Thanks @dd1474 for the prompt notes back for VP community. Wish more & more folks follow your example of bringimng everyone on the same page, quicker

From what was shared by SBCL Management in initial remarks and in the more detaiuled Q&A that followed, let me share key takeaways from my side – that move the needle the most, in my book. Please NOTE, I have liberally added my own connect-the-dots (italicised) interpretations to what i heard.

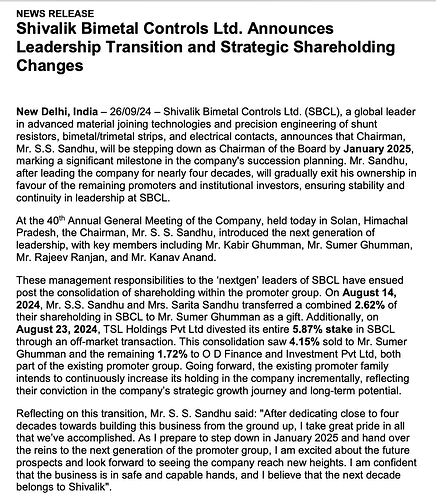

Shivalik Bimetal AGM 2024 Sep 26 Key Takeaways from a medium term perspective

-

Notwithstanding where the Auto/EV Market (SBCL business mainstay) revival stands, SBCL has invested in fructifying other growth drivers to start delivering within the next 6months to a year, that will start bringing in significant contributions in the medium term.

a) Forward integration to Current Sensing PCB modules (new factory will cater to this and other such value added segments as these will require a different set of processes/automation than components/strips) (interestingly this has been a customer-driven demand for long)

b) India Bimetals should be a big driver of growth in the medium term in tandem with the exploding growth in datacenters and energy storage requirements. Switchgear segment will move the needle here. Schneider and ABB relationships are going strong. Schneider Electric to invest Rs 3,200 crore to make India manufacturing hub

c) US Bimetals set to come back in a big way given the massive incentives underway in the US for setting up huge industrial capacities (destocking is mostly done, consequently power & energy management solutions demand exploding). Eaton 2024 Partner Conference Product Roadmap

If 2023 AGM/Mumbai meet excitement communication was around new EBW Shunts relationships (other than Vishay) scaling up, 2024 AGM excitement in SBCL Team certainly is in above 3 segments by my reading. Request VP domain experts like @GourabPaul and others in the wider invest community to help do more diligence and share back here at VP

-

Hella and Continental relationships NOT scaling up. This is not related so much to EV slowdown as to Supplu chain getting shifted out of China. SBCL was hitherto dealing with program managers from China and the entire validation process there; now with the supply chaion shifting back to Europe(?) SBCL had to start dealing afresh with an entirely new set of program managers/validation process. A likely deferment of 6-9 months. FY26 should start seeing traction back