Got it. That explains. Thanks.

Posts in category Value Pickr

Sterling & Wilson Solar Ltd. – Will the Sun Keep Shining? (22-08-2024)

Assuming a bulk of SW’s new orders is going to come from Reliance, module prices shouldn’t really matter much as it would be a Free Issue Material from RIL right? In that case their margins could actually improve as the share of reliance orders increases in the next FY?

Sterling & Wilson Solar Ltd. – Will the Sun Keep Shining? (22-08-2024)

I was surfing on some Nigerian websites to know more about the EPC order S&W won. Got this new snippet, saying the Energy ministry got backing from the US for its solar needs. It has mention of Sun Africa, which is the main beneficiary of this Order. And i think its a US company. Does this connect some dots?

HIL – Eco (onomic) friendly way to play rural prosperity in India (22-08-2024)

I understand that the salary might be higher than usual, but in small companies where profits can be unpredictable or sometimes when below normal levels, it’s common to see elevated salaries when the company is aiming for significant growth. To lead the company through a successful turnaround and drive it onto a growth trajectory, hiring a strong MD & CEO is crucial. This often comes with a higher salary, which is acceptable because it reflects the value they bring to the company. It’s preferable to see a substantial salary for the CEO rather than having funds diverted through other means, which could present a misleading picture to shareholders. I mean this is my perspective to look at this may be this may not be same for everyone. As an investor we should keep an holistic approach while looking over these issues.

IDFC First Bank Limited (22-08-2024)

Thanks Deepak for sharing the letter.

If someone does not want to read the whole letter below are few quick takeaways.

- “For instance, we plan to grow our branches by only 10% annually but grow deposits by ~25% CAGR until FY27. Many digitisation efforts are under implementation.

- Together, we plan to reduce the overall Cost to Income ratio by about 800 bps from 72.9% in FY24 to 65% by FY27 and continue to improve from there.”

3)”Because the foundation that has been laid, we expect our Opex to grow only by 19-20% this FY25, while income is expected to grow by about 23-24%. - We expect the phenomenon of Opex growth being lesser than the income growth to play out consistently over the next few years. This will structurally improve the profitability of the Bank. Based on this, we are planning for our PPOP% to reach around 3.3-3.5% of assets, on a core basis, in five years from levels of 2.25% in FY24.”

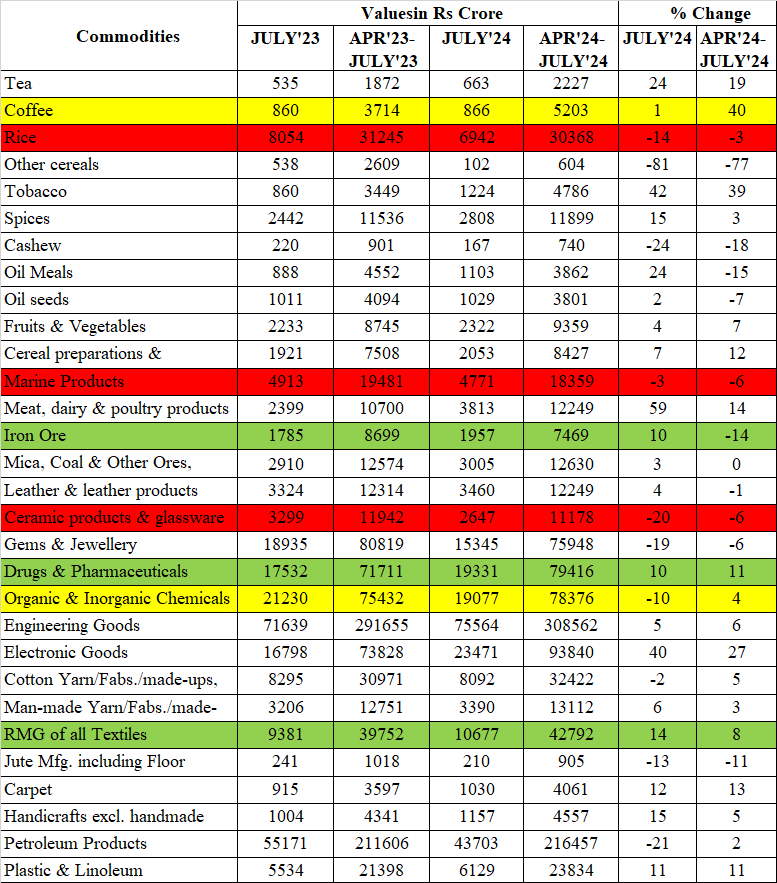

Export data and learnings (22-08-2024)

July 2024 update:

India’s overall exports(merchandise and services combined) during June 2024 is estimated at USD 62.42 Billion, an increase of 2.8% compared to July-23.

Total import during July -24 is estimated at USD 72.03 billion, positive growth of 7.14 % over July-23.

Monthly merchandise export during July -24 is USD 33.98 Billion compared to USD 34.49 Billion during July- 23.

The estimated value of service export during July -24 is at USD 28.43Billion compared to USD 26.22 Billion during July-23.

Coffee exports become flat during July in contrast to high growth seen during previous months.

Rice exports continue to remain in a downward trajectory.

Marine products exports are down by 3%.

Iron ore exports increased by 10% during July, consecutive months of positive growth. .

Ceramic products and glassware exports reduced significantly.

Pharma exports increased by 10%.

After 2 quarters of growth in export chemicals are down by 10% during July.

RMG of textiles exports increased by 14% which is a significant increase seen during the last few quarters.

Balaji Amines Opportunity (22-08-2024)

Ah ok. Generally when someone says Q1 2023, I take it as first financial quarter in the same year (2023).

Malhar’s Investing Thoughts (22-08-2024)

Where to look for more (recent) information about Loyal equipments?

Hitesh portfolio (22-08-2024)

Hi Hitesh Sir !

Please share your views on Kopran (Just crossed 52 W high) and Religare ( Near 52 W high) on technical Chart basis.