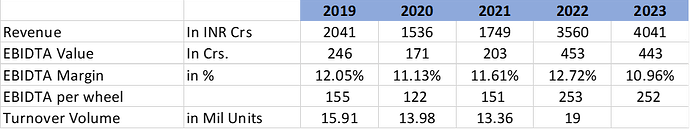

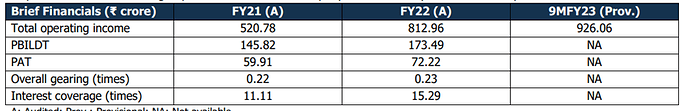

There has been decent top line growth in last 2-3 years for SSWL – from ~2000 Crs in 2019 to ~4000 Crs for FY’23. EBIDTA per wheel has gone up from ~150/wheel to 250/wheel due to mix change – alloy wheels contributing 1/3rd of revenue.

(IMHO, EBIDTA per wheel or rather per kg, if possible, is right metric to track considering only value-addition margin flows to bottom line while RM price is passed on. Higher RM cost will optically expand top-line and reduce margin %).

This has resulted into improved balanced sheet – long term debt reduced from ~600 Crs in 2019 to ~222 Crs in FY’23 – further driving RoCE (from 15% to 25% in corresponding period). On top of this, promoter has successfully reduced the pledged shares from 19% of promoter holding to ~7.5% between 2022-23.

Growth drivers ahead:

- Alloy wheel segment (which has done exceedingly well for them) has recently completed capacity augmentation of 60% to take the capacity to 4.8 mil/year from 3.0 mil/year. Revenue potential of 700+ crs at full scale. Also, anti—dumping duty from China has been extended for next 5 years which will help them in domestic market.

- Legacy steel wheel segment has capacity utilization of 78%, headroom for organic growth. Plus, company is at advanced stages to acquire AMW auto assets under NCLT resolution plan. This will give additional capacity of ~7 mil. wheels (35%) per year. (though management has indicated that production may not start immediately and machinery will be shifted to existing plants where they are seeing good demand from existing customers)

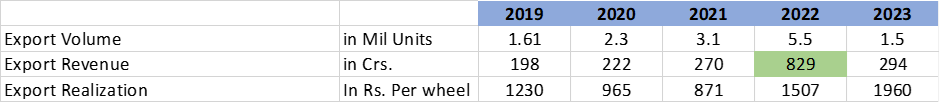

- Export business had done reasonably well for them in 2022 (830 Crs.,likely due to supply chain disruption during COVID), came down to ~300 Crs in FY’23 possibly due to inventory destocking. Significant opportunities in export to US/EU due to imposition of ADD/CV to China, Thailand, Taiwan, S. Koria and Vietnam

- Getting into EV motion control solutions in JV with Redler. The company anticipates to offer it as a complete solution bundled with wheel sets and will be the only player in India to initiate this move. Most likely they will be PLI qualified under Component Champion Incentive Scheme. Redler appears to be a good tech partner from new age engineering capabilities.

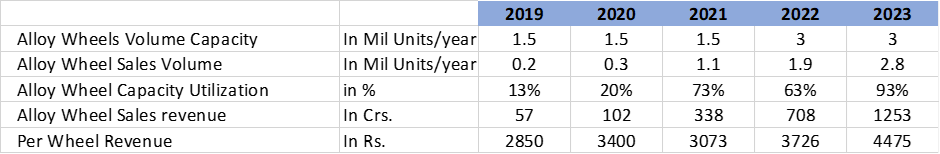

Alloy wheel Segment:

Premiumization and market shift is very evidently playing out. In 2014 the demand of alloy wheels was only 10 percent of total wheels made in India but the demand has grown to 40 percent in recent years. It is assumed that by 2025 the demand for alloy wheels will go up to 70 percent.

-

SSWL had set-up the 1.5mil/year alloy wheel facility in 2017 at Mehsana by technical tie up with Kalink Korea, who is leading alloy wheel manufacturer and is among top 7 of the World in Alloy Wheel supplies.

-

OEM’s Suzuki/Ford/Tata/Honda in vicinity of less than 70 Kms. Additionally, sea port proximity hence cheaper imported Raw Material and easy access for Exports.

-

Capacity increased by 2x in 2021 which has been further increased by 60% in 2023.

-

Anti-Dumping Duty – Starting Sep’2018, India Government had imposed anti-dumping duty on imported alloy wheel rims for 5 years till 2023. Government has further extended the ADD for 5 years till 2028 (link). This anti-dumping duty has made import unviable thereby widening the demand supply gap by additional 1Mn wheel rims.

-

So far, Maruti is not a customer under alloy wheel segment. As per management commentary, some break through is expected within FY’24 with Maruti.

Key differentiator appears to be LPDC (Low Pressure Die Casting) casting process that they follow as compared to GDC (gravity die casting) that rest of the players mostly uses.

Gravity Die Casting (GDC) < Low pressure Die Casting (LPDC) < Flow Form technology :

As Gravity Die Casting relies on gravity to fill the mould, the process is slower and is, therefore, less suited to long production runs. Whereas, the pressure filling of the die in Pressure Die Casting allows the alloy to be injected very quickly and, coupled with the highly automated nature of the process, very high productivity can be achieved while the potential for human error is reduced.

There is a difference in the quality of casting that can be achieved from each process. The rapid filling of the mould under pressure, allows Pressure Die Casting to achieve very precise and complex castings that are dimensionally accurate and with thinner walls. As-cast surfaces can be very smooth, which reduces secondary machining.

Some advantages of LPDC are:

- Very good strength values

- Complex geometries possible as sand cores can be sued

- Higher material utilisation, no need for feeders

- High dimensional accuracy

- Whole process well-suited to automation

- Less complicated machine and die technology

Flow forming technology: is one of the most advanced manufacturing technologies to enter the wheel industry. Flow Forming Technology involves the application of pressure to the inner barrel of the wheel, while spinning and after it has been casted. This process stretches and compresses the aluminum, which increases tensile strength. In this respect the process shares similar properties to those found in the forging process. The final product is lighter, stronger, has increased elongation, and a much greater shock resistance as well as the ability to increase load capacity over a traditional cast wheel (of the same design).

Very recently Wheels India Ltd. has started exporting Flow Form Cast Alloy Wheels to the US market. (link) from January’23.

[not able to find flow-form production capacity for WIL. scale-up of this business is key monitorable though]

Since last couple of concalls, management is talking about venturing into new casting technology for which significant budgetary allocation has been made. Is there a possibility that they are aspiring for Flow-form technology? Can be significantly positive.

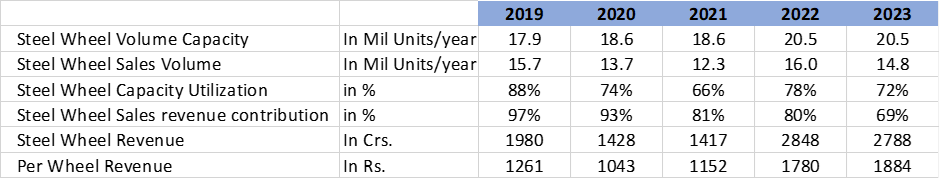

Steel Wheel Segment:

By production segment, they command ~70%+ market share in OTR, ~50% market share in PV, MHCV, Tractor each. 30% market share in 2W (as Hero group has family run company Rockman supplying wheels. Likewise, conjecture that Bajaj 2W business must be catered by Endurance tech being family/relatives).

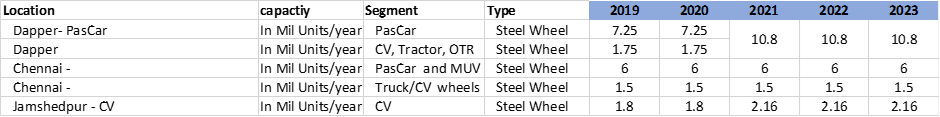

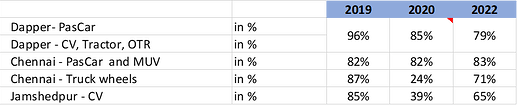

Below is a break-down of production capacity by location and by product segment:

Also, below is the current capacity utilization levels across sites:

Production capacity is expected to go up to 27.5 mil (35%) post AMW acquisition. Very very strong demand (domestic and export) from CV/OTR segment.

Export Business:

They had a significant export pick-up in 2022, presumably due to global supply chain disruption. Export revenue increased from 270 Crsin 2021 to 829 Crs in 2022. 2023 witnessed a de-growth, partially due to supply chain normalcy and inventory carry over in the trade channels.

In Q1’24 they have done close to 150 Crs of export business and guidance is towards 600 Crs+ of export revenue in FY’24.

-

What is helping export business is Antidumping Duty & CVD on Chinese Steel Wheels in EU & USA. Initially, DoC imposed 231% duty on import of Steel wheels from China (notification) in 2019. However, they had to curb the cross shipping from Thailand, Taiwan, S. Koria and Vietnam in 2021 (notification)

[Note: Alloy wheel are excluded from AntiDumping duty from China] -

This has opened up a potential market of 10Mn High Speed Trailer Steel Wheels. Export Business Margins are substantially EBIDTA accretive.

-

Also, as per management commentary in concalls, global market for alloy wheels is pegged at 350 Mil/year. Their aspiration to take the production capacity close to 10 mil/year over 3 to 5 years from current 4.8 mil/year. Out of available land bank of 70 acres in Mehsana, current facility is built on 35 acres area. So, they still have spare 35 acres for brownfield expansion.

Competition landscape:

-

Kosei-Minda, Chennai: (link) : MKA has two plants in India, one plant is located in North India in Bawal, Haryana with an annual capacity of 2.1 Mn wheels and second plant is located in Dekavada, Gujarat with an annual capacity of 1.7 Mn wheels. MKA mostly uses gravity die casting technology for alloy wheel while it does have small manufacturing facility for manufacturing of alloy wheel using Low pressure die casting (LPDC) technology. It has technical licensing agreement with Dayou Global Korea for providing LPDC technology. The company has an established relationship with reputed OEMs, viz., Maruti Suzuki India Limited, Suzuki Motor Gujarat Private Limited and Mahindra & Mahindra Limited since inception.

Going by financial numbers for Minda-Kosei from Care Rating report, they have decent margins and well manageable debt:

-

Rockman: From Munjal family of Hero is a 2 wheeler focused player. Rockman is the largest domestic manufacturers of 2W alloy wheels in India, with an installed annual manufacturing capacity of ~15 million alloy wheels. Also, have a ready-made capacity of 1 million wheels in Tirupati, Andhra Pradesh for 4-wheeler alloy wheels and there is a plan to expand it to 2million wheels in the next 2 years.” HMCL accounted for ~70% of Rockman’s revenues. Predominantly is using GDC technology.

Financials of Rockman from credit rating report (link) suggests low margin and high debt operation.

-

Wheels India – The company is amongst the largest manufacturers of automotive steel wheel rims in India and earth mover steel wheel rims globally. WIL enjoys a dominant domestic market share of 42% in M&HCV, 80% in LCV, 55% in tractors and ~30% in passenger cars steel rims at the consolidated level. 25% export or approx. 1000 Crs. However very low EBIDTA and high debt. WIL’s consolidated debt levels are likely to remain relatively high over the medium term for its scale of operations, given the capex commitments of around Rs. 150.0 crore per year in FY2024 and FY2025 (to be funded through mix of debt and internal accruals), and WIL’s high working capital requirements.

Wheels India Ltd has started exports of wheels using flow-form technology beginning Jan’23. (Link). This is big monitorable to track volume and scale-up of flow form tech for WIL

Overall, very high debt burden and low-EBIDTA.

-

Synergies Castings: 100% EOU, located in Visakhapatnam, India, the SYNERGIES plant has a total wheel casting capacity of 960,000 wheels and chrome plating capacity of 240,000 wheels benchmarked at 18” size. Currently SYNERGIES supplies alloy wheels to several automobile majors like General Motors-USA, Ford-USA, Chrysler-USA, General Motors-India, Ford-India, Honda, TATA Motors, Toyota, Fiat, Hyundai, Nissan, Volkswagen and Mahindra & Mahindra amongst others.

-

Enkei, Pune: Catering to Japanese OEM’s only (strange business model). Had a production capacity of 120,000 wheels per month in 2W and 110,000 wheels per month in 4W as on December 31, 2022. Very inconsistent EBIDTA.

-

Delltronix, Nandambakkam: 1. Annual Installed Capacity of 0.96 Mln wheels, 2. Unable to fully utilize installed capacity due to severe quality issues, 3. Plant set up with used equipment. Fitch rating of ‘D’. Has filed for CDR.

Above is not an all-encompassing competition mapping. Players like Maxion, Ronal Wheels, CITIC Dicast and Enkei Global are much bigger and advanced players with global production/sourcing bases. In context of SSWLs size and scale, Minda Kosei is a decent competitor with deep engagement with customers across product lines, scale of operation and healthy balance sheet. Wheels India will appear second, albeit burdened with debt and low return ratio operations. Rest of the players may still have some areas to buckle up.

In summary, appears to be significant demand tailwind across domestic and exports business – sharp industry shift due to premiumization and protective measures across markets by regulators.

Moderate competitive intensity as domestic players yet to improve on current margins and balance sheet strength. Additionally, so far, very limited effort visible on improving tech capabilities by competition. On export market, well positioned to capture large possibilities created by CV/ADD by US/EU on China and rest transhipping countries.

Have ready capacity to cater to next leg of demand, thanks to timely capex. Also, balance sheet and cash flows are in a much better shape today for next leg of capex.

Disc: No invested

Tarun

| Subscribe To Our Free Newsletter |