Adani group founder and chairman Gautam Adani and his nephew Sagar have been summoned to explain their stand on the US Securities and Exchange Commission (SEC) allegation of paying $265 million (Rs 2,200 crore) in bribes to secure lucrative solar power contracts. Summons have been sent to Adani’s Shantivan Farm residence in Ahmedabad and his nephew Sagar’s Bodakdev residence in the same city for a reply to SEC within 21 days.

Posts in category All News

Narendra Modi bears the hallmark of popular mandate: Sarbananda Sonowal (23-11-2024)

Union Minister Sarbananda Sonowal attributed the BJP-led NDA’s success in the Maharashtra and Assam elections to Prime Minister Narendra Modi’s effective governance. Sonowal emphasized that the newly elected candidates are committed to continuing the development agenda in their constituencies. He highlighted the positive impact of Modi’s leadership on India’s growth and the Northeast region’s progress.

Bypolls: Ruling parties hold sway in states; BJP gains in UP, Bihar, Rajasthan; TMC reigns in West Bengal (23-11-2024)

Ruling parties emerged victorious in most of the 13 states’ assembly byelections. The BJP and its allies secured significant wins in Uttar Pradesh, Bihar, and Rajasthan. The Trinamool Congress swept West Bengal, while Congress faced setbacks. Priyanka Gandhi secured a landslide victory in the Wayanad Lok Sabha bypoll.

Ujjivan Financial – Small Finance Bank (23-11-2024)

Don’t think that management ever said that immediately after reverse merger they would apply for universal banking license. All they said at various instances was that first their focus is on completion of reverse merger before applying for Universal Banking licence. And obvious reason being that balance sheet & capital adequacy improved meaningfully post reverse merger. They have for the first time given timeline of applying in this financial year in June,2024 at the analyst meet in Mumbai.

I would like to believe that ideal time to apply for Universal Banking licence is post March, 2025 results. But they might apply, as already communicated by them, in Q4 of current financial year.

EMS Limited – Tapping in the growth in the water management space (23-11-2024)

Key Points from the Earnings Conference Call

- Strong Q2 Performance:

- Increased tender activity and revenue growth due to government push in the water sector.

- Improved performance driven by urbanization and increased demand for sanitation and drinking water.

- Order Book and Pipeline:

- Current unexecuted order book stands at approximately 2,345 crores.

- Current bid pipeline is around 6,470 crores, with significant opportunities from the Amit scheme.

- Expecting to convert a significant portion of the pipeline into orders in the next 2-3 months.

- Financial Performance:

- Operating income for the first half of FY25 is 435.214 crores.

- Hopeful of delivering similar performance in the coming years.

- Margins and Outlook:

- Confident of maintaining margins around 29%.

- Expecting a stronger H2 FY25 compared to H1 due to the monsoon season.

- Aim to maintain the growth trajectory and improve upon past performance.

- Geographical Focus:

- Majority of orders currently come from Uttar Pradesh.

- Expecting increased order inflow from the water sector, particularly from the Amit scheme.

- New Projects and Diversification:

- Secured a 700 crore project in Kolkata.

- Actively bidding for projects in other states like Jharkhand, Chhattisgarh, and Karnataka.

- Exploring opportunities in the power sector.

- Considering diversification into the building and construction sector.

- Financial Position and Future Plans:

- Comfortable with the current financial position and no immediate plans for fundraising.

- Aim to maintain the growth rate and improve upon past performance.

- Exploring options for monetizing the land acquired from the paper company.

- Considering hiring a new CFO.

- No significant penalties imposed for delayed execution or non-fulfillment of performance.

- Secured an EN status for a 700 crore project in Kolkata.

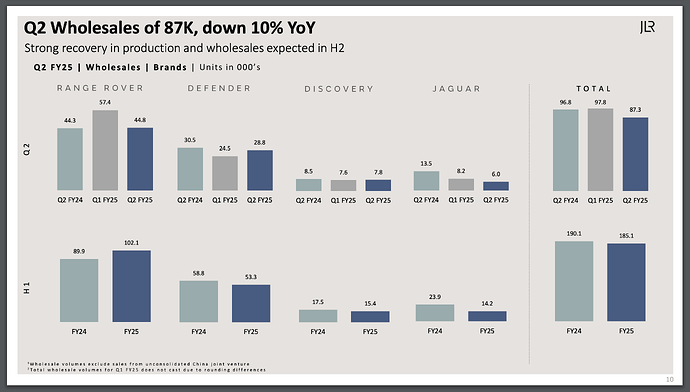

Tata Motors – DVR (23-11-2024)

absolute bonkers. this is practically brand suicide. there is no way to fix this. decades of heritage undone in one campaign.

but the good part is they did not drag land rover into this mess. the volumes of Jaguar are much smaller, albeit nuking the brand equity like this is nothing short of a crime.

Adani denies any pact to operate Kenya airport (23-11-2024)

Billionaire Gautam Adani’s group on Saturday clarified on reports of Kenya cancelling more than $2.5 billion in deals after US indictment on bribery charges, saying it had not entered into any binding agreement to operate Kenya’s main airport. On the pact it had signed last month to build and operate key electricity transmission lines in Kenya for 30 years, the group said the project did not fall within the ambit of Sebi’s disclosure regulations, thereby not warranting any disclosure on its cancellation.