Inditrade Capital’s chairman, Sudip Bandyopadhyay, views the Mahayuti’s return to power as positive for the market, particularly for infrastructure spending. He anticipates further market boosts from potential interest rate cuts by the RBI and policy changes in the US that could benefit Indian exporters. Bandyopadhyay also sees opportunities in PSU banks, defense, and power sectors, but cautions against overvalued stocks.

Posts in category All News

Government of India announces the sale of three dated securities for a notified amount of ₹30,000 crore (26-11-2024)

The Government of India (GoI) has announced the sale (re-issue) of (i) 7.02% Government Security 2031 for a notified amount of ₹10,000 crore, (ii) New GOI SGrB 2034 for a notified amount of ₹5,000 crore and (iii) 7.34% Government Security 2064 for a notified amount of ₹15,000 crore. The auction will be conducted using multiple price method. Both competitive and non-competitive bids for the auction should be submitted in electronic format on the Reserve Bank of India Core Banking Solution (E-Kuber) system on November 29, 2024 (Friday). GoI will have the option to retain additional subscription up to ₹2,000 crore against each security.

BEL shares 2.39 per cent in Tuesday’s trading session (26-11-2024)

The Relative Strength Index of the stock stood at 60.09 on Tuesday.

Crude oil futures rise as Russia intensifies drone attacks on Ukraine (26-11-2024)

December crude oil futures were trading at ₹5,844 on MCX during the initial hour of trading on Tuesday

Buy Kolte-Patil Developers, target price Rs 480: HDFC Securities (26-11-2024)

HDFC Securities recommends buying shares of Kolte-Patil Developers. The target price is Rs 480. The current market price is Rs 368.6. Kolte-Patil Developers is expected to achieve its booking value guidance of Rs 80 billion for FY25. The company has strong cash flows and is a net cash positive company. HDFC Securities maintains a buy rating.

Jaybee laminations ltd – transforming your portfolio (26-11-2024)

[Short description of investment thesis:

Jaybee Laminations ltd (JBLL) manufactures transformer cores which go into transformers which in turn go into power transmission network. With long term growth tailwind in power transmission network and subsequently in transformers, JBLL is a great long term opportunity to ride this tailwind.]

• ABOUT THE COMPANY:

Jay Bee lamination is a manufacturer of CRGO Silicon Steel Cores for the Power & Distribution Transformer Industry of India. JBLL has over four decades of track record in the CRGO Silicon steel cores business.

PRODUCTS:

Products manufactured includes Cut Laminations, Slit Coils & Assembled Cores having end use in transformer industry

The lamination industry serves as a critical proxy for the transformers market due to its indispensable role in ensuring the efficiency and performance of transformers. Electrical laminations, particularly CRGO and CRNGO steel laminations, are essential components that minimize core losses and enhance magnetic efficiency

MANUCTURING UNITS:

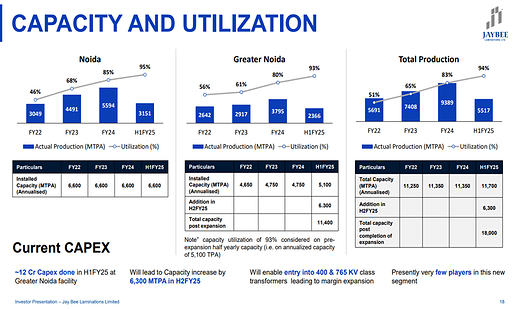

o Currently having manufacturing units located in Noida & Greater Noida in Uttar Pradesh. Current installed capacity of ~11,700 MTPA with Additional capacity of ~6,300 MTPA being added at the existing Greater Noida Plant by H2FY25

Currently operating at 95% capacity (H1FY25)

o Having in-house laboratory for raw material and finished goods sample testing and in-house tooling division for blade sharpening

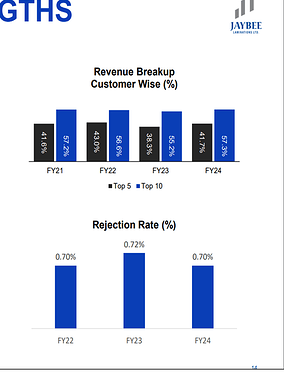

CUSTOMERS:

END INDUSTRY:

Sector Wise Revenue Break-up (%) – FY24 = Transformers – 97.92%

The biggest buyer of transformers in the Indian market is the government. But we are also seeing an increase of transformers demand from the private sector, especially with solar and wind energy is concerned. Because for new generation types, there will be requirement of new transmission and distribution infrastructure that will require new transformers.

Company currently sells transformer to power generation customers and power distribution customers.

(Power transformer players definitely fetch a better margin, because ticket size of each transformer is very high compared to distribution transformers. A standard distribution transformer would be in the price range of ₹50,000 to ₹5 lakhs. While the power transformers can go in crores, they can be as high as ₹5 crores to ₹25 crores per transformer. So, the end customer becomes very, very stringent on the quality standards of the power transformers. Because if a power transformer fails, it blocks the entire grid. The grid goes for a toss, and the lead time to produce another transformer or repairing that transformer is very big. The transportation is very difficult, because each transformer weighs about, it can weigh about 50 tons to 300 tons. So, all those factors considered, the quality standards go up significantly in power transformers. And the entire value chain, the entire supply chain has to be like that. So, the end customer, who does inspection at our premises also for the raw material as well as the final product that we make for the transformer tower)

**INVESTMENT THESIS**

• HIGH END USER INDUSTRY GROWTH:

(JBLL supplies CRGO cores for transformers → transformers are used in transmission of power → Increased Transmission of power depends upon increased power generation and demand)

We estimate India’s power demand will record a healthy CAGR of more than 7% over FY24- 27 driven by growing economic activity.

According to the Ministry of Power’s estimates, on the capacity side, India’s installed power capacity is expected to rise at a 10% CAGR over FY24-FY30E to 777.1GW from 450.8GW currently

India’s power transmission sector is poised for significant growth, driven by surging electricity demand and ambitious renewable energy capacity addition targets. CEA expects USD110bn in investments over FY22-32E.

NATIONAL ELECTRICITY PLAN 2023-32:

The National Electricity Plan 2023-32 for Central and State Transmission Systems has been finalised with an investment outlay of INR9.15tn. Under the new plan, transmission network in the country will be expanded from 485,544ckm in 2024 to 648,190ckm in 2032. During the same period, the transformation capacity will increase from 1,251GVA to 2,345GVA. Nine High Voltage Direct Current (HVDC) lines of 33.25GW capacity will be added in addition to 33.5GW presently operating. The interregional transfer capacity will increase from 119GW to 168GW. This plan covers the network of 220kV and above. The estimated costs of the Inter State Transmission System (ISTS) and the intra-state transmission system are INR6.61tn and INR2.55tn respectively (as per CEA).

Between FY24 and FY32, the system-wide transformation capacity should expand by a substantial 1,158GW (an 8.53% compound annual growth rate), and the transmission network will grow by approximately 3.7% (from 485,544ckm to 648,190ckm).

As per CEA, an estimated expenditure of INR9.15tn would be required for implementation of additional transmission system of 220kV and above voltage level in the country (transmission lines, substations, and reactive compensation, etc.) during 2022-32.

The NEP will stimulate a significant increase in transmission capex, bolstering the grid’s capacity to accommodate the growing demand for electricity. However, challenges in grid connectivity for new renewable projects in certain regions have been observed, potentially impacting the overall project timeline

India Power and Distribution Transformer Market: The market size was valued at around USD 3.97 billion in 2023 and is projected to reach around USD 8.41 billion by 2030. The market is estimated to grow at a CAGR of around 10.84% during the forecast period, i.e., 2024-30.

All transformer companies have robust orderbooks and bidding pipelines. Also, huge re-rating has happened in transformer companies. It might lead to re-rating in JBLL shares

So, there’s no demand concerns for atleast next 6 years. The strong prevailing demand is also confirmed by the fact that JBLL was operating at full capacity and is expected to fully utilized newer capacities

• CAPACITY EXPANSION:

o Capacity Expansion completed at Greater Noida in October, 2024. Capacity increased from 11,700 MTPA to 18000 MTPA with Additional capacity of 6,300 MTPA.

Incremental revenue potential of the newer capacities is about ₹180 crores ((FY24 sales – 303cr)

o New Greenfield facility: Entered into a lease agreement for a property located at Noida, Gautam Buddha Nagar, admeasuring ~3,662.97 sq. mtrs. • This will be used to establish a new manufacturing facility to support future expansion, growth, and new projects • This expansion is necessitated as our existing manufacturing units are expected to reach close to full capacity utilization in FY26 • The new manufacturing facility at Unit-III is projected to commence commercial operations in H2FY2026

o All three units put together, theoretically, we can go up to about 25,000 to 30,000 tons. (From currently 11,700 tons in H1FY25). On full utilizations, the turnover can be around ₹900 crores. (FY24 sales – 303cr)

• ENTRY INTO VALUE ADDED PRODUCTS:

o Targeting new market segments • Aiming to tap new market segments of Power transformers including for 400 kV and 765 kV class. • Given the scarcity of consistent suppliers in these higher voltage class of transformers, this strategic expansion presents a substantial opportunity to escalate production volume.

Currently caters to transformers upto 220 KV with a plan to tap new market segment of Power transformers including for 400 kV and 765 kV class by H2FY25. (The Greater Noida plant we have a new facility, where a new shed which has all the facilities required to process 400 kV and 765 kV class orders)

The demand is increasing in 400 kV and 765 kV class. d the second reason is the capacity utilisation is also very high, and outputs are much better. So it made sense for us to expand in those segments. So we are continuing to expand in those segments, and we will soon target those customers.

o Better margins: 400 kV class and 765 kV class would fetch better gross margins of about 2% to 5%.

o Increase Share of Value-Added Products: With the enhanced capacity, higher value-added products would be added in the product portfolio increasing their share in overall revenue. Revenue mix in total revenues of value-added products over next 2-3 years will be on an average 25% in terms of capacity.

o Power Grid approval upto 220KVA. Approval for 400KV class transformer at Greater Noida in process (“We are in the process of applying to PGCIL for 400 kV class approval. Once we get, 400 kV class approval, we will be able to target those end customers. And once we prove our ability in 400 kV class, then the natural step will be to get approval in 765 kV class. We will be applying soon. We are expecting the approval within this half year.”)

o There are no public listed companies who are operating in 400 and 765 kV class.

o Already executed orders of value-added products: We have already actually executed a 400 kV class order. So about, ₹4 crores to ₹5 crores of sale has already happened in the 400 kV class range. And with those precedents, and examples that were already set, we will go up to PGCIL and get it approved. So that should take about three to four months if everything goes well.

The company has about ₹18 crores of orders for 400 kV class.

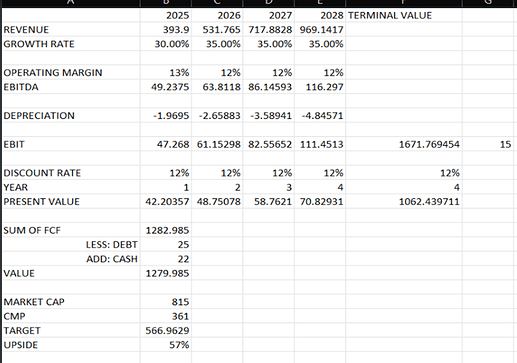

• STRONG GROWTH GUIDANCE:

Targeting 30% Volume CAGR for the next 3 years. Looking to achieve 400cr revenues for FY25 and 600cr revenues for FY26 ( (FY24 sales – 303cr)

We are hoping to end the year with the capacity utilisation between 70% to 80% On over 18,000 MT capacity. So, three years down the line, we intend to go to full capacity utilisation in all three units, and probably next plan of expansion will probably start once the Unit III is underway.

We are expecting full capacity utilisation in the first half of the next financial year. It could be early also. It could be, but for sure, within the first half of the next financial year. (Of current 18000 MTPA capacity)

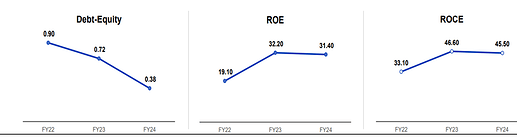

• STABLE FINANCIALS WITH GREAT RETURN RATIOS:

Net debt free as of H1FY25

RISKS

• COMPETITION:

CRGO steel industry is about 3 lakh tons in India on an annual basis. And like in FY ’24, we did about 9,400 tons. So that becomes about 3%, 3.5% of the market share. There are a few players, who are in the range of 25,000 to 30,000 tons, and then there are players in the range of 15,000 to 20,000 tons, then we are at a level of between 10,000 to 12,000 tons.

Vilas Transcore (listed company) Kryfs Power, Amod Stampings, and Vardhman Stampings are amongst the competitors.

(“In 400 kV and 765 kV class, I assume there would be about five to seven players. But it also depends on who has raw material and who is consistently working with these customers. So, I would say about five players. In lower range of 220 and below, in the organized space, again, there could be about including the five that I’ve talked about in 400 and 765. Additionally, there would be about five, seven players. so, these players would be contributing about, I mean, it’s a fairly vague assumption, but I think it would be about 40%, 45

But this market also has an unorganised segment. So, the total number of players on paper would be about more than 100.” )

There aren’t any unorganised players in power transformers.

Competitors are increasing capacity (Vilas Transcore also increasing capacity by 3x), but I think there will be a healthy market for everybody if the entire pie increases.

Lack of competition from overseas: One is that BIS is applicable on the product. So, there is a lethargy amongst the core manufacturers outside India to get BIS approvals. Second, and the bigger reason is that the lead times are very short. So, for example, our order book is generally one to three months. So, within that, lead times and each customer’s order is tailor made. So, we need to stock up inventory first, and then the order comes. So based on that, the lead time is so short that a player from outside India will not be able to serve the market.

(“Two years down the line, in terms of how the industry competitive dynamics may change as far as the demand supply gap is concerned because there are other players also who are increasing their capacity by 2x, 3x. So, two years down the line how do you see the demand supply playing out in terms of either I mean, will there be a mismatch or will there be a glut? What is your sense on that?

Management: I don’t really have a straightforward answer to your question. It all depends on the market dynamics. But looking at the demand side, I don’t see that, there will be much of supply demand mismatch. Or in fact, it could be that supply is still limited, but demand is coming strong.”)

• SLIGHTLY HIGH VALUATIONS (LACK OF MARGIN OF SAFTEY):

Currently trading at 18x FY25 EV/EBIT. Which is much cheaper than many of the transformer players. But still is above the comfort zone of 15x ev/ebit.

(Above estimates are conservative. Management is targeting 600cr by FY26 and 900cr by FY27)

MISCELLEANEOUS

• EBITDA MARGINS DYNAMICS:

Company has fixed EBITDA per ton margin structure regardless of FG-RAW MATERIAL price changes.

(“Our revenue has been close to ₹153 crores, which is almost at the same level as the previous half years. As I said, this was mainly because of the prices coming off, but the volumes have increased. Our EBITDA margin has increased because on a per kg basis, our EBITDA margins do not vary with the raw material or the sale prices. Hence, the margins on a percentage basis are increased to an extent of 52% YoY and 39% at half-yearly basis. Our PAT margins have increased by 49% on both YoY and HoH basis.

If you see that considering that the prices would not have dropped, volumes increased by 20%. And if you consider a 20% increase in the turnover, say, currently our turnover would have been ₹180 crores. So, on that basis, the margins would be around 7.8%. So, we are projecting margins around that level.

We will be somewhere in between 10% and 15%. 15% was achieved because of the low turnover base. Like I said, the turnover was low, but the volumes have increased. So, I mean, if you consider the PAT margin, it was actually 7.8%. If you consider, a similar price range increase of the last year. So considering ₹180 crores, ₹185 crores of turnover, if we consider a 20% jump in from compared to the last half year. The PAT margins are actually not 9.4%. It is lower. And similarly, EBITDA will also be we are hoping to target between 12% to 13%.)

Vulnerability of profitability to volatility in raw material prices and foreign exchange rates: The operating margins of the company remain susceptible to the volatility in price of the raw material. The raw material is generally imported and takes 2-3 months to deliver, and the company maintains moderate inventory and hence any fluctuation in raw material prices may impact the operating margins. Further, since a part of the raw material requirement is met through imports, the company is exposed to the adverse fluctuations in the foreign currency exchange rates.

Going forward, JBLL is expected to sustain PBILDT margins in the range of 10-11% on a growing revenue base in view of growing demand in the industry. – Credit Report

• CRGO STEEL SOURCING: We have tie ups with the most of the CRGO steel producing mills. There are about 10 to 15 CRGO mills in the world who are commercially and largely producing CRGO steel. We have the tie ups with most of the mills, and we directly purchase from the mills as well as we purchase through their stocking centres or through traders within India.

CRGO steel is mostly an imported product. But our imports are less. We almost have a ratio of about 80:20. 80% is domestic, and 20% is import.

With respect to CRGO steel, there has been certain restrictions by the government on the Chinese suppliers. However, like I said earlier, we have sufficient ties with the other CRGO steel producers to ensure that our requirements are fulfilled.

The problem is not that the CRGO is in short supply. It happens because there are multiple grades in CRGO steel. The customer generally has a very shorter forecast of, which grades will be required and with what quantities. And that that becomes a problem for us also sometimes. So, we basically purchase CRGO steel different grades on the basis of our projection, basis of our customer feedback. And because of that, our inventory level has also gone up. So, we are basically covered with a good level of inventory with respect to targeting the new customer base.

• EXPORTS: • Expand sales to International Markets including US and Europe • Increasing sales network overseas including Africa and Asia

Our exports in the last half year were about 11%, and previously, I think it was about 13% to 14%. We will continue to keep this level constant, because export is mostly distribution transformer cores. So, the volumes will be lesser than the power transformer cores that we are targeting in the near future. So even if we are able to keep up the same ratio with the increasing volumes, we will be happy.

• Lab Equipment Installation • Install the lab equipment received from Germany by H2FY25 • Get NABL Accreditation which will lead to reduce dependency on third party testing thereby reducing supply lead time

• Large working capital requirement: JBLL has working capital intensive operations largely on account of moderate debtors and inventory period required for business operations, while the company receives minimal credit from its suppliers and most of the procurement is done on letter of credit basis which led to increase in working capital requirement by the company. The Gross Current Asset though decreased, however still stood high at the level 151 days as on March 31, 2023 against 230 days as on March 31,2022.

Inventories increased from 44cr in Mar 24 to 90cr in Sept 24 (Sign of increased demand along with increased capacity)

• Product focus: We will focus on CRGO steel and amorphous core, because we are experts at core manufacturing. So that will be our first focus. As long as we are able to get growth in the core manufacturing part of transformers, we will not diversify. Once, that market gets saturated in the future for us, then we will think about diversification.

• Debt levels: We intend to keep the debt level at the same, because when we came out with the IPO, our main objective was to fund the working capital requirement that will come with the higher volumes. So, considering that last year, we did about ₹300 crores turnover with the debt that we had. We want to keep it at pretty much the same level with increasing turnover.

• Raw material fluctuations: The raw material prices fell in the last nine or 10 months that had an effect majorly in the last half year. Raw material prices fell primarily, because I mean the reason of raw material prices fluctuation is the global supply and demand of CRGO steel. It also depends on what is the demand structure in the U.S. and European markets. So, because CRGO steel is highly dependent on the power projects that come across from the utilities all over the world. So, if a certain power project comes up in a big way, the demand suddenly increases. And if power projects are not there, then the demand can decrease. So based on that, the fluctuation can be there.

• If I look at the gross profit per ton or EBITDA per ton, they have also increased by 15% to 20% in the first half compared to last year.

There were two reasons. One was, obviously, there was a certain inventory gain, and the second reason, which was more prevalent was the mix that we changed. When I say mix, it is not between segments or product mix. It is mainly about what kind of orders that we take from the customers. So, we sort of had the options to choose specific orders which were suited to our facilities, suited to our capacity because there can be orders in the industry, because the sizes, the dimensions, and the mix of orders can be so varied in our industry. But, if say a certain machine that has a capacity of 100 tons per month, it can go down to 50 tons per month, if we don’t use the right kind of orders on that machine. So capacity utilisation is the key and the orders that had the best margins was the key.

• Detailed concall and presentations right after first ever result declarations.

• Second generation already in management.

• Ashish Khacholia was present in concall

DISCLOSURE: INVESTED (3.5% of portfolio as a starting position. Conviction levels are high)

36 companies doubled their sales and PAT in a disappointing Q2 earnings season (26-11-2024)

Despite a lackluster Q2 earnings season, 36 companies defied the trend, doubling both sales and profits. Some achieved growth in the thousands of percentage points, driven by strong demand in sectors like pharma and realty. Analysts remain optimistic about a stronger second half of FY25, citing festive demand and rural recovery.

Max Healthcare shares 2.6 per cent in Tuesday’s trading session (26-11-2024)

The Relative Strength Index of the stock stood at 49.96 on Tuesday.

Market rally continues on political optimism and positive global cues (26-11-2024)

Sectoral performance showed mixed trends, with PSU Bank index being a standout performer