Posts in category Value Pickr

Midcap Momentum Portfolio (26-11-2024)

@alphaAKS With Sharpe returns, we are comparing the returns of the stocks and subtracting a risk free returns from it. If we are doing this for all stocks and then ranking, we can as well do it directly based on returns. As the subtracted value remains constant across all stocks it does not add value to do ranking after this. This has been the doubt that I always had.

However, with Z score, we are not ranking based on returns directly. Z score is a statistical number to show how much the stock is away from the Mean and on which side. We are ranking based on this number. In effect, we are not ranking directly based on returns, but on a factor that checks where the stock lies within its universe.

And, if we are checking over multiple look back periods, I think Z score is one of the better indicators for ranking.

Midcap Momentum Portfolio (26-11-2024)

@alphaAKS With Sharpe returns, we are comparing the returns of the stocks and subtracting a risk free returns from it. If we are doing this for all stocks and then ranking, we can as well do it directly based on returns. As the subtracted value remains constant across all stocks it does not add value to do ranking after this. This has been the doubt that I always had.

However, with Z score, we are not ranking based on returns directly. Z score is a statistical number to show how much the stock is away from the Mean and on which side. We are ranking based on this number. In effect, we are not ranking directly based on returns, but on a factor that checks where the stock lies within its universe.

And, if we are checking over multiple look back periods, I think Z score is one of the better indicators for ranking.

Pokarna Limited: (26-11-2024)

-

Mgmt, in an earlier interview, guided for 30-35% growth in FY25. In H1FY25, the company’s revenue increased 23%, while PAT increased by 53%.

-

Stars aligning? Factors at play:

-

Margin Expansion: Company’s strategic shift towards producing margin products is leading to expansion in margins (for reference, EBITDA margins were 26% in FY23 while 34% in FY24). In H1, the company did margins of 36% & company is confident to maintain this margin profile. H2FY25 should see this play out as well, as margins were about 32% in the second half of last year which should improve this year.

-

Tax benefits: In FY25, the company is transitioning to a lower tax regime. The company’s effective tax rate for FY24 was 36%, and they are shifting to a 25% tax regime. However, in H1, due to some reversals, the company could bring it down to just ~32% levels. The company has guided for 25% tax rate from hereon, hence next 4 quarters should see PAT margins to increase by 7-10 percentage points on account of normalizations

-

CRHOMIA & KREOS: The company has completed/in process of completing a CAPEX of 100 crore for CHROMIA and KREOS. The CHROMIA line went live on October 11th, and KREOS will become operational in Q4FY25. As per management, this will result in the production of thin slabs with exotic designs, which will contribute to further increase in margins and operating leverage. The main contribution from it will be from FY26 onwards, as it would take 3-6 months to stabilize.

-

New Production Line: The company has recently announced 440cr, which will come live by March’26. Company is expecting 100cr+ PAT from it on steady state. For reference, company’s TTM PAT is 115cr. What’s even great is that it will be been set up on land that the company already bought a few years back, hence improvement in asset turnover and return ratios.

-

Monetising Apparel business: The company closed its unprofitable apparel business in March 2024. It is looking for buyer & expect to complete the monetization in next 12 months.

-

Granite business: Company is working on reviving its loss making granite business. Any improvement in that is cherry on the cake.

-

Other factors to contribute include:

- Interest rate cuts in US to boost house construction, leading to Quartz demand,

- Diversifying into other geographies like Russia, Canada & parts of Europe is also happening on good pace, albeit on a low base – would take few more years to see major revenues from these regions

- Most of the earnings of the company are in USD, which is expected to get stronger post-Trump joining in Jan – this will make export to the US more attractive as well contribute a bit to FOREX gains

- Freight rates have been normalizing from last few months; this should ease the trade

- Due to healthy cashflows, expecting the company to repay a substantial % of its debt (including for recently announced CAPEX of 440cr) by the end of FY27 and become debt-free

- Key risks:

-

Import Tariffs: Post Trump taking over, US could impose import tariffs, including on Quartz which could impact the company’s business. However, the company believes that any such tariffs would affect all exporters equally, hence not much of a concern.

-

Antidumping Duties: While the company has been successful in recent duty reviews, there remains a risk of future anti-dumping actions.

-

Health and Safety Concerns: The potential health hazards associated with quartz manufacturing and potential regulatory restrictions pose a risk to the industry. Company is following all protocols to ensure safety of workers. Further, even if US ban manufacturing of quartz in US (looks very unlikely), will it impact positively to exporters from other regions?

-

Intensifying Competition: Increasing competition from Chinese, Vietnam, Thailand, Turkey, and other exporting countries could impact market share and pricing. Worthy to note that, there is already heavy anti-dumping duty on Chinese export of Quartz, hence currently impact is not much. Further, company’s product is well placed with distributors / channel partners which is key for growth.

Pokarna Limited: (26-11-2024)

-

Mgmt, in an earlier interview, guided for 30-35% growth in FY25. In H1FY25, the company’s revenue increased 23%, while PAT increased by 53%.

-

Stars aligning? Factors at play:

-

Margin Expansion: Company’s strategic shift towards producing margin products is leading to expansion in margins (for reference, EBITDA margins were 26% in FY23 while 34% in FY24). In H1, the company did margins of 36% & company is confident to maintain this margin profile. H2FY25 should see this play out as well, as margins were about 32% in the second half of last year which should improve this year.

-

Tax benefits: In FY25, the company is transitioning to a lower tax regime. The company’s effective tax rate for FY24 was 36%, and they are shifting to a 25% tax regime. However, in H1, due to some reversals, the company could bring it down to just ~32% levels. The company has guided for 25% tax rate from hereon, hence next 4 quarters should see PAT margins to increase by 7-10 percentage points on account of normalizations

-

CRHOMIA & KREOS: The company has completed/in process of completing a CAPEX of 100 crore for CHROMIA and KREOS. The CHROMIA line went live on October 11th, and KREOS will become operational in Q4FY25. As per management, this will result in the production of thin slabs with exotic designs, which will contribute to further increase in margins and operating leverage. The main contribution from it will be from FY26 onwards, as it would take 3-6 months to stabilize.

-

New Production Line: The company has recently announced 440cr, which will come live by March’26. Company is expecting 100cr+ PAT from it on steady state. For reference, company’s TTM PAT is 115cr. What’s even great is that it will be been set up on land that the company already bought a few years back, hence improvement in asset turnover and return ratios.

-

Monetising Apparel business: The company closed its unprofitable apparel business in March 2024. It is looking for buyer & expect to complete the monetization in next 12 months.

-

Granite business: Company is working on reviving its loss making granite business. Any improvement in that is cherry on the cake.

-

Other factors to contribute include:

- Interest rate cuts in US to boost house construction, leading to Quartz demand,

- Diversifying into other geographies like Russia, Canada & parts of Europe is also happening on good pace, albeit on a low base – would take few more years to see major revenues from these regions

- Most of the earnings of the company are in USD, which is expected to get stronger post-Trump joining in Jan – this will make export to the US more attractive as well contribute a bit to FOREX gains

- Freight rates have been normalizing from last few months; this should ease the trade

- Due to healthy cashflows, expecting the company to repay a substantial % of its debt (including for recently announced CAPEX of 440cr) by the end of FY27 and become debt-free

- Key risks:

-

Import Tariffs: Post Trump taking over, US could impose import tariffs, including on Quartz which could impact the company’s business. However, the company believes that any such tariffs would affect all exporters equally, hence not much of a concern.

-

Antidumping Duties: While the company has been successful in recent duty reviews, there remains a risk of future anti-dumping actions.

-

Health and Safety Concerns: The potential health hazards associated with quartz manufacturing and potential regulatory restrictions pose a risk to the industry. Company is following all protocols to ensure safety of workers. Further, even if US ban manufacturing of quartz in US (looks very unlikely), will it impact positively to exporters from other regions?

-

Intensifying Competition: Increasing competition from Chinese, Vietnam, Thailand, Turkey, and other exporting countries could impact market share and pricing. Worthy to note that, there is already heavy anti-dumping duty on Chinese export of Quartz, hence currently impact is not much. Further, company’s product is well placed with distributors / channel partners which is key for growth.

Protean EGov Technologies Ltd – A Play on the ONDC, Digital Policies (26-11-2024)

How will it benefit this company?

A tool to compare against industry average (26-11-2024)

If you go throgh the scanner, it gives you all the required info to invest judiciously. So don’t waste your time in creating a new tool. Investment is all about investing in a company which has successfully generated revenue year on year with certain growth in such revenue year on year plus EBITDA is above 20% of the revenue and it is growing atleast 10% year on year. Make sure the promoter’s equity is in excess of 50% and the debt equity is less than 1. If you ensure these factors, I am sure you will be accumulating wealth at a good pace going forward. All the best in your investment journey.

Microcap momentum portfolio (26-11-2024)

I am using Yahoo Finance too, and data seems to be accurate in most cases. You are using AdjClose right and not just the close value for calculations?

Starting my momentum portfolio based on my python code from 1st December ![]()

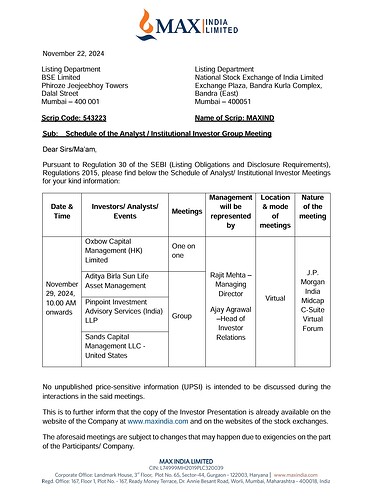

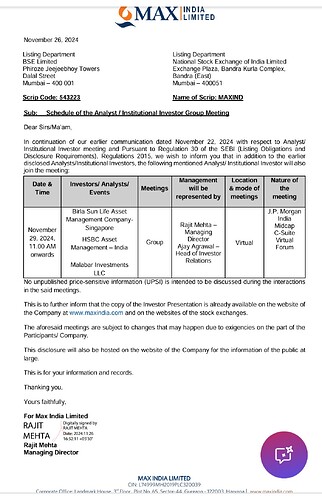

Max India – Demerger, Will sum of parts be greater than single entity (26-11-2024)

Posting about Max India (Antara Senior care).

Interesting to see the institutional investor names for the analyst meet scheduled on Nov. 29th. Few foreign investors, Malabar investments, Birla sun life Asset etc. I think slowly the stock is getting the attention of institutions, a good sign.

As per last concall, management planning for a 100cr fund raise mostly via rights issue.

D: Invested, Biased. Optimistic about the senior care sector. Closely watching management commentary & the scale up of different verticals.