Thank you for the reply. Your point clears the doubt as I could see sizeable cash tied up in inventory and receivables.

Posts in category Value Pickr

CFO vs Net Profit (04-12-2023)

Thank you for the reply. Yes indeed they are having sizeable capex currently and yes as I could understand a lot of cash is tied up in WC.

Bonus Shares & Impact of Bonus Shares for Investor (04-12-2023)

The share price will also be reduced to half, so dividend yield would be 2.5 by 50 ie 5%. So no effect will happen on dividend yield due to bonus.

NPST – Technology Provider for UPI Tech (04-12-2023)

Competitors- Mindgate (40-45%), Olive Crypto, FSS, FIS, Kia, all 6 players together handle 95-96% volume

StageInvesting +Elliot Waves (04-12-2023)

(post deleted by author)

Biocon – The ultimate biosimilars play! (03-12-2023)

Thanks.

Yes i know zydus is better positioned in indian mkt but it never focused on US mkt because of issues i mentioned above.

My point was w.r.t US mkt biosimilar scenerio.

Although in 1st cut rosy stories it’s touted as a niche area which gives impression of monopolies and high margins and so on so on.

The fact is that pharma has changed a lot from 2007 when indian companies are plucking the low hanging fruits.

Now even biosimilars are converting into commodity at a fast pace although not same pace like generics.

But the situation is challenging and its difficult to have all the ingredients which were there in 2007.

Less competition and hence less erosion

Higher margins

Scale of economy * Higher margins for substantial time

Golden era of indian pharma.

In my view, we will have growth duration in coming years where biosimilars will play the same role as that of generics in 2007.

But how much margins * scale of economy * mkt share is a key area to watch/forecast.

Thanks

Ksolves – a newage software development firm (03-12-2023)

Ksolves has 450+ employees as per latest presentation. Assuming 400 of those are technical staff (interns, junior engg, developers, lead etc), they generated roughly 90 crores of revenues, which comes out as 20-22 lakh revenue per employee, that’s about 25000 USD per employee, which is on the lower side.

Biocon – The ultimate biosimilars play! (03-12-2023)

Thanks for sharing this perspective, most of the databases I have seen points to much higher price erosion in biosimilars (upto 70-80%) rather than only 50%. I also try to keep track of their US market shares at different points of time.

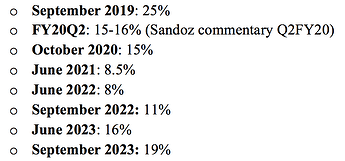

Pegfilgrastim (Fulphila) market share

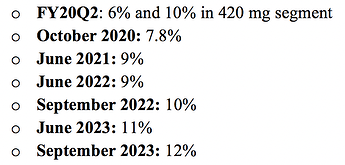

Trastuzumab (Ogivri) market share

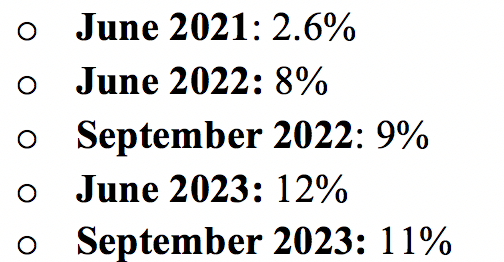

Insulin Glargine (Semglee) market share

Basically, they have struggled to get beyond 15% market share sustainably. For context, Indian generic cos generally get 30%+ market shares in small molecules, and thats when economies of scale start kicking in. Lets see if Biocon can improve this going ahead.

Sorry but this is incorrect, in India Zydus has a larger biosimilar portfolio than Biocon. Biocon has never focused on Indian market.

Disclosure: Not invested (no transactions in last-30 days)

Dreamfolks services limited( DFS) (03-12-2023)

Disc: not invested