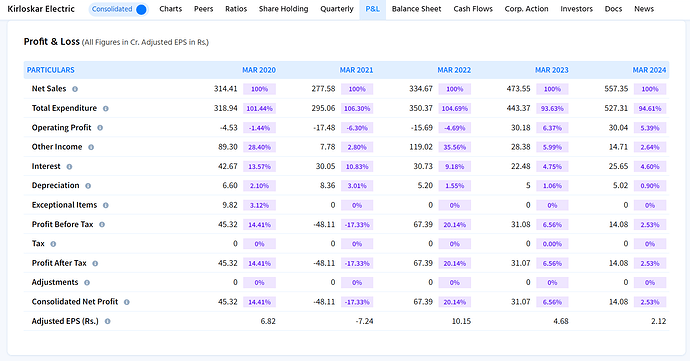

Recent noise around Kirloskar Electric Company (KEC) one of India’s leading manufacturers’ has lead to raising a few concerns regarding its operations:

- Profit decline despite sales growth: Despite maintaining consistent sales growth over the past 5 years, KEC has witnessed a significant decline in profits during the same period which raises questions about the company’s cost management, operational efficiency, or other underlying factors affecting profitability.

(Image Source: Finology Ticker)

-

Reduced Reliance on Other Income: The common size income statement in the image above shows that KEC’s profitability has been impacted by a reduced dependence on other income sources(such as interest, dividends, and gains from investments).

-

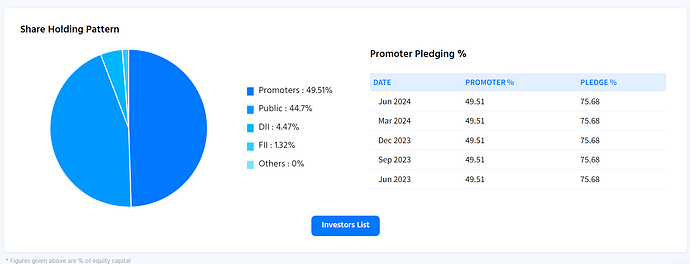

Promoter share pledging: Promoter holding is strong (49.51%), but 75.68% of their shares are pledged which means promoters have used their shares as collateral for loans. It is also a sign of financial stress or liquidity needs.

(Image Source: Finology Ticker’s Shareholding Table)

-

Auditor’s Qualified Opinion: KEC received a qualified opinion from auditors due to material misstatements related to trade receivables from certain subsidiaries, raising corporate governance concerns.

What do you think about this?