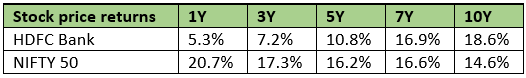

Good note from Banyan Tree on HDFC Bank. Given the relative underperformance of the past 5 years, controlled long-term NPAs, investment in branch expansion and employees, and better hold on subsidiaries HDFC Bank is poised for a reversion to mean and go back to 18-20% growth mark over the next decade.

However, it is our assessment that with PSU banks still forming 66% of total deposits and 64% of CASA deposits, there is still room for private banks (including HDFC Bank) to increase their market share over time.

HDFC Bank has been upfronting investments in its business, in order to prepare for the next leg of growth. It is not too far-fetched to think that HDFC Bank can at some point, become as large as SBI, and it seems to be preparing for that with its branch expansion.

With the merger, HDFC Bank also becomes the ultimate parent to all the subsidiaries of HDFC Limited i.e. life insurance, general insurance, and asset management etc. From being a group company to ultimate parent, the relationship with them will improve with better focus and engagement. Perhaps this will result in higher growth and profitability in the subsidiaries and lead to better value for HDFC Bank as well.

Due to its underperformance over the last several years, HDFC Bank now trades at the bottom end of our valuation band. This is particularly so, as we are at the end of December and now rolling over our valuation bands to the next year. As per consensus analyst estimates, HDFC Bank is expected to report 18-20% over the next 2-3 years, in line with its 10-year history. In a market where it is very hard to find an attractive business trading at a reasonable price, HDFC Bank looks like a mouth- watering opportunity to us. We use such words sparingly (have used it only once before in our newsletters over the last 18 odd years) and we remain confident that HDFC Bank will deliver good returns to shareholders over the foreseeable future.

| Subscribe To Our Free Newsletter |