Posts in category All News

Transpek Industry limited (23-11-2024)

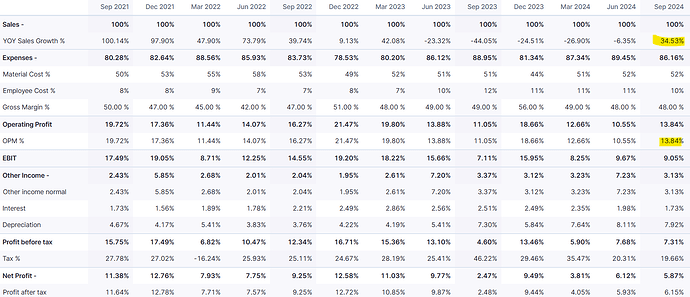

Transpek posted good set in Q2 FY 25 thanks to a lower base. Not sure if there is any management concall scheduled soon to find out what is behind these numbers. If anyone has any other data/reports pls chip in. Profit margin has improved sequentially, posting the common size P&L snip from screener.

| Particulars | Q2 FY25 | Q2 FY24 | YoY Change (%) | Q1 FY25 | QoQ Change (%) |

|---|---|---|---|---|---|

| Revenue | 163 | 121 | 34.7% | 152 | 7.2% |

| Operating Profit | 23 | 13 | 76.9% | 16 | 43.8% |

| PBT | 12 | 6 | 100% | 9 | 33.3% |

| PBT Margin | 7% | 5% | 2% | 6% | 1% |

| Net Profit | 10 | 3 | 233.3% | 9 | 11.1% |

| PAT Margin | 6% | 2% | 4% | 6% | 0% |

Disclosure: Not invested. Post purely for study purposes. thanks.

Ranvir’s Portfolio (23-11-2024)

Glenmark Pharma –

Q2 FY 25 concall and results updates –

Revenues – 3434 vs 3207 cr, up 7 pc

EBITDA – 602 vs 462 cr, up 30 pc ( margins @ 18 vs 14 pc, significant margin improvement )

PAT – 354 vs (-) 62 cr ( not comparable because LY, the company had to bear a one time exceptional loss of 205 cr )

R&D expenses – 227 cr @ 6.6 pc of revenues

Geography wise sales performance –

India – 1281 cr, up 14 pc ( @ 37 pc of sales ). Significantly outgrew the IPM which grew @ 7.6 pc. Cardiac, Respiratory and Derma therapies grew strongly. Company’s OTC business also grew strongly @ 15 pc. Company is ranked no 2 in Derma and Respiratory therapies and no 5 in cardiac therapy in India

Company already has some unique / differentiated products in IPM. These are – LIRAFIT ( Liraglutide – GLP-1 drug ), JABRYUS ( to treat atopic dermatitis, in-licensed from Pfizer ), TISLEIZUMAB and ZANUBRUTINIB ( in-licensed from BeiGene )

North America – 740 cr, down 1 pc ( @ 22 pc of sales ). Company has commercialised 8 injectable products in US. Launched 04 products in US in Q2. Slated to launch another 3-4 products in Q3. Have a strong filing pipeline – 02 Nasal sprays and gFlovent awaiting approval

Europe – 687 cr, 15 pc ( @ 20 pc of sales ). Branded respiratory portfolio led by Riyaltris continues to lead the growth in EU. Awaiting approval for 4 more respiratory products in EU ( were filed in Q4 LY ). Expected to launch WINLEVI ( derma drug for severe acne ) in selected EU mkts in next FY. Has in-licensed WINLEVI for 15 European mkts + South Africa

RoW – 704 cr, down 4 pc ( @ 20 pc of sales ). Reported 19 pc growth in Russia. Launched Riyaltris in Mexico, Kenya and some Asia-Pacific mkts

Till date, company has commercialised RIYALTRIS in 41 markets. They have filed for approval for RIYALTRIS in 90 markets. Should be launching it in 10-11 mkts in next 2-3 Qtrs

Company has partnered with Hikma ( has out-licensed RIYALTRIS to them ) for US market. Seeing good demand traction for the same

Expect to launch RIYALTRIS in China in FY 26. Has out-licensed it to Grand Pharma in China

Company has in-licensed ENVAFOLIMAB ( Onco Drug ) from Jiangsu Biopharma ( China ) for commercialisation in over 20 markets across the globe

Guiding for a full yr EBITDA margin of 19 pc ( that means they should do 20 pc kind of margins in H2 vs 18 pc in H1 )

Company believes, RIYALTRIS has the potential to do a $ 200 million sales / yr in next 3-4 yrs time. This year, it should cross the $ 100 million sales mark

The pipeline of respiratory products lined up for approvals / launches in US + EU should support growth in next 6-12 months

Company is now ranked 13 in IPM with 9 brands in top 300 brands in India

Company is the first one to launch Liraglutide in India under the brand name LIRAFIT. Had launched JABRYUS in India in Jan 24. Company is currently engaged in a lot of marketing, educational, promotional activities across dermatologists across India. TISLEIZUMAB and ZUNUBRUTINIB are expected to be launched in next 9-12 months

Company expects a significant growth pickup in RoW mkts in H2 after a flattish H1. Expects to end the year with high single digit growth in RoW mkts

Company is now ranked no 2 in the Kenyan Pharma mkt

Company’s developmental drug – ISB 2001 – to treat Multiple Myeloma ( a type of blood cancer ) is undergoing Phase – 1 trials in US. The initial data is very encouraging. Hence the company is currently curtailing its expenditure behind other novel assets and focussing primarily on ISB 2001. Likely to keep spending aprox 450-500 cr / yr on the R&D effort at Ichionis ( company’s Innovation led subsidiary )

Company is looking to find a partner for further funding @ Ichionis after raising money by out-licensing ISB 2001. This should take some time and also depends on the safety and efficacy data of ISB 2001. At present, company seems confident of being able to do so in FY 26/27

Company’s Plant in US at Munroe is Serving a USFDA warning letter. Once that is lifted ( should happen in FY 26 ) and company starts launching products from there, it should result in significant operational leverage for the company. Currently, company ends up spending 150-200 cr / yr on the Munroe plant with no revenues

Should be able to commercialise WINLEVI in next 9-12 months. Should be able to start launching ENVAFOLIMAB in next 3-6 months. Should achieve descent scale in both these assets in about 2-3 yr’s time

Disc: holding, biased, not SEBI registered, not a buy/sell recommendation

ValuePickr- Mumbai (23-11-2024)

I have sent request, please accept!!

Oracle Financial Services (23-11-2024)

I am not sure which all OFSS project are working.

Based on my information many of their project with big clients have been scraped.

I wonder how OFSS getting all these results.

What Adani Group CFO said about the bribery charges (23-11-2024)

None of Adani group portfolio companies, comprising 11 listed firms, have been accused of any wrongdoing, conglomerate’s CFO Jugeshinder Robbie Singh said on founder and chairman Gautam Adani’s indictment on bribery charges in the US. In a post on X, Singh said the group would make a detailed comment on the US indictment once it gets counsel approvals.

Microcap momentum portfolio (23-11-2024)

Hello sir, can you pls suggest how is the portfolio doing during this sharp correction w.r.t the index.

NDA sweeps bypolls to four assembly segments in Bihar (23-11-2024)

The ruling NDA secured victory in all four Bihar assembly bypolls, signaling a potential shift in the political landscape ahead of the 2025 elections. The BJP’s strong performance, coupled with the JD(U)’s success, suggests a consolidation of NDA support. Meanwhile, the RJD faced setbacks, losing its position as the single largest party.

How Scott Bessent Went From Democratic Donor to Trump Treasury Secretary Pick (23-11-2024)

The hedge fund investor predicted last year that President-elect Donald J. Trump’s political fortunes were on the rise.

Sectarian Violence Kills at Least 25 in Northwest Pakistan (23-11-2024)

The clashes overnight between Sunni and Shiite tribes in Khyber Pakhtunkhwa Province came a day after gunmen ambushed a convoy of vehicles in the area.