My take on Azad Engineering

In 2015-16, while working on a consulting project for a Fortune 500 parts manufacturer, I acquired limited knowledge of the A&D industry, procurement processes, and supply chain strategies.

Disclaimer: My analysis may be biased and potentially overly critical. Nonetheless, if their claims turn out to be true , this could represent a solid investment opportunity.

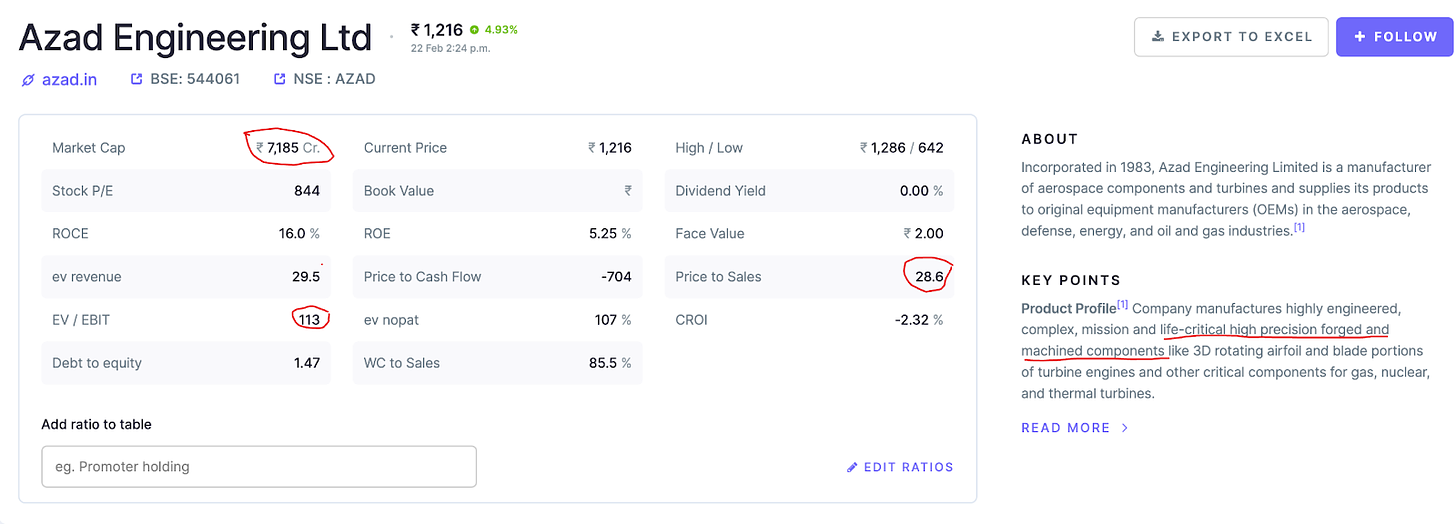

However, I remain cautious due to the lack of evidence supporting Azad Engg.’s valuation comparable to that of a Tier-1 A&D comps.

For a company to warrant such premium in valuation, it must possess a robust competitive advantage, advanced technology, and foreseeable high growth in the near term, among other factors.

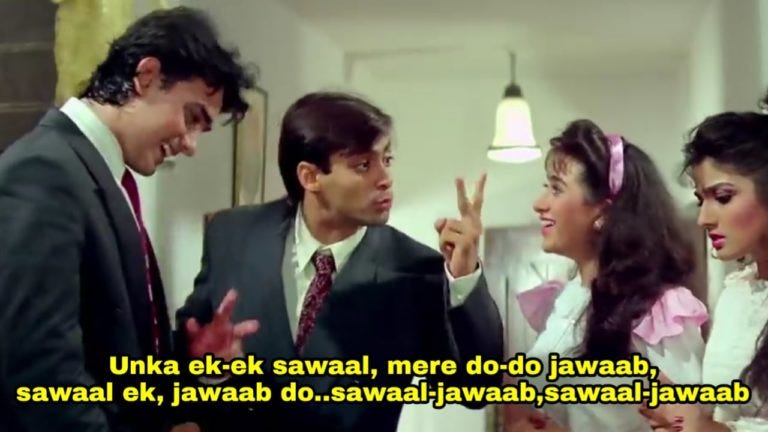

After reading the IPO Prospectus and recent quarterly earnings transcript, I was reminded of this hilarious scene from “Andaz Apna Apna”.

Throughout the content, I sensed inconsistencies and potential red flags. See Part 3 for my detailed notes.

- Excessive repetition of “mission-critical” and “life-critical” product applications without specific details.

- The CFO was asked about Gross Margin, but he repeatedly discussed EBITDA margin. Even the comments on EBITDA lacked substance.

- An analyst/investor act like an appointed cheerleader.

- A manufacturing firm that doesn’t track realization (gross profit per kg).

- Provide vague responses to sensible questions from competent analysts

I’ll take a stab at and challenge the following criteria for a company to command a premium valuation.

- Does the company justify its valuation as an A&D supplier when it currently derives only a fraction of its revenues from A&D?

- Does this company possess the characteristics of T-1 suppliers, such as patents, strong technology, experienced engineers, and technocrat promoters (often, but not always)?

- How is it that a Tier-1 supplier makes no mention of patents and technology in the prospectus?

- How qualified is the tech leadership team?

- How many M.Techs and engineers do they employ?

- What is the average experience level of senior personnel there?

- How many patents has the company filed to protect its IP (if it has any!)?

- Why does the company not track its realization per kg? How else should they be assessed for efficiency and scale?

- Company claims that it would take 15-20 years for a new competitor to catch up. So my follow up question is what takes years to replicate?

- Distribution – Yes

- Patents – Yes

- Brand – Yes

- B2b relationships – Possibly yes

- Unique business process – Possibly yes

Which of the above does the company have? I couldn’t find any. If you do, please share.

Is there any fundamental value to this company beyond simply riding the wave of overvaluation in A&D+small/mid cap space?

I don’t have a clear answer yet, but I suspect the following heuristics/biases might be playing a role:

- Illusory truth

“Repeat a lie often enough and it becomes the truth.”- Nazi Joseph Goebbels

Excessive repetition of “mission-critical” and “life-critical” product applications without specific details to make investors believe so without questioning any further. (Details in part 3)

- Halo effect

The promoter’s dropout status attracts attention, but can it ensure efficient management of a complex manufacturing business?

- Confirmation bias

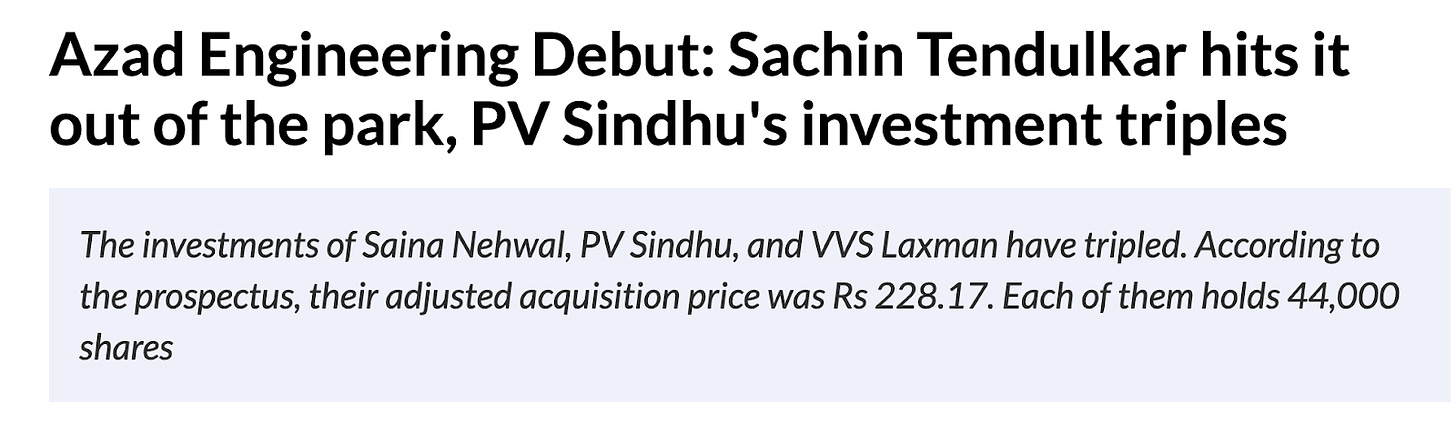

I have the utmost respect for all the sports personalities mentioned below, and I have no doubt about their skills and temperament in their respective sports.

My BS detector advises me to ignore the noise generated by celebrity investors. While celebrities may not intend harm, the media’s hunger for news often magnifies get-rich-quick schemes.

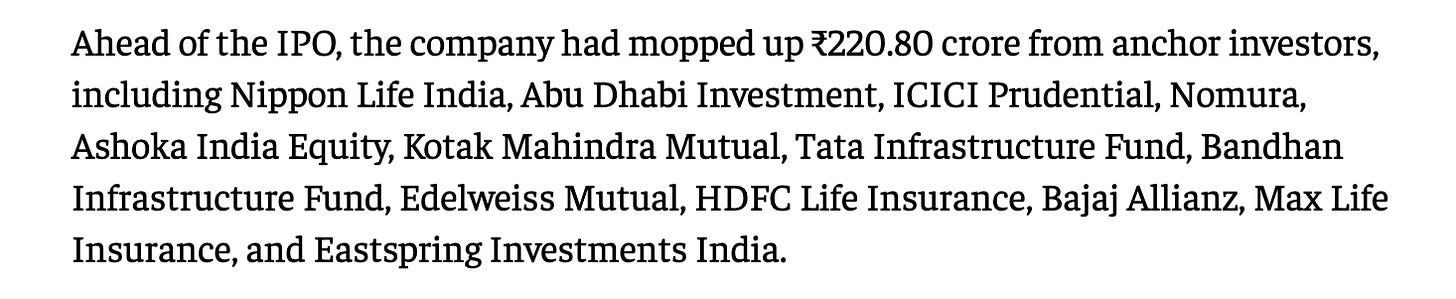

Another cheap signal fueling the confirmation bias: Marquee names in the anchor book

Second-level thinking, as advocated by Howard Marks, is key to dealing with noise (and BS)

First-level thinking : Many prominent names have invested, so they must have done their due diligence.

Second-level thinking:1 Institutions are also susceptible to biases. Rs. 220 crore is small change given the size of these funds. Hence, I must ignore this noise and think independently.

I’m sure this isn’t the first occurrence, and me-too companies often capitalize on hype during bull markets.

Second-level thinking is crucial – prioritize fundamentals over hype and independent analysis over celebrity endorsements.

Read more here

| Subscribe To Our Free Newsletter |