So, we feel there is a strong case for a pullback, for a bounce back from these levels. Whether the bounce back translates into a reversal or not, only time will tell but we feel that 23,200, the risk reward is fairly favourable for fresh investments, for fresh entries and I think this is an area where one can look to add on to the names which are available at a bargain list.

Posts in category All News

Power Grid shares charge on securing power transmission project in Gujarat (21-11-2024)

Shares of Power Grid Corporation India gained up to 2.58 per cent at Rs 323.20 a piece on the BSE in Thursday’s intraday

Midhun’s Investment journey and Space to organize investment ideas (21-11-2024)

Thanks for the kind words @Shakti_Srivastava ,

I don’t think Cyient is highly valued compared to the peers in the industry like Avalon, Syrma or Kaynes. Cyient recently acquired Altek in the US with ITAR certified facility ( Lets you supply to US military ) . Cyient DLM has c. 70% of their business in Aero and defence domains. The management pedigree is also good. I expect H2 to be better than H1. Hence took a tracking position . If they continue to execute will add .

Vadilal Ice Cream (21-11-2024)

Anyone has any idea about yesterday’s 20th Nov court hearing? Any decision taken?

Share price of Avenue Supermart as Sensex drops 416.86 points (21-11-2024)

Promoters held 74.65 per cent stake in the company as of 30-Sep-2024, while FII and DII ownership stood at 9.95 per cent and 5.95 per cent, respectively.

Adani indictment turns into political slugfest; BJP, Congress slam each other (21-11-2024)

Gautam Adani, founder of the Adani Group, and seven other executives have been indicted in the US on charges of securities fraud, wire fraud, and violations of the Foreign Corrupt Practices Act. They are accused of orchestrating a bribery scheme to secure solar energy contracts in India and misleading investors, raising over $3 billion.

BEL stock price 0.96 per cent as Sensex (21-11-2024)

As of 30-Sep-2024, promoters held 51.14 per cent stake in the company, while FIIs held 17.27 per cent and domestic institutional investors had 15.81 per cent.

Midhun’s Investment journey and Space to organize investment ideas (21-11-2024)

Hi @Chirayu_Shah , Thanks for the compliment and for writing in.

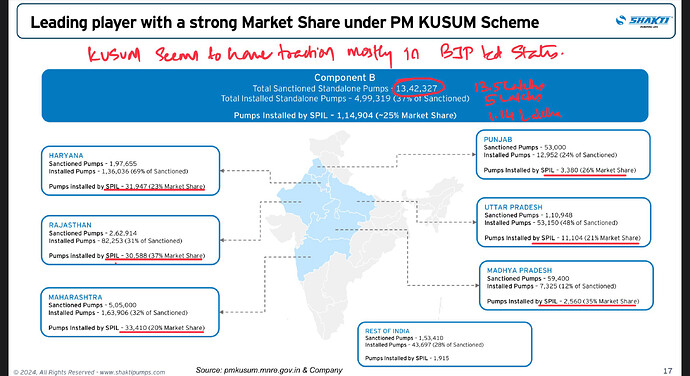

Regarding Shakti pumps, MH is the state with largest pumps being sanctioned under component B and Shakti has a 20% share in installation. Agree that there is a political risk associated in MH. On the valuation front it’s still relatively cheap at c.30 trailing PE. I would wait for the dust to settle post MH results to add/ fresh position .

Regarding Annapurna ,

I think Madhur numbers are not reflecting in H1 consolidated numbers . It’s looks good to me considering the overall slow down in the urban consumption . Madhur adds the fast growing sweets and confectionery segment to their repertoire and like you said their margins are better than Annapurna . I might add some more quantity in Annapurna shortly.