State of the Markets

Note: Why do we need to understand the state of the markets?

The state of the markets is like the “pitch” in a test match. The captain needs to read the pitch and then decide on the playing eleven. For example, if it is a turning wicket, you may wish to play an additional spinner. Similarly, based on the state of the market, you might wish to change your allocations or stock selection.

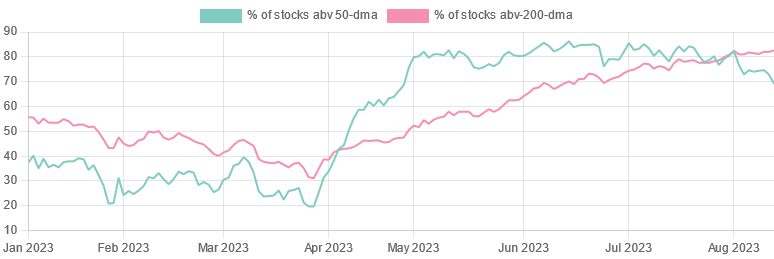

One of the ways in which market health can be measured objectively is by monitoring the market breadth. It is purely data-based, unbiased and objective. Like any other indicator, it needs to be evaluated in sync with many other factors together and never in isolation. However, it is a good metric to keep track of. As of now market breadth is strong.

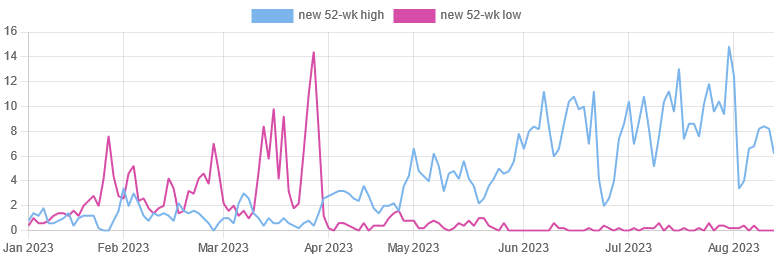

No of stocks hitting new 52 weeks highs has cooled down but it continues to be much higher than no of stocks hitting new 52-week lows (Universe Nifty 500).

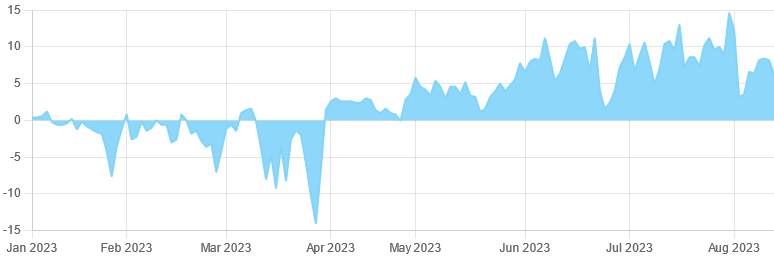

Therefore the net new 52 highs and lows are continuing to remain strongly positive. (Universe Nifty 500).

% of Nifty 500 stocks above key long-term moving remains elevated.

Factor Investing – A basic introduction

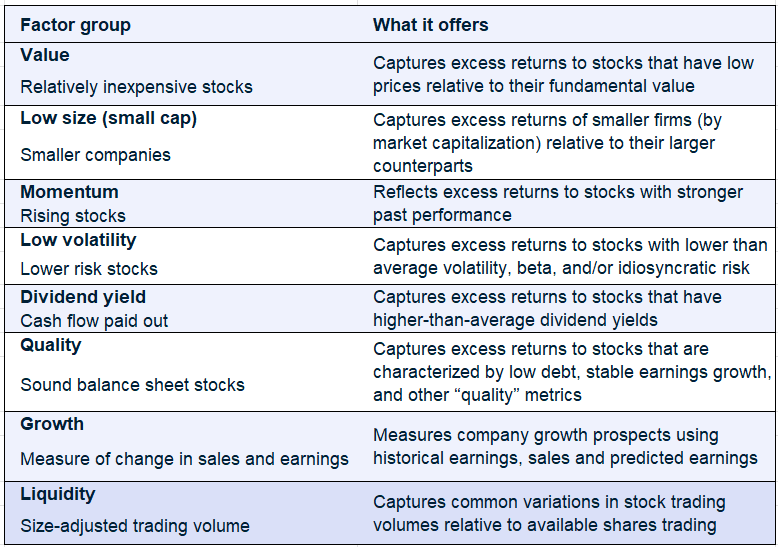

As an investor, it is important to have some grasp of factor investing. If you hold a portfolio of stocks, the return it generates is due to something. This something is the reason for the return. The return generated could be because the stocks are paying handsome dividends or maybe because they are blue-chip companies. These reasons are known as factors.

We all do factor investing, either knowingly or unknowingly. Investors buy cheap stocks. That is the value factor. They chase momentum stocks, the momentum factor. Some investors prefer growth, the growth factor and some others may prefer smallcap stocks, the size factor.

Factors in use

Individual organisations, mainly large quant firms, have defined their own factors. For example, MSCI has defined the following factors in their process.

Factors can also be defined at a macroeconomic level with determinants such as GDP growth, inflation, interest rates etc being considered as defining ones.

Multifactor Models

In real life, we rarely invest if only one thing is going for us. We need more. In comes multifactor models. So, you might be interested in stocks which combine growth and quality together. Or momentum and liquidity. Or Value and Dividend Yield. Or low size, growth and momentum. The combinations can be many. But the idea is that we look for more than one factor to be in our favour when we search for stocks to buy.

NSE Nifty has rolled out strategic indices and has four defined factors – Quality, Value, Alpha and Low Volatility. It has created both single and multifactor strategic indices that you can look at.

The multifactor indices are:

- NIFTY Alpha 50 Index

- NIFTY Alpha Low Volatility 30

- NIFTY Alpha Quality Low Volatility 30

- NIFTY Alpha Quality Value Low Volatility 30

Use of Factors in Quant Investing

In India, most people equate quant investing with either high-frequency trading or momentum investing. It is neither. These are small subsets of the quant investing universe.

I personally prefer using those quant factors, which augment my own investing process. So, momentum, mean-reversion or multifactor models like quality+growth+momentum are where I try to focus on.

Some references if you wish to learn more on this topic:

https://www.blackrock.com/us/individual/investment-ideas/what-is-factor-investing

| Subscribe To Our Free Newsletter |