I think, you are right. Even the traditional risk wary middle income customers in T2 and T3 towns are also now preferring the MF than FDs. Looks like HDFC is already trying to sell some of their loan portfolio. The Solution could be change in the tax treatment by government for FDs. In case of FD, you are taxed at slab and are forced to pay the tax every year when compared to Capital gains tax which are at a lower rate and you need to pay only when you capitalize it. The cash may be in the system with securities market but still FDs provide the banks with cheaper source with clear view of the liquidity requirement.

Posts in category Value Pickr

Granules India Ltd (18-09-2024)

oops, yes, they have reduced…Thanks for correcting.

Sterling Tools (STL): Fasteners & EV MCUs (18-09-2024)

What is the source of this news?

DroneAcharya Aerial Innovations – a new age business (18-09-2024)

Also, the targeted numbers in FY24 Annual report is different to the presentation you shared. It says 300% increase in revenue, EBITDA and PAT in FY25.

Promoter stake is also low at 28.2%.

Only tracking this stock so far.

Mudit’s Portfolio (Stage Analysis + Price Momentum) (18-09-2024)

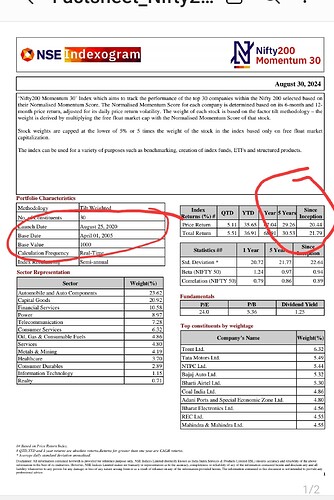

@troll Its actually backtest done by NSE from 2005

NIBE LTD – Manufacturing of critical components in defence industry (18-09-2024)

The range of the company is mind boggling. As per its website and the orders it has received, its makes EV bicycle, EV 3 W,batterries, electronics, weapon launchers, munitions,VMC machines, gabrion walls, ATVs and now forayed into space infra also. The company’s new proposed mega facility is into making aircraft parts. No sure how such a tiny and new company is able to foray into such diverse fields. However the co is able to get orders/enter into MOU with reputed agencies like L &T, MIL,Thales etc. Company need to focus on its strong point so as to scale and excel. Will look for such a direction from a comapny before taking a plunge.

“Kothari Petrochemicals: From Poly to Power – Shaping Tomorrow’s Petrochemical Landscape” (17-09-2024)

Update about Managment of Kothari Petrochemicals

I couldn’t find any red flag about managment online.

- Arjun B. Kothari (Director): Arjun Kothari is a key figure in the HC Kothari Group, holding multiple directorships across the group’s companies. He has a strong background with experience at General Electric Corporation (USA) and holds degrees from prestigious institutions like Northwestern University and the Paris Institute of Political Studies. There are no significant negative reports about him in terms of mismanagement or conflicts of interest

- M. Rajavel (Whole-Time Director): Rajavel has extensive experience, especially in marketing and overseeing the company’s expansion projects. His involvement since 1997 and his role in steering the company’s commercial functions suggest his importance within Kothari Petrochemicals. Again, no negative associations or issues have been reported

- S. Sundarraman (Independent Director): With over 25 years of experience in taxation and auditing, Mr. Sundarraman has served as chairman of significant financial organizations. His track record in cost-saving solutions and business transparency positions him as a reputable figure. There is no record of controversies surrounding him

- V. V. SuryaRau (Independent Director): A veteran of the petrochemical industry, SuryaRau held various leadership positions at NOCIL Limited and Reliance Industries. His expertise in operational excellence and safety management further strengthens the company’s governance. Again, no public reports of misconduct or issues have surfaced

- Brij Mohan Bansal (Independent Director): Mr. Bansal has an extensive career in the oil and gas sector, notably as the Chairman of Indian Oil Corporation (IOCL). His involvement in high-level international dealings and mergers adds strategic value to the company. No negative issues were found regarding his role

Links:

https://www.kotharipetrochemicals.com/about-us/management-team/

“Kothari Petrochemicals: From Poly to Power – Shaping Tomorrow’s Petrochemical Landscape” (17-09-2024)

Conclusive Note

At Kothari Petrochemicals Ltd., we see a business that exemplifies the fundamental tenets of long-term value creation. With its unique position as India’s largest producer of Polyisobutylene (PIB), the company operates in a niche segment, providing an essential component for industries ranging from lubricants to pharmaceuticals. Its debt-free status, consistent profitability, and strong free cash flow generation demonstrate financial prudence and a robust foundation for future growth.

One of the aspects I admire most about Kothari Petrochemicals is its ability to reinvest profits back into the business. The company’s expansion from a production capacity of 36,000 MT to 48,000 MT without relying on debt is a hallmark of sound management. This reflects a discipline we value highly: growth driven by operational earnings rather than external financing. While capital expenditure has increased, it is being funded through internal cash flows, a strategy that positions the company to weather economic storms.

The company’s EBITDA margins have steadily improved, reflecting not just top-line growth but also the efficiency with which Kothari operates. These are the businesses we like—those that consistently increase margins through careful cost management and strategic expansion.

However, even well-run businesses aren’t without their challenges. Customer concentration, where a significant portion of revenue comes from just a few clients, is something to keep an eye on. As with any company dependent on a few key relationships, the loss of a major customer can have material consequences. The good news is that Kothari has shown an ability to diversify its customer base geographically, supplying products to 20 countries, including large markets like Japan, Belgium, and the USA. Geographic diversification is a positive step, but continued efforts to diversify the customer base are essential for long-term stability.

One area of concern is the receivables buildup, which has grown at a faster rate than revenue. While this is not an immediate threat, the trend should be monitored closely. Long receivables collection periods could signal operational inefficiencies or customer credit risk. For long-term investors, it is important to ensure that the company’s profits are realized in cash, not just on paper.

Another issue is inventory growth. Inventory has risen faster than sales, which raises a red flag regarding demand forecasting and inventory management. In times of economic uncertainty, excess inventory can become a liability. However, Kothari’s leadership has a solid track record of managing costs, and we trust they will address this imbalance efficiently.

Raw material price volatility remains a risk. Kothari’s reliance on key suppliers like Reliance Industries and Chennai Petroleum Corporation means that any disruptions or price increases could impact margins. The company’s formula-based pricing model for long-term contracts mitigates some of this risk, but this remains an area to watch closely, especially with crude oil markets being inherently volatile.

Looking at the broader picture, Kothari Petrochemicals has the characteristics of a business we like to own: a strong competitive position in a niche market, prudent management, and a clear strategy for reinvesting profits into growth. The business doesn’t rely on external capital, which means shareholders benefit from organic growth—a far more sustainable model.

For the long-term investor, Kothari Petrochemicals offers a compelling case for value. The company has built a moat around its operations by focusing on a specialized product and continuously improving efficiency. While there are some challenges, such as customer concentration and working capital management, these are far outweighed by the company’s strengths.

In closing, Kothari Petrochemicals is well-positioned to reward shareholders over the long haul, provided that management continues its disciplined approach to growth and operational efficiency. It’s the kind of business that may not always make headlines, but it’s the kind of business that delivers steady returns for those with the patience to stay invested.

“Kothari Petrochemicals: From Poly to Power – Shaping Tomorrow’s Petrochemical Landscape” (17-09-2024)

SWOT Analysis

Risk Analysis

While Kothari Petrochemicals has many strengths, I would be remiss not to mention a few key risks:

Client Concentration Risk: Approximately 39% of KPL’s revenue comes from its top five clients. This high concentration poses a risk should any of these key clients reduce orders or switch suppliers.

- This level of concentration may limit Kothari’s bargaining power and expose the company to pricing pressure from larger customers, who may push for discounts.

Competition from Global Players: While Kothari Petrochemicals dominates the domestic market, it faces stiff competition from global giants in international markets.

Environmental Regulations: The petrochemical industry is under increasing scrutiny for its environmental impact, and stricter regulations could increase operational costs.

Raw Material Volatility: KPL’s reliance on Chennai Petroleum and Reliance Industries for its raw material inputs exposes it to price volatility, particularly in the face of rising crude oil prices or geopolitical tensions.

Product Diversification: Management has acknowledged that their reliance on PIB as a single product line presents risks, particularly if demand for PIB declines in the future.

- If the demand for PIB declines for any reason, whether through technological advancements (new materials replacing PIB) or industry shifts, Kothari would be vulnerable.

Export Market Risks: Kothari exports to over 20 countries, but this comes with increased exposure to foreign market dynamics.

- Currency Fluctuations: With a growing percentage of revenue coming from exports (26% in FY23), Lynch would likely examine Kothari’s exposure to foreign exchange risk. A significant appreciation of the Indian Rupee against other currencies could reduce the profitability of its exports

International Competition: As Kothari expands into international markets, it will face competition from larger global players. It faces competition from international players, particularly in markets like China. The global petrochemicals market is fiercely competitive, and KPL’s relatively small size compared to some global giants may pose challenges in maintaining its market share abroad

Cyclicality of End Markets: While PIB serves multiple industries, many of its primary markets, such as automotive lubricants, plastics, and paints, are cyclical in nature. This means that Kothari’s business is tied to the broader industrial economic cycle. During periods of economic slowdown or recession, demand for industrial chemicals can fall sharply.

- We might question how well-prepared the company is for economic downturns or industry slowdowns ? For example, during a slowdown in automotive production, demand for lubricants would fall, impacting PIB sales.

Capital Intensity and Future Capex Plans: While Kothari is funding its growth through internal cash flows, we would want to know the capital expenditure requirements over the next few years. The company is already expanding production capacity from 36,000 TPA to 48,000 TPA, but how much more capital will be required to maintain this growth trajectory? If future capex plans are too aggressive or require significant outlay, we might have to raise concerns about dilution of returns or whether the company could hit a point of diminishing returns. While Kothari’s debt-free status is a positive, we would still want to keep an eye on how much of the company’s cash flow is being reinvested into plant expansion rather than returning value to shareholders.

Global Economic and Regulatory Risks: While Kothari’s international expansion strategy—aiming for 40% export revenue by 2026 — is a growth drive, it also becomes exposed to international regulatory environments. We might raise questions about the regulatory challenges in certain markets. For example, Europe has increasingly strict environmental and chemical regulations, and the cost of compliance in these markets can be substantial. While global diversification is an attractive growth strategy, it also opens the company up to macroeconomic shocks, and regulatory hurdles, which could dampen growth if they aren’t managed properly.

Limited Pricing Power: Companies that can raise prices without losing customers hold significant advantages. However, Kothari Petrochemicals operates in a relatively commodity-like business, where its products, while specialized, are still heavily influenced by input costs and market demand. The company’s long-term contracts and formula-based pricing mechanisms, while helpful, indicate that Kothari doesn’t have unlimited pricing power. In markets where customers can switch to alternative suppliers or when competitive pressures rise, Kothari may not be able to maintain its margins if input costs rise.

Competitive Advantages & Moats:

One very important factor when I evaluate any business, one of the first questions I ask is: Does it have a durable competitive advantage?

Many investors fail to appreciate the strength that comes from product specialization. Kothari’s focus on PIB—and its expertise in manufacturing multiple grades of it—allows it to capture a large share of a specialized market. This specialization acts as a moat because competitors would struggle to match Kothari’s scale and expertise in this product.

Kothari Petrochemicals has a clear competitive moat in several ways:

- Scale Advantage: As the largest manufacturer of PIB in India, Kothari benefits from economies of scale, which allows it to produce PIB more efficiently than smaller players.

- Specialization: Being specialized in a niche market gives Kothari an edge over competitors who produce a wider variety of chemicals. Specialization often leads to cost advantages and operational efficiencies, and it’s harder for new entrants to compete effectively when a company already dominates the space.

- Debt-Free Status: The absence of debt provides a significant competitive edge, allowing the company to reinvest its earnings into expansion and innovation without financial strain.

- Export Growth: The company is expanding its presence in international markets like Southeast Asia and Europe, which reduces its dependence on domestic demand. Diversification into these new markets strengthens the moat because it spreads risk and opens up more revenue opportunities.

Opportunities & Growth Drivers:

Growing Demand for PIB: The demand for PIB is expected to grow at a CAGR of 4-5% globally, driven by the increasing use of lubricants, sealants, and adhesives across industries like automotive, packaging, and chemicals. With its leadership in PIB production, Kothari Petrochemicals is well-positioned to capitalize on this growth.

Global Demand for Lubricants: The global lubricant market is expected to grow at a CAGR of 3.5%, with PIB being a critical ingredient in synthetic lubricants.

Geographic Expansion: With over 31% of its revenue coming from exports, Kothari Petrochemicals is expanding its footprint in international markets. The growing demand for PIB in emerging markets presents a significant opportunity for revenue growth.

Product Innovation: The company is exploring new applications for PIB, including its use in electric vehicle (EV) batteries and advanced packaging solutions. This diversification can open up new revenue streams and provide a competitive edge in the market.

Capex Plans: Kothari plans to expand its production capacity by 15-20% over the next 2 years to cater to growing demand.

Mergers & Acquisitions: The management is exploring opportunities to expand its product portfolio by acquiring or partnering with companies in complementary product segments.

Capacity Expansion: KPL’s production volume grew by 6% YoY in FY23, with the company expanding its plant’s capacity to 48,000 MT. This capacity expansion will allow KPL to cater to growing demand across multiple industries, including automotive, plastics, and lubricants. The company’s long-term agreements with key clients ensure a steady revenue stream and minimize exposure to short-term market volatility.

Revenue Growth Outlook: With a strong pipeline of orders from both domestic and international clients, KPL is poised for further growth. The company’s ability to lock in long-term supply agreements with formula-based pricing shields it from fluctuations in raw material prices, ensuring stable margins.

Conference Call and Management Insights:

KPL’s management has been prudent in managing the company’s growth and finances. However, there is a lack of detailed forward-looking guidance, which may leave some investors uncertain about the company’s future growth trajectory. Nonetheless, the company’s debt-free status, consistent capacity expansions, and strong relationships with key clients highlight management’s capability to drive long-term value.

- Capacity Expansion: To cater to the growing demand for PIB, especially in export markets.

- Cost Management: The company is focusing on further improving its cost structure to offset any impact from rising input costs.

- Sustainability Initiatives: Management highlighted ongoing investments in greener production technologies aimed at reducing the environmental impact of PIB production.

Kothari Petrochemicals has shown a growing commitment to sustainability:

- The company is making significant strides in reducing carbon emissions by adopting energy-efficient production processes.

- In line with global sustainability trends, Kothari has begun exploring the use of recycled feedstocks for PIB production, which could serve as a new product line in the future.

Key Insights from Management Discussion & Investor Presentation

The MD&A highlights KPL’s strategic focus on product diversification and capacity expansion. Despite the challenging global environment, KPL’s management has maintained strong profit margins and a clear focus on expanding into new markets. The company’s export revenue has steadily grown, indicating successful international market penetration.

- Expansion Plans: Management outlined a strategy to increase exports to 40% of total revenue by FY2026.

- ESG Initiatives: Kothari Petrochemicals is focusing on reducing its carbon footprint and transitioning towards sustainable manufacturing.

- Focus on Innovation: Management emphasized the importance of investing in R&D to develop higher-value PIB derivatives.

- Risk Mitigation: The company has hedged its exposure to raw material price fluctuations and is exploring ways to secure long-term supply contracts to stabilize input costs.

KPL’s latest investor presentation emphasized:

- Capex Plans: INR 100 crore allocated for product diversification and capacity expansion

- Geographical Revenue Mix: 74% domestic and 26% export markets

- Strategic Initiatives: The company is focusing on developing new high molecular weight PIB products, which are expected to drive future growth.

Conclusion: Long-Term Investment Outlook

Kothari Petrochemicals Ltd. presents a compelling investment opportunity for both long-term investors and traders. Its strong market position, consistent revenue growth, debt-free balance sheet, and expansion into new markets make it a solid player in the petrochemical industry.

However, investors should be mindful of risks related to client concentration, raw material price volatility, and global competition, particularly from large players in China. KPL’s ability to diversify its product portfolio and expand its customer base will be key to maintaining its competitive edge.

This is a “fast grower” with significant upside potential. The valuation, while not dirt cheap, is still reasonable given the growth runway ahead. For investors looking for a small-cap company with a dominant position in a niche market and growth on the horizon, Kothari Petrochemicals is worth a close look.

Disclaimer: Took a recent exit, monitoring now for future entry point

Links:

https://www.screener.in/company/KOTHARIPET/

https://www.moneycontrol.com/financials/kotharipetrochem/results/quarterly-results/KP12

Study Links