Mazda, Monthly – Broken out of a near 5 year resistance last month. Re-tested it this week (also the Sept 12th Open/Close) and seems to be getting a move on.

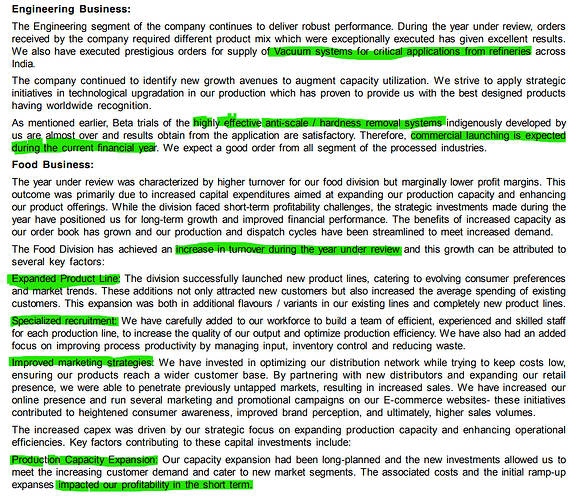

Fundamentally, the company has two lines of business – Engineering division that makes products like vacuum systems, condensors and other such process equipment used across industries and Food division that manufactures instant drinks mixes, jams, squashes, soy sauce, flavouring essences and extracts and food colouring. It markets them under their own brand bcool (instagram / amazon) but this is primarily a B2B play.

Snapshot from AR

The antiscale product could have pretty wide application across industries and the management has achived reasonable success in this new product already. Food business margins should go up along with increase in turnover from here on. The capex which is completed should be sufficient for 10 yrs growth as per management (Last expansion was 15 years ago)

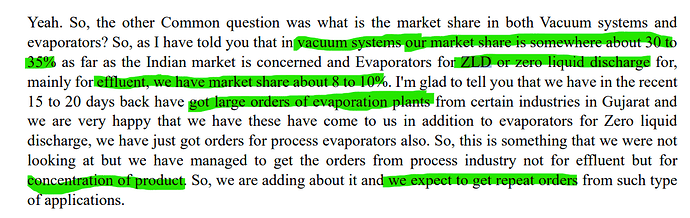

The company did its first concall last month. It looks like they have enough orders for current year in the engineering division. The company has decent market share in its products. ZLD could have a tailwind with the crackdown on pollution.

The new capex in the food division has started commencement from March but has had few issues stabilising and those teething issues seem to have been resolved as of last month, so contribution should increase going forward. Food division has only 18% revenues from domestic and the rest is exports. They dont want to scale distribution too fast before understanding the nuances, so will very likely not be making heavy investments until they are sure of what works where.

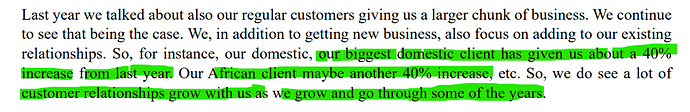

A lot of the B2B food business is repeat in nature. They seem to have a knack of retaining customers and maintaining relationships by not cutting corners or taking shortcuts

The guidance is for a growth of 15% over FY23 which isn’t bad considering the big jump in FY23. Also the margins of the company are trending up structurally as compared to the past. The valuation is not very demanding at 15x, given the growth prospects.

I liked how candid and conservative the management is – multiple places in the concall they correct the optimism of the participants and are also very knowledgeable in their line of business, which is a big plus in a 400 Cr market cap company. The new young hires made by the company shows that the business is trying to make a transformation as it grows bigger. I also like the fact that company doesn’t want to gain market share at the expense of margins but would rather foray into new products (like the antiscaling product) and establish new footholds which is essential for growth from 200 Cr topline to 500 Cr topline.

Disc: Have positions between 1000-1200

| Subscribe To Our Free Newsletter |