Mishtann Foods Ltd.

Took me a while to find out what exactly is their business! I’ll make a small case for the SHORT opportunity, otherwise (in my opinion) it most certainly is a possible fraud. (It would be an insult to use the word “Corporate Mismanagement”)

-

It took me a while to pull up their annual report than it usually does (trying to hide something)

-

Annual report is too flashy (looks like a marketing brochure) with details of the industry rather than the numbers of the actual business. MD&A discloses no information about the business.

-

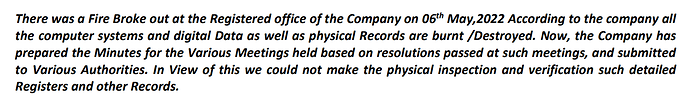

The fire incident that burnt all the records (Physical + Digital). Must have been one hell of a fire!!!

-

2 directors resigned. The business has huge insider ownership about 80% of outstanding shares. (Shareholding Pattern Public ShareHolder ).

-

The “Secretarial Audit Report” (pg 42) and “Annexure B” (Pg 46) – I judge from the wordings that the auditors haven’t done their job properly or they haven’t expressed their findings truthfully.

-

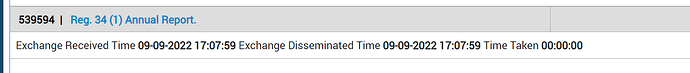

Annual report was filed way too late in September. I think they were busy making “Dhokla”

-

Not even once in their report have they mentioned the quantity of rice they have sold! They have mentioned the domestic & export breakdown in the footnotes. Isn’t that something that you mention in the beginning?

-

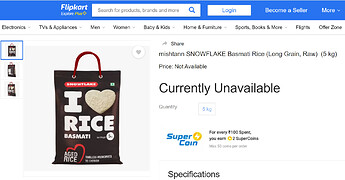

Product is not available on Flipkart or Amazon. Neither are the reviews and I am yet to see an actual picture of the bag of rice from a consumer! All I was able to find was virtual Photoshoped photos on the web.

-

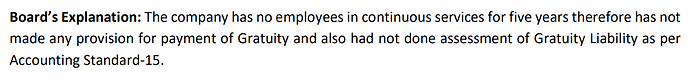

They have a total of “10 full-time employees” and the total number of employees hired on temporary/contractual/casual basis for 2021 is “NIL.” Also, this has made me wonder:

DAAWAT has about 2800Cr in Rev. and 78Cr in employee cost (2.78%), KRBL has about 4253Cr in Rev and 101Cr in employee cost (2.37%) and MISHTANN has 490Cr in Rev and 0.396Cr in employee cost (0.08%). This is a 2021 AR comparison for all 3 businesses. If this is true, the people in Mgt. are superhumans.

-

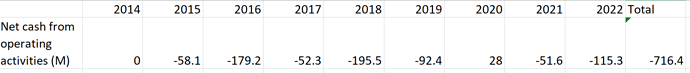

And to put the final nail to the coffin, the business has not generated cumulative positive cash flow over its life so far. (Numbers are from their annual reports’ cashflow statement). Had I done it my way, I think the outflow would be more negative.

FYI, The statement of cashflows AND profit & loss did not exist in 2014. They had a cash balance of 74M and non-current assets of 32M. Its a very smart accounting gimmick they have played I think.

Quantitatively speaking,

Liquidation value:

Lets say you have full control over the business – you sell everything and you pay everyone.

Total assets 1600M approx – Total Liabilities 590M approx = 1010M (Equity)/500M (shares) → Realizable value per share is 2.02 INR (This is me being very generous and assuming that these assets actually do exist)

If I calculate the liquidation value the Buffet way (which is what I usually do), realizable value is hardly 1.38 INR. This is including an loan asset of 143M (which I believe will not be recoverable because its given as other advances, only God knows for what), otherwise the value drops to 1.10 INR.

Also, there was a mention of this business on:

Will I SHORT it? – I am very intrigued and maybe I might. (I still need to do a lot of accounts reconciliation from 2014 to) I do not have a long/short position at the moment. Moreover, this reminds me of a wise man who once said “Markets can remain irrational for more than I can remain solvent!”

Regards

M

| Subscribe To Our Free Newsletter |