better utilization of cash. Also, the current market rates are good as well. The company had an interest income of 5 crores in the current quarter, so the return on the cash is not very bad either.