Each of these has moved a lot. As always, regrets of underallocation ![]() ; would love to hear how others deal with this

; would love to hear how others deal with this

Have decided to exit Integra. Current valuations don’t make much sense to me. Might buy again later but I think there will be healthy time correction here.

Some more names that seem interesting:

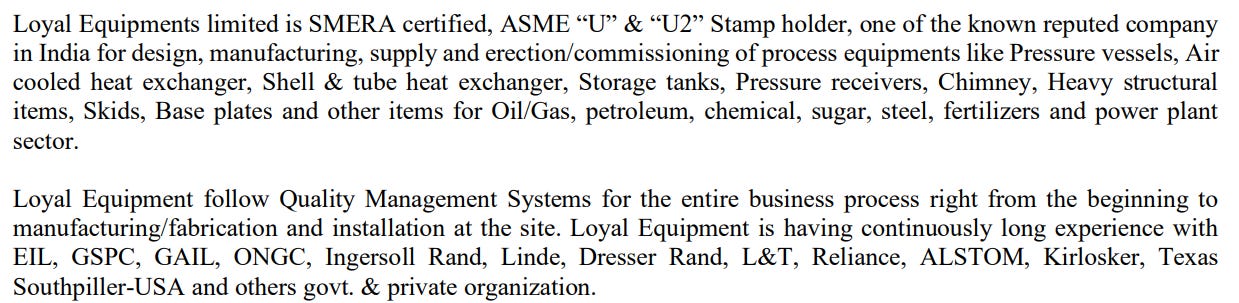

- Loyal Equipments

Loyal Equipments (‘Loyal’) makes process equipments like heat exchangers for petrochemicals, chemicals, fertilisers and other sectors.

In 2020, Loyal announced an order from Linde for INR 20 Cr per year for 5 years.

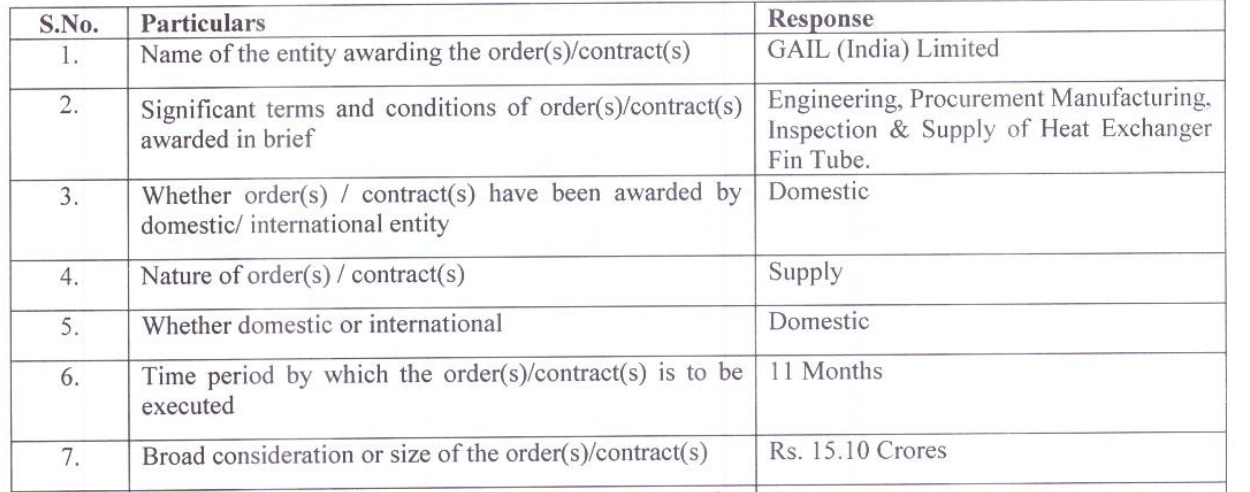

More recently, in October 2022, Loyal announced an order for INR 15.1 Cr from GAIL to be executed in 11 months.

Loyal is a member of Heat Transfer Research Inc (HTRI).

One of Loyal’s competitors, Anup Engineering, mentioned strong tailwinds due to the ongoing capex cycle in their recent conference call. Interestingly, even though Anup’s revenues, profits and market capitalisation are each roughly 10x that of Loyal, Loyal has a higher asset turnover ratio and lower debtor days.

Loyal has cited domestic competition as a key threat in its annual report. Likewise, the above referenced concall of Anup Engineering mentions the increases in capacity by domestic companies. One can find a list of key competitors in tender documents, here and here: Therm Transfer Equipment, Aero Engineers etc.

One can track their exports here.

Loyal has a subsidiary based in Texas, USA, for booking orders (all manufacturing is done in India). Through this subsidiary, Loyal is a registered vendor with NASA.

Loyal has engaged in a consultancy project with IIT Gandhinagar.

Loyal’s posts on LinkedIn have attracted comments from senior managers at reputed firms like GMM Pfaudler, Atlas Copco and Linde India. Managing director Mr Alkesh Patel posted about potential opportunities in defence and aerospace for Loyal.

-

HG Industries

Acquired by Greenlam, did capex of 125 Cr which commenced commercial production last month, with peak revenue potential of 400 Cr. Market cap is less than 100 Cr. -

Lakshmi Electrical Control Systems

LMW group, captive sales to LMW is around 80% of LECS revenue.

LECS revenue historically is around 7% of LMW revenue; LMW concall says their textile machinery division alone will have revenue of 5900 Cr in FY24 backed by current order book. LECS FY24 revenue should be 400 Cr+ conservative

LECS is debt free, >20-25% RoCE consistently, also ramping up sales in smart energy meters and EV charging.

LECS has stake in LMW worth 100 Cr+ at CMP which can itself rise in value. Assuming zero holdco discount, LECS net EV is 170 Cr. Single digit PE FY24 and less than 0.5x sales even conservatively.

In case anyone wants to collaborate on these, I would be happy to do so.

Disc- holdings/tracking positions in all

| Subscribe To Our Free Newsletter |