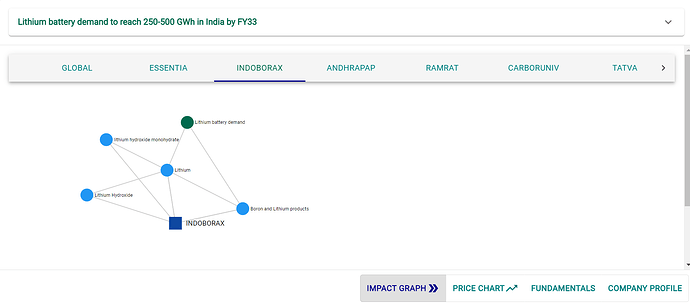

India is poised for a monumental surge in lithium battery demand, and Indo Borax & Chemicals Limited (NSE:INDOBORAX), a manufacturer and seller of boron and lithium products, stands to benefit significantly. With projections indicating that the demand for lithium batteries could reach between 250 to 500 GWh by fiscal year 2033, the company’s prospects are looking brighter than ever.

The recent report, titled ‘EV Batteries: Battle to control EV supply chain’ by Axis Capital, has highlighted that achieving a 250 GWh battery demand would necessitate incentives of INR 1.8 trillion over the period of fiscal years 2024 to 2028, along with an initial capital expenditure (capex) of USD 30-33 billion. This forecast is in line with India’s ambitious goals to electrify its transportation sector and reduce its carbon footprint.

So, how exactly is this bullish forecast going to positively impact Indo Borax & Chemicals Ltd’s stock price?

Increased Demand for Lithium Products : Indo Borax & Chemicals Ltd manufactures and sells lithium hydroxide monohydrate products. With the rapidly growing demand for lithium batteries in India’s electric vehicle (EV) market, the company’s lithium products are likely to be in high demand. This uptick in demand can potentially lead to increased revenues and higher profits.

Positioned for Growth : Indo Borax is already established in the Indian market and has been providing quality lithium products for years. This positions them well to capture a substantial share of the growing market, given their experience and track record.

Market Confidence : A booming industry and an established player like Indo Borax can instill confidence in investors. As they see the company benefiting from India’s electric vehicle revolution, it can attract more investment and drive up the stock price.

Favorable Regulatory Environment : As the Indian government provides incentives and support to the EV industry, it indirectly benefits companies like Indo Borax. The conducive regulatory environment can create a positive atmosphere for the company to thrive.

Strong Financial Performance:

In addition to these promising forecasts, Indo Borax boasts impressive financial credentials that make it a compelling investment opportunity.

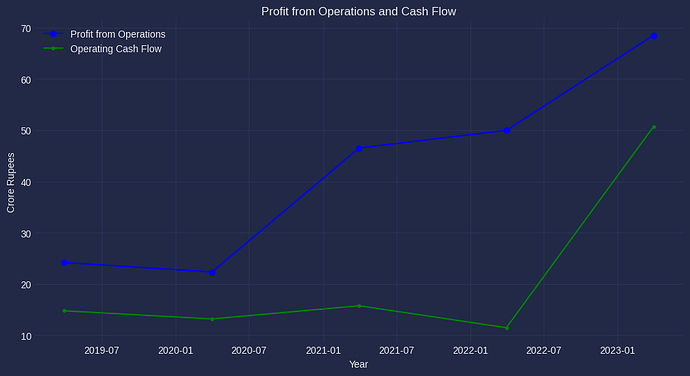

The above figure shows operating profit growth for the last 5 years.

Robust Profit Growth : Over the past five years, Indo Borax has demonstrated remarkable profit growth, with a staggering 243% increase. This equates to a compounded annual growth rate (CAGR) of 28%. Such consistent profit growth signifies a company that is efficiently utilizing its resources and generating value for its shareholders.

Strong Cash Flow Position : The company maintains a healthy cash flow position with a consistent 183% growth over the last five years and a CAGR of 23%. This strong cash flow not only ensures operational stability but also provides flexibility for investments in research, development, and expansion.

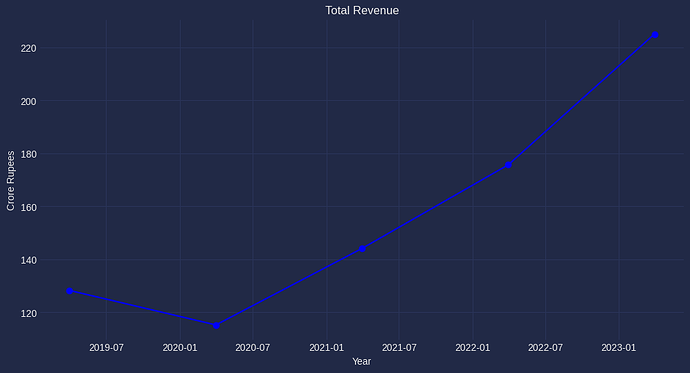

The above figure shows the revenue for the last 5 years.

Impressive Revenue Growth : Indo Borax’s revenue has surged by 75% over the past five years, demonstrating a CAGR of 11.89%. This growth highlights the company’s ability to capture market opportunities and meet the rising demand for its products effectively.

Attractive Valuation Metrics : The company’s PEG (Price/Earnings to Growth) ratio stands at 0.5, well below the typical threshold of 1. A PEG ratio below 1 suggests that the stock may be undervalued relative to its growth prospects.

Favorable Valuation Ratios : Indo Borax boasts a Price/Book (P/B) ratio of 2, which is below the industry median. Additionally, the Price/Earnings (P/E) ratio is a modest 10.7, also below the industry median. These metrics indicate that the stock may be attractively priced compared to its peers.

Debt-Free Status : The company’s debt-free status is a significant advantage in a potentially high-growth industry. It means that Indo Borax does not have substantial interest payments or debt-related risks that could hinder its growth or financial stability.

Conclusions

In conclusion, the surging lithium battery demand in India is expected to have a positive impact on Indo Borax & Chemicals Ltd. In light of Indo Borax & Chemicals Ltd’s robust financial performance and the burgeoning demand for lithium batteries in India’s electric vehicle market, the company is well-positioned to thrive. These factors, combined with a favorable regulatory environment and established market presence, bode well for the company’s future. The company is well-positioned to capitalize on this trend, potentially leading to increased revenue and growth opportunities.

Reference: Lithium battery demand to reach 250-500 GWh in India by FY33

Disclaimer: The article is not a recommendation or advice as to whether any investment is suitable for a particular investor.

| Subscribe To Our Free Newsletter |