37th AGM transcript is there on here

Posts in category Value Pickr

Just Dial: First Mover of Indian Local Search Market (12-09-2023)

Is anyone tracking this story?

Gujarat Themis Biosyn Ltd – Bulk Drugs growth momentum (12-09-2023)

Personally, I was little disappointed/perplexed with GTBLs decision to NOT apply for PLI benefit though being one of the leading player for one of the eligible products (Rifampicin) under fermentation category. Guess, the huge capacity requirement of 100 MT/year (against current capacity of ~10 MT/Year) being one of the key eligibility prerequisite was deterrent for them . More so, since they don’t have forward integration into formulation and have to do B2B sales. That is where forward integrated player like Macleods Pharma was able to commit a 200 MT Rifampicin capacity and avail PLI benefit.

Some recent positive development, which can make good for lost PLI benefit, (to some extent). Seems that GTBL has applied and has been selected to avail GSBTM (Gujarat State Biotechnology Mission) benefits

Policy level benefits appears to be very attractive (Link):

- Capital Assistance – Overall incentives under Capital Assistance shall be 25% of capital investment with a ceiling of INR 40 Crores

- Operational Assistance – Eligible applicants shall be entitled to avail overall assistance at 15% of Operational Expenditure with a ceiling of INR 5 Crores per annum.

- Employment Generation Incentive – e benefit for claim upto 50% of CTC with a ceiling

not exceeding INR 50,000 per male employee and not exceeding INR 60,000 per

female employee. - EPF Assistance – 100%/75% EPF contribution for female/Male employee respectively.

- Interest Subsidy on Term Loan- interest subsidy on Term Loan at the rate of 7% for borrowings up to INR 100 Crores within a ceiling of INR 7 Crores per annum

- Electricity Duty – Electricity Duty on power purchased from State Electricity distribution companies or power distribution licensees shall be on 100% reimbursement basis for a period of five years

This Policy shall remain in force till 31st March, 2027. Also, it has worked in favour of GTBL since Biotechnology Mission incentives are flexible in terms of product category and capacity, as compared to PLI scheme.

As an aside, spent some time on Gujarat State Biotechnology Mission website (link). Mighty impressed by the approach and effort by state Govt to attract and promote Biotech in the state.

Thanks,

Tarun

Disc: Invested, no transaction in last 60 days

The harsh portfolio! (12-09-2023)

Hi Ghanshyam,

I agree that NAM looks like a good opportunity, given their MNC background which generally fetches higher valuation in Indian markets and strong recovery in investment performance. The broader investing style of NAM is value investing which is very similar to HDFC, and both have seen exceptional recovery in performances in past few quarters.

This being said, I feel bank backed MFs have a structural advantage over non-bank backed MFs (superior network). This is clearly visible in growth over longer periods of time. Until March 2023, HDFC AMC always had higher AUM growth.

Even from March 2023 to June 2023, HDFC AMC witnessed higher growth (@15% from 449bn to 516bn) vs NAM’s growth of 12% (from 295 to 329bn).

ETFs are very low yield commoditized businesses and most ETF money is driven by one large customer (EPFO). If we see a shift to ETFs over a long period of time in India, the entire industry profit pool will evaporate. Just as an example, I am also invested in a German asset manager who are leaders in ETF and passive products. This co trades at very low valuations. I try to buy them when their enterprise value becomes negative (meaning business becomes free) or their absolute dividend yield approaches 10%. I am worried if ETF trend picks up in India, consequence might be catastrophic for AMC businesses.

Linc Ltd: Writing the future of Bharat (12-09-2023)

Initiating this thread on Linc Ltd. Putting in my notes for Q1FY24 concall. I believe that this is a good place to start researching a company. Looking forward to all of y’all inputs.

Pentonic Sales

- Pentonic sales continue to grow, reaching over 36% market share.

- Export revenue contributes over 16% to the company’s top line.

Revenue Growth

- Operating revenue for Q1FY24 grew by 14.2% to INR 111.88 crores, compared to INR 97.94 crores in Q1FY23.

- Pentonic’s contribution and stationary portfolio growth drive stronger top-line performance.

Writing Instrument Dominance

- Linc maintains a strong presence in the writing instrument segment with a market share of approximately 7%.

- Pentonic emerges as a leading brand in India’s affordable writing instrument industry, reaching INR 150 crores since its FY2019 launch.

Gross Profit Margin Expansion

- Gross profit margin expands to 32.3% in Q1FY24, marking a 693 basis points increase from Q1FY23.

- Gross profit grows by 45%, outpacing the 36.3% growth in overhead costs, demonstrating robust operating leverage.

Strong EBITDA Growth

- Operating EBITDA increases by 65%, with the operating EBITDA margin expanding from 8.2% (Q1FY23) to 11.8% (Q1FY24).

- Profit after tax rises to INR 7.39 crores compared to INR 4.38 crores in Q1FY23.

Formation of Morris Linc Private Limited

- The company establishes a subsidiary, Morris Linc Private Limited, to initiate a joint venture with Morris, a global writing instrument and stationery player based in South Korea.

- Linc will be the majority shareholder, with further details forthcoming in subsequent quarters.

- Morris Linc products will be priced in the range of Rs. 30 to Rs. 50.

- They will offer advanced features in the writing instrument segment.

- The new products will not compete with existing ones in the portfolio.

- The Morris product line includes markers, a category that Linc Limited is currently working on. Since Linc has minimal or no presence in this category, there is no expected cannibalization.

Expanding Market Reach

- The company extends its presence in non-stationary outlets, including kiranas, medical stores, and Pan plus, reaching 1.44 lakh such outlets directly.

- Total touchpoints surpass 2.45 lakh outlets, with a focus on further expansion.

Geographical Revenue Diversification

- Revenue share from south and west zones increases from 27% (FY19) and 36% (FY23) to 43% in Q1FY24.

- The company aims to expand its reach to more than 5 lakh touchpoints by FY25.

Focus on High-Value Products

- Emphasis on high-value, high-margin products, with Pentatonic volume growing over 34% YoY.

- Introduction of Pentonic G – RT, priced at Rs. 40, and development of three more Pentonic products within the financial year.

Deli Brand Success

- Deli, the stationary brand, achieves a turnover of INR 6.4 crores in Q1FY24, up from INR 4.98 crores in Q1FY23.

- Revenue share of Deli increases from 4.7% (Q4FY23) to 5.8% (Q1FY24), targeting a top line of at least INR 75 crores by FY25.

Expansion Plans

- Plans to increase manufacturing capacity in Gujarat by establishing an additional facility adjacent to the existing factory.

- Infrastructure creation for doubling production capacity to 20 lakh pens per day.

- Total project cost expected to be approximately INR 50 crores. Initial infrastructure work costing INR 17 crores to be finished by FY24.

Debt Reduction and Cash Flow

- The company effectively reduced its net debt over the past five years, becoming debt-free.

- Free cash flow increased to INR 15.6 crores as of June 30, 2023.

Capacity Increase

- First phase of equipment expansion to 50 lakhs pens per day expected in FY25, at a cost of INR 18 crores.

- Second phase planned subsequently at an estimated cost of INR 15 crores.

- Anticipated meeting FY25 demand through existing capacity and increased outsourcing agreements.

Revenue Growth Targets

- Aims to achieve a top-line revenue of INR 750 crores by FY25, with a CAGR of around 25%.

- Aims to achieve a top-line revenue of INR 600-625 crores by FY24

- Expects Pentonic’s share of revenue to reach 40%, with an additional contribution from ally products.

- To achieve a 25% growth target in the next three quarters after a 14% growth in Q1, Linc Limited is focusing on growing the Pentonic portfolio, which showed over 30% growth in Q1.

EBITDA Margin and ROI

- Targets an annual operating EBITDA margin of about 15% by FY25.

- Expects a return on investment (ROI) above 21%

Pentonic G – RT

- Priced at 40 Rs

- Recently tested in Bombay, Pune, Chennai, and Kerala.

- Received excellent customer response during the test phase.

- Linc Limited is ready to launch the gel pen nationwide.

- Anticipated to be accessible throughout India in the next two to three months.

Exploring Export Market Opportunities:

- Linc Limited prefers to promote its own brand in international markets.

- White labeling is generally avoided due to potential margin challenges.

- Open to white label opportunities if they offer long-term partnerships and substantial benefits.

Export Gross Margins:

- Export gross margins are generally slightly better than domestic margins.

- For instance, if domestic margins are around 40%, export margins could be approximately 44%-45%.

Major Export Markets:

- Linc Limited exports to approximately 40 countries.

- Prominent markets include Southeast Asia, neighboring countries, Africa, Middle East, Brazil, Russia, and North America.

Seasonality in Business:

- Q1 is a lower quarter due to seasonal factors.

- Summer vacations during Q1 result in reduced consumption, especially among primary consumers, school and college students.

Outsourcing vs. In-house Production:

- Linc Limited is considering outsourcing as it aligns with industry trends where FMCG companies often maintain a 50:50 ratio of in-house and outsourced production.

- Outsourcing provides flexibility and reduces asset commitment. It is recommended by investors and considered a balanced approach.

- The current ratio of outsourcing to in-house production stands at 50:50.

Marketing:

- Budget constraints limit extensive 360-degree marketing.

- Current approach includes careful selection of print media.

- Campaign running in Times Of India (all editions).

- Additional strategies: outdoor advertising in select cities, digital and social media.

- Future plans may involve a TV campaign, likely in the next year when more budget is available.

Online Availability of Product Range:

- E-commerce Potential: Online sales offer significant potential, especially with the Deli brand, known for a wide range of stationery.

- Chinese Partner: Linc Limited’s Chinese principal company derives 50% of its sales from e-commerce, indicating substantial opportunities.

- Current Share: Presently, e-commerce contributes only 3% to the company’s revenues.

- Future Growth: Linc Limited sees substantial potential for growth in the e-commerce segment and is actively exploring opportunities to increase its share in India.

Positioning at Micro Retail Outlets:

- Challenges: Positioning at micro retail outlets where consumers seek pens irrespective of the brand is challenging in India’s unstructured market.

-

Strategies:

- Relationship Building: Sales teams work on building good relationships with retailers.

- Visibility: Maintaining brand visibility through various media channels.

- Point of Sale Displays: Providing retailers with attractive displays for product placement.

- Consumer Demand: Popular brands like Pentonic are top-of-mind for consumers, and retailers prefer stocking such demanded brands.

Impact of Pentonic on Linc Brand Sales:

-

The Linc brand experienced a decline in sales for some legacy products in Q1 due to price increases.

-

While some products absorbed the price increase and are growing, others are yet to recover.

-

The company aims to limit the decline in legacy products and hopes for improved performance in the future.

-

Margin Breakdown:

- Highest margin: Pentonic (company-manufactured brand)

- Second highest margin: Uni-Ball and legacy products

- Third highest margin: Deli brand (imported finished products)

-

Price Adjustment for Raw Material Costs:

- In the Rs.10 pen range, there is limited room to increase prices when polymer prices rise.

- Typically, there’s room for a 6%-7% price increase to the trade, but end-user prices remain relatively stable.

- This strategy is employed to mitigate the impact of rising polymer prices.

Gelx India-Kenya Acquisition:

- Market Expansion: The acquisition in Kenya serves the purpose of expanding Linc Limited’s market presence in East Africa, particularly in countries with tariff barriers that restrict imports from India.

- Export Advantage: With a local unit in East Africa, Linc Limited gains the ability to export its products to neighboring markets without incurring duty costs.

- Revenue Expectation: The company anticipates achieving a topline of approximately $2 million (around Rs. 15 crores) by FY25 through this expansion.

Disc: No position. Only studying.

Bull therapy 101-thread for technical analysis with the fundamentals (12-09-2023)

I generally try to buy and sell in 3 tranches. After buying the first tranche, if the stock moves in expected direction, I add two more times after around 10% rise each. If the movement is not as per expectation, stop loss gets triggered. After the acquisition, I always try to place a trailing stop loss which is revised upwards in every 1-2 weeks or stay the same as per the stock’s movement. After the previous support is breached, first stop loss gets triggered and after each 5% fall, SL2 and SL3 gets triggered. After buying a stock, we generally develop an affinity towards the stock and selling it after surrendering paper gains is really difficult. So I try to make the process as automated as possible. The process is not perfect and will never be. We all need to learn and implement continuously.

It is quite helpful for someone if he/she has an alternate profession and don’t need to depend on the markets for daily expenses. Let the market decide when it wants to throw us out.

@Nickp

Some people are really objective towards evolving macro and change decisions accordingly. For the rest of us, macro makes our views biased and create a self reinforcing negative feedback loop.

Moreover, macro is subjective and can’t be quantified. Two months ago, we all were impressed by the power of LLMs and the kind of productivity gain it would bring in the white collar professions. AI was expected to lead us to the next information age. Right now, we all are worried about an impending crash in China because of the signs like housing bubble, population decline, high youth unemployment etc. If China really performs bad, it would send shockwaves across the globe. Whether one is a pessimist or an optimist, one can always find data to support and reinforce that particular view point.

The harsh portfolio! (12-09-2023)

Hello Harsh !!!

Thank you so much for your posts, I look forward to them.

I am following AMC’s from quite some time.I am holding both Nippon and HDFC AMC.

I like Nippon more for the following reason.

1.Clear Leader in ETF products as of now, If we see US markets, three players control 90% of market (More liquidity brings more customers).

2.20-30% cheaper than HDFC and distributing entire PAT as dividend.

3.Performance of funds across various categories is among best across time frames.

4.SIP market share improved from 6.5% (June 22) to 8.3% (June 23), this will lead to market share improvement in coming quarters.

5.Equity AUM improving as % of total AUM (This is true for HDFC as well…They are leaders here).

Comparison of recent AUM data on closing basis.

1.Total AUM up for both by 66K CR in last 8 months (Nippon up by 23% while HDFC up by 14%).

2.Equity AUM up for both by 37K CR in last 8 months (Far higher growth for Nippon).

Would like to hear your thoughts on this.

Dynemic Products – a relatively undervalued chemical stock! (12-09-2023)

Food colour volume for FY23 3992 MTPA

Bull therapy 101-thread for technical analysis with the fundamentals (12-09-2023)

-

Oil prices reached their highest levels of 2023, causing worries about a slowing global economy.

Oil prices reached their highest levels of 2023, causing worries about a slowing global economy. -

Key inflation data was expected later in the week, with the consumer price index on Wednesday and the producer price index on Thursday.

Key inflation data was expected later in the week, with the consumer price index on Wednesday and the producer price index on Thursday. -

The Dow Theory for stocks remained intact, indicating a positive trend in equities.

The Dow Theory for stocks remained intact, indicating a positive trend in equities. -

Oracle and Casey’s General Stores reported earnings, with Oracle’s stock dropping 9% and Casey’s exceeding earnings expectations.

Oracle and Casey’s General Stores reported earnings, with Oracle’s stock dropping 9% and Casey’s exceeding earnings expectations. -

Stock futures were little changed shortly after the closing bell.

Stock futures were little changed shortly after the closing bell.

AA – Abhishek’s Attic (place to store stuff to clear my head)! (12-09-2023)

What to expect from the market?

I don’t know what will happen in the short term. When we invest in equities, we should assume that we will get i) a 10% fall every year, ii) a 15%-20% fall every 2-3 years and iii) a 30-40% fall every 5-8 years. If you are not comfortable with such variations in your holdings, then the stock market is unlikely to suit you.

An important point to remember is that if you keep waiting for the market to correct when things are going well, you will not be able to buy when things take an ugly turn.

Today, the broader markets, especially the mid and small-cap space, took a significant beating. If your instinct was to sell and run away today then how would you be able to buy when there is gloom and doom all around?

There have been multiple studies in the past that staying in the market through its ups and downs is what makes the difference to the long-term portfolio.

Below is the monthly chart of the Nifty 500. You will see that the index has trended upwards even with sharp corrections in between.

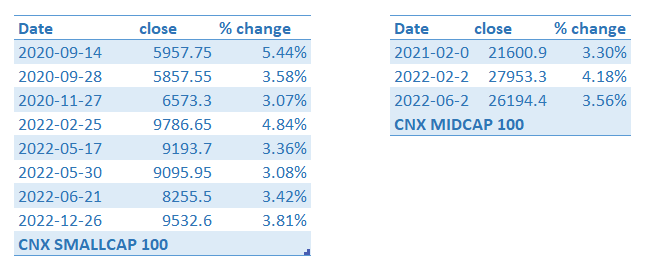

Also, I have attached the number of times the midcap and small-cap indices have taken a sharp cut in the last 3 years (post-Covid).

Fig: Nifty 500 weekly chart

Fig: Fall greater than 3% in CNX Smallcap 100 and CNX Midcap 100 in the last 3 years

What should be done on such days?

Now, on a day like today, when we saw broad-based selling, there are many questions that come to mind. But the main variations are:

- what do I do if I am already fully invested?

- what do I do if I have some cash in hand to deploy?

I don’t have a good answer to any of these questions. I will just say what I do.

When I get into an investment, I have a stop loss in place. The stop loss varies based on many factors but one of the main factors is the duration of expected holding. If I am buying something for the long term, my stop losses (or trailing stops) are much larger than if I am taking an opportunistic bet.

So, on a day like today, I don’t do anything.

In bull markets, there are multiple instances when we see very sharp counter moves for between 1 to 3 days. So, in general, I will not react unless a stop loss is hit. If it is, I will get out.

If I am holding a large percentage in cash, I may even deploy small quantities. The main idea is to ensure that the main trend of the market is not broken before I buy more. And that usually cannot be ascertained in one day.

The actual buy-sell decision will have to be taken over the next 2-3 days.

If I have to buy, I will stagger and buy over the next few weeks. I would also re-evaluate the portfolio to see if any switch needs to be made.

I continue to be very bullish about the Indian markets over the next 3+ years perspective. As such, these falls are opportunities to add cash to our portfolios.

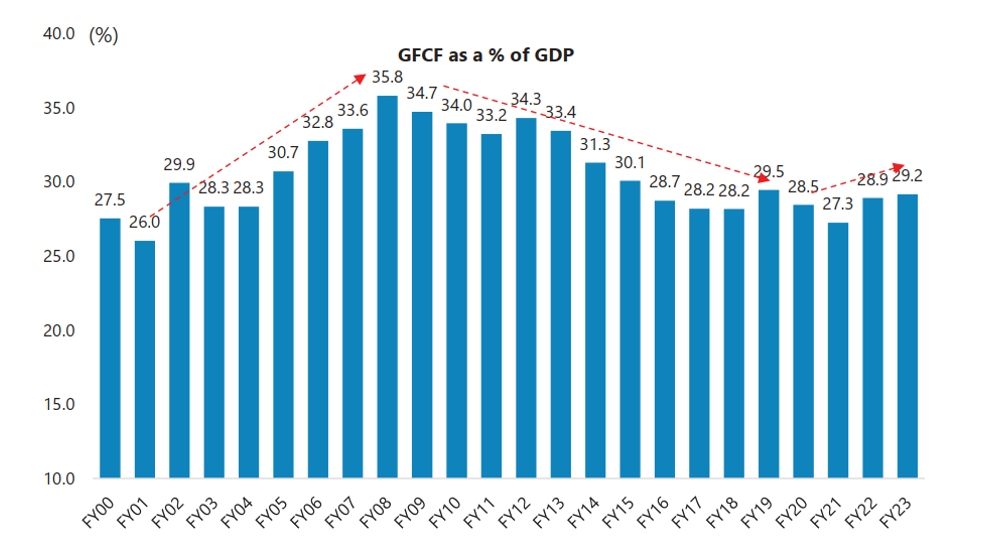

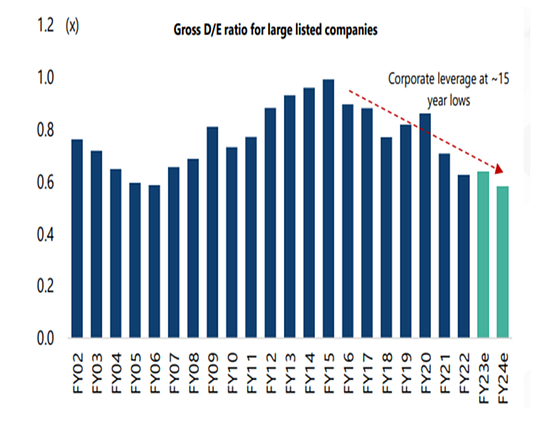

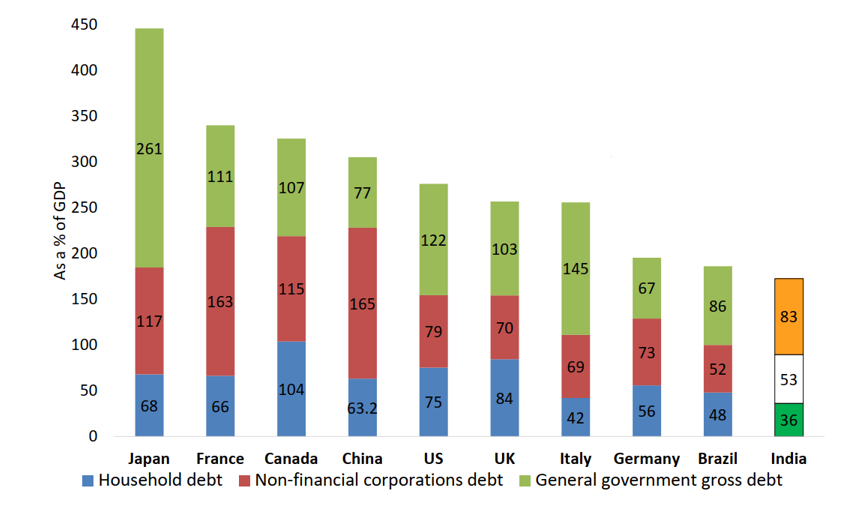

The Macro Bull Case

- GFCF (investments) are rising as a % of GDP

- Bank balance sheets have improved consistently over the last few years

- India has one of the lowest debt as a country giving RBI more manoeuvrability in monetary policy

The Macro Bear Case

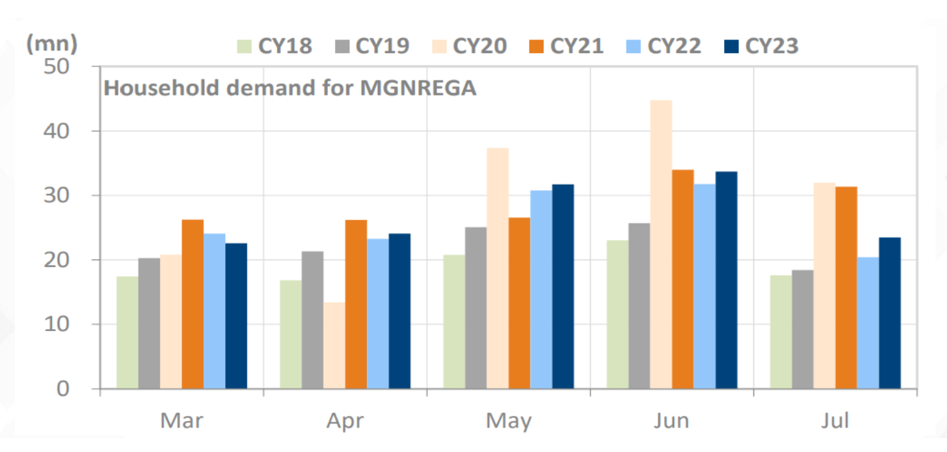

- MNREGA demand uptick signifies a poor rural economy

Crude is inching higher once again and could be headed to $100/bl

In Summary

- Do nothing for now.

- If you have cash, deploy slowly. Once the trend is clear, deploy aggressively.

- Be mentally prepared to book profits or losses if the market worsens quickly.