(post deleted by author)

Posts in category Value Pickr

Wheels India Rights – Free money for minorities? (29-11-2023)

After the restructure in the group company has come up with detailed presentation.

Few interesting points.

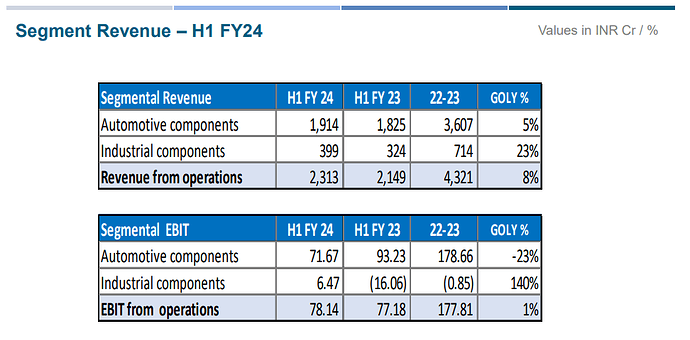

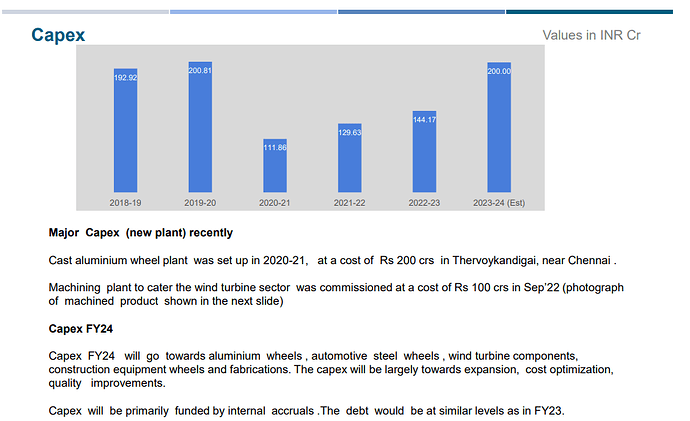

- Most of the capex done in the last 3 years is not contributing to bottom line. some segments are in loss as the capacity utilization is low

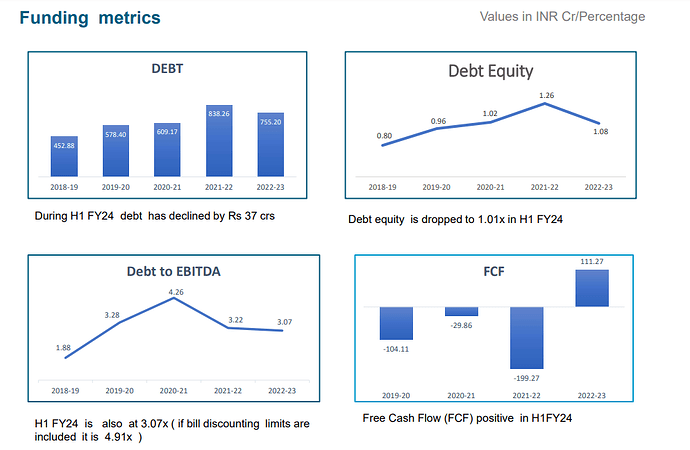

- Company started focusing on free cash flows from last 1 years. All the capex is happening with internal accruals only.

- The company has diversified in to new segments like renewable segment, aluminum wheels etc which are in the ramp stage.

- Debt is coming down from last 2 years. In total debt of 731 Cr, long tern debt is 230+Cr. Rest of it is for working capital debt.

Disc: Invested (transactions in last 30 days)

Confidence petroleum (29-11-2023)

I got curious yesterday on the multi-bagger aspect of the discussion, so thought to check if I have more such multi-baggers in my portfolio. Here is the list of 3x (3 multi-baggers) till 18x (18 multi-baggers) stocks in my portfolio. I have 1x and 2x as well but mostly these are recent investments or laggards.

Long term investment strategy (Buy, hold but don’t forget) (29-11-2023)

Both make sense, so for you only criteria to sell is when fundamental are deteriorated.

Idea of investing is to make money by investing in good companies, so when do you sell the stock ?

Newgen Software (29-11-2023)

Management is optimistic for H2 and market is pushing stock prices based on this and latest bonus investment. If results come as per management concall than markets may continue to re rating the stock as market is always forward looking.

I am also invested significantly from lower levels and booked 20 percent profits around 900 levels.

I have kept the balance fr long term as I am convinced with long term story and I don’t have any other investment options in equity.

Affle India – India Mobile Internet Advertising Leader (29-11-2023)

Affle has phenomenal sales growth over last 5 years or so. Around 55% CAGR. This in my view isn’t sustainable and that too on 25% EBIT margin. Any one who has valued this company using DCF, what’s the future sales growth potential you have taken and rationale for the same?

Investment Learning (29-11-2023)

To start with, in accounting concepts, an entity is seperate from its owner.So, if an owner invests Rs.100, it will be like the business/entity has borrowed Rs.100 from the owner.Hence, Rs.100 will be shown in assets side in Cash and Bank balance and Rs.100 will be shown as liability (to be paid to owner>>>under Equity/Capital).

Out of the 100, if 30 is used to buy fixed asset, then cash and bank balance will be 70 and fixed assets will be Rs.30 making the total asset 100 and liabilities remaining unchanged at 100.