I have subscribed to some in the recent past.

Any Rights Issue, from a certain time after approval date, till some time before record date for allotment, an instrument called “Rights Entitlement” are created with its own ISIN, that is available for trading, and can be purchased. In some cases trading is active.

The amount of “Rights Entitlement” created is the total amount of shares available for Rights Issue. The trades are all delivery based and hence who ever owns the Rights Entitlement as of Record date can subscribe to the Rights Issue

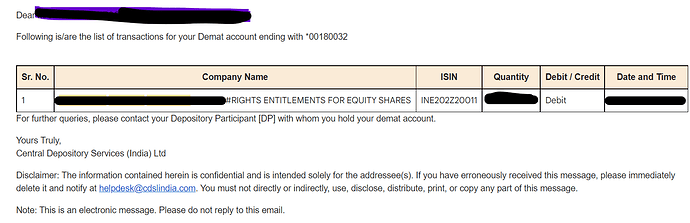

Yes, both the Rights Entitlement and the shares upon subscription to the Right Issue are credited to the demat. You get mails from the relevant Depository with details like this

They will be applied for listing by the company and once they are, they are admitted for trading…typical not more than a month, iirc.

There will be theoretical price to the rights based on the closing price, cum-Rights, on Record date. In my observation/experience, the ex-Rights is higher than its theoretical price; but I have also seen it go lower in some cases. While it depends on many qualitative factors, the purpose of Rights plays a big role (and to a good degree independent of other factors). So if it’s for specific purposes that are seen to increase value, the price may open at a higher price than theoretical price. However if it is because the Promoters want to save a failing business and seeking Rights, it opens lower…but these are very anecdotal and I may be just trying to put some reasoning where none may exist.

-

You can create a tax loss to reduce your tax burden, by buying entitlements and selling your pre-rights holding soon after the record date when the share price falls (Rights Issue are always priced lower than market price). And you may work to have the same holding as earlier thanks to shares you get via entitlement. The minor flip side is to hold it for a year etc (you likely know the works)

-

If (a) there is a large gap between the share price when Rights is priced and the Rights Issue, (b) Rights Issue is materially big, and (c) say you think the share price is quoting far lower than intrinsic value at that time, then there is merit in evaluating purchase of more entitlements as you lower your average cost, with the assumptions that odds will be high that the ex-Rights will be higher than the theoretical ex-Rights.

An instructive live example is the Rights Issue of Sundaram Finance Holdings Ltd, which priced its Rights at 50, ratio of 23 offered for every 49 held. The share price was quoting at around mid 70s.

You may learn more here – SFHL Link Section VII, page 113 of the LoF gives the terms and should be able to answer all your questions.

Finally, for any application related doubts, contact the CS of the company. They are tasked to see Rights are fully taken up and will go the extra mile to help

| Subscribe To Our Free Newsletter |