A recent idea that have come to @nirvana_laha and my notice as an ancillary play to EV batteries.

https://www.screener.in/company/HEG/consolidated/

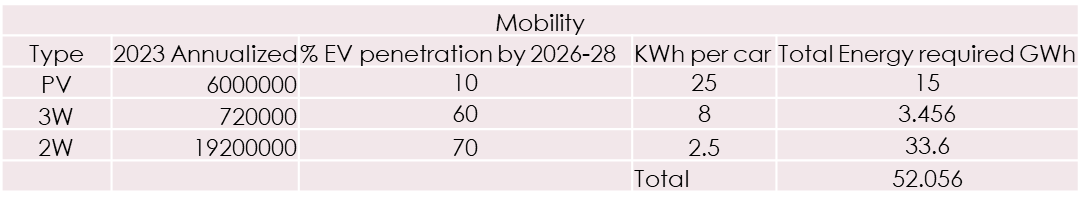

Demand scenario of Lithium ion batteries

Conservatively Battery capacity required by 2030 is around 122 GWh – Source and Discussion with experts.

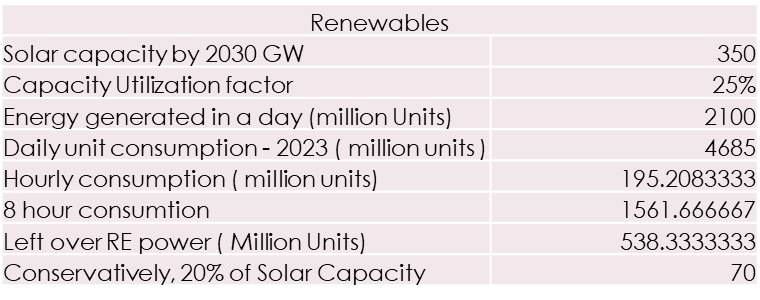

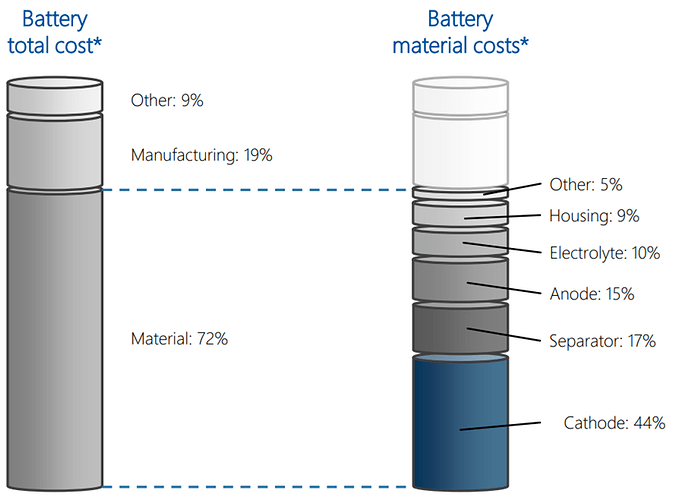

Major components of a Battery

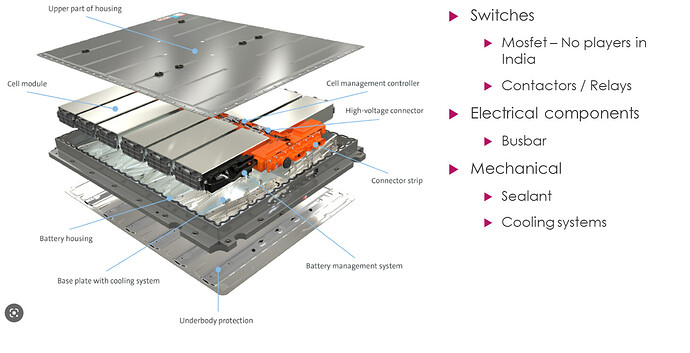

Major components of a lithium ion cell

Approximate percentage of anode in a cell by cost source

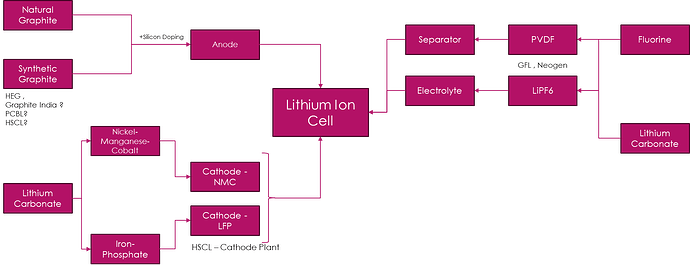

the battery cell chemistry value chain

Conservatively = 122 GWh of lithium ion battery demand

1 GWh battery requires around 1000 tons of Graphite

Domestic demand by 2030 would be 1,22,000 tons at least. Globally much larger

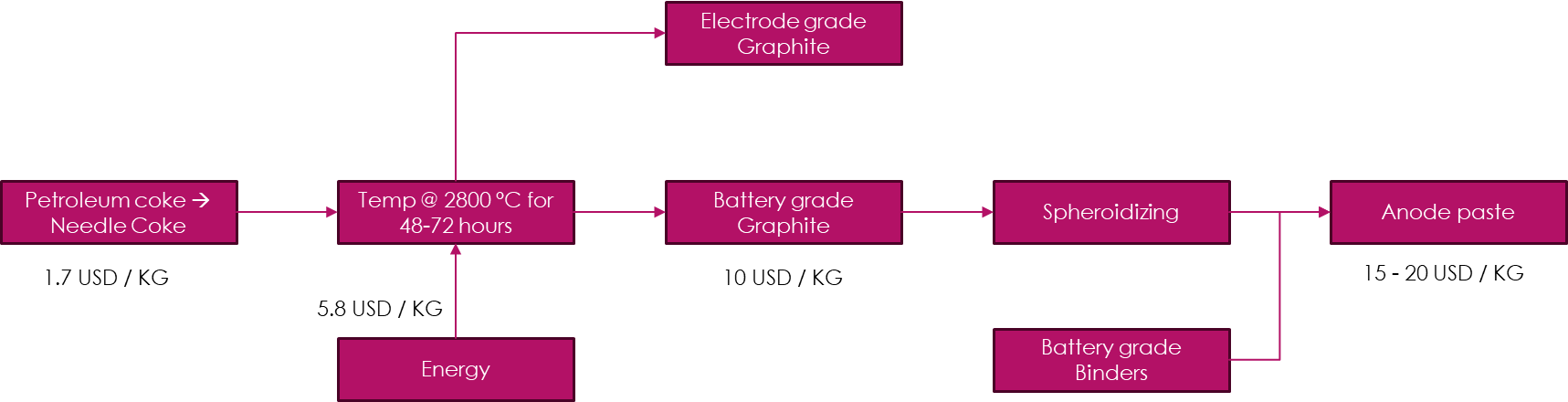

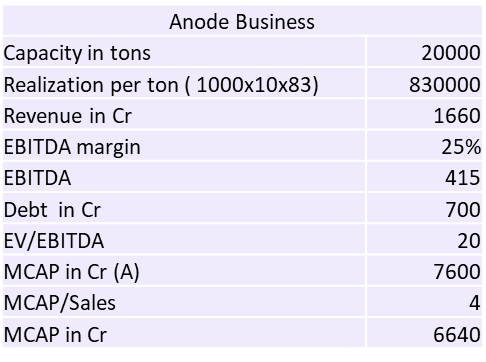

~40-50% of the cost is energy for anode production. HEG is the first company to invest in Capex under subsidiary TACC for 20000 tons by FY27.

HEG’s power cost is 5.5 rupees / Unit vs G.I ~ 8 rupees / unit, the management has claimed that they are the cheapest in the country and competitive with China

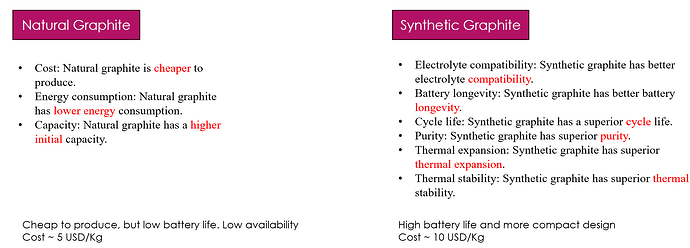

This is the cost structure, HEG’s new subsidy TACC will supply Battery grade Graphite

Synthetic graphite’s demand is rising as it can enhance life and fast charge applications. Most manufacturers will make synthetic graphite.

Upcoming trigger

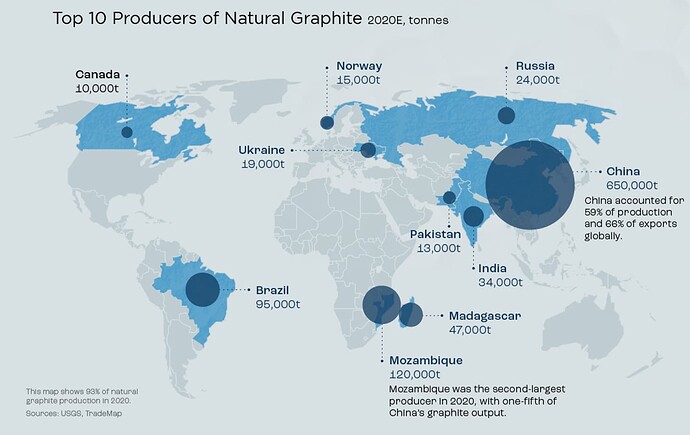

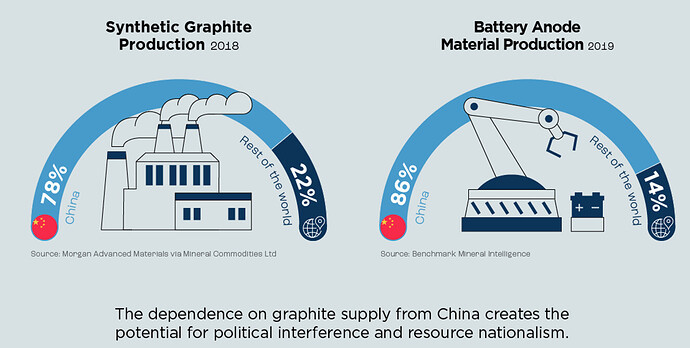

Chinese ban on Graphite export

China is a dominant graphite producer / refiner. The export curb would mean higher cost of Anode powder for rest of the world

Anode powder cost might rise to $14-15 for the rest of the world. Graphite will become a very strategic mineral.

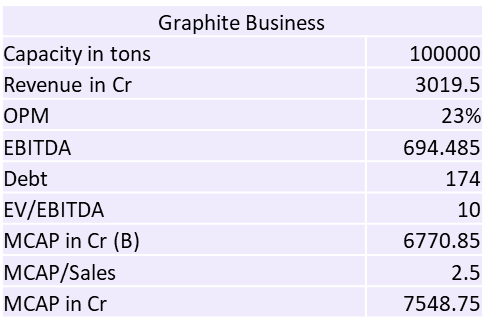

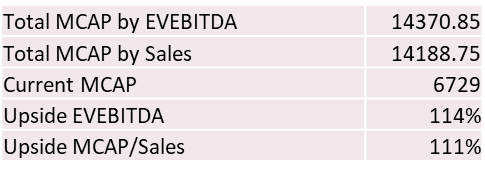

Valuation by FY27

Note:

- Graphite powder will be used regardless we use Sodium ion, Lithium ion chemistries

- Silicon will not replace the traditional graphite anode before 2030. There is no commercial usage evidence [usage by Tesla, Merc, BYD ] other than company marketing

PEERS

Himadri Specialty Chemicals – Supplies to OLA on behalf of their JV partner, LFP play

PCBL – Not clear if they will venture into anode powder production, but management has indicated that they are definitely on the lookout for EV plays

Graphite India – Invested in some startups focused on silicon anode ( moonshot IMO)

Epsilon – Focus on US markets.

Disc: Invested and Biased. I am not a valuation expert.

| Subscribe To Our Free Newsletter |