Rategain

RateGain Travel Technologies Ltd is a leading distribution technology company globally and the largest Software as a Service (SaaS) provider which works in the shadows of travel and hospitality industry in both domestic and international travel markets. The firm offers specialised services across different verticals like hotels, airlines, online travel agents, meta-search companies, package providers, car rentals, cruises, and ferries.

What does it do? – It has three major verticals:

1. Data as a Service (DaaS) (33% of Revenues) – Here, RateGain analysis a massive 24bn data pack of millions of customers to find consumption and decision making patterns and helps the companies (hotels, airlines, etc.) with dynamic pricing that may help them maximise their revenues and profits

2. Marketing Technology (MarTech) (43% of Revenues) – Helping the hotel and travel companies with their digital presence by feeding real-time consumer insights into its software, packaging it and selling it as a subscription to the airlines, hotels, and online travel agents. Helping optimise bookings, monitor engagement and travel intent data

3. Distribution (24% of Revenues) – Helping hotels with availability, rates and digital content across multiple online travel agencies (OTA) and global distribution systems

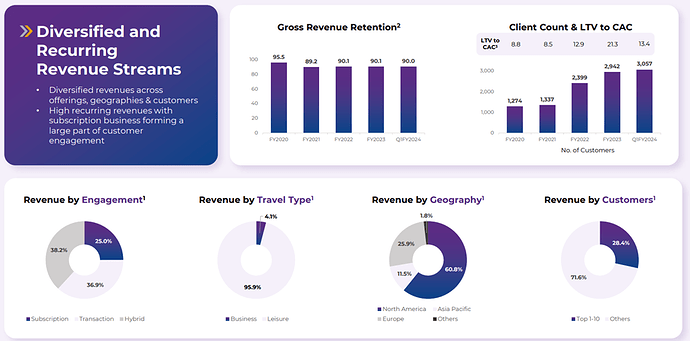

These are more details of the revenue streams of the company:

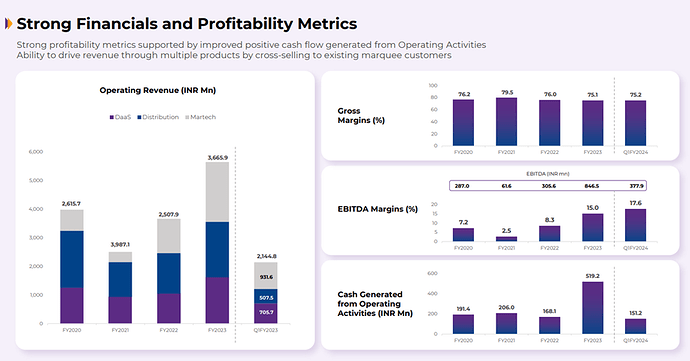

As far as the profitability is concerned, here is a snippet from their latest Q1FY24 presentation:

Key points to note:

- DaaS Segment is growing the fastest – it grew at a massive 139% YoY in Q1FY24

- MarTech grew at 88% YoY

- Distribution grew at 27% YoY

- Added 115 new customers in Q1FY24 – now they have over 3000 customers globally

- Revenue per employee increased by 53% YoY

- Pipeline of 36Cr revenue (which is over 40% of the annual recurring revenue)

- 63% of the revenue is predictable in nature (Subscription based)

- Sticky customers with 90% Gross and 110% Net Revenue Retention

- 7 of the Top 7 customers have been with them for more than 10 years, which makes one believe that they might be doing something right there

- Margins expanding – 17.6% OPM as of now, expected to reach 25% in the next few years as there is high operating leverage in the business

- Actively acquiring companies for synergies and more revenue streams

- Acquired Adara at a very attractive valuation of 0.6x revenues (Adara finds ways to measure the actual travel intent of a customer and helps RateGain to further strengthen its dynamic pricing

- As per a report, it apparently has 185 companies on its target acquisition list

- Cash rich company with Net Cash & Cash Equivalents of 34Cr

- Tailwinds in the travel industry – 17 out of 22 key global destinations have fully recovered over 2019 levels.

- Aims to double revenues in the next three years

- Important to note that RateGain have a single direct competitor, globally

- 25 of the top 30 OTAs and 23 of the top 30 hotel chains in the world are its customers

- Some international carriers like Lufthansa and Singapore Airlines are its clients too

- Moreover, India’s newest low-cost carrier Akasa Air tied up with RateGain even before its launch. Just because it wanted to ensure that it was getting its pricing right from the start

Risks:

- Since the company is highly correlated with the travel and hospitality industry, its performance is largely dependent on how these industries perform.

- Being in a constantly evolving space, RateGain also faces the risk of competition in developing better tech products and keeping up with the changing dynamics of the industry

- Valuations are on the expensive side but that may be less of a concern if it keeps growing at this pace and is able to expand its margins

Disc: Invested

| Subscribe To Our Free Newsletter |