(Image credit: Chennai Angels)

Dolly Khanna was at one time the single largest shareholder of Hawkins Cookers with a massive holding of 1,59,302 shares. She knew that if the news leaked out that she was disillusioned with the prospects of Hawkins and was looking to dump the stock, there would be mayhem and her fans would go on the rampage.

So, Dolly tried to do her selling as surreptitiously as was possible in the circumstances.

Dolly was not entirely successful in her endeavor because my radar did sense that she was up to something (see Is Dolly Khanna Selling Hawkins Cookers? and Dolly Khanna Slashes Holding In Hawkins Cookers).

However, we did not react to the news in time. By the time the bad news finally dawned, Dolly had walked out from Hawkins, leaving her fans high and dry to face the music (see Dolly Khanna Escapes Hawkins Cookers’ Carnage Even As Punters Rue Their Luck).

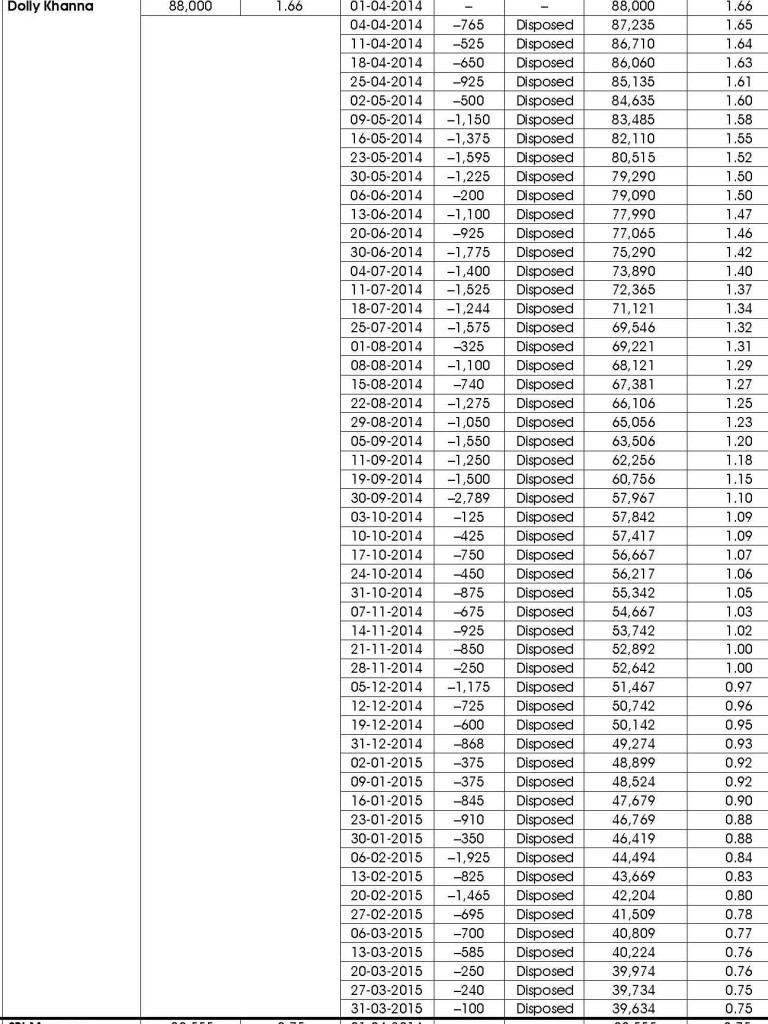

Now, important data has surfaced which shows the skilful manner in which Dolly sought to fly under the radar to avoid detection of her selling action.

In the period from 4th April 2014 to 31st March 2015, Dolly sold a truckload of 48,366 shares of Hawkins Cookers in teeny-weeny bits. She was at the job almost every alternate day, selling as few as a 100, 125, 200, 325 shares on an occasion.

Dolly must have repeated the process in the earlier financial years as well. By this masterful process, Dolly was largely able to escape the great carnage that Hawkins Cookers witnessed.

It may be remembered that the Hawkins Cookers debacle also spelt doom for Basant Maheshwari’s popular Basant Top 10 Service. Basant was forced/ induced to shut his stock advisory service in the wake of incessant criticism from his subscribers and members of the public (see Basant Maheshwari Brings The Curtain Down On “Basant Top 10″ Stock Advisory Service) over the failure of Hawkins.

It is also worth noting that two other major shareholders, Kotak Midcap MF, and Subodh/ Manisha Purohit, steadily disposed off a major part of their holdings during the year.

Incidentally, an interesting bit of information is that while Dolly Khanna and the other major shareholders were busy selling their shares, Megh Manseta (see How Megh Manseta Compounded His Wealth At 30% CAGR And Became A Multi-Millionaire) was doing the reverse. He increased his holding in Hawkins from 33,000 shares as of 01.04.2014 to 34,500 shares as of 31.03.2015. Megh Manseta bought 1,500 shares in four tranches.

Hawkins’ largest shareholders now are SBI MF and Kotak Emerging Equity Scheme.

Hope Hawkins gets its act together before these major shareholders also get restless and dump the stock!

Hi Arjun,

Again same question, how do you get the above details ?

Please let us know the way.

Thanks.

The info is in the annual report for FY 2014-15

ok..But for that do u check each & every company’s annual report.

Hi Arjun,

I understand that we have to go through SHP of company but fr that we need to check many companises.

Isnt there any way through which we can directly check what big investors have bought instead of going thru SHP of each company…

Where did you get this data ???

The info is in the annual report for FY 2014-15

Which annual report Company’s or Dolly Khanna’s ?????

Dolly ki doli to nikal gayi. baaki baratiyon ka kya hoga?