Atleast in ICICI securities merger, quantum MF intervened. Tata motors DVR merger issue didn’t have any takers.

Posts in category Value Pickr

Shakti Pumps – solar shakti (power)! (20-09-2024)

very basic understanding is missing. and fact check is very important.

farmer gets subsidy- cost is not 3-5 lacs. it is anywhere between 20% to 50%.

concept of non existent organic demand is incorrect. the organic demand is already there.

there are 4.5 cr diesel pumps already operating in India. operating a diesel pump is not free. replacement of these with solar pumps is automatic.

on the RM cost- 50% is solar modules not steel. solar module prices have declined and not set to increase even with duties in India.

the comment on margin again incorrect. revenue per pump is fixed, solar module prices have declined, even if they remain stable. margins will stay or expand.

IIFL Finance (erstwhile IIFL Holdings) ~ Retail focused diversified NBFC (20-09-2024)

But this below article says about layoffs.

Looks like NDTV profit wants to keep the stock price suppressed.

Update: The article is written without knowing RBI lifting gold loan restrictions.

Tata Motors – DVR (20-09-2024)

When can we expect share credit? It’s not done on 18th.

NPST – Technology Provider for UPI Tech (20-09-2024)

Good point Rupesh but I wonder why analyst and big investors weren’t worried about this back then vs acting suddenly now? Why is the reaction so late?

Shakti Pumps – solar shakti (power)! (19-09-2024)

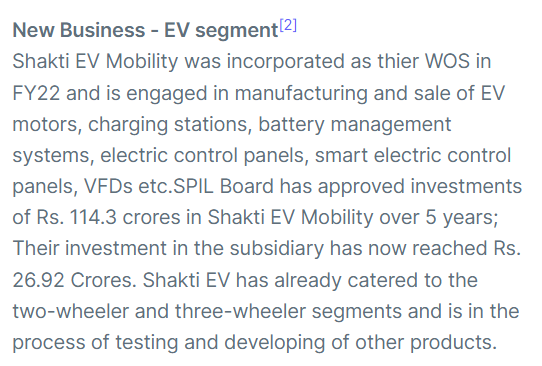

When I read the latest concall, I understood that Shakti Pump Management has been also moving into “EV Mobility” with investment of 114.3 crores.

My question is, aren’t they moving away from their core business (talking of solar pumps only), which still has huge untapped market to capture in India and at the same time much more in Europe and/or Americas. I feel like management is diversifying its focus, which might be detrimental to the innovation and brand in medium term.

Maybe someone can comment, am I right in thinking like this?

Investing Basics – Feel free to ask the most basic questions (19-09-2024)

@BuyRightSitTight @aadhar.aggarwal

There’s some mismatch in info.

As per my calc:

| Mar’23 | P&L | Issue | Others | Sep’23 | |

|---|---|---|---|---|---|

| Share capital | 1833.79 | 0 | 284.96 | 0 | 2118.75 |

| Reserves | 2570.07 | 97.78 | 2051.712 | -103.762 | 4615.8 |

| 4403.86 | 97.78 | 2336.672 | -103.762 | 6734.55 |

However, the issue amount amount is not matching with the amount in CFS.

| Proceeds from issue as per cash flow statement | 4388.38 | ||

|---|---|---|---|

| Proceeds from issue as per above calculation | -2336.672 | ||

| Difference (shown as bonus issue in CFS) | 2,051.7 |

What this difference figure signifies is not clear

Green Hydrogen as a Fuel – Indian Companies leading the Green Revolution (19-09-2024)

Support for Green Energy Surges While Developers Struggle with Grid Delays.

Green Energy Receives $386 Billion Funding, But Can Grid Access Issues Be Solved?

India’s journey towards a greener and more sustainable energy future is making significant advancements, supported by large-scale investments, ambitious projects, and favorable policies along with various challenges and concerns.

Let us demystify it understand it.

Two major renewable energy conglomerates Adani and Torrent, both are actively engaged in the business of power generation through solar, wind and hydro.

Adani New Industries Limited

Adani New Industries Limited (ANIL) the wholly owned subsidiary of Adani enterprise Limited have heavily invested in various projects. Let us find about it’s Green energy ambitions.

- 10 GW solar manufacturing plant

- 5 GW wind turbine manufacturing plant

- 5 GW Electrolyser manufacturing plant

- 10 GW green hydrogen production facility in which Hydrogen capacity is 0.5 million metric tons per annum (MMTPA) and ammonia production is 2.8 million metric tons per annum (MMTPA).

Green Hydrogen, which is the next best alternative to traditional fuels is highly significant. Adani’s 0.5 MMTPA capacity for green hydrogen and 2.8 MMTPA for green ammonia will not only help reduce India’s carbon footprint but could also make the country a major exporter of green energy products.

This ambitious initiative aims to position Adani New Industries Limited at the forefront of India’s renewable energy push, with an eye toward both domestic consumption and export markets.

Torrent Power Limited

Torrent Power has also made substantial commitments to renewable energy development. In a regulatory filing, the company announced investments totaling ₹64,000 crore ($7.7 billion USD) for integrating renewable energy. This investment has the potential to create 26,000 jobs directly and indirectly.

The ‘Shapath Patra’ ie. Affidavit which was submitted to the Government by the Company accommodated some of the commitments which are mentioned below

- 10 GW of Installed Renewable Energy Capacity by 2030

The investments that are made for this is around 57,000 crores . A MoU has been signed with the Gujarat Government to execute a 5 GW solar, wind, or hybrid project in Dwarka district. - Green Ammonia Production Facility

Investments of around 7,200 crores is pledged for the capacity of 100,000 kilotons per annum (KTPA).

This focus on green ammonia is aligned with global trends, as ammonia is a crucial ingredient for sustainable energy systems and a key part of the hydrogen economy.

Government Support

India’s green energy efforts have not gone unnoticed by financial institutions. REC , a state-owned power sector lender, has pledged ₹6 lakh crore for renewable energy projects, with additional support from IREDA and the State Bank of India , each committing ₹5 lakh crore .

Such financial support is pivotal in pushing renewable energy initiatives, ensuring that companies like Adani and Torrent Power have the resources to carry out their plans. Funding is not only the key as infrastructure and supply chain hurdles also needs to be taken in to consideration.

Major Challenge

As promising as these investments are, one of the most pressing challenges for India’s renewable energy sector is the lack of adequate grid access and transmission infrastructure . A surge in global demand for high-voltage direct current (HVDC) transformers, essential for integrating renewable energy into power grids, is causing significant delays for developers. In simple terms HVDC is technology that efficiently transmits electricity over long distances using direct current, reducing power loss compared to traditional alternating current (AC).

According to industry insights, transformer lead times have increased dramatically, from 50 weeks in 2021 to 120 weeks in 2024 , creating a bottleneck in scaling renewable energy projects. The availability of transformers, land, and legal clearances are further stalling the development of transmission infrastructure, especially in key states like Rajasthan and Gujarat . These delays could potentially derail the government’s target of adding over 50 GW of renewable energy capacity annually to meet its 500 GW target by 2030 .

Another issue is that, the Power Grid Corporation of India (PGCIL) is constrained by a mandate to source transformers domestically, requiring at least 60% local value addition , due to which the production of new transformers have been slowed down, which in turn disrupts the supply chain.

Conclusion

India’s renewable energy sector stands at a crossroads, with massive investments and government backing on one side, and significant infrastructure and supply chain hurdles on the other. Companies like Adani New Industries Limited and Torrent Power are leading the charge in green hydrogen, solar, and wind energy projects, but they, along with others in the industry, must navigate the complexities of grid access delays and equipment shortages.

Meeting India’s ambitious target of 500 GW of renewable energy by 2030 will require not only financial resources but also innovative solutions to infrastructural bottlenecks. The government’s role in creating a more enabling environment, coupled with strategic industry responses, will ultimately determine whether India can lead the world in green energy while maintaining a sustainable and balanced approach to growth.

Do share your thoughts and Views.

Torrent Power (19-09-2024)

Support for Green Energy Surges While Developers Struggle with Grid Delays.

Green Energy Receives $386 Billion Funding, But Can Grid Access Issues Be Solved?

India’s journey towards a greener and more sustainable energy future is making significant advancements, supported by large-scale investments, ambitious projects, and favorable policies along with various challenges and concerns.

Let us demystify it understand it.

Two major renewable energy conglomerates Adani and Torrent, both are actively engaged in the business of power generation through solar, wind and hydro.

Adani New Industries Limited

Adani New Industries Limited (ANIL) the wholly owned subsidiary of Adani enterprise Limited have heavily invested in various projects. Let us find about it’s Green energy ambitions.

- 10 GW solar manufacturing plant

- 5 GW wind turbine manufacturing plant

- 5 GW Electrolyser manufacturing plant

- 10 GW green hydrogen production facility in which Hydrogen capacity is 0.5 million metric tons per annum (MMTPA) and ammonia production is 2.8 million metric tons per annum (MMTPA).

Green Hydrogen, which is the next best alternative to traditional fuels is highly significant. Adani’s 0.5 MMTPA capacity for green hydrogen and 2.8 MMTPA for green ammonia will not only help reduce India’s carbon footprint but could also make the country a major exporter of green energy products.

This ambitious initiative aims to position Adani New Industries Limited at the forefront of India’s renewable energy push, with an eye toward both domestic consumption and export markets.

Torrent Power Limited

Torrent Power has also made substantial commitments to renewable energy development. In a regulatory filing, the company announced investments totaling ₹64,000 crore ($7.7 billion USD) for integrating renewable energy. This investment has the potential to create 26,000 jobs directly and indirectly.

The ‘Shapath Patra’ ie. Affidavit which was submitted to the Government by the Company accommodated some of the commitments which are mentioned below

- 10 GW of Installed Renewable Energy Capacity by 2030

The investments that are made for this is around 57,000 crores . A MoU has been signed with the Gujarat Government to execute a 5 GW solar, wind, or hybrid project in Dwarka district. - Green Ammonia Production Facility

Investments of around 7,200 crores is pledged for the capacity of 100,000 kilotons per annum (KTPA).

This focus on green ammonia is aligned with global trends, as ammonia is a crucial ingredient for sustainable energy systems and a key part of the hydrogen economy.

Government Support

India’s green energy efforts have not gone unnoticed by financial institutions. REC , a state-owned power sector lender, has pledged ₹6 lakh crore for renewable energy projects, with additional support from IREDA and the State Bank of India , each committing ₹5 lakh crore .

Such financial support is pivotal in pushing renewable energy initiatives, ensuring that companies like Adani and Torrent Power have the resources to carry out their plans. Funding is not only the key as infrastructure and supply chain hurdles also needs to be taken in to consideration.

Major Challenge

As promising as these investments are, one of the most pressing challenges for India’s renewable energy sector is the lack of adequate grid access and transmission infrastructure . A surge in global demand for high-voltage direct current (HVDC) transformers, essential for integrating renewable energy into power grids, is causing significant delays for developers. In simple terms HVDC is technology that efficiently transmits electricity over long distances using direct current, reducing power loss compared to traditional alternating current (AC).

According to industry insights, transformer lead times have increased dramatically, from 50 weeks in 2021 to 120 weeks in 2024 , creating a bottleneck in scaling renewable energy projects. The availability of transformers, land, and legal clearances are further stalling the development of transmission infrastructure, especially in key states like Rajasthan and Gujarat . These delays could potentially derail the government’s target of adding over 50 GW of renewable energy capacity annually to meet its 500 GW target by 2030 .

Another issue is that, the Power Grid Corporation of India (PGCIL) is constrained by a mandate to source transformers domestically, requiring at least 60% local value addition , due to which the production of new transformers have been slowed down, which in turn disrupts the supply chain.

Conclusion

India’s renewable energy sector stands at a crossroads, with massive investments and government backing on one side, and significant infrastructure and supply chain hurdles on the other. Companies like Adani New Industries Limited and Torrent Power are leading the charge in green hydrogen, solar, and wind energy projects, but they, along with others in the industry, must navigate the complexities of grid access delays and equipment shortages.

Meeting India’s ambitious target of 500 GW of renewable energy by 2030 will require not only financial resources but also innovative solutions to infrastructural bottlenecks. The government’s role in creating a more enabling environment, coupled with strategic industry responses, will ultimately determine whether India can lead the world in green energy while maintaining a sustainable and balanced approach to growth.

Do share your thoughts and Views.

Lotus Chocolate Company: A Tasty Affair (19-09-2024)

Hi All, just want to clarify that all the biggies – likes of Mondelez, Nestle, Mars are able to hedge the price of cocoa given the sheer volumes they sell globally. They have a centralised source for sourcing cocoa and own acres and acres of farms in countries like Ghana. So they enjoy economies of scale and hedging benefits and even though price of cocoa has increased by 3x they are still relatively insulated which is why price of dairy milk silk has only gone up by 10% in last 6 months while that of Amul chocolates has gone up by 30%. Beyond a point domestic players like Amul will not be able to pass on the price hike to the consumer and will begin to lose market share to the global giants which will mean that either Lotus’s topline will crash or its margins. The lower the price of cocoa the better it is for smaller players to thrive or it’s the end of the road. All small chocolate D2C brands have shut shop because core ingredient – cocoa – which contributes to 50% of COGS is now unaffordable.

Disc : not invested