Summary of Q3FY24 Highlights:

Macroeconomic Trends:

- The US economy has shown improvement, and inflation is under control.

- China’s supply situation has eased, contributing to positive macro conditions.

- The Red Sea issue might impact freight costs, leading to a 15-day inventory stocking for the company due to reduced ship arrivals.

Quarterly Performance:

- Volume growth exceeded 10%, with a price erosion of 3-3.5%.

- Geographical growth saw positive trends in India, the US, and LATAM, while the EU business remained flat, and Japan experienced a decline.

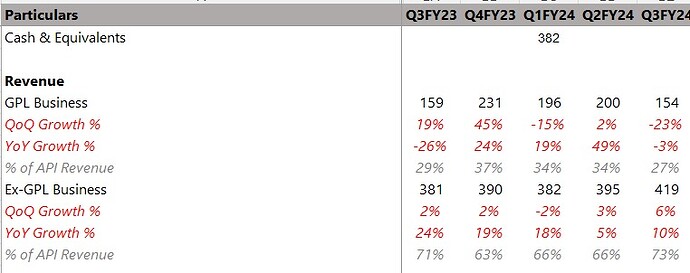

- Expectations of a slowdown in the GPL business.

- Gross margin improvement attributed to better input prices, validated supplies, and improved margins in CDMO.

- PLI had a 1-1.5% impact on margins.

CDMO Segment:

- Confidence in the CDMO segment is high, with a minimum offtake commitment of $5M, commercialization in the next financial year, and ongoing projects in advanced stages.

- One project in the range of $5-10M are expected to be signed in late Q4FY24 or Q1FY25. Company is in advanced talks for one more project.

- Management showed Confidence in the order book buildup, with expectations of CDMO contributing to 15% of the business in the next five years.

- Anticipated CDMO growth implies a target of Rs 4,000Cr topline in the next four years.

- CDMO projects have a long gestation period, with 10-12 projects in discussion.

- USFDA inspections, expected in a 3-year cycle, could happen at any time.

Other Financials:

- Higher employee costs expected in Q4FY24, returning to normalcy thereafter.

- Anticipated reduction in employee costs to 9% from FY25.

- Capex for FY24 estimated to close at Rs 150-160Cr.

- Asset turnover for newer facilities expected to remain at 2.5-3x.

- Opex for newer facilities improving on a per-kilo basis as the company focuses on larger batches.

Product and Filings:

- DMF and CEP filings have exceeded 500, with the addition of four new products in Q3FY24.

- Strong generic pipeline and order book contribute to positive business growth expectations.

Nirma Acquisition:

- CCI approvals received for the Nirma acquisition, awaiting additional approvals.

- The company plans to provide updates on the acquisition in the near term.

View:

- The company anticipates achieving a growth range of 10-15% over the next 3-5 years, propelled by factors such as organic expansion, the introduction of new capacities, and the onboarding of CDMO partners.

- An area of concern for the market was the parent business, constituting approximately 35% of the overall topline, due to its high-margin nature, which posed challenges for acceptance. However, in contrast, the company has demonstrated one of its lowest contributions from GLP, and despite this, it has successfully maintained margins as guided, standing at around 30%.

*With ~30% margins, 30%+ ROCE and net cash position, the company can further re-rate. This is particularly anticipated as the looming impact of GLP diminishes with the entry of Nirma. I believe companies like GLS can trade anywhere between 15-20x EV/EBITDA (vs 12x currently and 7x at low).

- One thing to be Aware of: The newer capacities will be giving lower asset turn-over (2-2.5x) vs previously reported by company (3-4x). This is because the assets currently generating topline are derived at slump sale, hence the Asset turns are inflated. Thus, ROCEs are expected to trend downwards too. Nevertheless, the company still can do 20-25%+ ROCEs easily.

Disclosure: Educational purposes only, Not a buy recommendation, I am not SEBI registered analyst or advisor an I am invested in it hence my views may be biased.

| Subscribe To Our Free Newsletter |