Hi @Pragnesh sir, Could you please share your thought process behind your investment so that we can learn from it? Also, mind sharing your allocation % now?

Posts in category Value Pickr

Investing Basics – Feel free to ask the most basic questions (16-10-2023)

Credit Rating query:

When we say “XYZ company is AAA rated” so how is this rating different from credit ratings of loan facilities that the company has availed? Because a company may different types of loans like external commercial borrowings, fund based, non-fund based, working capital, certificates, NCDs, NCDs, etc.

For eg., the credit ratings of Reliance’s loans ranges from AAA to BBB

https://www.fitchratings.com/research/corporate-finance/fitch-affirms-reliance-industries-ratings-outlook-stable-21-09-2022

https://www.crisil.com/mnt/winshare/Ratings/RatingList/RatingDocs/RelianceIndustriesLimited_February%2023,%202022_RR_288458.html

I had read that only two companies are AAA rated (Microsoft and Johnson & Johnson) but as seen above even Reliance is rated AAA so why is Reliance not included as AAA rated?

International Conveyors Ltd (16-10-2023)

Business Details:

- About the company: ICL was founded in 1973 and is engaged in the manufacturing and marketing of solid woven fabric reinforced PVC, which is basically a polyvinyl chloride fire retardant, anti-static belting. ICL conveyor belting was made in accordance with the British underground coal standards through its licensing arrangement with Scandura. ICL had actually a collaboration with Scandura up to 1991-1992 and when Scandura was bought over by our competitor Fenner, this collaboration broke but then ICL grew after that.

- Products: The company manufactures the most extensive range of products comprising Type-3 to Type-6 that are most suitable for the domestic market and Type-3 to Type-18 which is more popular in the overseas market. When Companysay about Type-3 or Type-6 or Type-18. It basically talks about the strength of the belt. For Type-3 the strength of the belt is 3000 pounds per inch, whereas Type-18 when Companytalk it is 18,000 pounds per inch.

It’s one of the largest manufacturers of solid woven belting in the world and has a complete product range with the ability to make Conveyor Belting up to 3150 kN/m (type 18) in strength and belting widths ranging from 600 mm to 1800 mm. This is the widest product range of Solid Woven belts available from any one Company with a manufacturing capacity of 1 million meters per annum of PVC Solid Woven Conveyor Belting.

- Market Share: The company is India’s largest listed company having almost 40% market share as far as domestic is concerned.

- Approvals: The company is ISO 9001:2015 certified Company meets the international quality benchmark. The company also enjoys several certifications and endorsements from stringent global regulatory bodies. See for example, since this belting is going for underground mining, the Company needs to have approvals from the individual government. For example, if the Company is to supply to the US, if the Company is to supply to Canada, if Company is to supply to Europe, each government has its stringent requirements and the Company Needs to have approval from that and the Company is happy to inform you that Company has almost all the global approvals.

- Subsidiaries: The company also has two international subsidiaries, International Conveyors America Limited and International Conveyors Australia Limited, and through our subsidiaries, the Company supplies to America and Australia.

- The company is one of the major suppliers of FRAS. FRAS is basically a fire retardant anti-static belting for conveying coal and potash.

- The company basically has two manufacturing facilities in India, one is in Aurangabad which is in Maharashtra, and another manufacturing facility which the Company has in West Bengal, the place called Falta which is part of our SEZ.

-

Clients: Our major export is to the US, Australia, and Canada, and Companyare considered the preferred supplier, the world’s largest potash manufacturing companies Companyare also supplying now to the UK, South Africa, and Latin America and our next endeavor is to supply to Europe and Central Asia.

- Order Demand: It is a mixture of replacement as well as new demand because each mine has its own blocks and the company also explores the new blocks. So as on date, I think I would expect it to be 50-50.

- our main raw material is polyester which the company buys from Reliance, as well as PVC, which The Company buys from Finolex or Chemplast Sanmar.

- Indian clients: Companyare supplying to Shivani Colliery, Companyare supplying to Tata Steel, Companyare supplying to Earth Coal.

-

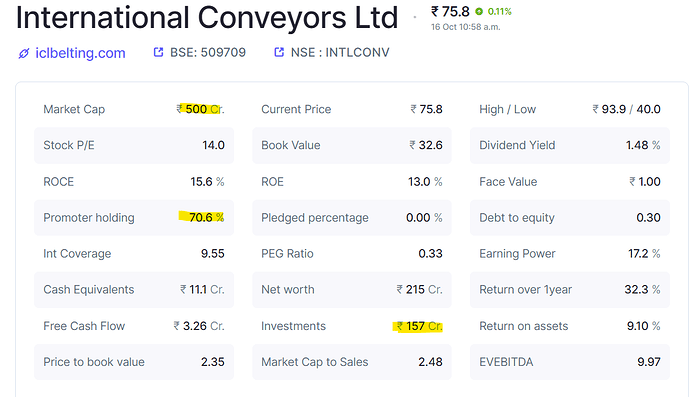

Treasury business comprises 25% of PBT: It has 225 crores invested in stock, mutual funds, and inter-corporate deposits.

Growth:

- Growth opportunity: So, if you talk about growth, yes, the Company has good growth prospects, taking into the infrastructure.

- Revenue growth in FY23 vs FY22: 1.60% growth in the topline resulted in 44.5% growth in the bottom line with margin expansion.

Corporate Governance:

- Shares Buyback: The company had bought back 41,21,000 equity shares pursuant to the buyback offer by utilizing a sum of ` 2,311.85 lacs which represents 77.84% of the Maximum Buyback Size and it has completed the process of extinguishment of the entire 41,21,000 Equity Shares bought back under the Buyback Process.

- Shareholding increase: Increased shareholdings from 48% to 70% in 3 years.

- Loans granted to companies:

Industry Tailwind:

- Conveyor belting is critical for the bulk transportation of materials like coal, potash salt, etc and no substitute has been found.

- • First company to have BIS Certifications • Our team has been involved in such projects.

Cement Industry Outlook:

Strategic Intent:

- New products and customers: From 2014 to 2019, the Company diversified into a new customer segment because prior to that Company was just concentrating on the coal industry and then the Company had diversified even to potash. So ICL moved forward in the export market to serve the needs of miners of potash, phosphate, etc. in North America as favorable regulation led to a growth in coal mining in the USA. Company design and development based on the customer’s requirement like for example, the requirements of potash or gypsum is slightly different than those of coal. So, Companyhave developed products accordingly and then the company started supplying them.

- Customer addition: Penetrate further into Australia’s underground coal mining segment to grow in the South African market, start supplies to Europe, which Companyhave already started now, and then start working with Central Asia.

- Industry Diversification: This diversifies broader books from multiple industries. Recently, Companyhave also started supplying in the cement industries and other aggregate industries like crusher industries and other peers. So, companies are not just restricting to coal and potash but are now diversifying to other industries. now Company is supplying into gypsum industry, recently company started supplying to the cement industry. waste management industries

Competitive Advantages and Intensity:

-

Regulatory approval acts as an Entry Barrier: The Company has regulatory approvals with the products using underground mines in India, the US, the UK, Canada, Australia, South Africa, and China.

-

Use of Wind power : ICL is constantly working on initiatives that focus on sustainability that Companyproduce more green energy than Companyconsume.Companyhave five windmills which are situated basically in Karnataka, Maharashtra, Gujarat and Andhra Pradesh and Companyproduce more green energy than Companyconsume.

-

Pricing power: So, saying that Companyhave either a monthly or fixed, yearly contract, where Company revise the price. This is the pre-agreed formula of the movement in the price from the international indices.Company at least have around 10-15 raw material which are going into production and what Mr. Udit was saying that Companyhave a contract with all our customers where the price gets either increased or decreased based on the indices movement on a six-month basis. The company should have double-digit EBITDA most of the time assured

-

FOB stands for “Free on Board”. It is a pricing model in which the seller is responsible for getting the goods to a specific location ie. Indian port and rest clients take the responsibility.

-

No Import Substitution: As far as rubber belting is concerned, you have a ‘N’ number of layers of the fabric whereas PVC belting is concerned it is a single fabric. So always in the case of rubber belting, you have an issue related to the separation of the different fabric layers which is not there in the PVC belting. Secondly, the advantage of PVC is mainly underground because PVC has the inherent property of fire retardancy which rubber does not have.

-

ICL design team can undertake full in-house design starting from preliminary design of systems from power and tension calculations all the way through to detailed design • The ICL team has years of experience in solid woven conveyor belting both for underground and above-ground applications.

-

Inhouse Manufacturing: Complete integrated in-house manufacturing – from yarn preparation, fabric weaving, compound mixing to finishing – to ensure total process and quality control at each step of manufacturing activity.

Risks:

- Raw materials: polyester or PVC, all are petroleum base and there was an abnormal increase in the raw material and that is the exact reason why the raw material to sales price has gone up so high.

- Related party transaction: The company had an equity even in Elpro International and it amounted to Rs.111 crores and it has been liquidated.

strong text

Financials:

Disclosure: Tracking position, for educational purpose.

Avenue Supermart: a compounding machine? (16-10-2023)

Was there any explanation from mgmt why the OPM was down this quarter compared to last quarter. Also the PAT is down YoY and QoQ.

Delta Corp – A huge but risky opportunity (16-10-2023)

I bought a big quantity at 180 and exited and booked loss completely at 143 at the previous fall, when it was close to selling free.

That was a bitter bullet to bite. But this strategy has paid me off. I don’t like to be invested in stocks, which has lot of uncertainty.

Last such big fall happened to me was in yes bank with big quantity. Booked 25% loss in that stock around 225. Never averaged. And today I’m still in the market.

In the case scenario, if deltacorp inches back to 200…I will never regret. There is no dearth of other good stocks in market.

Nithin’s Portfolio (16-10-2023)

There were Chinese manufacturers who manufacture para aminophenol via NB route example : Anhui Bayi Chemical Co

The fate of this company was eroded due to explosion :

- Another chemical enterprise exploded, causing one death and one serious injury!

- Upstream changes, the export price of paracetamol APIs will skyrocket?

Now since its closed, there is a big hole to fill in

Goodluck India Ltd (16-10-2023)

Few takeaways from Q4 FY23 Concall.

Q4 FY 23

BUSINESS

- Turnover increased by 66% to Rs.2,617.10 crores. EBIDTA increased by 53% to Rs.186.89crores and PAT stood at Rs.75.02 crores as compared to Rs.30.05 crores. The volume stood at264,418 tons as against 224,603 tonnes in FY2021, a growth of more than 17%. Realisation and volume led growth.

- It is headquartered in Ghaziabad with 364,000 tonne manufacturing capacity, spread across six facilities, five in Sikandrabad, Uttar Pradesh, and one in Kutch, Gujarat.

- Capex– This year the company has added 18,000 metric tonnes in the forging division and 20,000 metric tonnes in the precision tube engineering division.

- Four major verticals, which are ERW Steel Tube, Precision tube, Precision engineering and fabrication and forging.

- End User Industry- cater to many diverse sectors of the economy that include auto, infra, high speed railway, specialized infrastructure, solar, defense, aerospace and defense components.

- Engineering structures and precision fabrications- a key segment, not only in terms of our engineering expertise and passion, but also in terms of growth opportunities, provide both fabrication and services for infrastructure solutions. Be it road bridges, smart city structures, or supercritical bridges for high-speed railways corridor.

- Forging- specialize in stainless steel, duplex, carbon alloy, steel, forging exotic material and flanges, which is supplied in more than 100 grade products. Forging for defense is to start.

- Precision pipes and Auto tubes– very few players to manufacture high quality CDW tubes, segment is a substantial contributor of export revenue to the Company. Industry caters to our aerospace, nuclear power, and wind energy.

- CR coils, pipes and tubes– which is the oldest sector, manufacture ERW pipes and tubes that find application precision tubes, support structures and other infrastructure, agriculture, auto and many more.

- Utilization around 80%.

- L&T LOI work has already started, from June onwards, we can we can see the project on the floor.

- Competitor- forging Bharat Forge, very big name, they are making 10,000 tonnes. We are making 2000 tonnes.

- Target to be longterm debt free, short term debt to remain as cash is raw material.

- The increased prices will be passed on to the consumer, always with little time lag times, but they are passed through. It is a complete pass-through.

MANAGEMENT GUIDANCE

- Increasing the share of value-added products in our total product portfolio.

- Envision an order book of over Rs.1000 crore in the next 2 to 3 years from engineering structures and precision fabrications segment.