Wrote something on it a month ago, sharing it here.

KRBL, the largest producer of basmati rice in the world, is a company with more than 100 years of legacy. The company is headquartered in Noida, India. With a comprehensive product chain for integrated rice products.

Backdrop

India is one of the fastest-growing economies in the world and is expected to stay that way for the next 5 years if not for a decade, there are many tailwinds that are currently helping this growth one of them is India’s large young working population which is fueling demand for almost all the product one can imagine available under the sky, from biscuit, Chocolates, luxury clothes, Expensive vacations, Gold, Silver, Homes, Cars etc etc. Rice is one such commodity, though traditionally the Indian basmati rice market is dominated by Small and unorganized players there are a few well-known brands that have a strong market presence such as Daawat By LT Foods, Kohinoor, and Fortune Rice by Adani Wilmar and some other, but by far the dominating player in India is KRBL’s India Gate Basmati Rice brand. The company has a strong presence not just in India but outside India as well, they are well poised to take advantage of the evergrowing branded basmati rice market.

Company Info

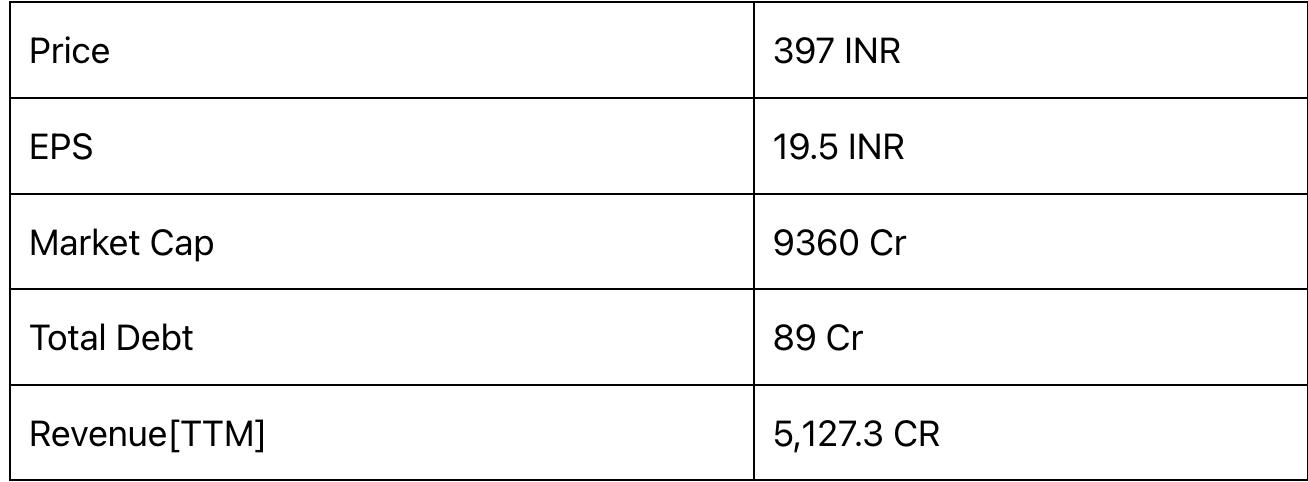

KRBL has more than 700 distributors across India, with 3 lacs+ retail outlets operating in more the 750 cities. Indian Gate Brand does not just have a share of the market but the share of mind in the Indian consumer mind, and they maintain this with regular advertising of their products strategically across regional markets. The company also has Introduced a new basmati rice brand ‘Unity’ In India which has grown to a 600+ Crore brand in the year 2023. In total, the company generated revenue of 4253 Cr INR, and already has done 4083 Cr INR in 9 months of FY23, FY23 is already on track to be the best year revenue-wise for the country.

The company not only has a strong presence in India but a strong presence around the globe. The company has ~40% of its revenue attributed to exporting rice. The company has a leadership position in GCC(Gulf Cooperation Council) region, India Gate is the #1 Indian Basmati rice brand in Qatar, UAE, and Bahrain India Gate is the only premium Indian Rice brand in GCC, Nur Jahan is the 2nd most popular brand in the region and preferred brand among price-conscious consumers. India Gate is the #1 Indian Basmati rice brand in Canada both in Ethnic and Modern Trade. Nur Jahan is the #1 Indian Basmati rice brand in South Africa with a 53% import share.

Back In India Company has ~34% market share in basmati rice with a dominant presence in ethnic trade and a strong presence in the Modern business of rice.

Investment Hypothesis

- Strong Basmati brands: India Gate basmati rice is a strong brand with huge market penetration, the brand just does not dominate the market share but it has a strong share of mind with strong mind recall. The company has launched the Unity brand which is now a 600+ Cr brand in itself which is helping the company to acquire new customers

- Long Runway to Grow: India has the largest working-class population in the world(~900 Million or 90 Crore people in the age group of 15–64), of which by 2030, more than 400 million people will be living in cities in India, which will fuel the consumption of more and more brands products as people who earn more are expected to spend more on branded products. The India packaged rice market reached a volume of 10.96 Million Tons in 2021. According to IMARC Group, the market will reach 15.33 Million Tons by 2027, exhibiting a CAGR of 6.10% during 2022–2027, which will translate to more growth for big and well-known brands in the market. Around 41% of Indian families prefer basmati rice bands and only 20% costumes branded basmati rice in comparison to 31% consuming non-branded ones, it provides a considerable opportunity for the company to grow.

- Focus on expanding distribution manufacturing in India and Abroad: The company is actively expanding, to Gujarat, Karnataka & Madhya Pradesh, to increase the production of both basmati and non-basmati rice. Already the company has expanded from 500 distributors in 2022 to 700+ distributors in 2023 and 3 lacs+ retail outlets operating in more the 750 cities which is almost twice in comparison to Daawat [LT Foods] retail presence of 1.6 lacs. Not only this, the company has engaged with a new partner for exporting to the middle east which has helped the company to increase overseas revenues.

- Low debt and strong cash flow: The company have no long-term debt and have 86 Cr INR short-term debt which is negligible vs the company’s strong revenue, which is averaging 4,041.84 Cr for the last 5 year[including covid years]. The company has higher profit margins in comparison to its peers enjoying 12.76 % average net profit margins for the last 5 years against Daawat [LT Foods] which is having a net profit margin of 3.33 %. Strong consumer loyalty, strong brands, and a large presence help the company to charge a premium against its competitors.

Risks

- Increased competition: The company is competing with strong players in sectors like Daawat which dominates the non-basmati rice market and growing in the basmati rice market share, Daawat maintains a low net profit margin which makes them cheaper in comparison to the India Gate brand. Also, the entry of Big players in the FMCG market can provide stiff competition to company players such as Reliance, TATA, and Adani can be a challenge for the Company.

- Corporate Governance Issues: Company MD was arrested in 2020 and got bailed in relation to the AgustaWestland case, the case is still pending in front of the supreme court, and needs to keep a close eye on this issue.

Links

- Company Website: https://krblrice.com/

- BSE Scrip page: Stock Share Price | Get Quote | BSE

- Latest Quarter report: https://www.bseindia.com/xml-data/corpfiling/AttachLive/4c946707-dd94-42f2-b4a6-aa78357cf4bb.pdf

- FY 22 Annual report: https://www.bseindia.com/bseplus/AnnualReport/530813/75900530813_16_09_22.pdf

| Subscribe To Our Free Newsletter |