credit cards? is there a separate card for dreamfolks? take rate will be extremely thin once again.

Posts in category Value Pickr

Maharashtra Scooters : Value of Listed Investments Make it a great value pick? (11-09-2024)

Thankyou for providing this sheet. It’s been a while since you made this sheet. Can you please update it for the benefit of all to evaluate the holding co. discount?

Large Cap investing (11-09-2024)

(post deleted by author)

Sanghvi Movers (11-09-2024)

@rcinvestor999 inspired by you i started tracking all renewables both wind and solar. data in below spreadsheet which is public:

Shriram Pistons & Rings Ltd (11-09-2024)

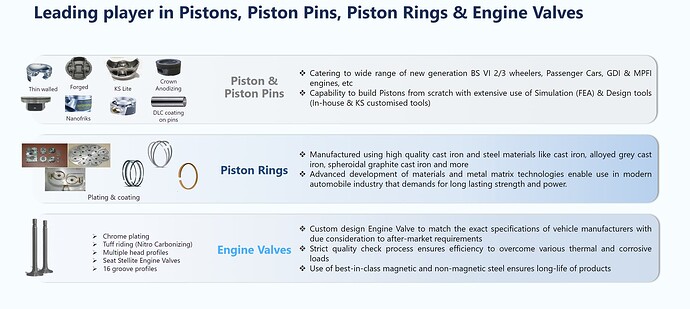

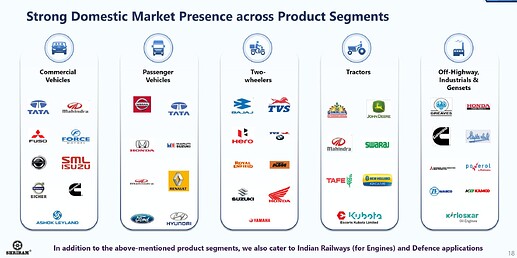

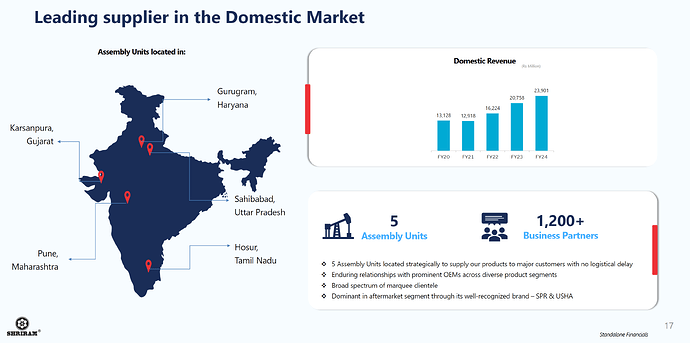

Shriram Pistons & Rings Limited (SPRL) is the leading manufacturer of Pistons, Piston Pins, Piston Rings, and Engine Valves in India, with the exceptional lineage of the Shriram Group one of the most reputed Industrial houses in the country. Its products are marketed to almost all renowned OEMs and Aftermarkets under the brands SPR and USHA, catering to both domestic and international markets. SPRL deploys most modern manufacturing equipment and processes, using state-of-the-art R&D Tech Centre, which is supplemented with continuous support from its global technology partners.

What Does This Thing Do: Pistons

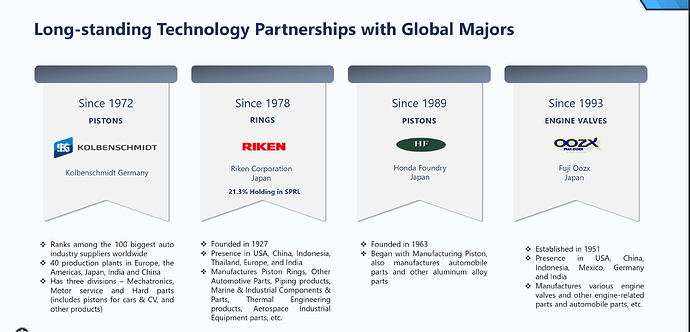

Tech Partnerships:

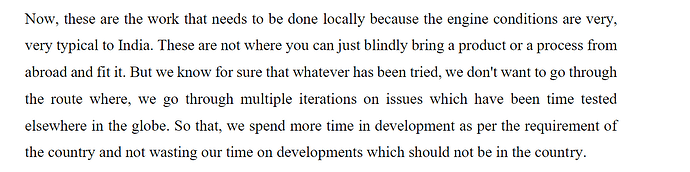

The company has long standing technology partnerships with Global Majors, it uses world class technology and also has its in house technology center. It customizes the technology to local conditions and then manufactures at scale for all major OEMs in India and Abroad.

Source: SPRL Concall

Business Segments:

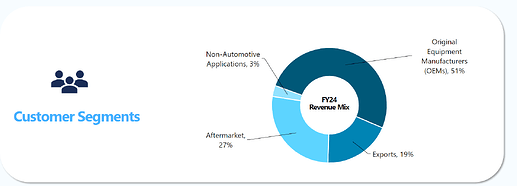

The company has a diversified revenue profile with no customer concentration and although majority of the business is linked to the global auto sector and is subject to cyclicality, its aftermarket and non-automotive business provide support in a downcycle.

Source: SPRL Concall

The current TAM for aftermarket business is 100m vehicles which would require regular refurbishment requirements and it sells its products through the USHA and SPR brand.

Competitive Intensity:

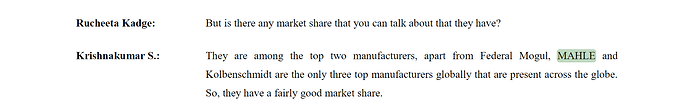

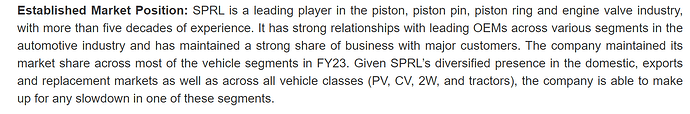

SPRL has dominant position and is a leading player in the piston, piston pin, piston ring and engine valve industry.

Source: Fitch rating report

Business Developments:

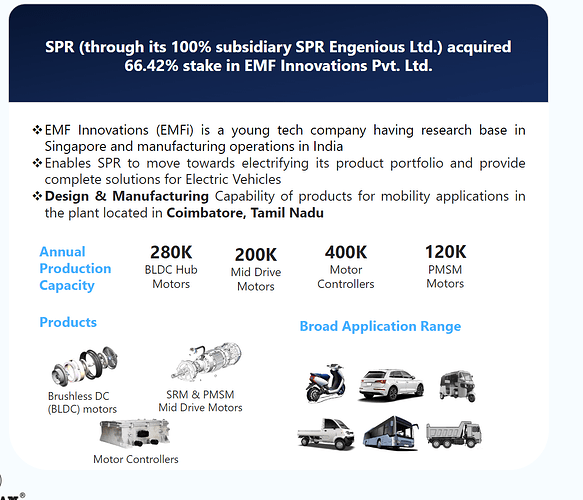

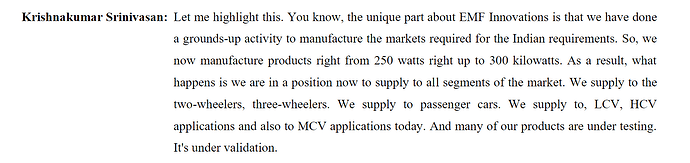

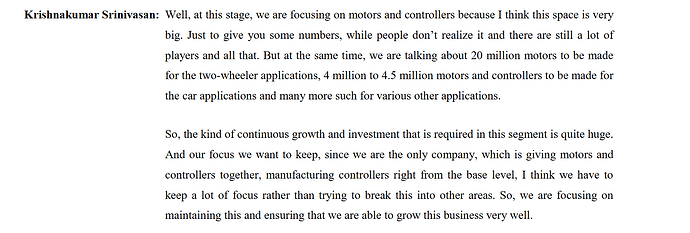

EMFI acquisition:

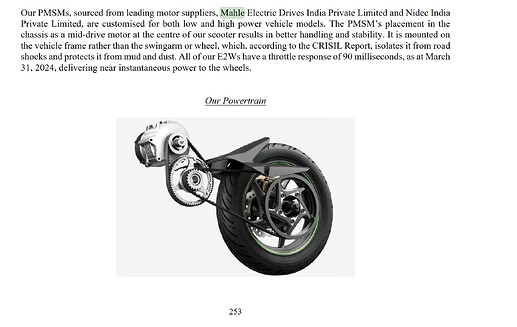

In anticipation of huge demand for motor and motor controllers they have done an acquisition of EMFI and currently have 0.5million capacity for motors and controllers annually, positioning them to meet the surging demand for these components and capitalize on the growing electric vehicle market across two, three, and four-wheelers.

The current TAM for motors and controllers is huge and SPRL has a history of partnering with global tech leaders customizing their tech in its tech center to meet Indian standards and then producing them at scale and using its existing relationships with OEM and distributors to sell them worldwide.

Source: SPRL AR

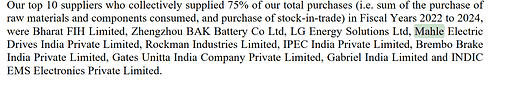

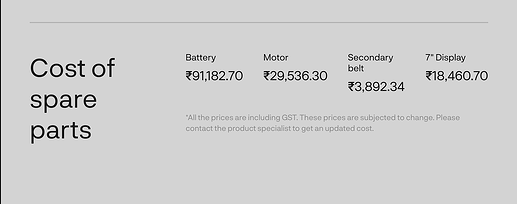

Now if we look into SPRL’s competitor Mahle, it was the supplier of mid drive hub motors to Ather. Ather in its DRHP has mentioned supplier concentration risk which suggests that there no major auto ancillary company that can supply good quality motors and controllers for EV applications.(Did some scuttle butt with an engineer who works at Ather).

Source: Ather DRHP

Source: Ather energy

After battery, motor and controllers is the second biggest cost in the BOM. SPRL can capture a huge market, currently OEMs are looking to de-risk their supply chain and thus it can capture market for the existing EV models as well.

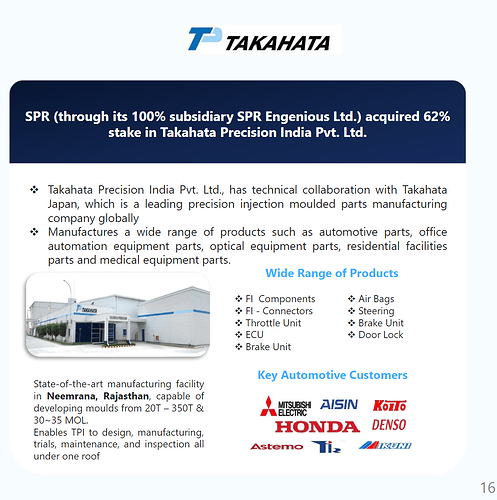

Takahata acquisition:

Strengths:

-

Sole supplier to Bajaj for supply of piston and valves for their CNG bike freedom 125.

-

It currently has 90% market share for piston and piston rings in CNG engines.

-

The company has anticipated change in advance with respect to change in technology from BS4 to BS6 and are actually leaders in providing solutions to their customers(OEMs).

-

Even after transitions to multiple new reforms and also witnessing a downcycle in the auto industry, SPRL has been able to maintain 55-60% gross margins and has always maintained double digit OPM.

-

With a cash rich Balance Sheet the company is well positioned to do acquisitions which would be margin accretive. It also has been able to consistently increase its OPM for the past many quarters.

-

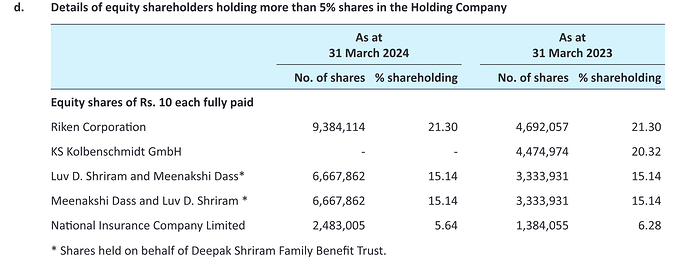

It has renewed its technical collaboration agreement and also the supply overhang is gone as KS Kolben has sold its 20% stake.

Source: SRPL AR

-

Ability to withstand technology change:

Key triggers:

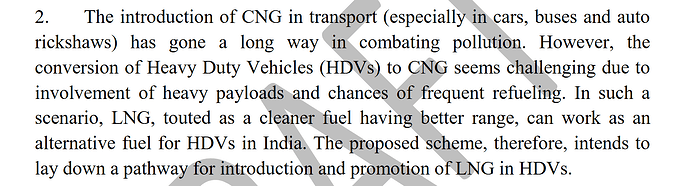

- Government has recently come with a draft scheme for promotion of LNG based mobility

draft-Scheme-for-promotion-of-LNG.pdf (368.6 KB)

-

Growing demand for hybrid vehicles potentially increases their content value per vehicle:

-

Capability to supply for E85 fuel, thus benefitting from the government’s thrust towards ethanol blending in fuel and promotion of flex fuel vehicles.

Indian auto companies will soon produce 100% ethanol-run cars and 2-wheelers: Nitin Gadkari – The Economic Times -

Key players like Adani Total Gas exploring retrofitting ICE engines to run on alternative fuels like CNG and LNG, shows vision of top players aligned with government and also shows progress in establishment of an ecosystem for adoption of alternative fuel systems.

Risks

- It has been consistently able to improve its OPM for the last few quarters due to operating leverage and productivity gains, thus it is operating at highest OPM currently, in a downcycle operating deleverage will reduce its profitability.

- SPRL has been a leading player in piston, piston pins, piston rings and engine valves, with their foray in precision plastic moulding and EV motors and controllers it carries significant execution risk in an area where their experience has been very limited.

- Management is keeping significant cash in its Balance Sheet for acquisitions instead of doing a buyback, diworsification in unrelated businesses can cause capital misallocation.

- Faster adoption of EVs can cause terminal risk to its core business.

Valuations:

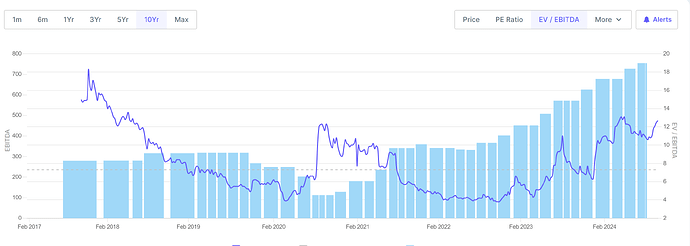

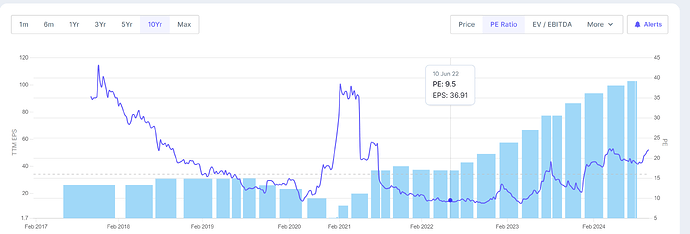

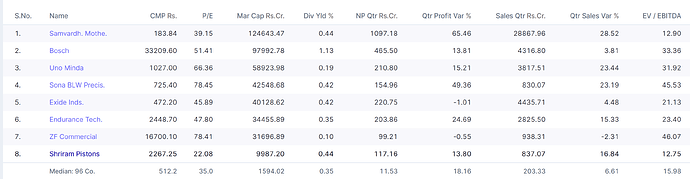

The company is currently trading at EV/EBIDTA multiple of 12.5x and P/E of 22x

Despite the company’s consistent outperformance of the industry and its robust cash flow, its valuation remains undervalued due to concerns about the long-term viability of internal combustion engines (ICEs) in the face of electric vehicle (EV) adoption. Thus it trades at a comparable multiples to Sharda motors. However, strategic acquisitions and a shift in product mix could significantly enhance its future prospects and lead to a rerating further.

Disclosure: Hold a tracking position

DCX Systems Ltd (11-09-2024)

New AR out.

Funnily enough, consolidated RPTs aren’t reported and the consol. section has standalone RPTs repeated. Lol.

Raymond – The Complete Man (11-09-2024)

If you have received Raymond Lifestyle shares as part of de merger, will LTCG apply after one year from the listing date (Sep 5, 2024) of RLL?

Lincoln Pharma … the next mid-cap pharma in the making …? (11-09-2024)

Do we know if the company gave any similar guidance in the past and walked the talk?

If it couldn’t manage 10% CAGR sales growth in past 9-10 years (on a much smaller base), I wonder if these are enough growth levers to double the topline in 3 years.

Cautious

Raymond – The Complete Man (11-09-2024)

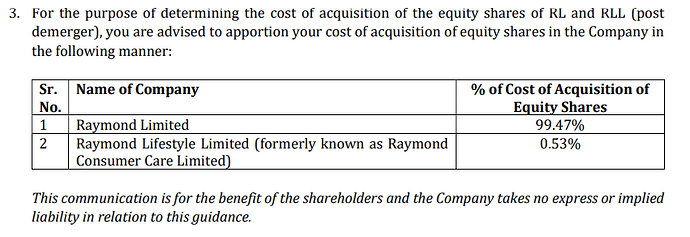

Thank you @life_long_learner. I remember reading it in BSE announcements but could not find it. Based on the news article date, I was able to track down the original BSE Announcements PDF: https://www.bseindia.com/xml-data/corpfiling/AttachHis/20dc5523-f1ca-4f24-a89c-d2252e3ddb6d.pdf.

Putting in a screenshot here in case the PDF goes away in the future:

Sai Silks (Kalamandir) – only listed player in the organized saree market (11-09-2024)

- Q1 FY25 revenue was INR 274 crores with a gross margin of 41.26%

- Total retail area stood at 6.53 lakh sq ft across 61 stores in 4 states as of June 30, 2024

- Opened 1 new store in Q1, faced delays in opening 2 planned stores due to pending local clearances

- Q1 saw negative same-store sales growth (SSG) of around 20% due to fewer wedding dates

- Gross margin improved by 98-99 bps year-over-year despite weak trends

- EBITDA margin dropped to single digits in Q1 due to negative SSG

- Expanding focus on Tamil Nadu and Karnataka markets

- Targeting to reach 100 stores by end of FY26

- Expecting to improve revenue per sq ft to INR 28,000-28,500 by FY26

- H1 FY25 expected to be flat or slightly better than H1 FY24

- Q2 FY25 showing signs of recovery with positive footfalls

- Targeting 90,000 sq ft of new store additions in FY25, though delayed from Q1 to later quarters

- KLM Fashion Mall format expected to have flat to slightly positive growth in FY25

- Converting some Kalamandir stores to Varamahalakshmi Silks format

- Expanding into new geographies like Trichy, Pondicherry

- Adding new categories like lingerie to KLM Fashion Mall format

- Wedding season driving sales recovery in Q2

- Higher-value items (INR 30,000-50,000 range) seeing growth again

- More wedding dates in H2 FY25 compared to H1

- Heatwave, elections impacted Q1 performance

- Expecting double-digit revenue growth and ~17% EBITDA margin in Q2 FY25

- Targeting progressive margin improvement year-on-year going forward

- Aiming for 100 stores by end of FY26